A Missouri Escrow Agreement is a legal contract between two parties, the Escrow Agent and the Escrow Principal. The Escrow Agent holds funds and/or documents in trust for the Escrow Principal until certain conditions of the agreement are met. The agreement outlines the duties and responsibilities of both parties, the terms of the escrow, and the conditions of release of the funds and/or documents. There are two types of Missouri Escrow Agreement: a Standard Escrow Agreement and a Special Escrow Agreement. The Standard Escrow Agreement is used for the most common escrow transactions and is the simpler of the two. The Special Escrow Agreement is used for more complex transactions and includes specific instructions that must be followed in order for the agreement to be valid.

Missouri Escrow Agreement

Description

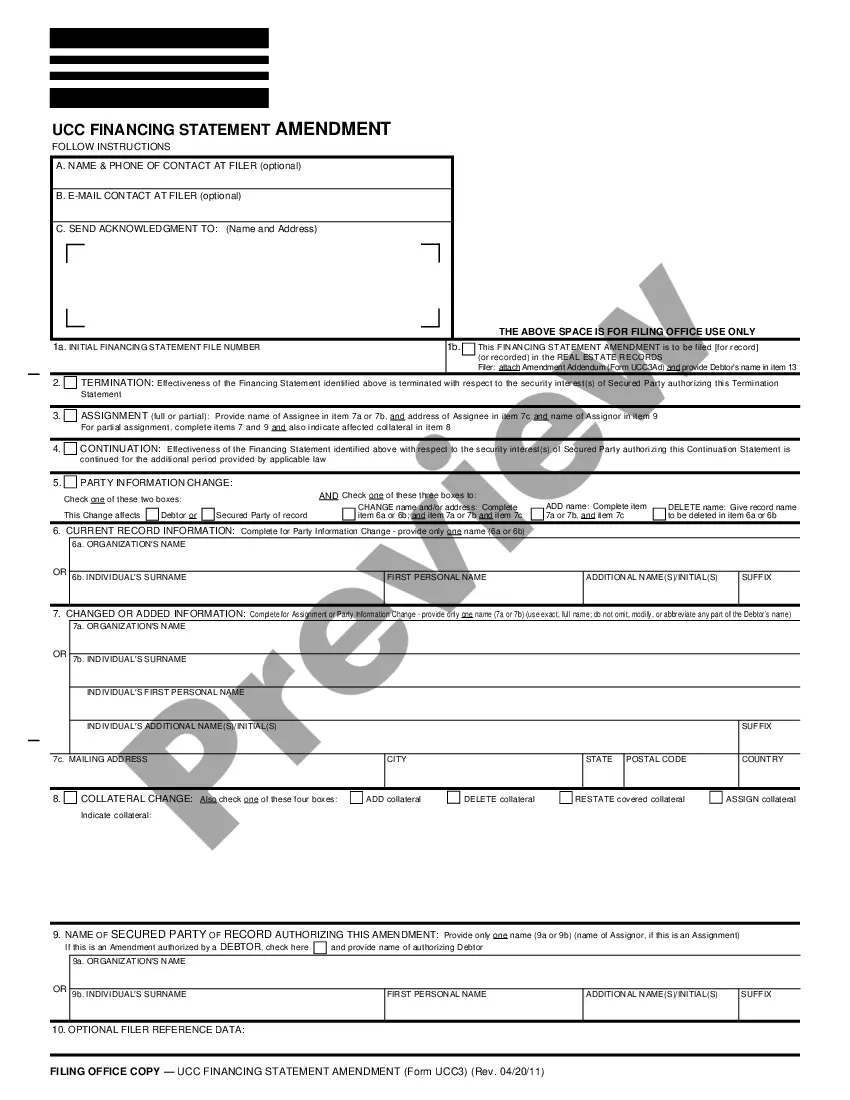

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Escrow Agreement?

