Mississippi Assignment of Oil, Gas and Mineral Lease

Description

How to fill out Mississippi Assignment Of Oil, Gas And Mineral Lease?

Obtain a printable Mississippi Assignment of Oil, Gas and Mineral Lease in just several mouse clicks in the most extensive catalogue of legal e-forms. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 provider of reasonably priced legal and tax forms for US citizens and residents on-line since 1997.

Customers who already have a subscription, need to log in into their US Legal Forms account, get the Mississippi Assignment of Oil, Gas and Mineral Lease and find it stored in the My Forms tab. Users who do not have a subscription are required to follow the steps below:

- Make certain your form meets your state’s requirements.

- If available, read the form’s description to learn more.

- If accessible, preview the form to discover more content.

- As soon as you’re sure the form fits your needs, simply click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay out through PayPal or credit card.

- Download the form in Word or PDF format.

As soon as you have downloaded your Mississippi Assignment of Oil, Gas and Mineral Lease, you can fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

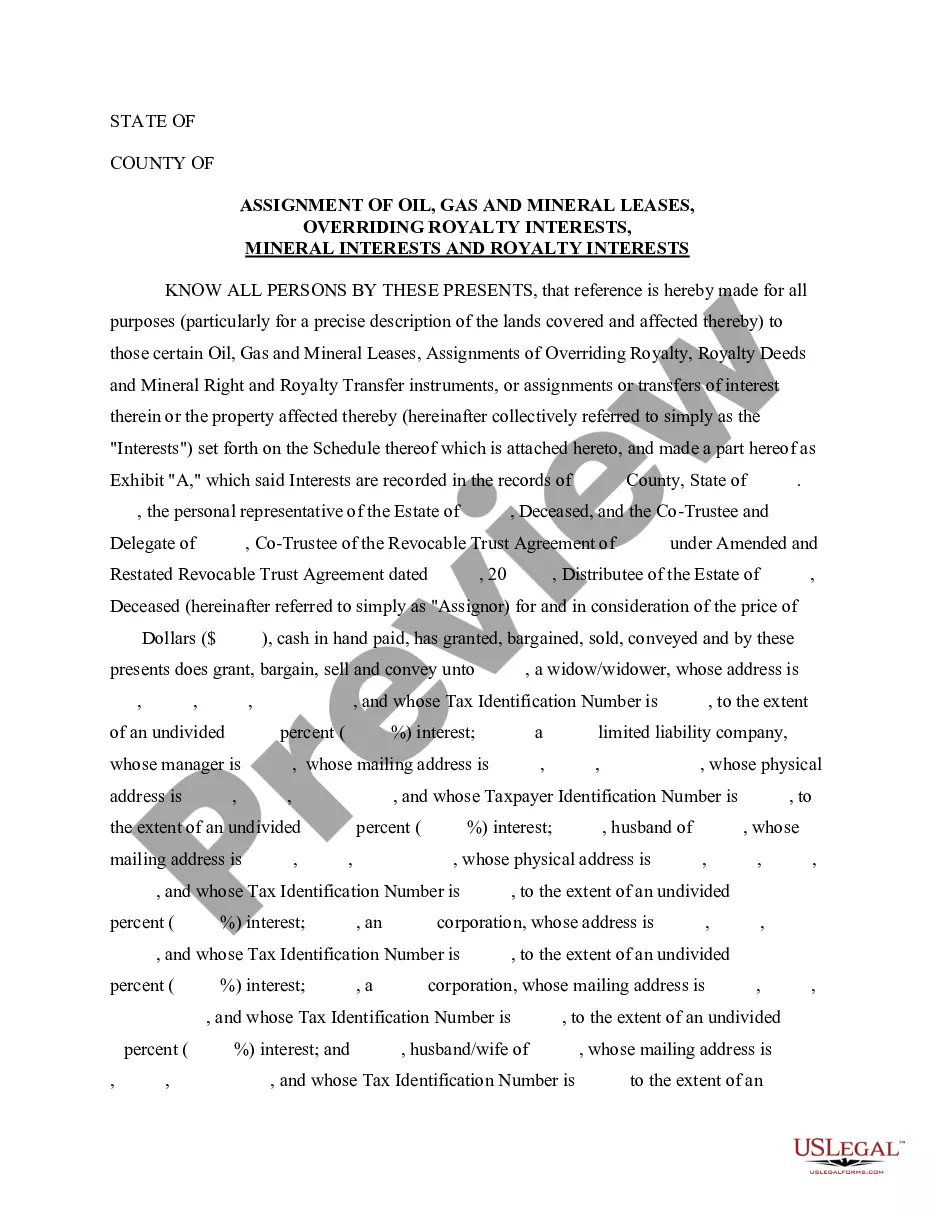

Assignment is a legal term whereby an individual, the assignor, transfers rights, property, or other benefits to another known as the assignee. This concept is used in both contract and property law. The term can refer to either the act of transfer or the rights/property/benefits being transferred.

