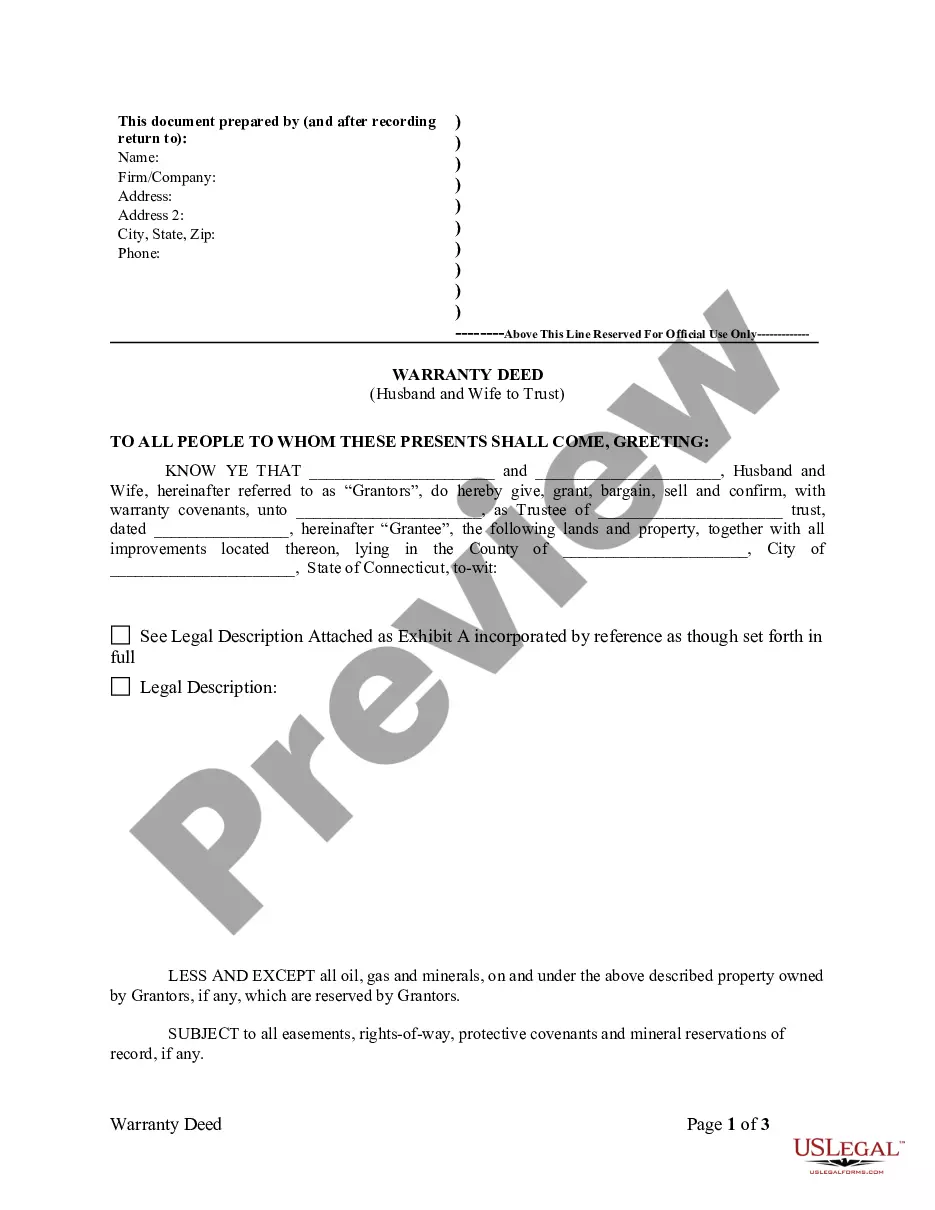

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Connecticut Warranty Deed from Husband and Wife to a Trust

Description

How to fill out Connecticut Warranty Deed From Husband And Wife To A Trust?

