Mississippi Receipt

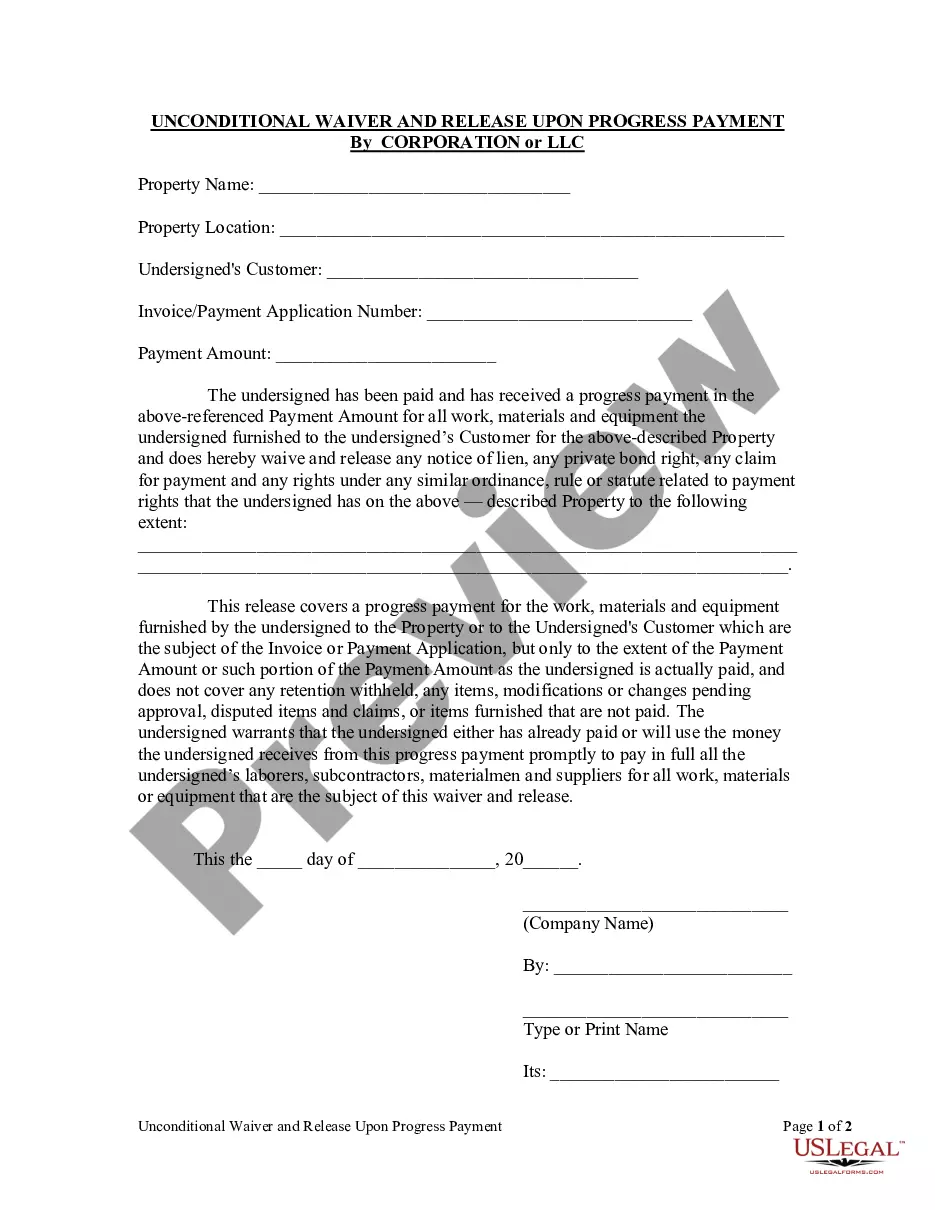

Overview of this form

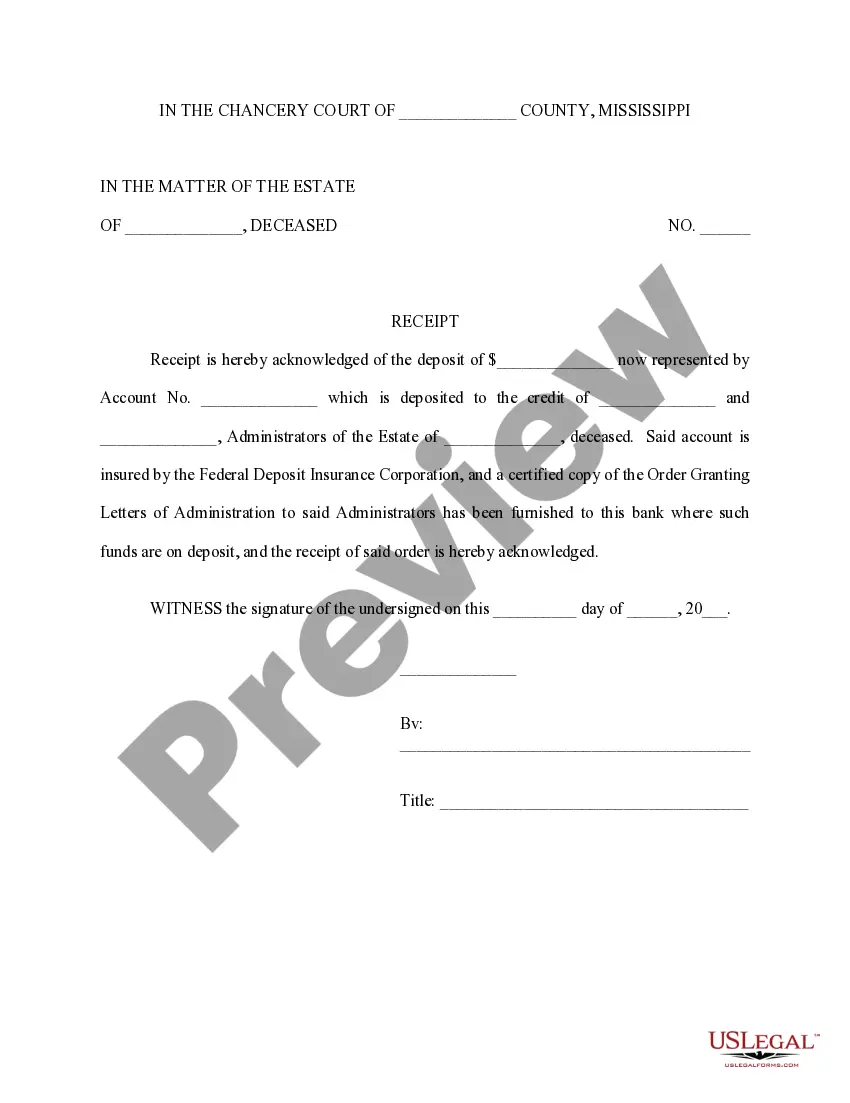

The Receipt is a legal document used in Mississippi to acknowledge the receipt of funds deposited to the Administrator's account in an estate matter. This form serves to confirm that the Administrator has received the funds, thereby fulfilling their responsibility to the estate and releasing them from future liability related to those funds. It is important to note that this Receipt differs from other forms of acknowledgments by explicitly addressing the satisfaction of the Administrator's interest in the estate.

Main sections of this form

- Identification of the estate and deceased individual

- Details of the deposit amount and account number

- Names of the Administrators handling the estate

- Statement of compliance with federal deposit insurance requirements

- Signature and title of the Administrator acknowledging receipt

When to use this form

This form should be used when an Administrator has received funds for an estate and needs to document this transaction formally. It is particularly important when satisfying the financial aspects tied to the administration of the estate, ensuring that all parties involved understand that the Administrator has received the funds and is released from liability.

Who this form is for

- Estate Administrators responsible for managing the funds of a deceased individual

- Banks or financial institutions processing the deposit on behalf of the estate

- Legal representatives or counsel assisting with the estate administration

Completing this form step by step

- Identify the name of the deceased and corresponding estate case number.

- Enter the total amount of the deposit and the account number it has been assigned.

- List the names of the Administrators who are handling the estate.

