Missouri Daily Accounts Receivable

Description

How to fill out Daily Accounts Receivable?

Selecting the finest legal document template can be challenging. Naturally, there is an array of templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The service provides thousands of templates, like the Missouri Daily Accounts Receivable, suitable for business and personal purposes. All documents are reviewed by professionals and comply with federal and state regulations.

If you are already a registered user, Log In to your account and click the Download button to get the Missouri Daily Accounts Receivable. Use your account to browse the legal forms you have previously purchased. Visit the My documents section of your account and download another copy of the document you need.

US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the service to download professionally crafted paperwork that adheres to state requirements.

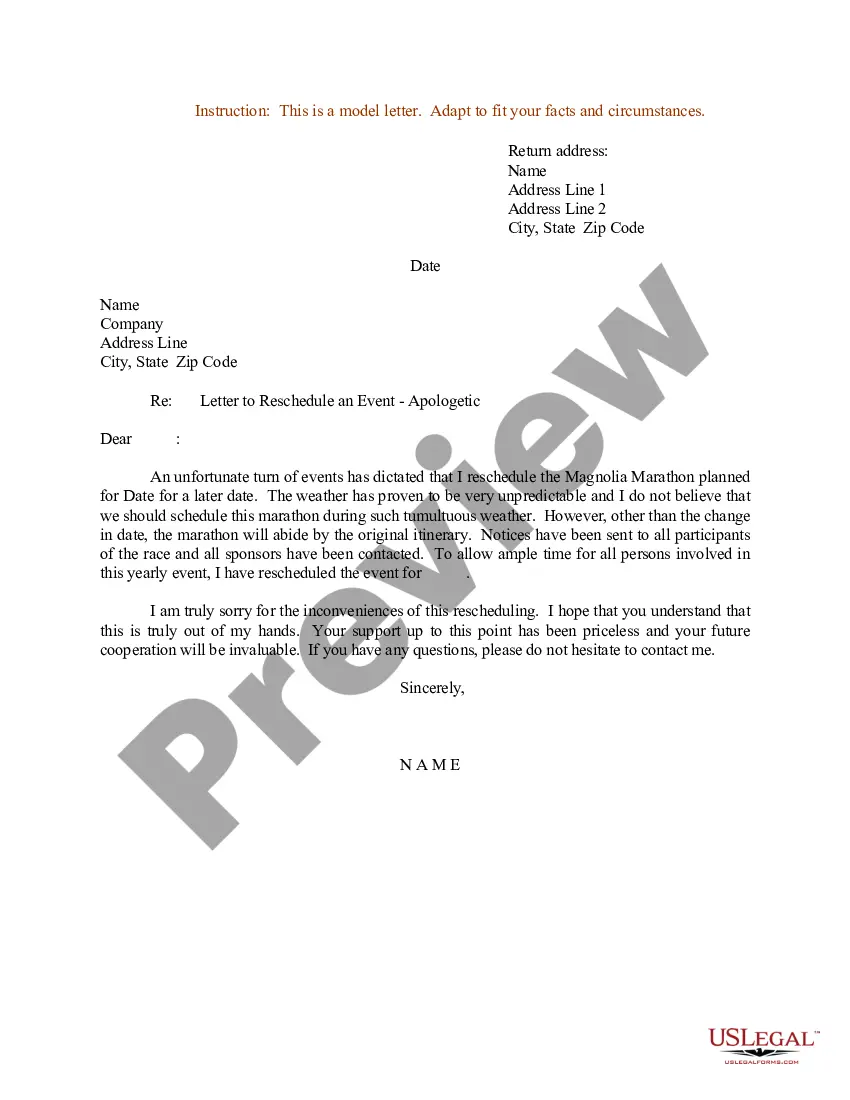

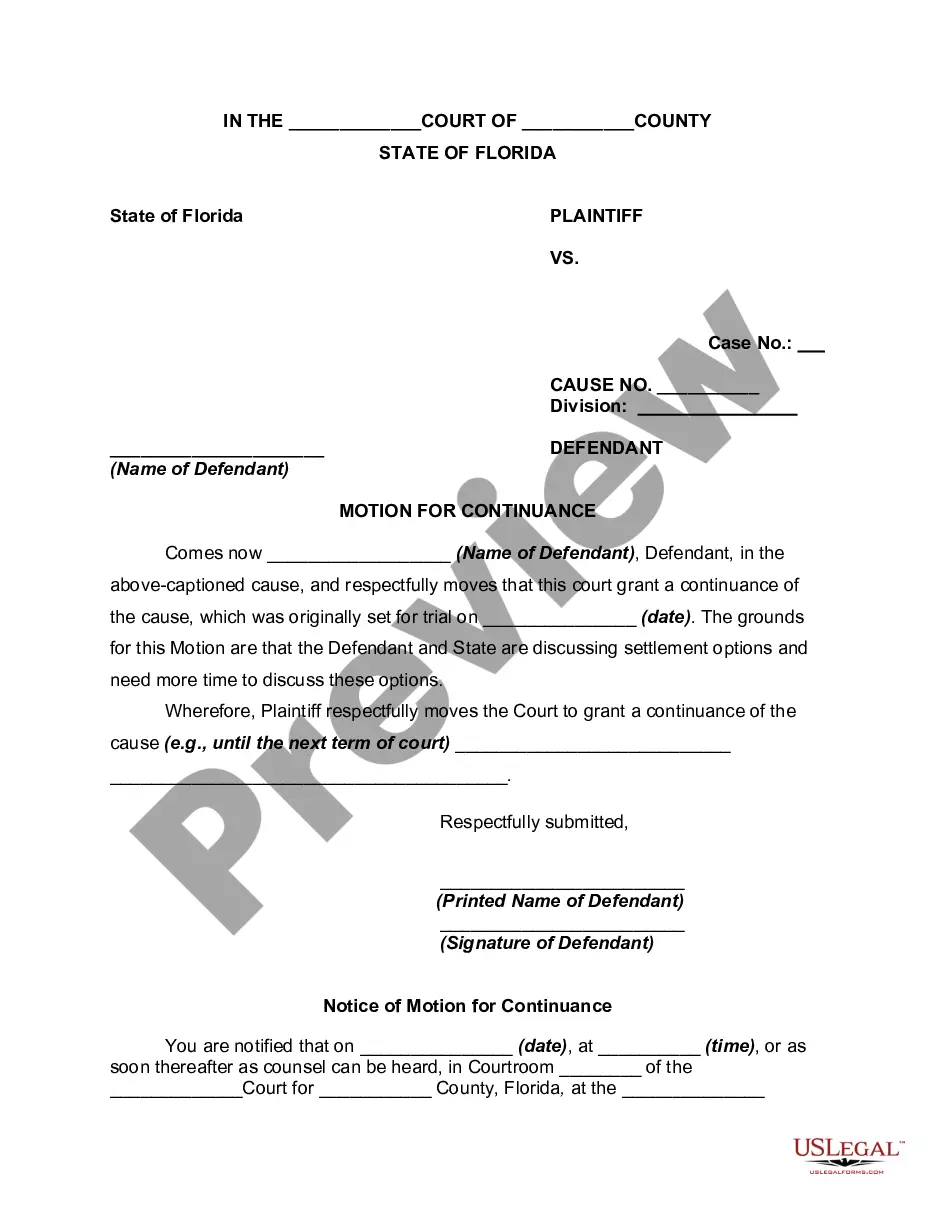

- First, ensure you have selected the correct form for your location/county. You can review the document using the Review option and examine the form outline to ensure it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate document.

- Once you are certain the form is correct, choose the Get Now button to obtain the form.

- Select the pricing plan you want and enter the required information. Create your account and complete the purchase using your PayPal account or credit card.

- Choose the document format and download the legal document template to your device.

- Complete, modify, print, and sign the downloaded Missouri Daily Accounts Receivable.

Form popularity

FAQ

On a trial balance, accounts receivable is a debit until the customer pays. Once the customer has paid, you'll credit accounts receivable and debit your cash account, since the money is now in your bank and no longer owed to you. The ending balance of accounts receivable on your trial balance is usually a debit.

Definition: Accounts receivable is the amount customers owe the company. Since revenue is a promise to pay (typically customers don't pay when they receive the product or service; they wait 30 days, or longer, to pay the bill), accounts receivable is the place where those promises are tracked.