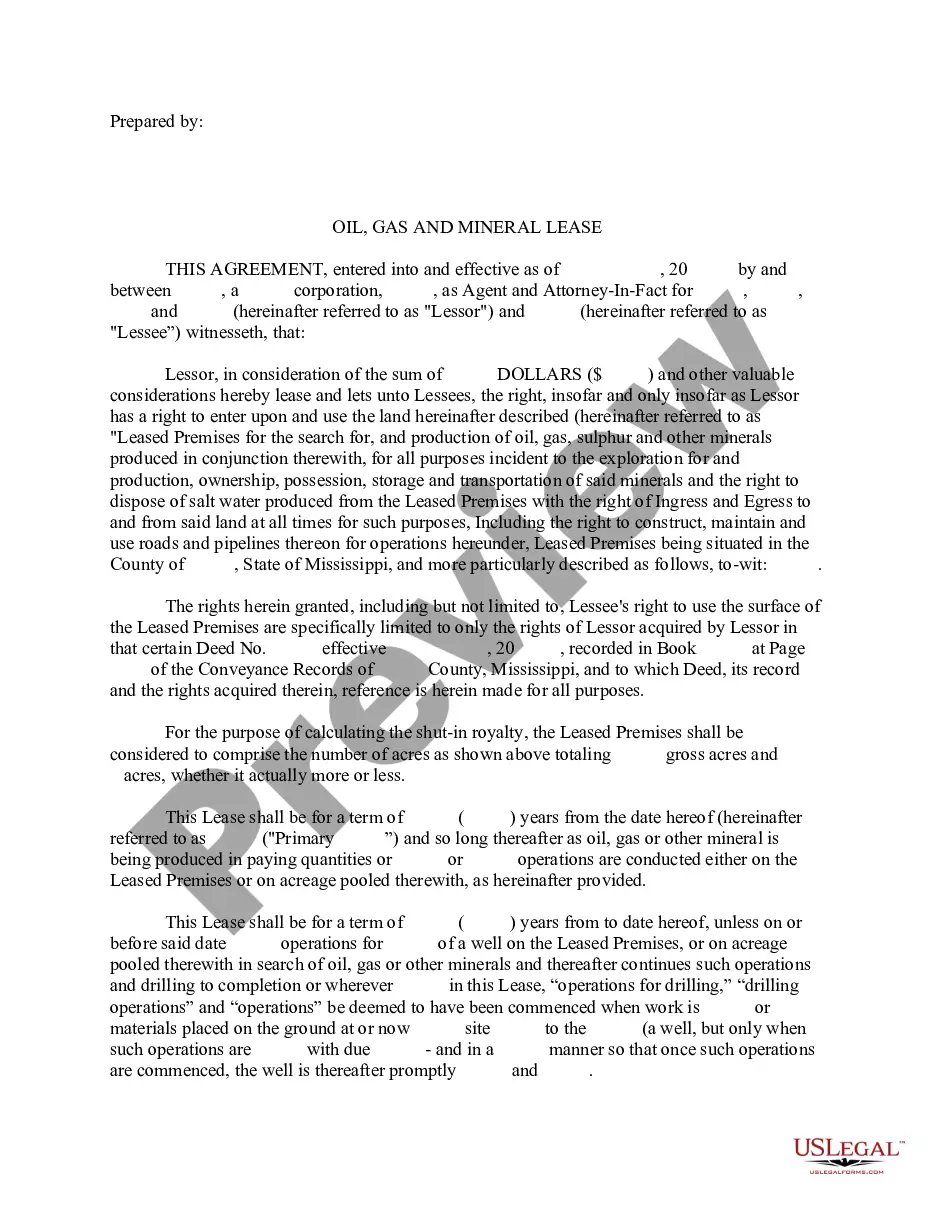

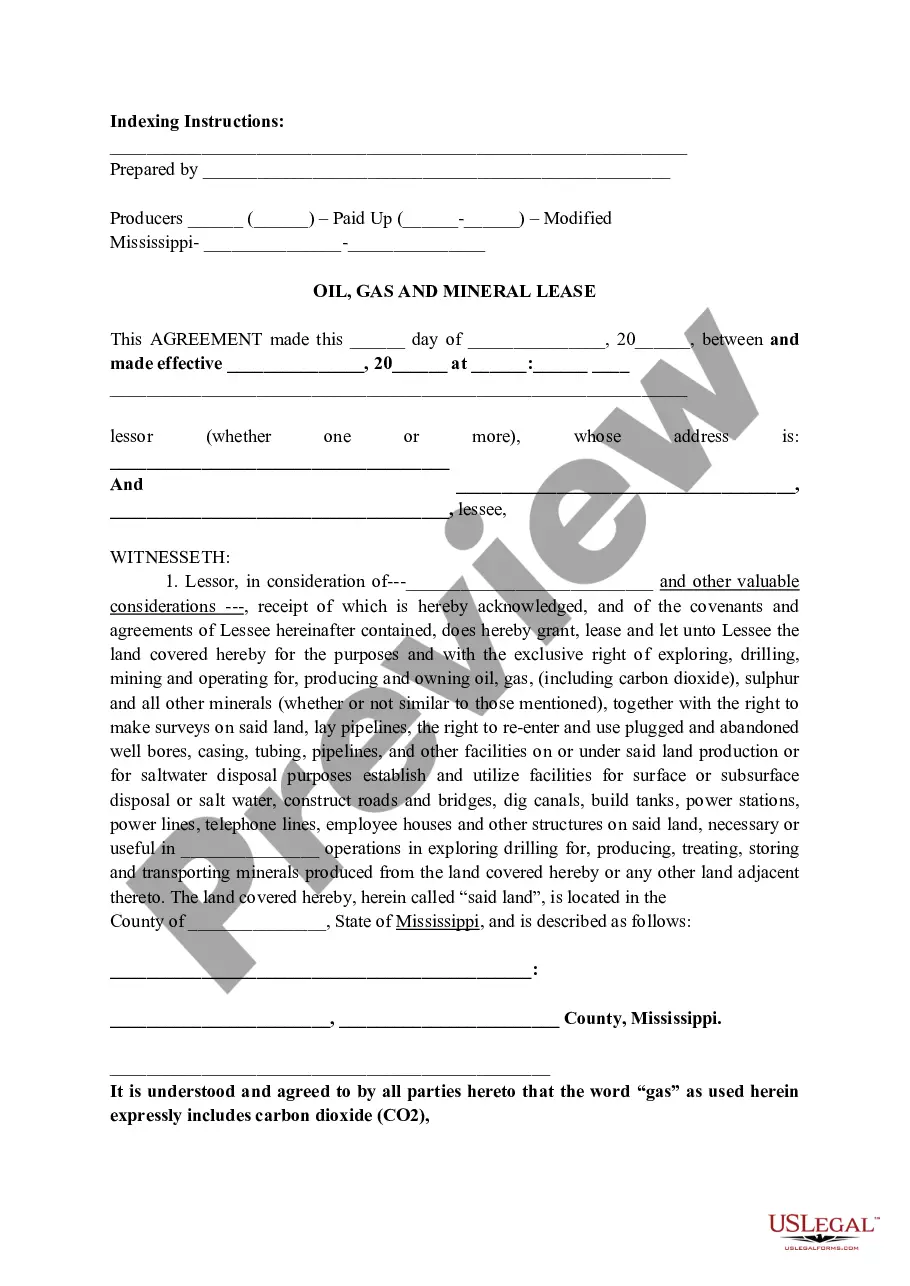

Oil and gas lease is an agreement between a mineral owner (lessor) and a company (lessee) in which the owner grants the company the right to explore, drill and produce oil, gas, and other minerals below the surface of the earth.

