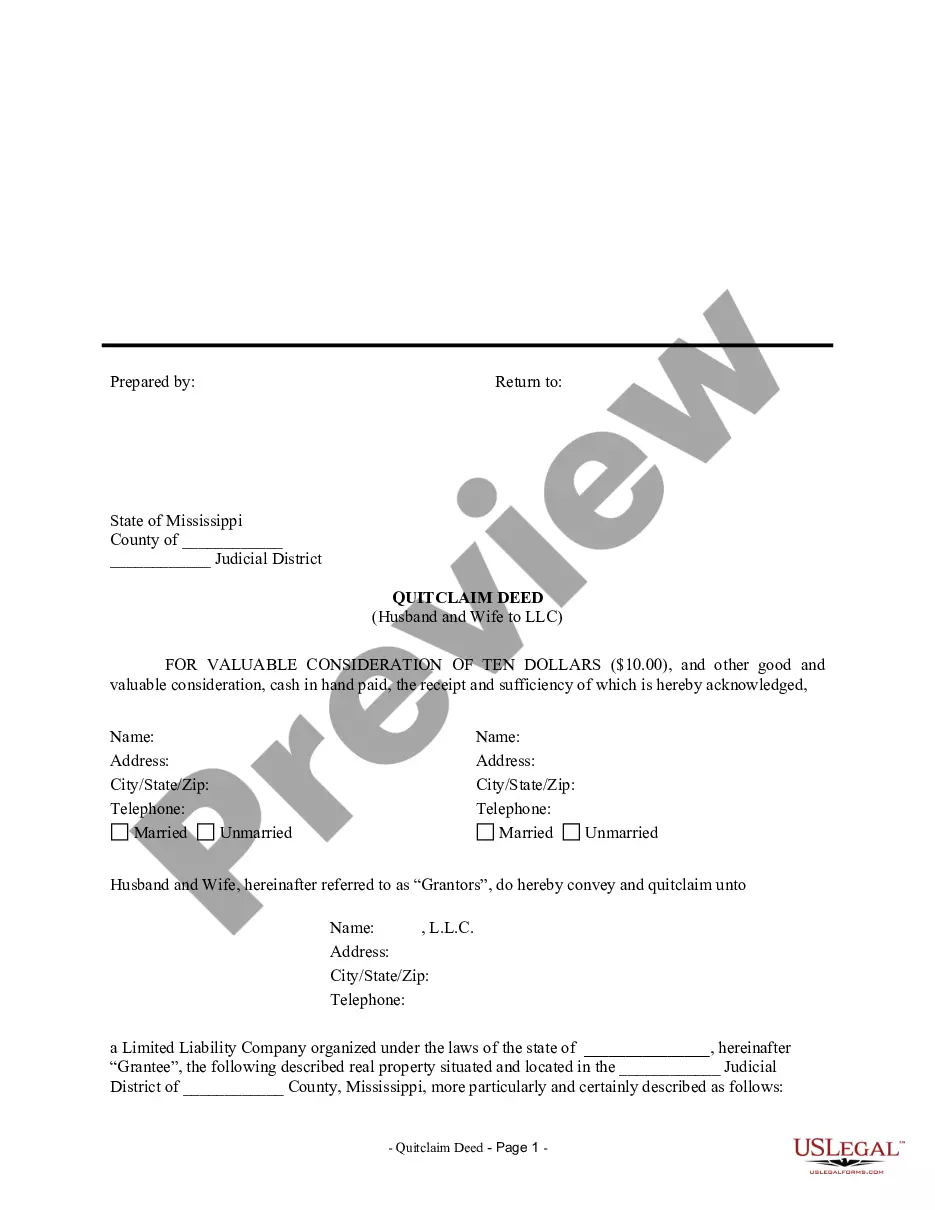

Mississippi Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out Mississippi Quitclaim Deed From Husband And Wife To LLC?

Acquire a printable Mississippi Quitclaim Deed from Spouse and Partner to LLC with just a few clicks in the largest collection of legal e-documents.

Locate, download, and print expertly crafted and validated samples on the US Legal Forms platform. US Legal Forms has been the leading provider of affordable legal and tax documents for US citizens and residents online since 1997.

Once you have downloaded your Mississippi Quitclaim Deed from Spouse and Partner to LLC, you can fill it out in any online editor or print it and complete it manually. Utilize US Legal Forms to access 85,000 expertly drafted, state-specific documents.

- Customers who already have a subscription must Log In directly to their US Legal Forms account, download the Mississippi Quitclaim Deed from Spouse and Partner to LLC, and view it saved in the My documents section.

- Individuals without a subscription are required to follow the steps outlined below.

- Ensure your form complies with your state's guidelines.

- If available, examine the form’s description for further details.

- If provided, review the document for additional content.

- Once you are certain the form fulfills your needs, click on Buy Now.

- Create a personal account.

- Select a plan.

- Pay through PayPal or credit card.

- Download the template in Word or PDF format.

