The Missouri Real Property Certificate of Value (MRC) is a document issued by the Missouri Department of Revenue that certifies the market value of real estate in Missouri. The certificate is used to assess the value of real estate for tax purposes. It is used by assessors to determine the taxable value of real estate for the purpose of taxation. The MRC is also used by lenders, buyers, and sellers to determine the market value of a property. There are two types of Missouri Real Property Certificate of Value: the Standard Certificate of Value and the Specialized Certificate of Value. The Standard Certificate of Value is used to value most basic residential properties, while the Specialized Certificate of Value is used to value commercial properties, vacant land, and other more complex real estate. Both certificates include information such as the owner's name, address, parcel number, sale date, purchase price, and assessed value.

Missouri Real Property Certificate of Value

Description

What Is a Real Property Certificate of Value?

A Real Property Certificate of Value (CV) is an official document used in various jurisdictions within the United States to provide detailed information about the transfer of title on a property. This certificate usually includes data such as the purchase price, property description, and date of transfer, all of which are essential for legal documentation and tax purposes.

Key Elements of the Real Property Certificate of Value

- Purchase Price: The total amount paid for the property.

- Property Description: Detailed description including location, size, and any pertinent features.

- Date of Transfer: The official date when the property changed ownership.

- Identifying Information: Data about the buyer and seller for records.

Step-by-Step Guide to Obtaining a Real Property Certificate of Value

- Identify the Local Authority: Determine which local government office handles property records in your area.

- Prepare Required Documentation: Gather necessary documents such as a government ID and proof of property ownership.

- Submit the Application: Fill out the required forms, sometimes available online, and submit them either digitally or in person.

- Pay Any Applicable Fees: Cover the costs associated with the application, which can vary by jurisdiction.

- Receive Your Certificate: After processing, the certificate will either be mailed to you or made available for pickup.

Risk Analysis for Neglecting a Real Property Certificate of Value

Failing to obtain or accurately complete a Real Property Certificate of Value can lead to several legal and financial complications, such as:

- Tax Discrepancies: Incorrect property value might result in tax assessments that are either too high or too low.

- Title Issues: Impedes the transparency in the change of ownership, potentially causing title disputes.

- Penalties: Non-compliance with local regulations might result in fines or legal challenges.

Pros & Cons of Real Property Certificate of Value

- Pros:

- Ensures legal compliance with property transfer laws.

- Provides a clear record for taxation purposes.

- Facilitates smoother property transactions.

- Cons:

- Might involve bureaucratic processes and fees.

- Requires staying updated with changing local regulations.

FAQs About Real Property Certificate of Value

- Who needs to obtain a Real Property Certificate of Value? Anyone involved in the purchase or sale of property in jurisdictions that require this document.

- Is there a standard fee for obtaining the certificate? No, fees can vary significantly between different counties and states.

- Can the Real Property Certificate of Value be contested? Yes, if there are inaccuracies in the document, it can be challenged legally.

