Minnesota Certificate of Merger of a Foreign Limited Partnership into a Delaware General Partnership

Description

How to fill out Certificate Of Merger Of A Foreign Limited Partnership Into A Delaware General Partnership?

It is possible to devote time online attempting to find the authorized file web template that suits the federal and state requirements you need. US Legal Forms provides a huge number of authorized types which can be examined by professionals. You can actually acquire or produce the Minnesota Certificate of Merger of a Foreign Limited Partnership into a Delaware General Partnership from your service.

If you already possess a US Legal Forms accounts, you may log in and click on the Download switch. After that, you may full, edit, produce, or indicator the Minnesota Certificate of Merger of a Foreign Limited Partnership into a Delaware General Partnership. Each authorized file web template you acquire is the one you have permanently. To acquire an additional backup associated with a acquired form, proceed to the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms website the very first time, stick to the easy recommendations under:

- Very first, make certain you have chosen the right file web template for your area/metropolis of your choice. Browse the form information to ensure you have picked the appropriate form. If offered, use the Preview switch to check with the file web template as well.

- If you want to find an additional variation from the form, use the Search discipline to discover the web template that suits you and requirements.

- After you have located the web template you want, simply click Purchase now to move forward.

- Find the pricing plan you want, key in your accreditations, and sign up for your account on US Legal Forms.

- Total the purchase. You may use your charge card or PayPal accounts to cover the authorized form.

- Find the structure from the file and acquire it to your device.

- Make adjustments to your file if required. It is possible to full, edit and indicator and produce Minnesota Certificate of Merger of a Foreign Limited Partnership into a Delaware General Partnership.

Download and produce a huge number of file layouts utilizing the US Legal Forms Internet site, that offers the most important selection of authorized types. Use specialist and status-distinct layouts to handle your company or personal requirements.

Form popularity

FAQ

What is a Delaware Limited Partnership? Delaware Limited Partnerships (DLPs) are a type of business entity in the United States. They are formed by filing a certificate of limited partnership with the Delaware Secretary of State. DLPs have two types of partners: general partners and limited partners.

If your company was not incorporated in Minnesota, but you wish to do business there, you need to apply for a Minnesota Certificate of Authority. Acquiring a Minnesota Foreign Qualification allows a company formed in Delaware or any other state to legally transact business in Minnesota.

A Delaware Limited Partnership refers to a business entity in the state of Delaware that consists of at least one general partner and at least one limited partner. The general partner can be either an individual or an entity, such as a corporation.

Owners of a newly-incorporated business often wonder if they need a Delaware business address. No, you do not need to have a business address or office in Delaware. All businesses incorporated in Delaware require a Registered Agent with a physical street address in Delaware, such as Agents and Corporations (IncNow®).

You can incorporate and register your business online, over the phone at 1-800-345-CORP, via fax at 302-645-1280 or through the mail by sending your documents to 16192 Coastal Highway, Lewes, DE, 19958.

How much does it cost to file the Certificate of Registration of a Foreign LLC in Delaware? The state charges $200 for regular filings. If you're in a hurry, you can pay the state an extra $50 and they'll process your paperwork within six days of receiving it.

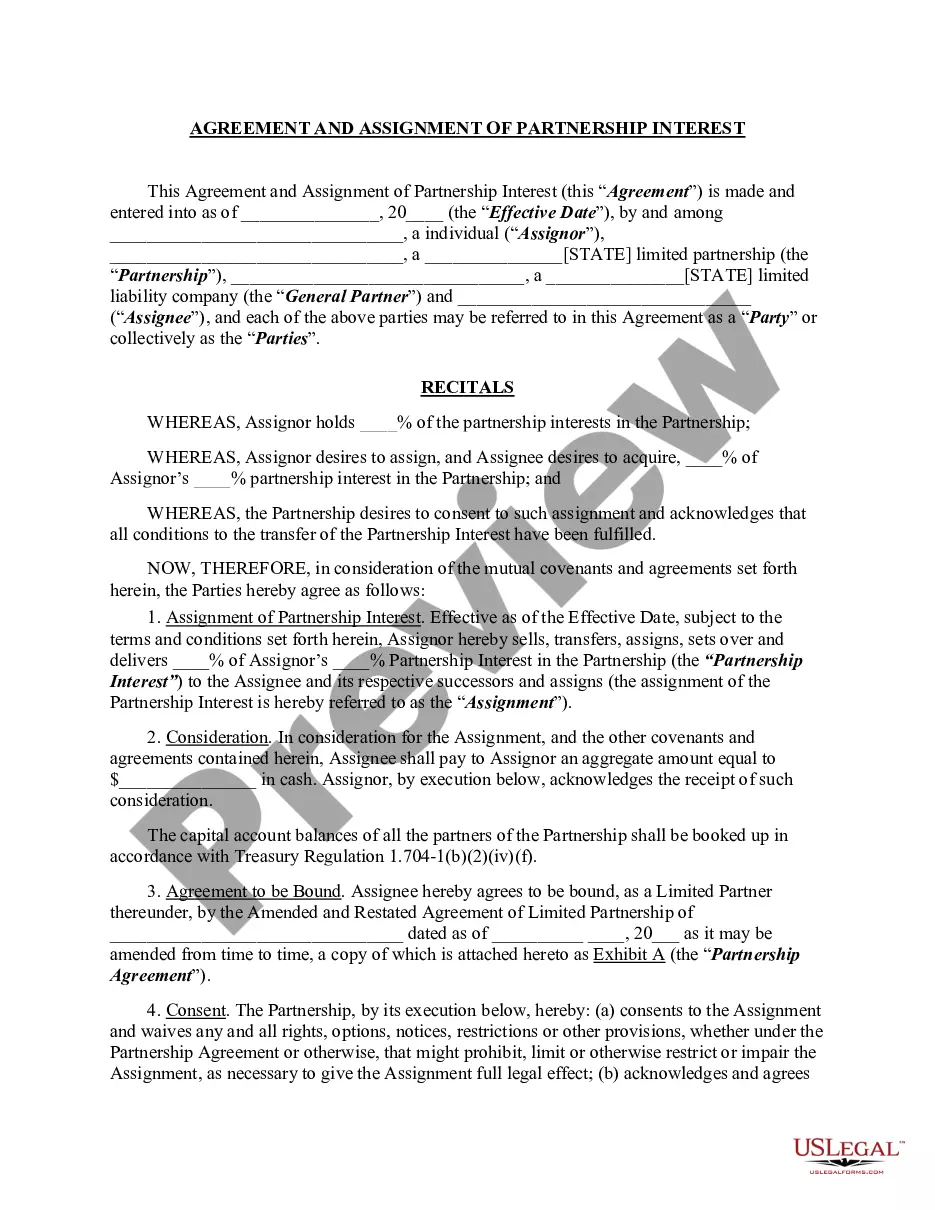

Certificate of Limited Partnership Interest means a Certificate signed on behalf of the Partnership by a General Partner evidencing the interest of a Limited Partner, including the Assignor Limited Partner on behalf of the Unitholders, in the Partnership.

(a) As used in this chapter, the words ?foreign corporation? mean a corporation organized under the laws of any jurisdiction other than this State.

The Certificate of Limited Partnership can be completed online as a PDF file and mailed to the Delaware Division of Corporations. Cost to Form an LP: The state of Delaware charges a filing fee of $200 to form a limited partnership.

Delaware uses the name domestication only for a similar transaction that officially moves an entity organized in another country to Delaware. Delaware's conversion process can also change a Delaware LLC into an out-of-state LLC.