Minnesota Certificate of Cancellation of Certificate of Limited Partnership

Description

How to fill out Certificate Of Cancellation Of Certificate Of Limited Partnership?

Are you currently inside a situation in which you need files for possibly business or personal purposes almost every day? There are a variety of legitimate file themes available online, but getting ones you can rely is not straightforward. US Legal Forms provides 1000s of develop themes, like the Minnesota Certificate of Cancellation of Certificate of Limited Partnership, that happen to be composed in order to meet federal and state demands.

When you are already informed about US Legal Forms internet site and possess a merchant account, simply log in. Afterward, it is possible to download the Minnesota Certificate of Cancellation of Certificate of Limited Partnership template.

If you do not provide an accounts and would like to begin using US Legal Forms, abide by these steps:

- Get the develop you require and ensure it is to the proper metropolis/area.

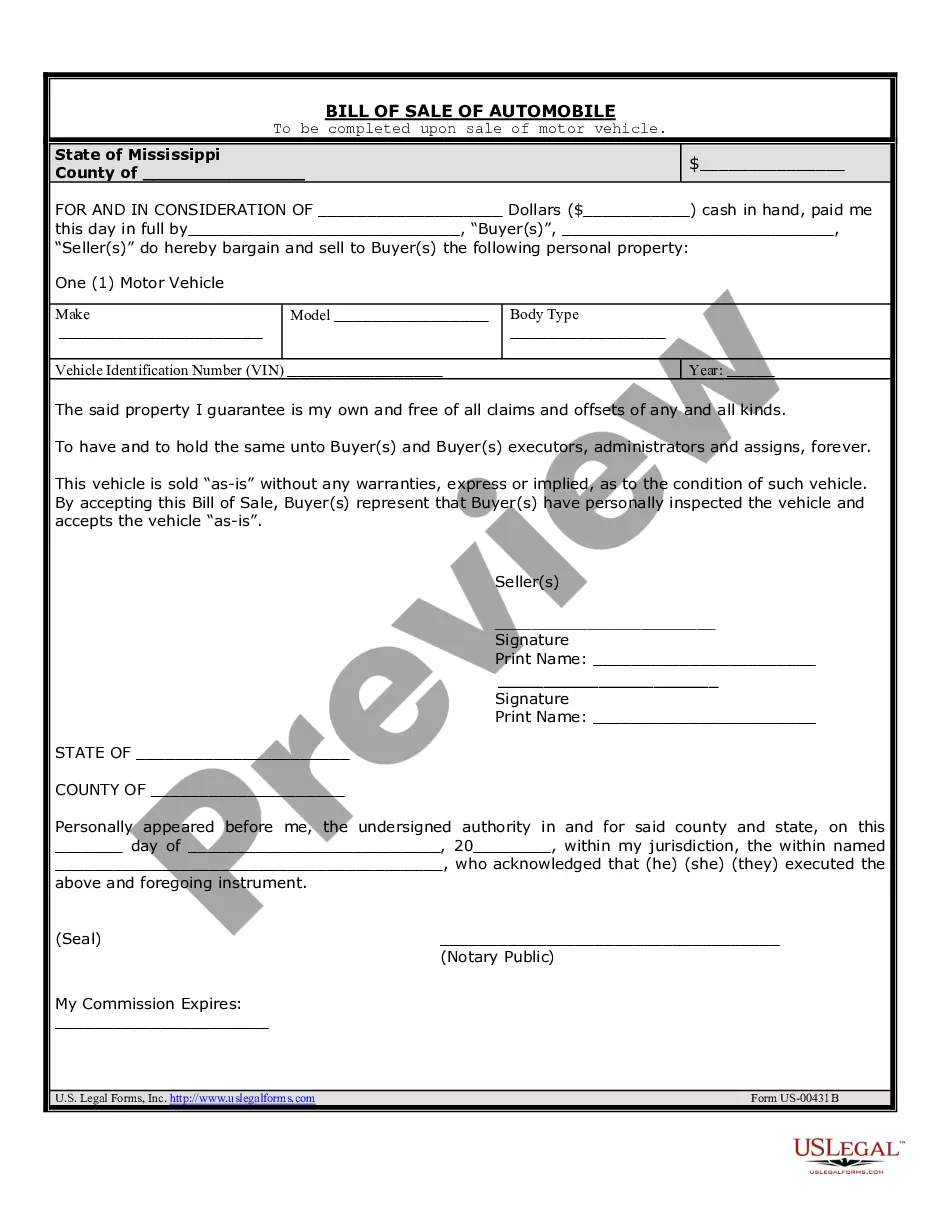

- Take advantage of the Review key to review the form.

- Look at the explanation to ensure that you have selected the correct develop.

- If the develop is not what you are trying to find, take advantage of the Search area to get the develop that suits you and demands.

- If you obtain the proper develop, click on Get now.

- Opt for the pricing strategy you would like, complete the required info to produce your money, and pay money for the order using your PayPal or Visa or Mastercard.

- Decide on a practical file file format and download your copy.

Discover all the file themes you possess purchased in the My Forms food selection. You can obtain a further copy of Minnesota Certificate of Cancellation of Certificate of Limited Partnership whenever, if possible. Just go through the required develop to download or print the file template.

Use US Legal Forms, one of the most comprehensive variety of legitimate types, to save lots of efforts and prevent faults. The service provides skillfully created legitimate file themes which can be used for a selection of purposes. Make a merchant account on US Legal Forms and start generating your life easier.

Form popularity

FAQ

The difference between LLP and LLC is an LLC is a limited liability company and an LLP is a limited liability partnership. ing to the government, specifically the IRS, an LLC is a business organization that is formed lawfully under the state by filing articles of organization.

In Minnesota, you'll need to dissolve an LLC by filing with the Minnesota Secretary of State. You can file the document for dissolution online at .sos.state.mn.us, by mail, or in person. If you have questions, you can contact them by phone at 1-877-551-6767 or 651-296-2803 for the Saint Paul metro area.

What is a "Notice of Lis Pendens"? A Notice of Lis Pendens is a document that is filed with a County Recorder's Office in Minnesota to show that there is a pending lawsuit in court regarding that land. ?Lis Pendens? is Latin for ?lawsuit pending? or ?litigation pending.?

Limited Liability Partnerships (LLPs) have become an increasingly popular business structure, particularly for professionals like attorneys, architects, and accountants. If you are contemplating forming an LLP in Minnesota, understanding its nuances is crucial for safeguarding your interests.

Limited liability partnerships (LLPs) allow for a partnership structure where each partner's liabilities are limited to the amount they put into the business. Having business partners means spreading the risk, leveraging individual skills and expertise, and establishing a division of labor.

A key difference in forming an LLC vs. LLP is that you can form a single-member LLC but not a single-partner LLP. This is because LLPs are a type of partnership ? so there must be at least two people to form one.

Some states only require that the certificate contains the name of the limited partnership, the name and address of the registered agent and registered office, and the names and addresses of all of the general partners.

The State Bar of California's Limited Liability Partnership (LLP) program certifies professional partnerships to allow partners to limit their vicarious liability for the acts tortious or otherwise of their partners and employees in ance with statutes and the State Bar's Limited Liability Partnership Rules and ...