- Acknowledge that the account is insured by the Federal Deposit Insurance Corporation.

- Have the Administrator sign the form, including the date and title.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include the correct estate case number.

- Omitting the total amount of the deposit.

- Not having the form signed by the Administrator.

- Using incorrect names or titles for the Administrators.

Benefits of completing this form online

- Convenient access to the form from anywhere, at any time.

- Editable templates that can be tailored to specific circumstances.

- Reliability in form preparation, drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

The Mississippi small estate affidavit may be used by an heir or successor when the decedent's estate (the person who died) left $75,000 or less in probate-able personal property.

Applying for probate in New South Wales All applications must be filed at the Supreme Court of New South Wales Registry, either in person or by post. The application must be accompanied by supporting documents including the will and death certificate, as well as an application fee.

Mississippi has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

Net value of probate estate is $50,000 or less, or. Probate asset is bank account or accounts totaling no more than $12,500, or. Probate estate is $500 or less.

Is Probate Required in Mississippi? Most of the time, probate is required in Mississippi.However, for most instances, probate is necessary to distribute the assets of the estate and transfer ownership to the heirs.

In Mississippi, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

In the best of circumstances, the Mississippi probate process usually takes 4 to 6 months. This would only be possible if the estate was fairly simple, all interested parties are agreeable, and documents are signed and returned to the probate attorney in a timely manner.