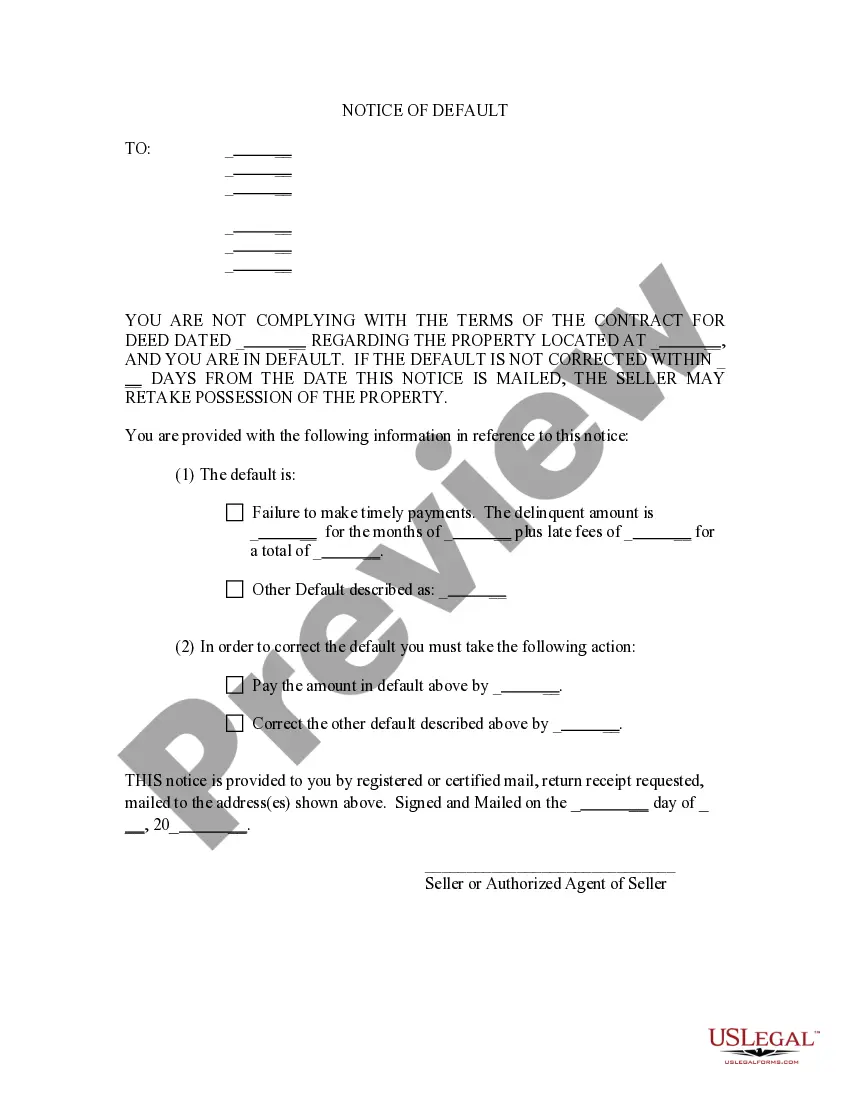

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for deed is in default, the performance required to cure the default, and the Seller's planned remedy in case the Purchaser does not cure.

Arkansas General Notice of Default for Contract for Deed

Description

How to fill out Arkansas General Notice Of Default For Contract For Deed?

Utilize US Legal Forms to acquire a printable Arkansas General Notice of Default for Contract for Deed.

Our court-acceptable forms are meticulously crafted and frequently updated by legal professionals.

Ours is the most extensive Forms library available online and provides economical and precise templates for clients, attorneys, and small to medium-sized businesses.

Select Buy Now if it’s the document you require. Create your account and pay using PayPal or by debit/credit card. Download the template to your device and feel free to use it multiple times. Utilize the Search feature if you wish to find another document template. US Legal Forms offers a vast array of legal and tax documents and packages for both business and personal requirements, including Arkansas General Notice of Default for Contract for Deed. Over three million users have successfully used our platform. Pick your subscription plan and acquire high-quality documents in a few clicks.

- The templates are organized into categories based on the state, and many can be previewed before downloading.

- To obtain samples, users must possess a subscription and Log In to their account.

- Click Download beside any template you require and locate it in My documents.

- For individuals without a subscription, follow these instructions to conveniently locate and download Arkansas General Notice of Default for Contract for Deed.

- Ensure you select the correct template corresponding to the relevant state.

- Examine the form by reviewing the description and utilizing the Preview option.

Form popularity

FAQ

Structuring a contract for a deed requires attention to several critical components, including the buyer and seller’s responsibilities, payment schedules, and terms of the title transfer. Clearly outline the consequences of default and ensure there are provisions for repairs and maintenance. A well-structured contract protects both parties; thus, consider seeking assistance from platforms like US Legal Forms to customize your agreement effectively. This can be particularly useful when handling matters related to the Arkansas General Notice of Default for Contract for Deed.

Writing up a contract for deed involves including all essential elements like the buyer and seller details, property description, payment structure, and any contingencies. It’s also important to specify the terms of default and what will happen in case of non-payment. Consider consulting templates or services, such as those offered by US Legal Forms, to ensure compliance with local laws. Following these steps will help you create a solid foundation for your Arkansas General Notice of Default for Contract for Deed.

To execute a contract as a deed in Arkansas, both parties must sign the document in front of a notary public. It’s crucial that the contract clearly outlines the terms of the agreement, including payment details and property descriptions. Once signed, you should record the deed with the local county recorder’s office to validate the transaction. This process aligns well with the Arkansas General Notice of Default for Contract for Deed, ensuring that your interests are safeguarded.

In Arkansas, land contracts do not legally have to be recorded, but it is highly recommended. Recording a land contract provides public notice of the agreement, which can protect your rights should a dispute arise. Moreover, having a recorded contract helps establish priority in case the property changes hands or if another creditor claims an interest. If you are working with an Arkansas General Notice of Default for Contract for Deed, proper recording can significantly benefit your situation.

A contract for deed can be a beneficial option if you seek flexible financing and easier access to home ownership. It allows buyers to secure a property without the immediate need for traditional financing. However, it's essential to be aware of potential risks and legal implications, such as the Arkansas General Notice of Default for Contract for Deed, which outlines the repercussions if payments are missed.

Usually, a real estate attorney or a qualified professional prepares a contract for deed. This ensures the document meets all legal requirements and adequately protects your rights. If you're unsure where to start, uslegalforms offers templates and guidance tailored to the Arkansas General Notice of Default for Contract for Deed, making it easier for you to create a valid contract.

Yes, a contract for deed typically needs to be notarized in Arkansas to ensure its legal validity. Notarization helps to certify that both parties have agreed to the terms and adds a layer of security. This aspect is particularly important when dealing with the Arkansas General Notice of Default for Contract for Deed, as it ensures all parties fulfill their obligations.

To record a contract for a deed in Arkansas, you need to prepare the document and then submit it to the local county recorder's office. This step is crucial for making the contract enforceable and protecting your interests, especially regarding the Arkansas General Notice of Default for Contract for Deed. You may want to consult with a legal professional for guidance on the necessary requirements and ensure everything is in order.