Mississippi Second Deed of Trust, Security Agreement, and Financing Statement

Description

How to fill out Mississippi Second Deed Of Trust, Security Agreement, And Financing Statement?

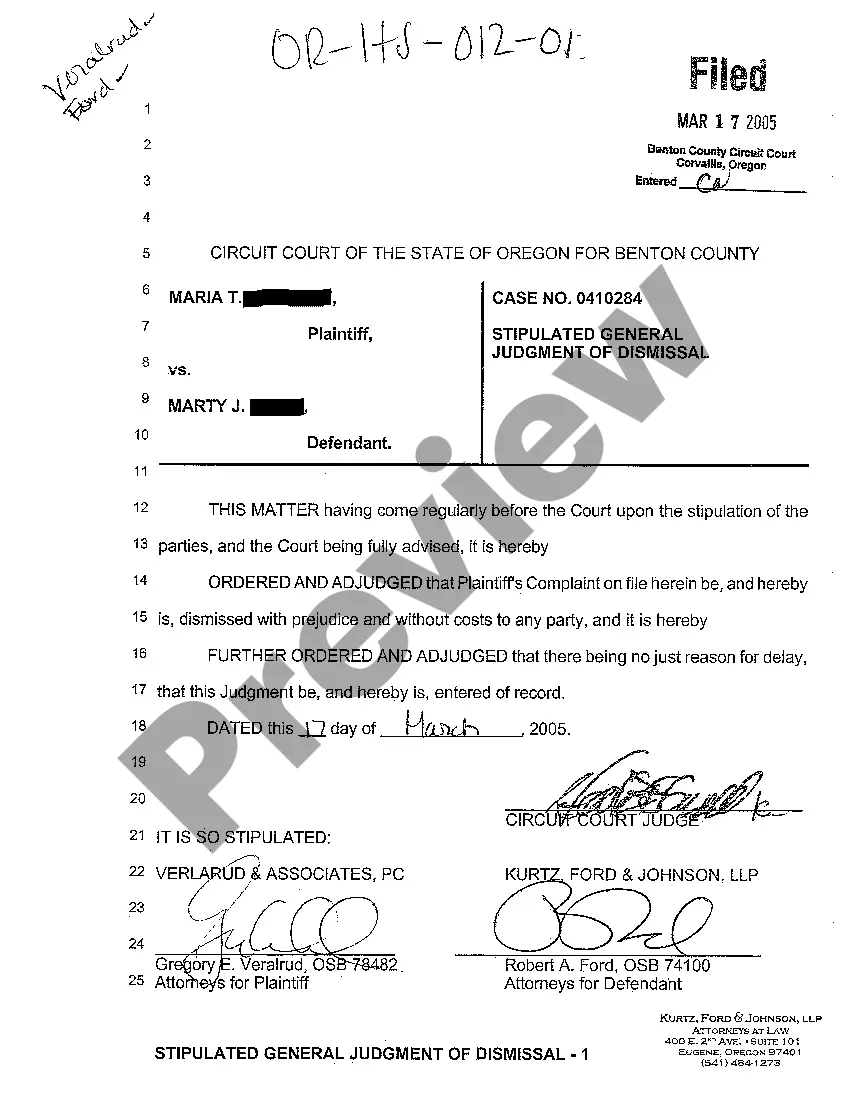

Get a printable Mississippi Second Deed of Trust, Security Agreement, and Financing Statement in just several clicks from the most comprehensive catalogue of legal e-forms. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the Top provider of affordable legal and tax forms for US citizens and residents on-line starting from 1997.

Users who have a subscription, must log in directly into their US Legal Forms account, download the Mississippi Second Deed of Trust, Security Agreement, and Financing Statement and find it stored in the My Forms tab. Users who do not have a subscription must follow the tips listed below:

- Make certain your form meets your state’s requirements.

- If provided, look through form’s description to learn more.

- If available, preview the shape to discover more content.

- As soon as you are sure the template suits you, click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay via PayPal or visa or mastercard.

- Download the template in Word or PDF format.

When you’ve downloaded your Mississippi Second Deed of Trust, Security Agreement, and Financing Statement, you can fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

