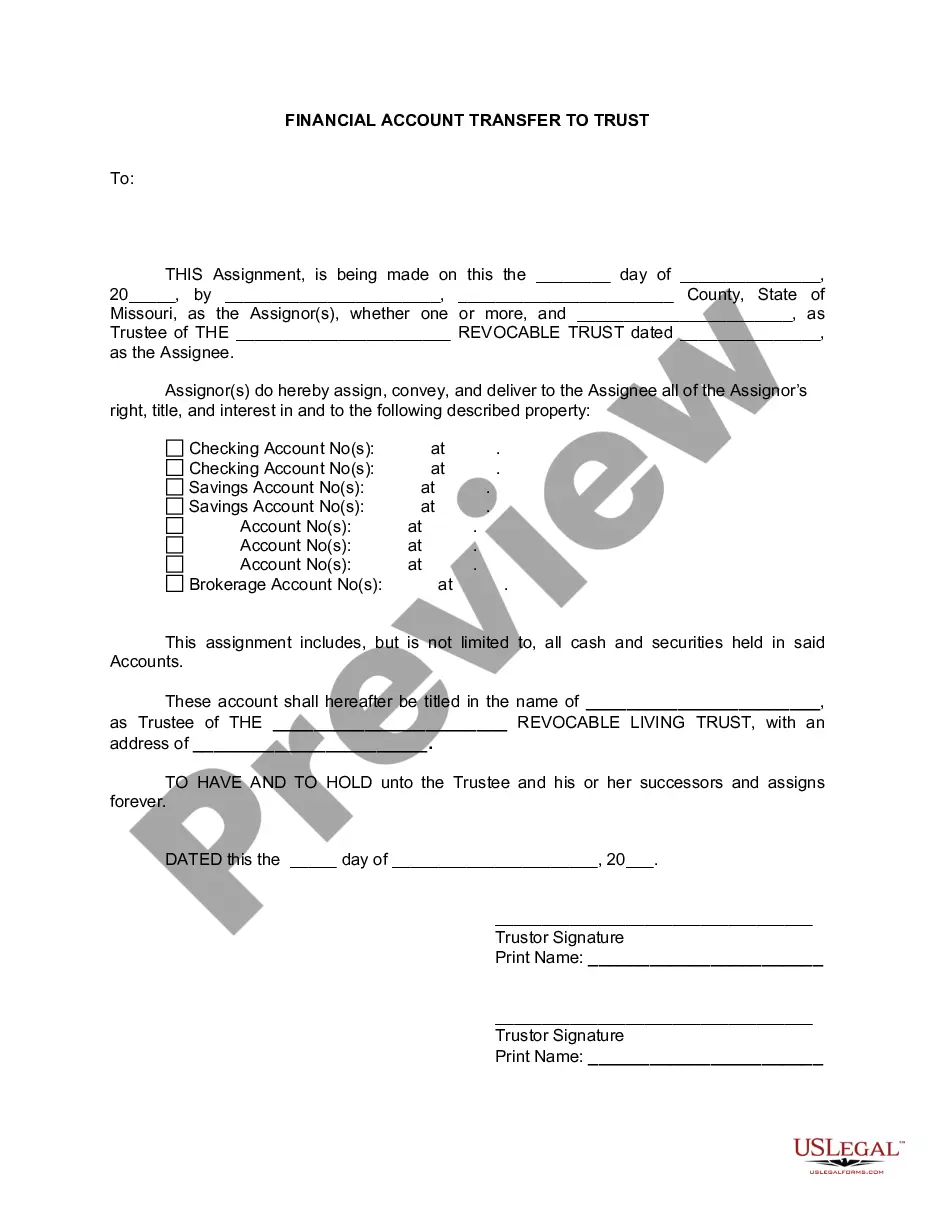

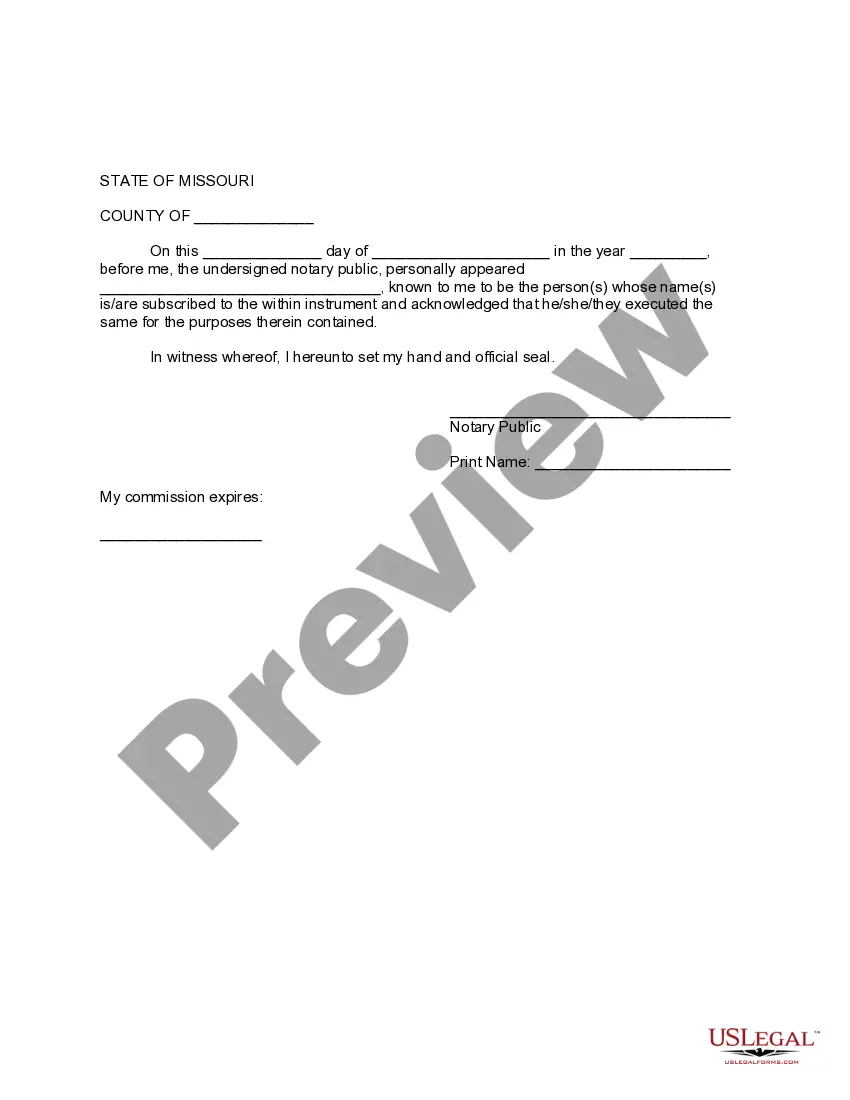

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Missouri Financial Account Transfer to Living Trust

Description

How to fill out Missouri Financial Account Transfer To Living Trust?

Obtain any template from 85,000 legal documents like Missouri Financial Account Transfer to Living Trust online with US Legal Forms. Each template is crafted and revised by state-certified lawyers.

If you possess a subscription, Log In. Once you’re on the form’s page, click the Download button and navigate to My documents to access it.

If you haven’t subscribed yet, follow the instructions below.

With US Legal Forms, you’ll consistently have instant access to the correct downloadable template. The service provides you with access to documents and organizes them into categories to simplify your search. Utilize US Legal Forms to acquire your Missouri Financial Account Transfer to Living Trust swiftly and effortlessly.

- Verify the state-specific criteria for the Missouri Financial Account Transfer to Living Trust you intend to utilize.