Further, annual rental fees for onshore oil and gas leases $1.50 per acre during the first five years and $2 per acre each year thereafter allow drilling companies to hold and explore mineral leases for the price of a cup of coffee.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

Nationally, mineral rights owners can expect anywhere from $100 to $5,000 per acre for their mineral rights lease. The most valuable mineral rights leases are on producing parcels of land that are still expected to hold many more precious minerals.

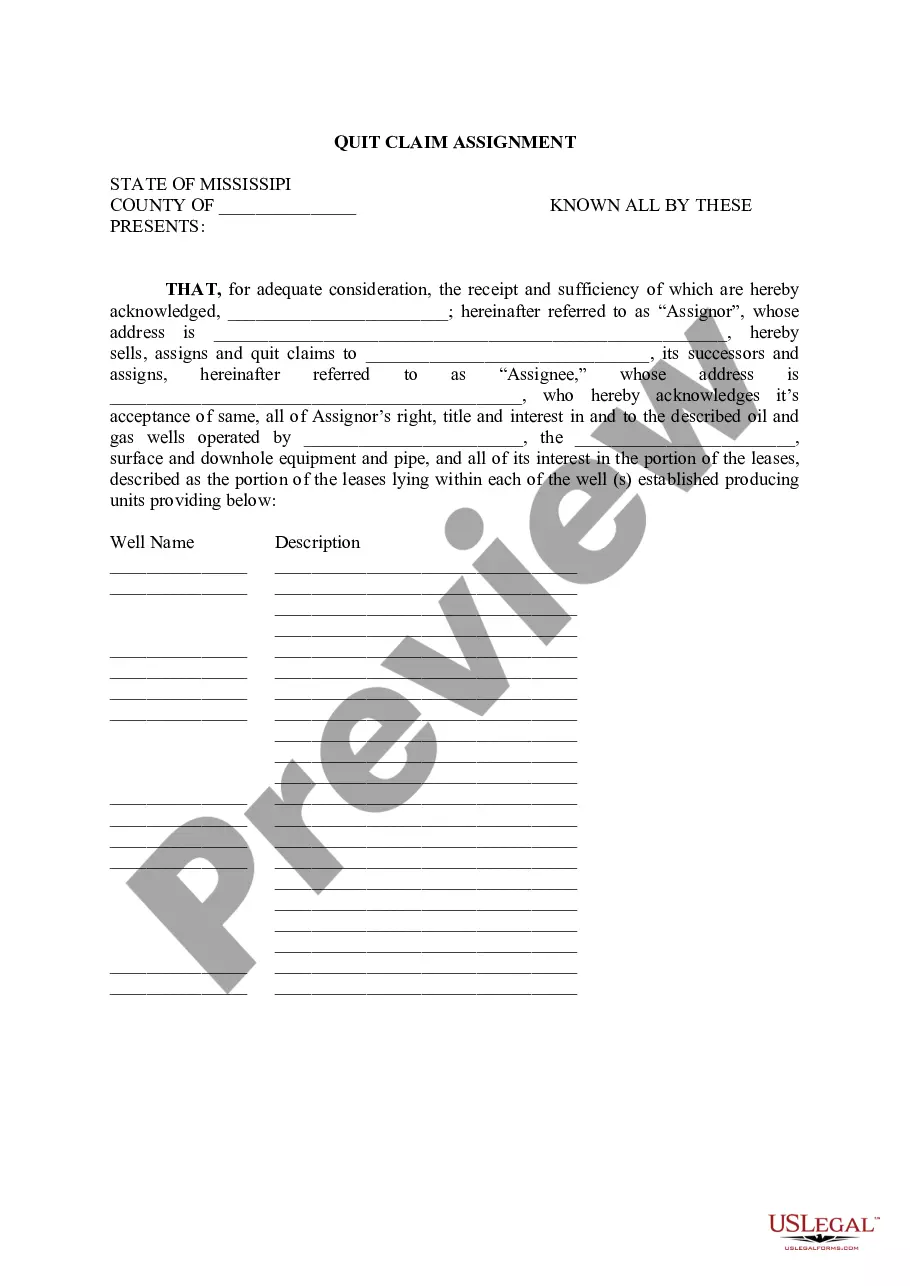

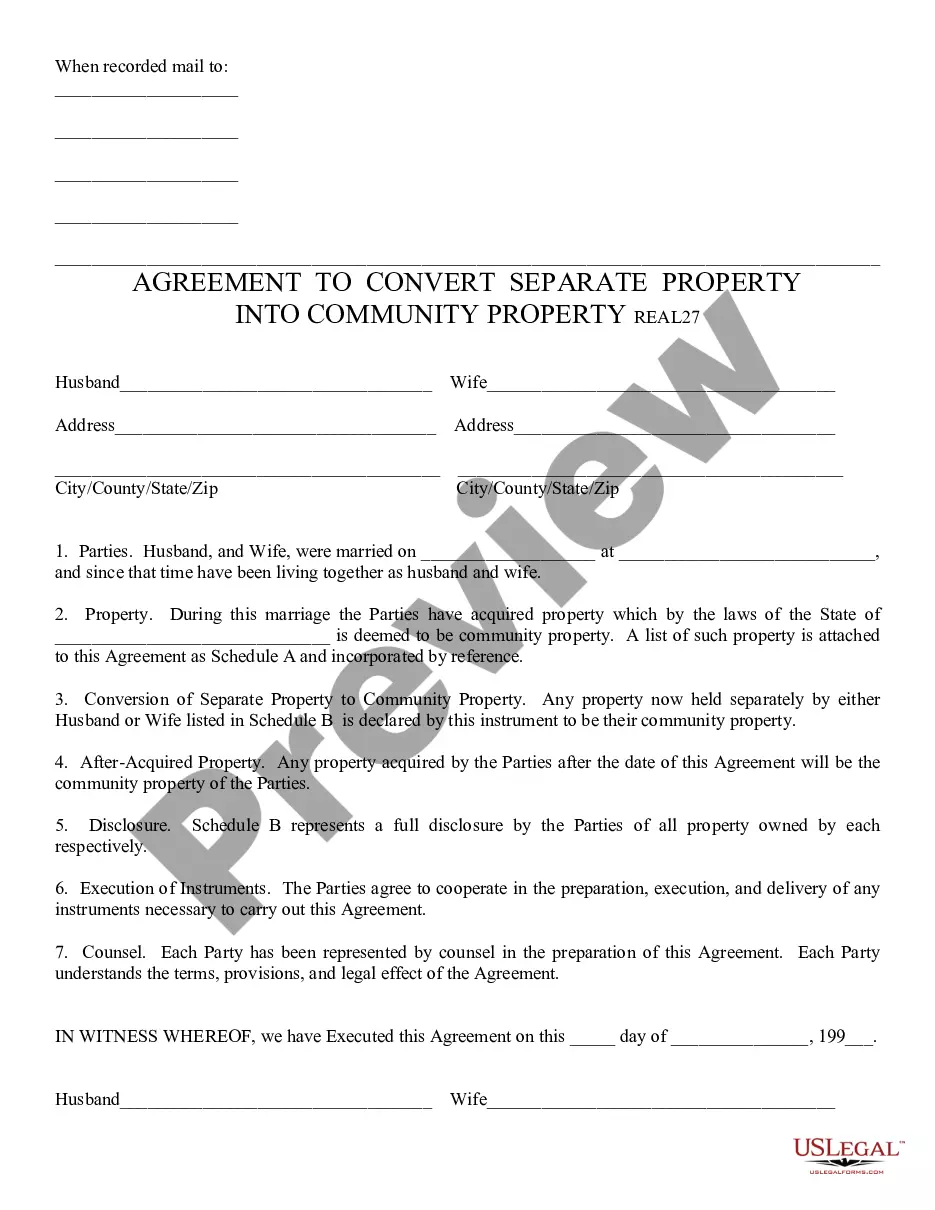

An Assignment of an Oil, Gas and Mineral Lease is a document in which the original Lessee, and or their successors, assign either all or part of their working interest and/or net revenue interest that they own in that lease. This is leasehold interest. You can also assign or reserve interest in wellbores.

Wellbore. An assignment can be limited to the wellbore of a well. A wellbore limitation means that the assignor is assigning only those rights to production from the wellbore of a certain well, arguably at the total depth it existed at the time of the assignment.

To ratify a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.In all likelihood, the lessee (usually the current producer) believes that you have legitimate grounds to break the existing lease.

When it comes to mineral rights, the standard admonition has long been consistent and emphatic: Avoid selling them. After all, simply owning mineral rights costs you nothing. There are no liability risks, and in most cases, taxes are assessed only on properties that are actively producing oil or gas.