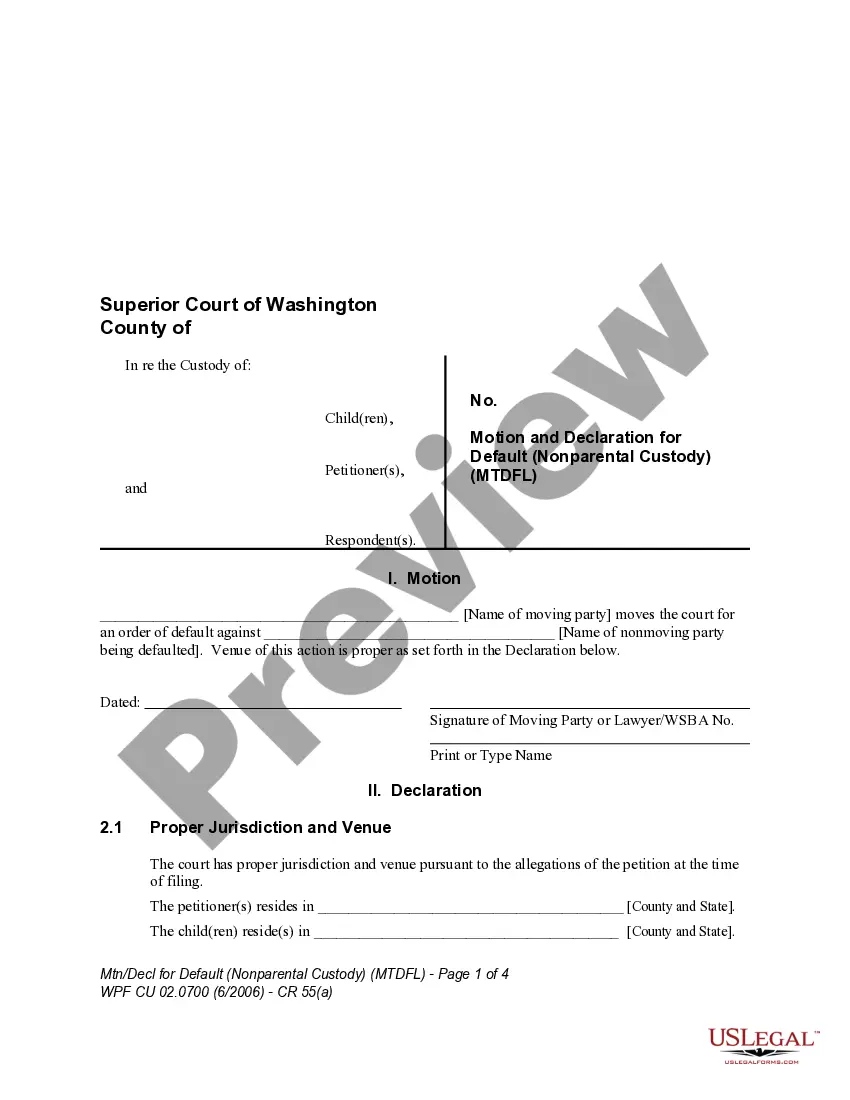

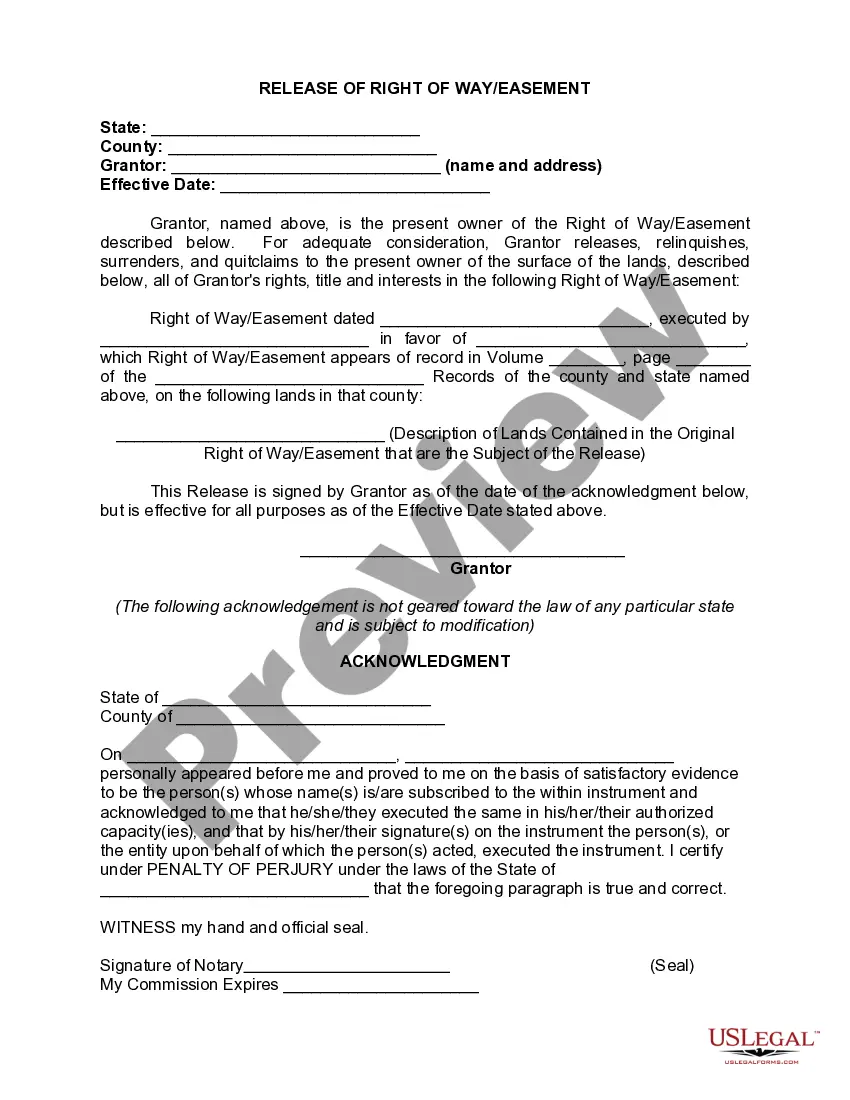

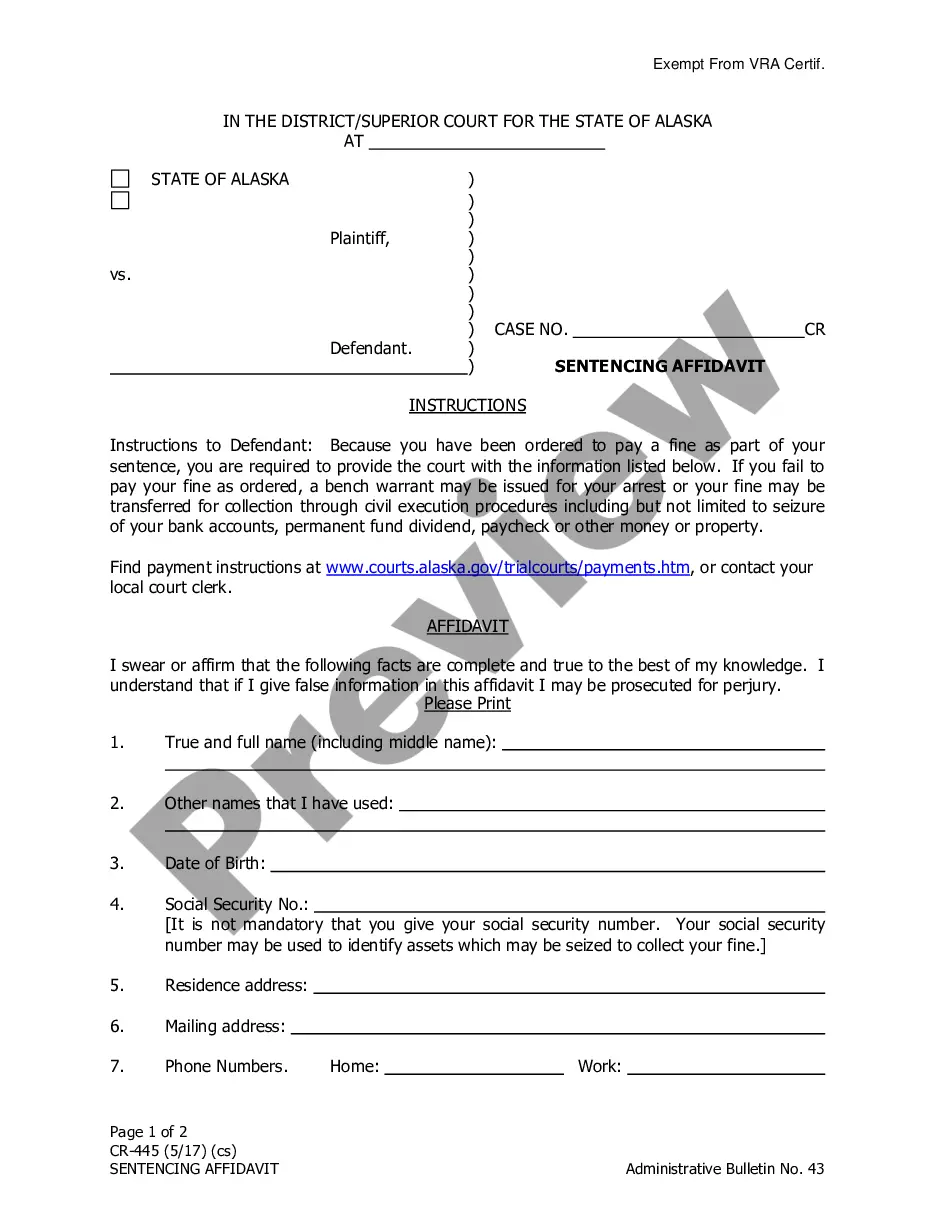

How to fill out Missouri Real Property Certificate Of Value?

Drafting legal documents can be quite a challenge if you lack accessible fillable templates. With the US Legal Forms online repository of official paperwork, you can feel assured about the fields you encounter, as all of them align with federal and state laws and are validated by our experts.

Acquiring your Missouri Real Property Certificate of Value from our collection is as easy as pie. Previously authorized users with an active subscription simply need to Log In and hit the Download button once they locate the correct template. Subsequently, if necessary, users can retrieve the same document from the My documents section of their account. Nevertheless, even if you are a newcomer to our platform, signing up with a valid subscription will only take a few moments. Here’s a quick guide for you.

Haven’t you explored US Legal Forms yet? Subscribe to our service now to acquire any official document swiftly and effortlessly every time you need it, and maintain your paperwork organized!

- Document compliance verification. You should thoroughly review the content of the form you require and confirm whether it meets your needs and adheres to your state laws. Previewing your document and examining its overall description will assist you in doing just that.

