Escrow Agreement

Understanding this form

An Escrow Agreement is a legal document that establishes a secure arrangement between two parties and an escrow agent. It defines how funds or documents will be held by a neutral third party until specific conditions are met, ensuring that both parties fulfill their obligations. This form differs from other agreements by emphasizing the escrow agent's role in managing the assets held in trust until the completion of the transaction.

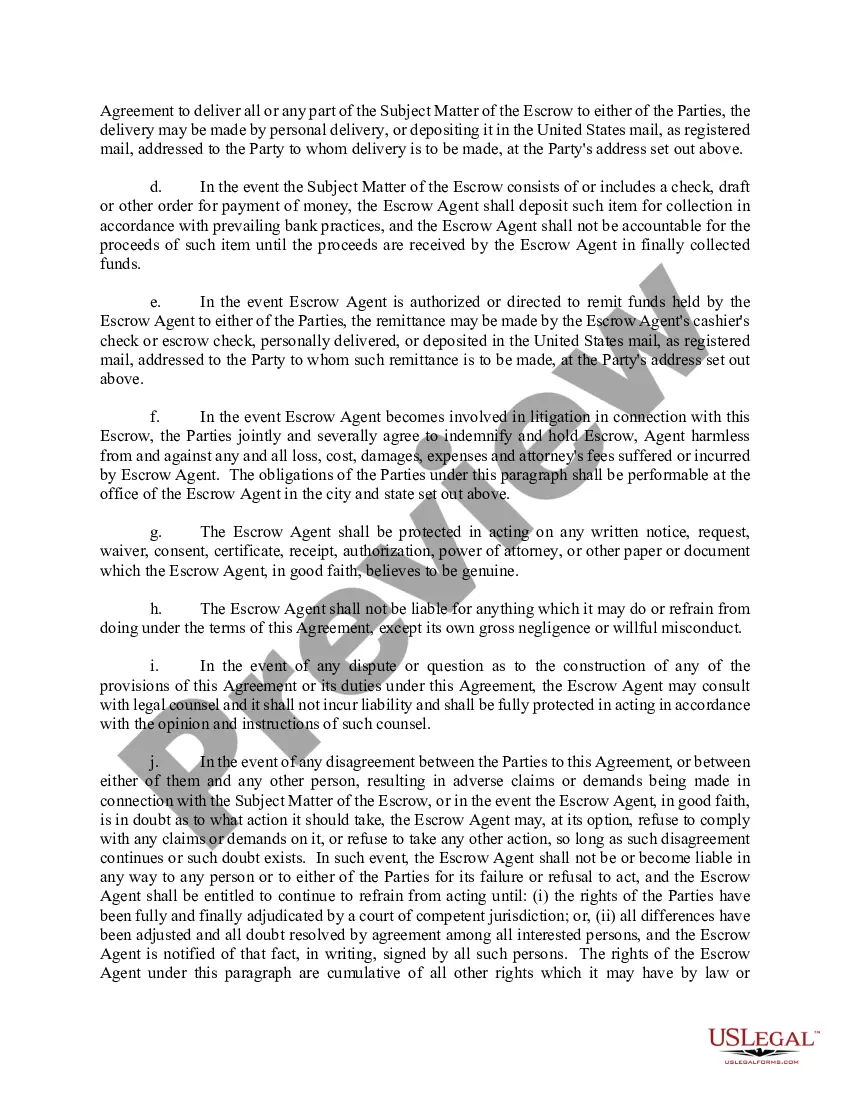

Form components explained

- Identification of the first party, second party, and escrow agent.

- Description of the subject matter being held in escrow, such as funds or documents.

- Instructions for the escrow agent regarding how to handle the subject matter.

- Provisions outlining the responsibilities and limitations of the escrow agent.

- Details concerning compensation for the escrow agent's services.

When to use this form

Use the Escrow Agreement when you need a secure way to manage the transfer of funds or important documents between two parties. This form is ideal in real estate transactions, online sales, or any situation where you require assurance that obligations will be met before releasing the assets.

Who this form is for

This form is suitable for:

- Individuals engaging in real estate transactions.

- Businesses involved in the sale of goods or services requiring financial security.

- Parties entering into agreements that necessitate a neutral third party for asset management.