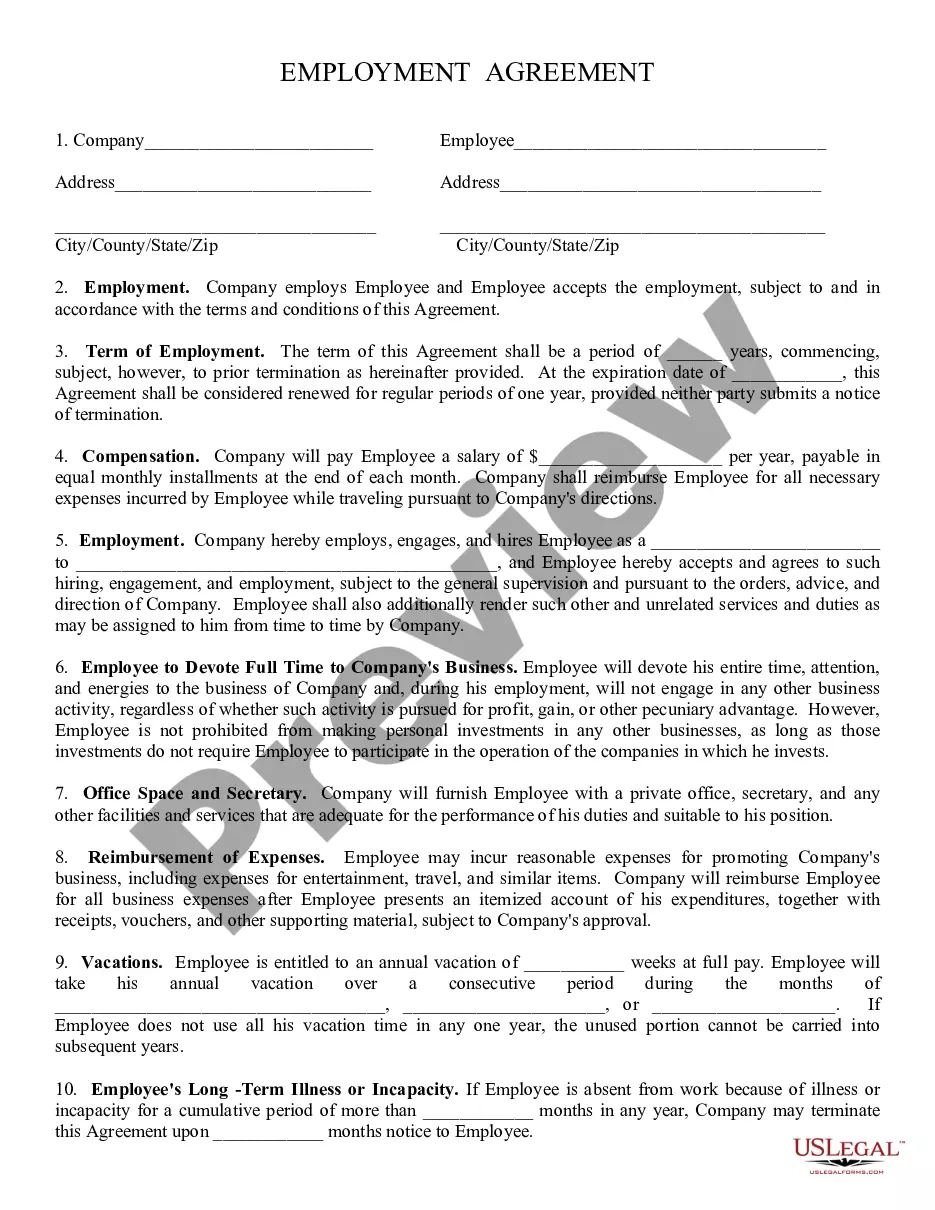

Managing official documents demands focus, accuracy, and utilizing correctly-prepared templates. US Legal Forms has been assisting individuals nationwide for a quarter of a century, so when you select your Missouri Escrow Agreement template from our platform, you can be assured it complies with both federal and state regulations.

Utilizing our platform is simple and quick. To access the required documents, all you need is an account with an active subscription. Here’s a brief guide to help you acquire your Missouri Escrow Agreement in just minutes.

All documents are designed for multiple uses, like the Missouri Escrow Agreement you see on this page. If you require them later, you can complete them without any additional payment - simply access the My documents tab in your profile and finalize your document whenever necessary. Experience US Legal Forms and prepare your business and personal documents swiftly and in full legal compliance!

- Make sure to thoroughly review the form's content and its alignment with general and legal standards by previewing it or examining its description.

- Look for an alternate formal template if the one you previously accessed doesn’t suit your circumstances or state laws (the tab for that is located in the top page corner).

- Log in to your account and save the Missouri Escrow Agreement in your preferred format. If it’s your first time using our service, click Buy now to continue.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose the format in which you would like to save your form and click Download. Print the template or add it to a professional PDF editor for electronic submission.