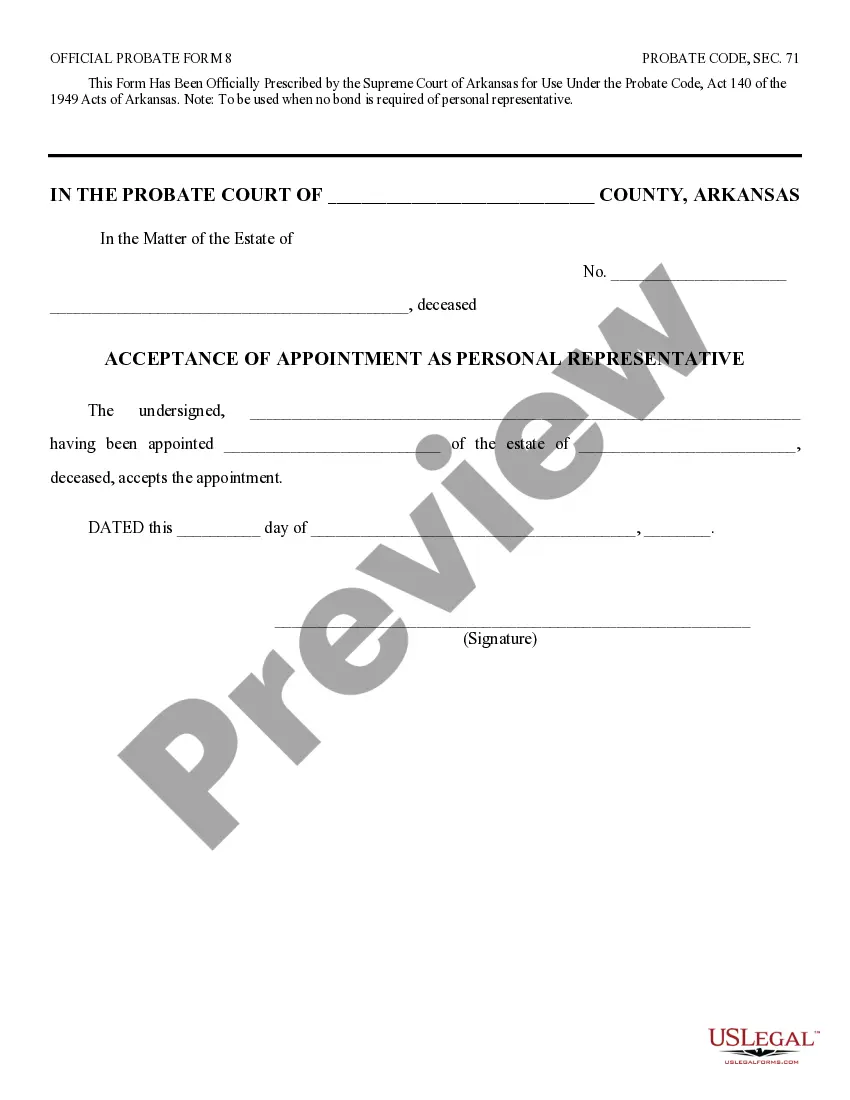

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

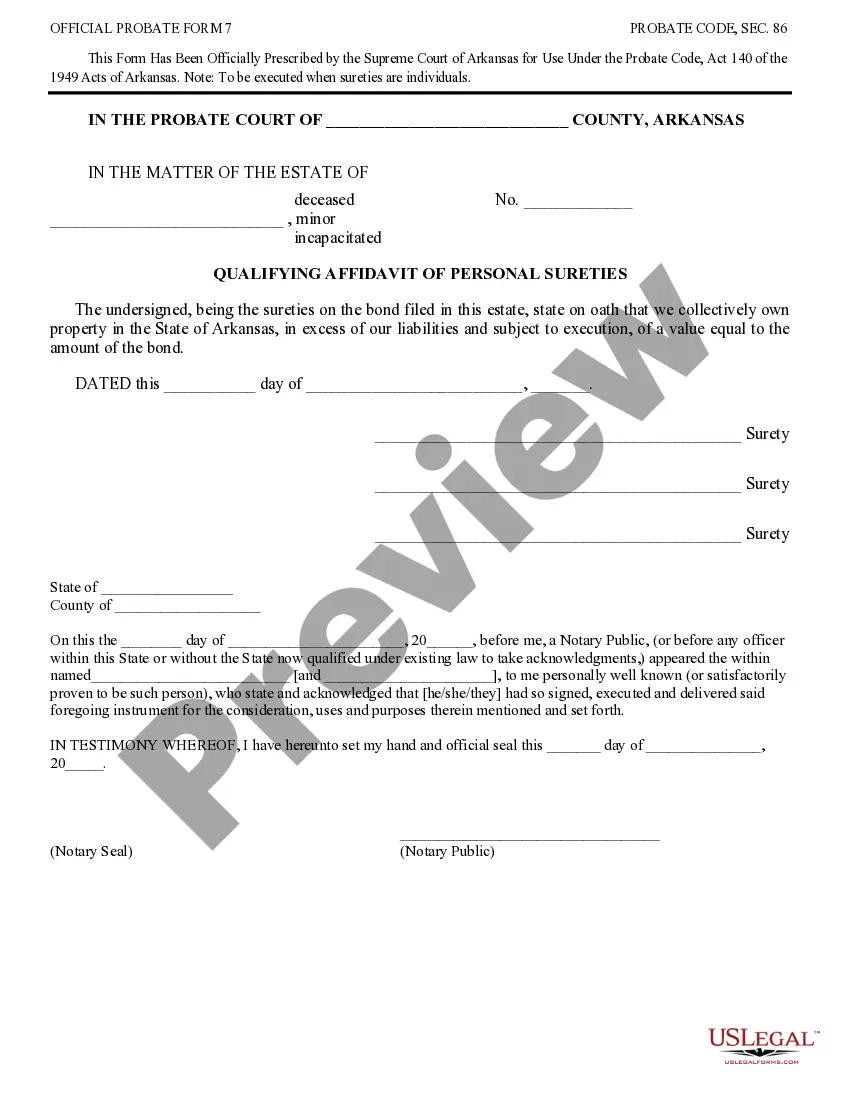

The UCC-1 Financing Statement is filed to protect a lender's or creditor's security interest by giving public notice that there is a right to take possession of and sell certain assets for repayment of a specific debt with a certain debtor.

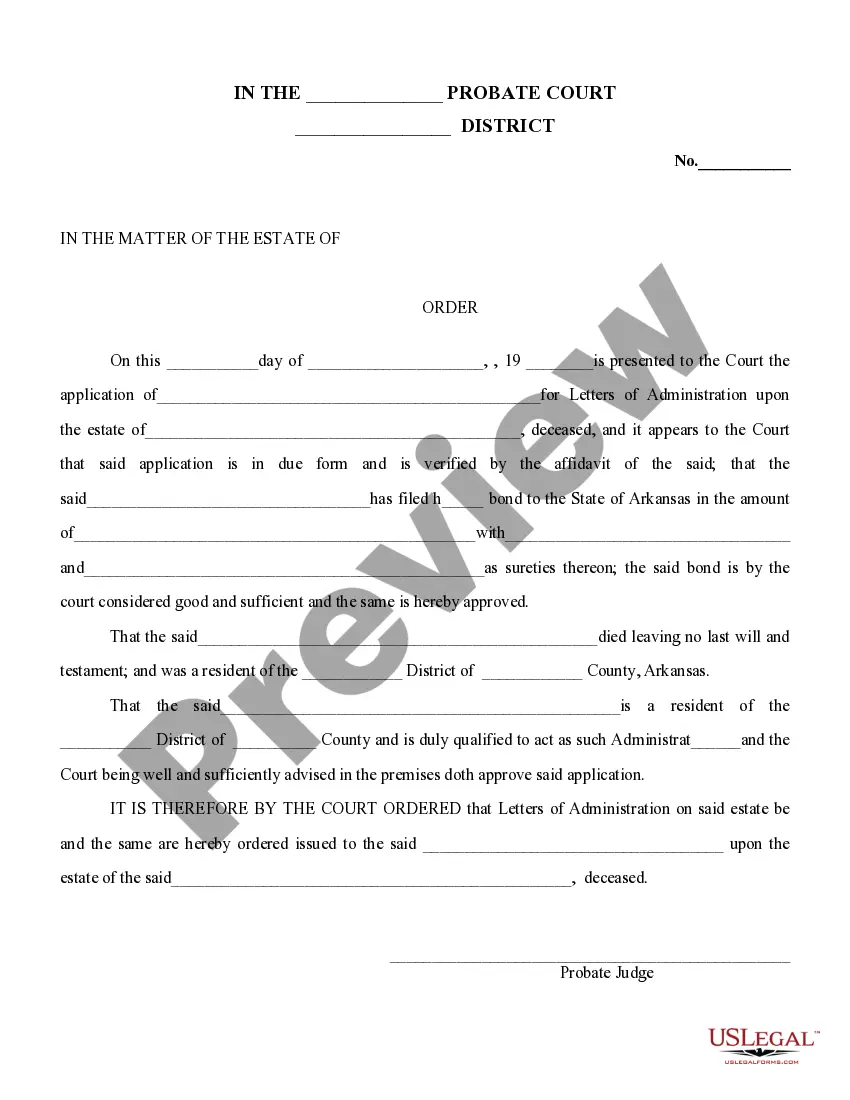

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

A deed of trust includes most of the same information as a mortgage, including: The original loan amount. A legal description of the property that's used as security or collateral for the mortgage. The names of parties: trustee, trustor, and beneficiary.

A UCC-1 financing statementalso sometimes referred to as a 'UCC-1 filing,' a 'UCC lien,' or simply a 'UCC-1'is a form that creditors use to create a lien against a debtor's property.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

The financing statement describes the types of collateral or personal property that is pledged against the value of the loan, and it identifies the parties that have an interest or stake in the collateral if the debtor defaults.