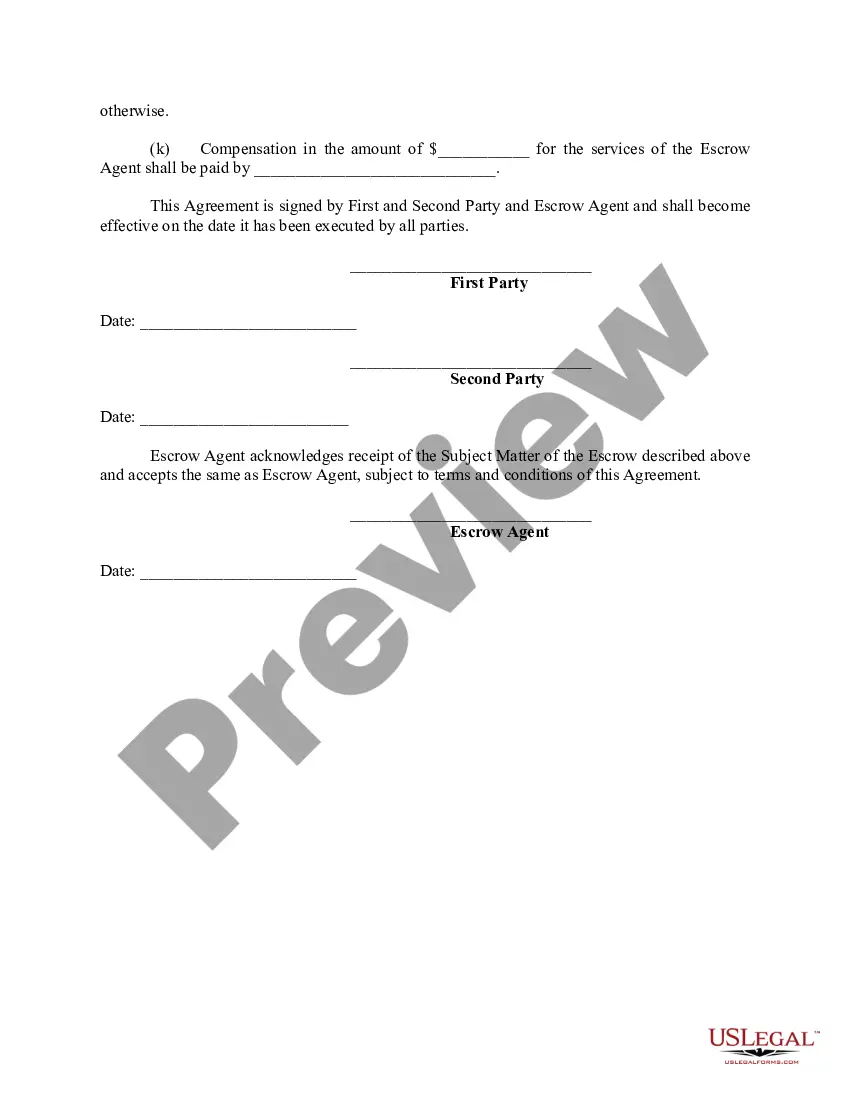

How to complete this form

- Identify the first and second parties, including their names and addresses.

- Designate the escrow agent along with their contact information.

- Clearly describe the subject matter being held in escrow.

- Provide detailed instructions for the escrow agent on handling the assets.

- Ensure all parties sign and date the agreement to validate it.

Does this document require notarization?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to specify the subject matter clearly.

- Not outlining detailed instructions for the escrow agent.

- Omitting signatures from all parties involved in the agreement.

Why complete this form online

- Convenience of downloading and completing the form at your own pace.

- Editability allows for easy modifications as needed.

- Reliability of professionally drafted templates to ensure legal compliance.

Quick recap

- The Escrow Agreement protects both parties by ensuring proper handling of assets until conditions are met.

- Clearly defined roles and instructions can prevent disputes and misunderstandings.

- Always verify state-specific laws regarding the use of Escrow Agreements.

Looking for another form?

Form popularity

FAQ

The escrow holder will hold onto and transfer the funds and documents during the transaction. In most cases the seller chooses an escrow holder, but this may also be negotiated in the offer or contract. The deposit check should be made out to the escrow holder and taken to the escrow or title company.

A thorough escrow agreement will list out the information that should be included in JWI or any instructions, such as the amount to be released, the party to whom the funds should be delivered, payment instructions and tax characterizations, or alternatively attach an instructions template to the escrow agreement.

Escrow Letter means the letter from the Facility Agent acknowledged by the Company dated on or about the date hereof regarding the various payments to be made at or about the Closing in respect of the Closing.

Include your name, home address, and mortgage account number. Identify the error. Tell your servicer exactly what error you believe occurred. Do not write your letter on your payment coupon or other payment form you get from your servicer. Send the letter to the proper address.

Don't make any new major purchases that could affect your debt-to-income ratio. Don't apply, co-sign or add any new credit. Don't quit your job or change jobs. Don't change banks. Don't open new credit accounts. Don't close or consolidate credit card accounts without advice from your lender.

Warning: Don't use or get credit while you are in escrow. Fannie Mae has implemented a policy that will affect what you buy during escrow. Since most lenders use Fannie Mae guidelines, you need to be aware of this policy.This means that most lenders will re-pull your credit just prior to closing escrow.

Once you and the seller agree on a price and sign a mutually acceptable purchase agreement, your real estate agent will collect your earnest moneysort of like a good faith deposit which is ultimately applied to your down paymentand deposit it in an escrow account at the escrow company or service specified in the

For example, an escrow account can be used for the sale of a house.In this case, the buyer of the property deposits the payment amount for the house in an escrow account held by a third party. The seller can proceed with house inspections confident that the funds are there, and the buyer is capable of making payment.