- Alternative search (optional). If there are any discrepancies, search the library using the Search tab at the top of the page until you discover a suitable template, and click Buy Now once you identify the one you need.

- Account setup and form acquisition. Sign up for an account with US Legal Forms. After account confirmation, Log In and choose your desired subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and subsequent usage. Choose the file format for your Missouri Real Property Certificate of Value and click Download to store it on your device. Print it to complete your paperwork manually, or utilize a multifunctional online editor to create an electronic version more quickly and effectively.

Form popularity

FAQ

To obtain a copy of your property deed in Missouri, you can start by contacting your local county recorder's office. They maintain records of property transactions, including deeds. You may also visit the office in person or check their website for online services. For added convenience, consider using US Legal Forms, which offers easy access to various legal documents, including the Missouri Real Property Certificate of Value.

Yes, home sale prices are generally considered public records in Missouri. This means that anyone can access this information, which can be beneficial for buyers and sellers alike. Utilizing the Missouri Real Property Certificate of Value can help you navigate these records and make informed decisions about property transactions.

In Missouri, seniors aged 65 and older may qualify for property tax exemptions and credits, which can significantly reduce their tax burden. However, they do not entirely stop paying property taxes unless they meet specific criteria. It is essential for seniors to consult the Missouri Real Property Certificate of Value and local regulations to explore their options and ensure they benefit from available programs.

The market value of your property is multiplied by the statutory level of assessment. Residential property is assessed at 19% of market value, Agricultural at 12% and Commercial & all other at 32%.

This includes your home, land, farmland, and commercial property. When a tract of land is sold, a deed or document must be filed in the Recorder's office.

To search for a lien filed by the Missouri Department of Revenue you may access or contact your county Record of Deeds office.

If a property is in a commercial zone, is residential allowed? Yes. With the exception of the J-Industrial District where new housing is only allowed if 40% of the frontage library.municode.com is already residential, residential uses are permitted.

Once market value has been determined, the Missouri assessment rate of 19% is applied. That means that assessed value should equal to 19% of market value. For example, if your home is worth $200,000, your assessed value will be $38,000.

Real Property ? this includes land, improvements to the land and all rights inherent in ownership. Personal Property ? this is any property that is not real property, and is not permanently affixed to or part of real estate. Personal property includes cars, boats and farm equipment.