Form popularity

FAQ

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

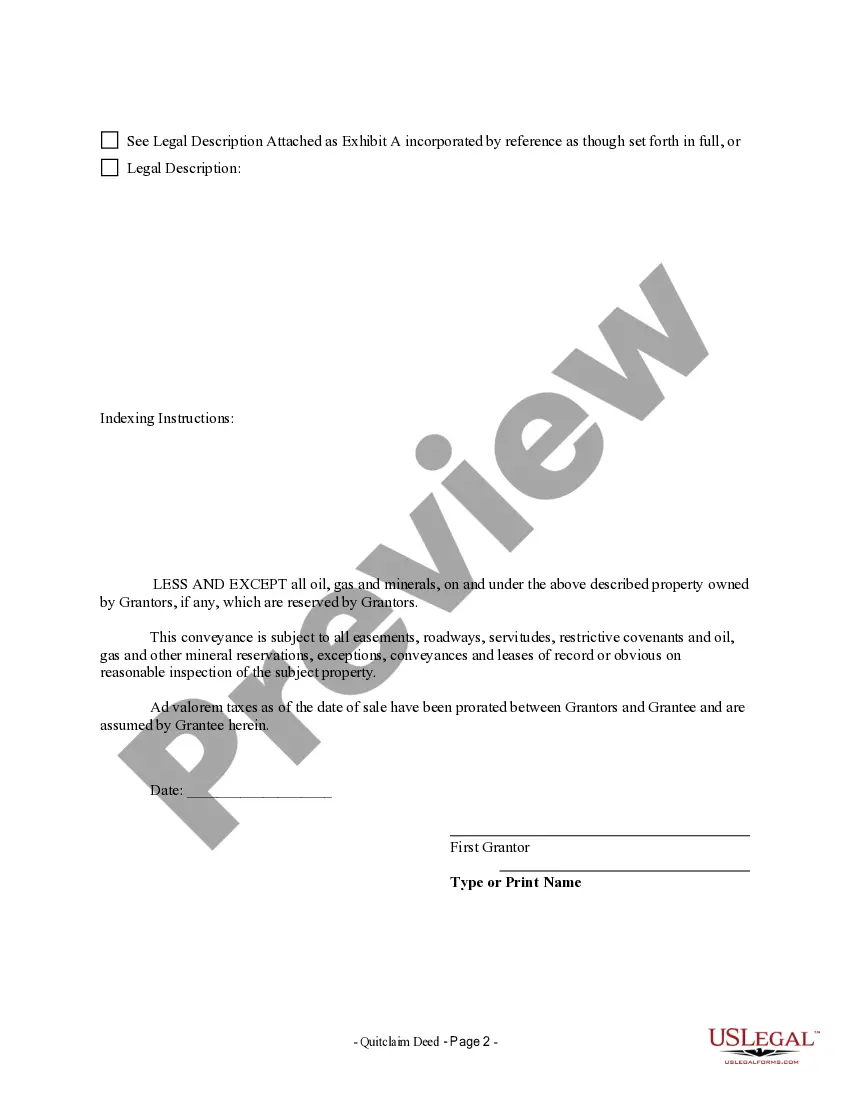

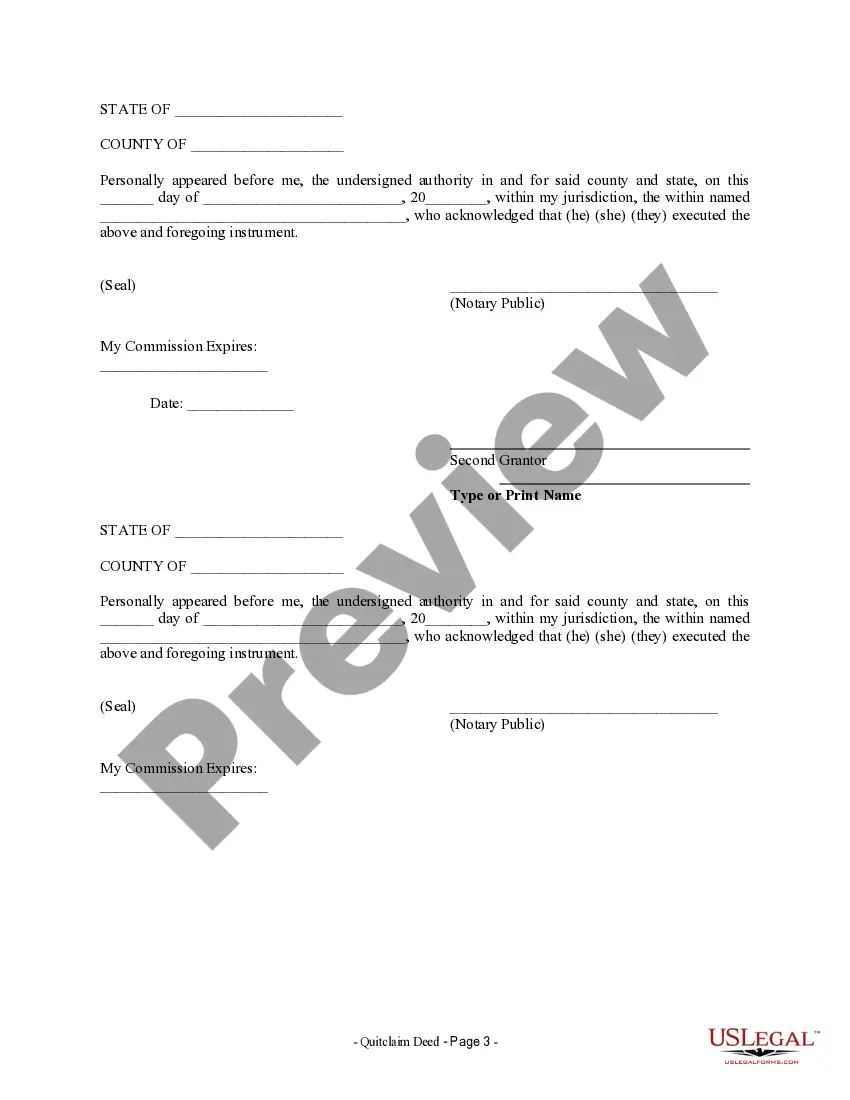

Before a quitclaim deed can be recorded with a county recorder in Mississippi, the grantor must sign and acknowledge it. The names, addresses, and telephone numbers of the grantors and grantees to the quit claim deed, along with a legal description of the real property should be provided on the first page (89-5-24).

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.