Accounts receivable is money you're owed, which makes it an asset. In fact your invoices are so valuable that some companies will even buy them off you. Once an invoice is paid, it's no longer an asset it becomes cash in the bank, which is even better.

The key role of an employee who works as an Accounts Receivable is to ensure their company receives payments for goods and services, and records these transactions accordingly. An Accounts Receivable job description will include securing revenue by verifying and posting receipts, and resolving any discrepancies.

The schedule of accounts receivable is a report that lists all amounts owed by customers. The report lists each outstanding invoice as of the report date, aggregated by customer.

Accounts receivable (AR) is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivables are listed on the balance sheet as a current asset. AR is any amount of money owed by customers for purchases made on credit.

Definition: Accounts receivable, often abbreviated A/R, is the amount of money that customers currently owe to the company for goods or services that were purchased on credit.

Definition: The schedule of accounts payable is a listing of all vendors in the accounts payable ledger that the company currently owes money along with the current account balances. In other words, the schedule of accounts payable is a list of all the people who the company owes in the accounts payable system.

Effectively track accounts receivableSome businesses track accounts receivables on a balance sheet, logging incoming cash by hand or manually in a spreadsheet. However, there are many businesses that use invoicing software to track accounts receivables and generate regular reports to help you manage your payments.

How to create an accounts receivable aging reportStep 1: Review open invoices.Step 2: Categorize open invoices according to the aging schedule.Step 3: List the names of customers whose accounts are past due.Step 4: Organize customers based on the number of days outstanding and the total amount due.10-May-2021