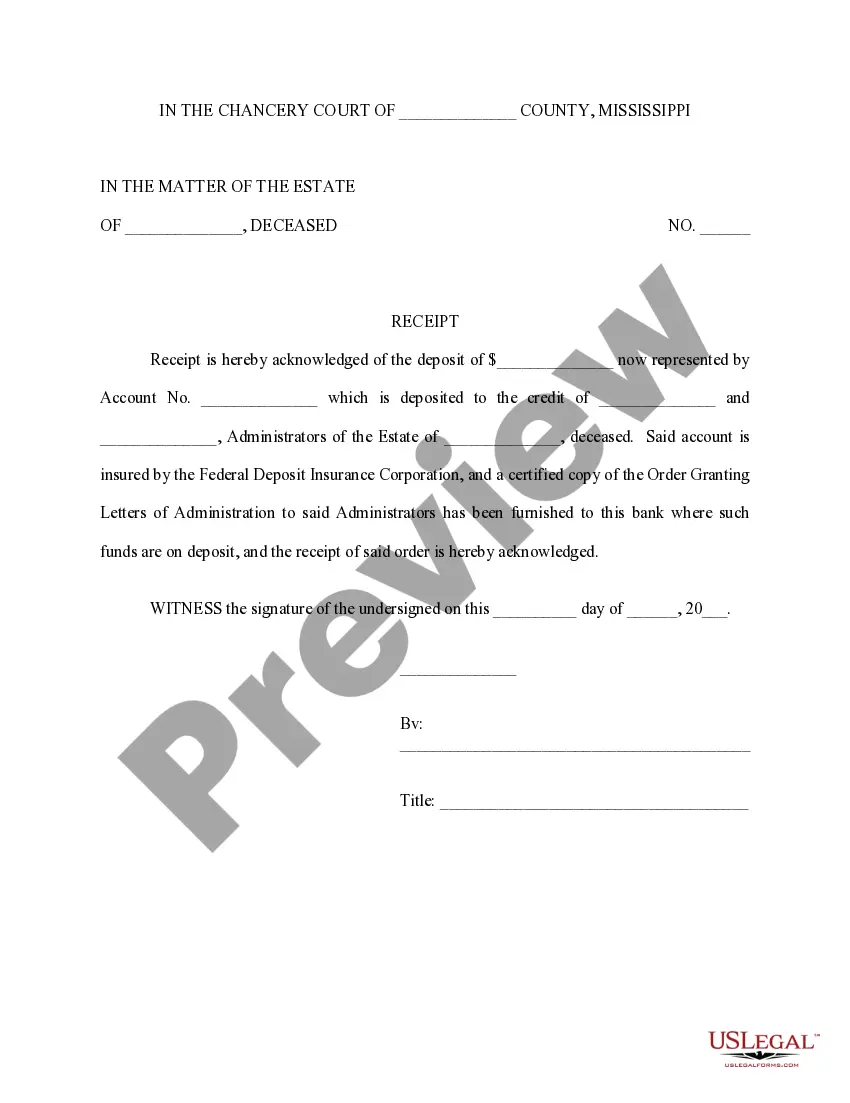

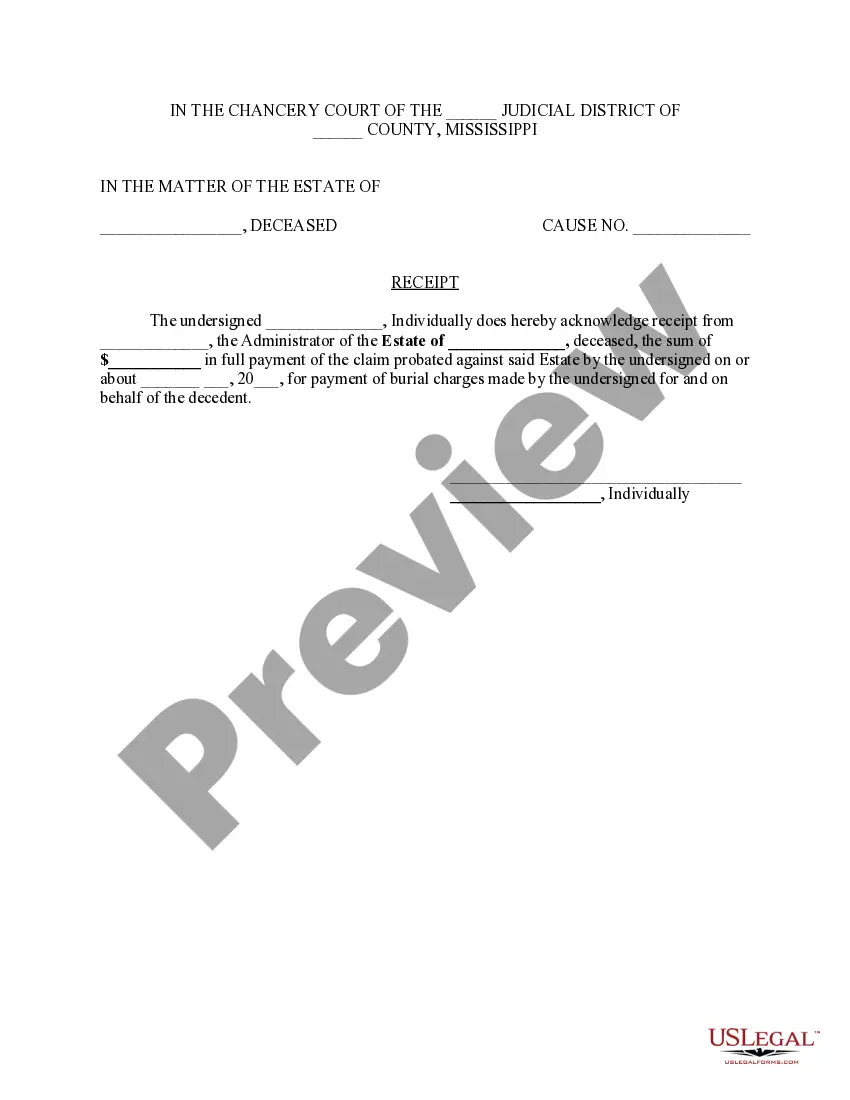

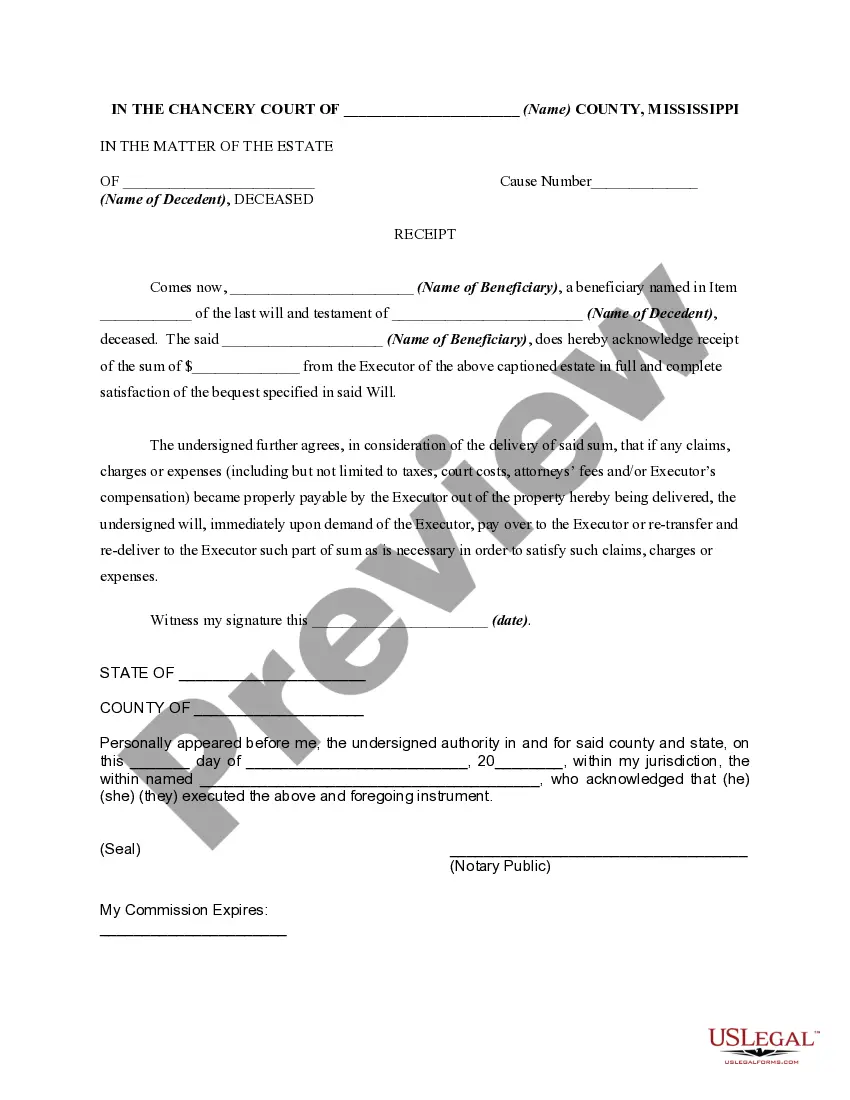

This form is a sample of a receipt used when paying over a bequest by an executor to a beneficiary in compliance with the will probated in the chancery court of Mississippi.

Mississippi Receipt from a Beneficiary under the Last Will and Testament of a Decedent

Description

How to fill out Mississippi Receipt From A Beneficiary Under The Last Will And Testament Of A Decedent?

Get a printable Mississippi Receipt from a Beneficiary under the Last Will and Testament of a Decedent within just several clicks from the most comprehensive catalogue of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 supplier of reasonably priced legal and tax forms for US citizens and residents on-line since 1997.

Customers who have already a subscription, must log in straight into their US Legal Forms account, download the Mississippi Receipt from a Beneficiary under the Last Will and Testament of a Decedent and find it stored in the My Forms tab. Users who never have a subscription are required to follow the tips listed below:

