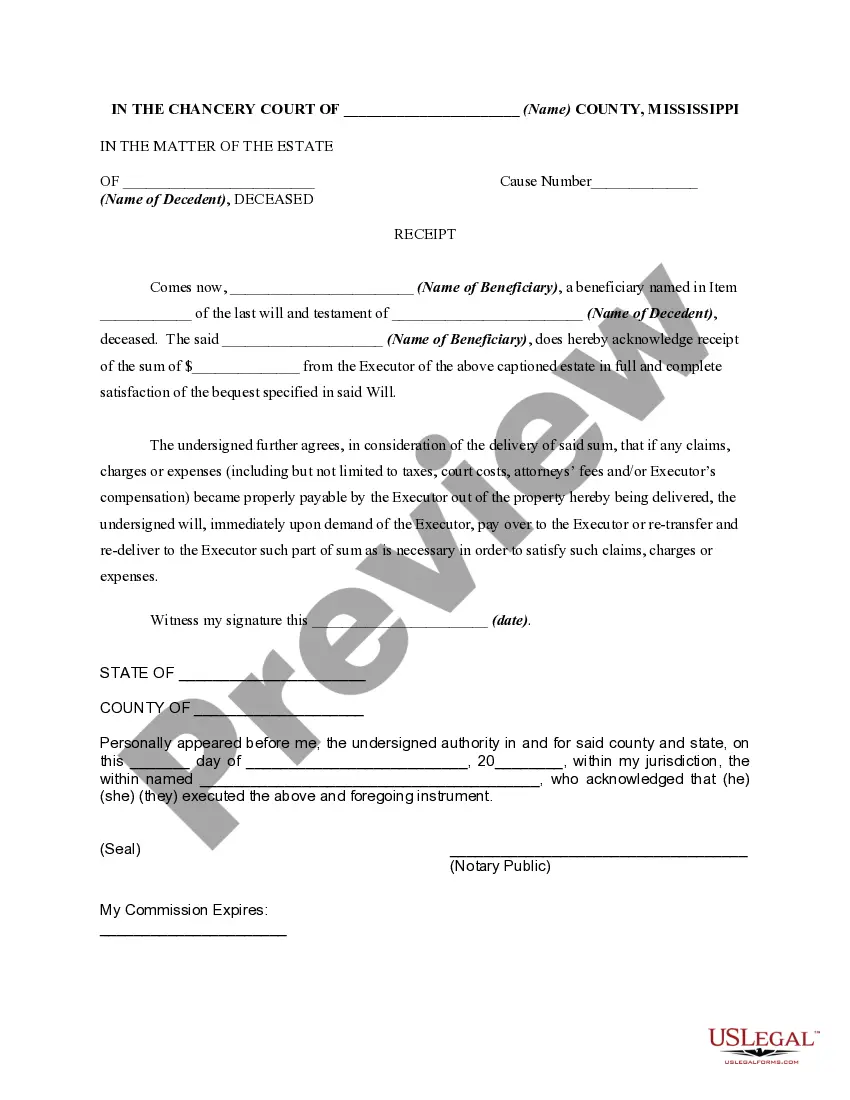

This form is a Receipt for Distribution from an Estate that records for the Executor and the Probate Court the distribution to a beneficiary of funds representing his claims against an estate.

Mississippi Receipt for Distribution From Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Mississippi Receipt For Distribution From Estate?

Acquire a printable Mississippi Receipt for Distribution From Estate in just a few clicks from the most extensive collection of legal electronic files. Locate, download, and print expertly prepared and certified samples on the US Legal Forms site. US Legal Forms has been the leading provider of affordable legal and tax templates for US citizens and residents online since 1997.

Clients with a subscription must Log In to their US Legal Forms account, download the Mississippi Receipt for Distribution From Estate, and find it saved in the My documents section. Clients without a subscription need to follow these steps.

After downloading your Mississippi Receipt for Distribution From Estate, you can fill it out in any online editor or print it and complete it manually. Use US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- Ensure your template complies with your state's regulations.

- If available, review the form's description for more details.

- If provided, examine the document for additional information.

- Once you're confident the form meets your requirements, click Buy Now.

- Create a personal account.

- Choose a subscription plan.

- Pay via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

It is also one the country's most tax-friendly states for retirees.Mississippi exempts all forms of retirement income from taxation, including Social Security benefits, income from an IRA, income from a 401(k) and any pension income. On top of that, the state has low property taxes and moderate sales taxes.

In Mississippi, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Generally speaking, inheritance is not subject to tax in California. If you are a beneficiary, you will not have to pay tax on your inheritance.

The Mississippi small estate affidavit may be used by an heir or successor when the decedent's estate (the person who died) left $75,000 or less in probate-able personal property.

You won't have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income. But the type of property you inherit might come with some built-in income tax consequences.

Unlike the federal estate tax, the beneficiary of the property is responsible for paying the tax, not the estate. However, as of 2020, only six states impose an inheritance tax. And even if you live in one of those states, many beneficiaries are exempt from paying it.

Mississippi probate is usually required if a deceased person died with Mississippi assets in his or her name and those assets do not pass automatically at the person's death.There are some alternatives to probate that may apply in limited circumstances.

Most estate disbursements are not subject to income tax, including cash provided it's bequeathed according to the terms of the decedent's will, through his probate estate. Cash received from a trust is income to the beneficiary, however.

Beneficiaries generally don't have to pay income tax on money or other property they inherit, with the common exception of money withdrawn from an inherited retirement account (IRA or 401(k) plan).The good news for people who inherit money or other property is that they usually don't have to pay income tax on it.