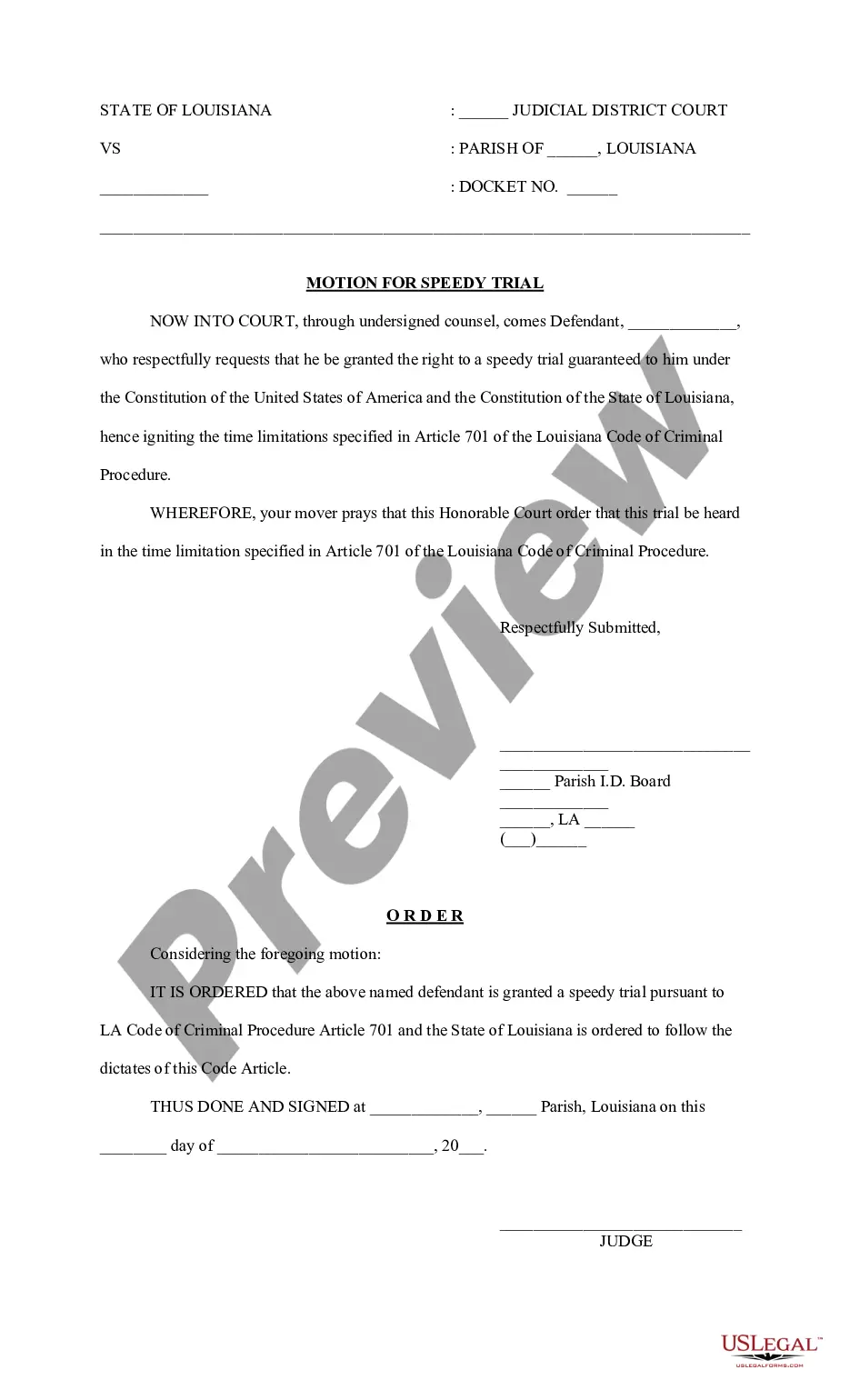

- Review the description and preview the sample.

- When you are confident the template meets your needs, click Buy Now.

- Choose a subscription plan that suits your financial situation.

- Create a personal account.

- Make the payment in one of two suitable methods: by credit card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable form is prepared, print it out or save it to your device.

Form popularity

FAQ

To transfer assets into a trust, the grantor must transfer titles from their name to the legal name of the trust. A grantor can create a living trust using an online legal document provider or by hiring an attorney. They can transfer almost any asset, including bank accounts, into a trust.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

Dmitriy Fomichenko, President, Sense Financial Almost all the major banks offer trust accounts. What you need to do is to call their customer representatives and inquire about the features you require. Some of the options include Bank of America, Wells Fargo, US Bank, and TD Bank.

Property you put in a living trust doesn't have to go through probate, which means that the assets won't get tied up in court for months and maybe years. However, you don't have to put bank accounts in a living trust, and sometimes it's not a good idea.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.