The greater quantity of documents you must generate - the more anxious you become.

You can find an extensive array of Connecticut Warranty Deed from Husband and Wife to a Trust templates online, however, you are uncertain which ones to rely on.

Eliminate the complications to make obtaining samples easier with US Legal Forms.

Input the required details to create your profile and complete the payment using PayPal or a credit card.

- If you possess a US Legal Forms membership, Log In to your account, and you will see the Download option on the Connecticut Warranty Deed from Husband and Wife to a Trust’s webpage.

- If you have never utilized our platform before, follow the sign-up procedure using these steps.

- Verify that the Connecticut Warranty Deed from Husband and Wife to a Trust is applicable in your jurisdiction.

- Double-check your choice by reading the description or by utilizing the Preview functionality if available for the chosen document.

- Click Buy Now to commence the registration process and choose a pricing plan that suits your preferences.

Form popularity

FAQ

To put your house in a trust in Connecticut, you need to execute a Connecticut Warranty Deed from Husband and Wife to a Trust. This document transfers ownership from you to the trust, ensuring the property is managed according to your wishes. Initially, you should consult with a legal advisor to understand the implications and steps involved. Once prepared, file the deed with your local town clerk to finalize the transfer.

While putting a house in trust offers benefits like avoiding probate, it does have a few disadvantages. One concern is the loss of control, as the trust's terms dictate how the property is managed. Additionally, there may be costs associated with setting up and maintaining the trust. Understanding these factors can help you make an informed choice about a Connecticut Warranty Deed from Husband and Wife to a Trust.

Putting a house in trust in Connecticut involves creating a trust document that outlines the terms and beneficiaries. Then, draft a warranty deed transferring the property from the husband and wife to the trust. Finally, sign the deed and file it with your local land records office to complete the transfer. This ensures that your Connecticut Warranty Deed from Husband and Wife to a Trust is legally recognized.

Generally, transferring a house to a trust is not considered a taxable event, as long as the trust is revocable and the owners retain control over the property. However, tax implications can vary based on individual circumstances and local laws. It's important to consult a tax professional to understand the specific tax considerations related to a Connecticut Warranty Deed from Husband and Wife to a Trust.

To transfer a warranty deed in Connecticut, you need to complete a new deed that specifies the current owners and the name of the trust that will receive the property. After drafting the deed, both the husband and wife must sign it in front of a notary. Next, file the deed with the local land records office to ensure it is officially recorded. This process will finalize the Connecticut Warranty Deed from Husband and Wife to a Trust.

To add your wife to your warranty deed, you’ll need to prepare a new deed that includes both your names. This may involve filing a Connecticut Warranty Deed from Husband and Wife to a Trust, which can also simplify future asset management. Ensure you consult a legal expert to guide you through the process and meet local requirements.

Yes, two or more people can be named on a warranty deed as co-owners. This is common in joint ownership situations, such as marriage. A Connecticut Warranty Deed from Husband and Wife to a Trust can clearly define ownership rights and provide for effective management of the property.

To add a spouse to a deed without refinancing, you can execute a new deed that names both spouses as co-owners. A Connecticut Warranty Deed from Husband and Wife to a Trust can accomplish this while ensuring the property is protected and managed according to your wishes. It’s wise to seek legal advice to ensure everything is correctly handled.

Yes, you can add a name to a warranty deed, typically by creating a new deed that includes all owners. This process may involve drafting a Connecticut Warranty Deed from Husband and Wife to a Trust to reflect the new ownership arrangement. Consult a legal professional to ensure compliance with local laws and proper execution.

Transferring assets into a trust involves changing the title of the assets to the trust's name. This process may require specific legal documents, like a Connecticut Warranty Deed from Husband and Wife to a Trust, for real estate. It’s crucial to follow the proper steps to ensure a smooth transition and avoid potential legal issues.