Missouri Accounts Receivable Monthly Customer Statement

Description

How to fill out Accounts Receivable Monthly Customer Statement?

Have you ever found yourself in a circumstance where you require documentation for either business or personal reasons nearly every day.

There are numerous legal document templates accessible online, but finding versions you can trust isn't easy.

US Legal Forms offers thousands of template options, such as the Missouri Accounts Receivable Monthly Customer Statement, which are crafted to comply with federal and state regulations.

Once you have found the correct form, simply click Get now.

Select the pricing plan you desire, complete the required information to create your account, and place an order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Missouri Accounts Receivable Monthly Customer Statement template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct area/state.

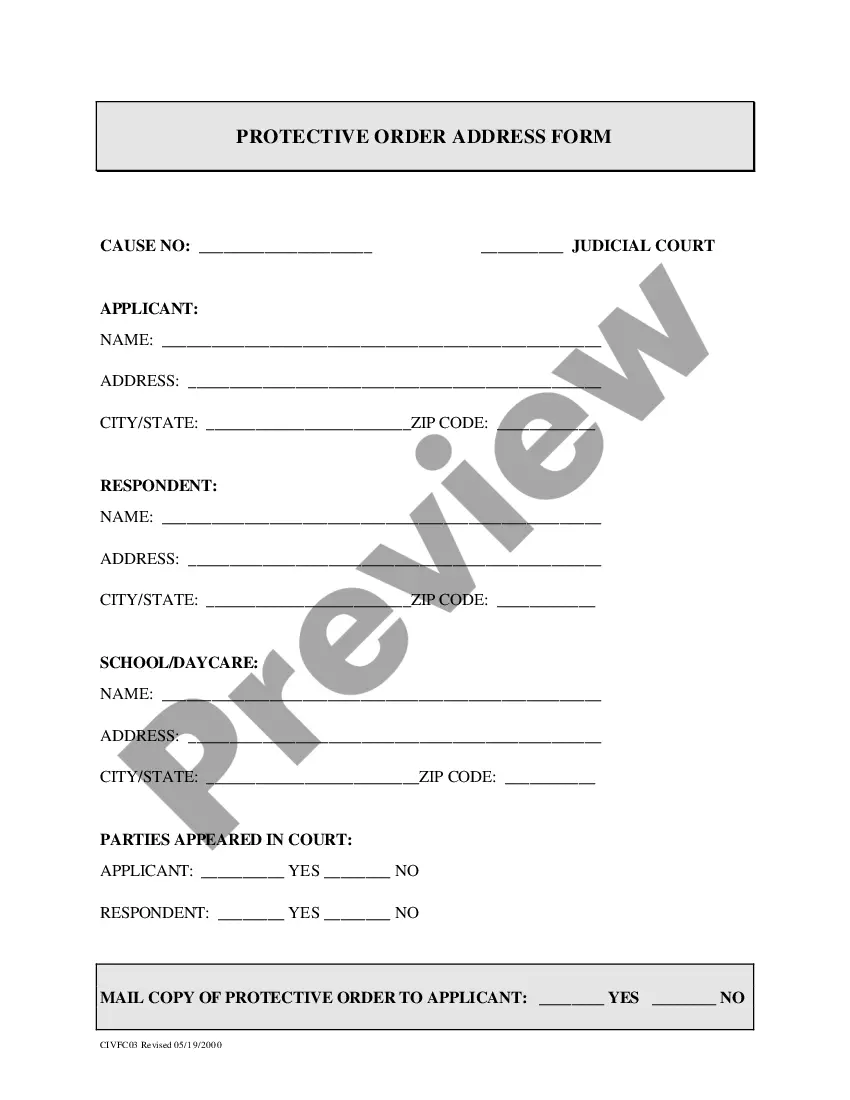

- Utilize the Preview button to examine the form.

- Review the description to confirm that you have selected the appropriate form.

- If the form is not what you are searching for, use the Search section to locate the form that suits your needs.

Form popularity

FAQ

A monthly AR statement is a report that summarizes a business's accounts receivable activity over the month. It typically includes details such as total sales, payments received, and outstanding balances for each customer. Utilizing a Missouri Accounts Receivable Monthly Customer Statement allows businesses to monitor their financial health and make informed decisions about credit and collections.

The accounts receivable aging report is the statement that shows accounts receivable in detail. This report categorizes outstanding invoices based on how long they have been due, helping businesses identify which accounts require immediate attention. By regularly reviewing your Missouri Accounts Receivable Monthly Customer Statement, you can ensure that you stay on top of overdue payments and maintain healthy customer relationships.

At a high level, this process is accomplished through invoicing and collections, and includes sending the invoice, managing collections, processing payments, matching payments to invoices, and posting the payments.

Ing to US GAAP, the company's accounts receivable balance must be stated at ?net realizable value?. In basic terms, this just means that the accounts receivable balance presented in the company's financial statements must be equal to the amount of cash they expect to collect from customers.

The accounts receivable collection period is the average collection period for a business to collect its outstanding invoices. A low collection period indicates that customers pay their invoices quickly, while a more extended collection period shows customers may take too long to deliver.

How to Calculate Your A/R Collection Period. Typically, the average accounts receivable collection period is calculated in days to collect. This figure is best calculated by dividing a yearly A/R balance by the net profits for the same period of time.

Accounts receivable (AR) is an item in the general ledger (GL) that shows money owed to a business by customers who have purchased goods or services on credit. AR is the opposite of accounts payable, which are the bills a company needs to pay for the goods and services it buys from a vendor.

Does accounts receivable count as revenue? Accounts receivable is an asset account, not a revenue account. However, under accrual accounting, you record revenue at the same time that you record an account receivable. Accounts Receivable?Keith's Furniture Inc.

The accounts receivable cycle starts when a service/product has been delivered, but not yet paid for, and is completed when the invoice is settled, and the amount paid in full.