Form popularity

FAQ

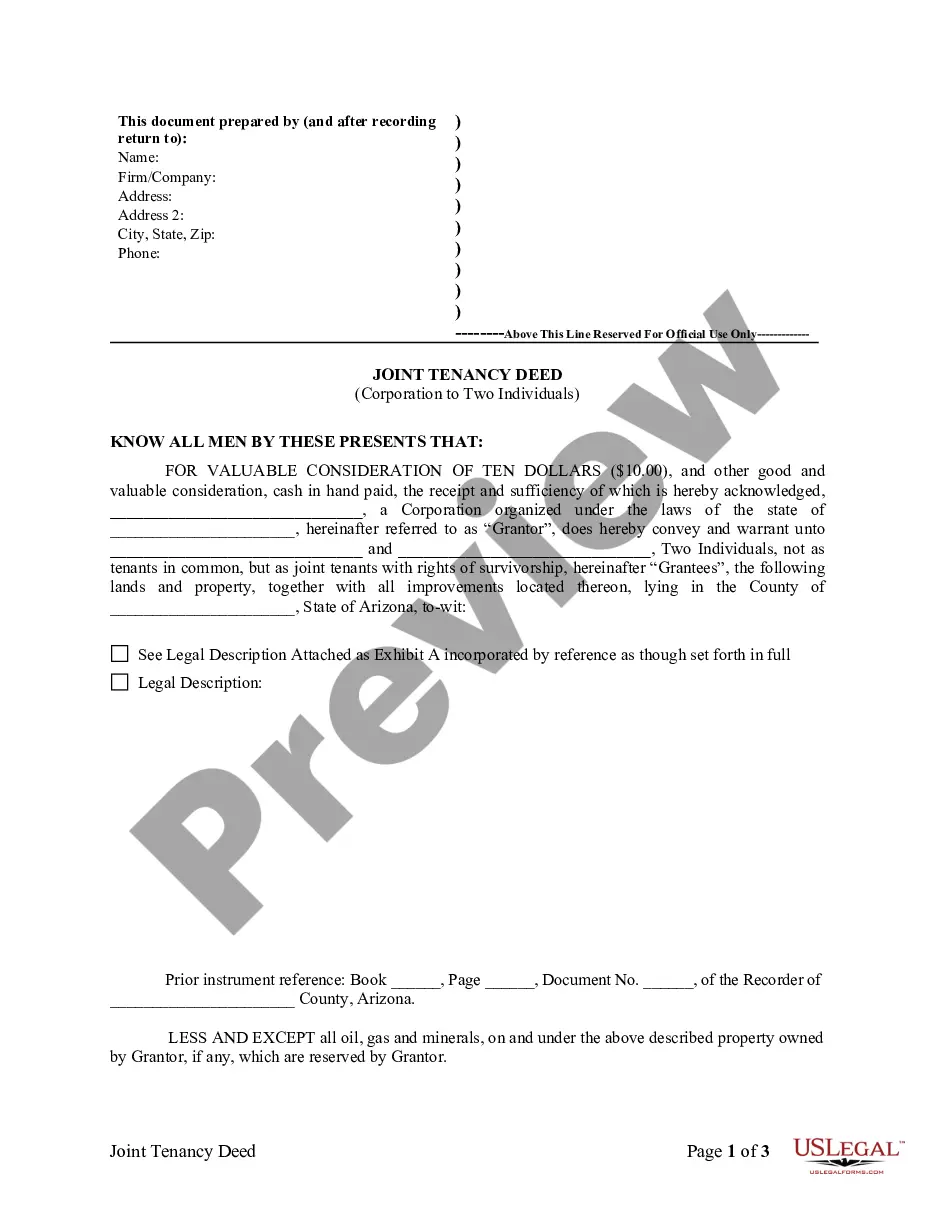

Escrow Protections Escrow provides assurances for all major parties in a real estate transaction?the buyer, the seller, and the lender?that their interests, and their funds, are protected.

In the home purchasing context, some mortgage lenders require that the buyer use an escrow account during the transaction. Even if there is no requirement to use an escrow account in the home purchase context, using such an account may provide additional protection to all parties involved in the transaction.

An escrow account is set up by an escrow agency in which both the seller and buyer (or their solicitors) are joint account holders. Escrow accounts are often used to hold money, securities, funds or any other kind of asset, providing protection for all parties.

How Escrow Agreements Work. In an escrow agreement, one party?usually a depositor?deposits funds or an asset with the escrow agent until the time that the contract is fulfilled. Once the contractual conditions are met, the escrow agent will deliver the funds or other assets to the beneficiary.