- Make sure your template meets your state’s requirements.

- If provided, read the form’s description to learn more.

- If readily available, review the shape to find out more content.

- Once you are confident the template fits your needs, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay through PayPal or bank card.

- Download the form in Word or PDF format.

When you have downloaded your Mississippi Receipt from a Beneficiary under the Last Will and Testament of a Decedent, you can fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

Paying any taxes that are due on the estate taking inventory of the property and belongings appraising and distributing the deceased person's assets settling any debts that are owed by the deceased inheriting assets named in a will if the first choice cannot acting on someone's behalf if he or she becomes sick or

If you are a named beneficiary in the will or a guardian of a minor child who is a beneficiary, you are likely permitted access to it by your state's laws. You should contact the executor to ask to see it. If you don't know who the executor is, obtain a copy of the death certificate through the county.

For a beneficiary to effectively monitor the administration of estate property it goes without saying the beneficiary needs information regarding the performance of the executor's duties and powers. To this end the law has imposed on executors and trustees a duty to account beneficiaries.

A Letter of Appointment of Executor helps prove you have been put in charge of someone's estate after they have passed away. As Executor, you've been given the duty to manage the estate and carry out the directions of the will; however, a court may require official documentation.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

While an executor is obligated to notify beneficiaries and then move things along at a reasonable pace, he or she isn't required to distribute inheritances at the time of notification. In fact, beneficiaries might not receive anything until several months after they've been notified of their place in the will.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.