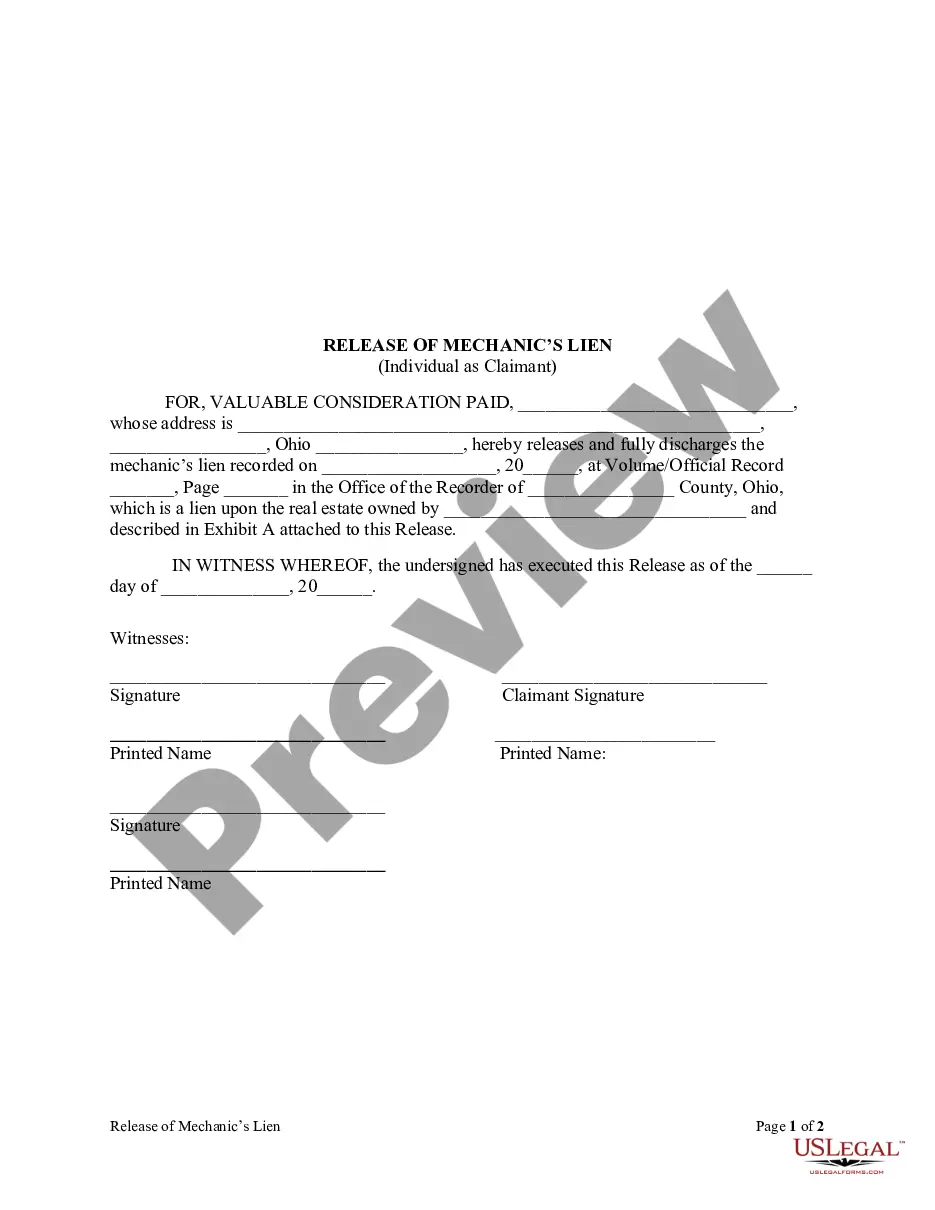

Escrows are voluntarily completed by full performance/execution and closing, or the escrow may be terminated by mutual consent. The termination of the sale escrow is accomplished by cancellation of the escrow, and by rescission or cancellation of the residential purchase agreement, or other form of agreement of sale.

The two essential elements for a valid sale escrow are a binding contract/agreement between buyer and seller and the conditional delivery to a neutral third party of something of value, as defined, which typically includes written instruments of conveyance (grant deed) or encumbrance (deed of trust) and related

Escrow Account Requirements All escrow or trust accounts must be maintained at a Missouri licensed financial institution. If the trust or escrow account bears interest, the broker must notify all parties to the transaction in writing as to who will be the beneficiary of the interest.

Only 15 states require lenders to pay interest on escrow accounts, since the funds usually sit there for months: Alaska, California, Connecticut, Iowa, Maine, Maryland, Massachusetts, Minnesota, New Hampshire, New York, Oregon, Rhode Island, Utah, Vermont, and Wisconsin.

If you have a mortgage, you likely have a mortgage escrow account. Look on a recent statement or bill. If there's a line or section for ?escrow,? part of your monthly payments have been going into your mortgage escrow account.