Minnesota Certificate of Merger of a Delaware Limited Partnership and a Delaware Corporation

Description

How to fill out Certificate Of Merger Of A Delaware Limited Partnership And A Delaware Corporation?

Discovering the right legitimate record format can be a have a problem. Naturally, there are plenty of themes available on the net, but how can you find the legitimate form you want? Use the US Legal Forms internet site. The services gives thousands of themes, like the Minnesota Certificate of Merger of a Delaware Limited Partnership and a Delaware Corporation, which can be used for enterprise and personal requirements. All the varieties are examined by professionals and meet federal and state demands.

If you are previously listed, log in for your accounts and then click the Acquire switch to get the Minnesota Certificate of Merger of a Delaware Limited Partnership and a Delaware Corporation. Make use of your accounts to appear with the legitimate varieties you may have purchased earlier. Proceed to the My Forms tab of the accounts and obtain another backup of your record you want.

If you are a brand new customer of US Legal Forms, here are easy instructions that you can comply with:

- Initial, ensure you have chosen the proper form for your town/county. It is possible to examine the form while using Preview switch and look at the form information to guarantee this is the best for you.

- In the event the form fails to meet your needs, use the Seach area to find the correct form.

- Once you are certain the form is proper, go through the Acquire now switch to get the form.

- Choose the rates plan you need and type in the essential details. Design your accounts and buy the order utilizing your PayPal accounts or Visa or Mastercard.

- Choose the document formatting and down load the legitimate record format for your product.

- Full, modify and produce and indication the attained Minnesota Certificate of Merger of a Delaware Limited Partnership and a Delaware Corporation.

US Legal Forms may be the biggest local library of legitimate varieties that you can see different record themes. Use the company to down load skillfully-produced paperwork that comply with express demands.

Form popularity

FAQ

member LLC can be either a corporation or a singlemember ?disregarded entity.? To be treated as a corporation, the singlemember LLC has to file IRS Form 8832 and elect to be classified as a corporation.

Changes can be made at any time throughout the life of the entity. For example, if you want to convert a Delaware Limited Liability Company (LLC) to a General Corporation, you can. There are many reasons why owners of an LLC may choose to change the entity to a corporation.

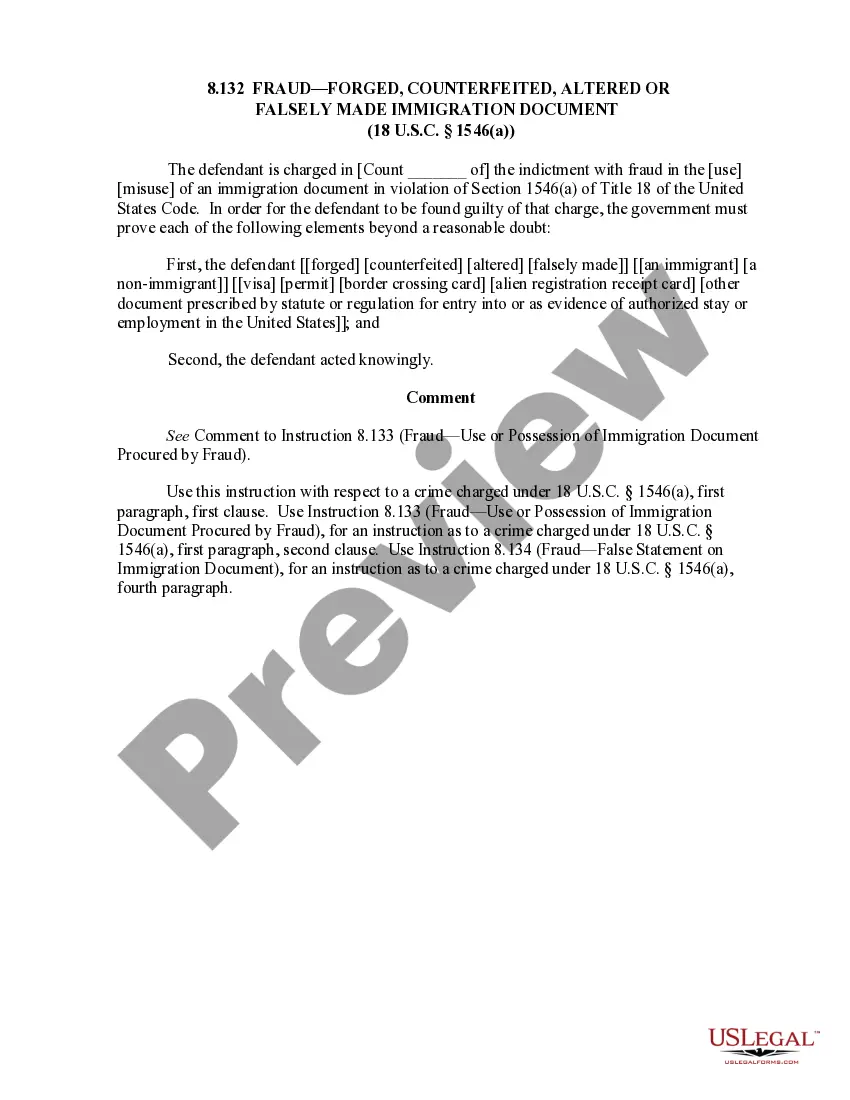

Also known as articles of merger. A certificate evidencing the merger of two or more entities into one entity.

(b) Pursuant to an agreement of merger or consolidation, 1 or more domestic limited liability companies may merge or consolidate with or into 1 or more domestic limited liability companies or 1 or more other business entities formed or organized under the laws of the State of Delaware or any other state or the United ...

601, any corporation may merge with any other domestic or foreign corporation under the terms of a plan of merger. The same statute allows a similar framework that allows a company to purchase or sell any amount of share in another company to a willing participant company.

Can a Foreign Person or Corporation Form a Delaware Corporation or LLC? Yes. Delaware does not discriminate against non-citizens inside or outside the United States. Many Delaware Corporations and LLCs are formed by foreign persons.

A Delaware LLC exists as a separate legal entity from its members, creating a shield that insulates the owners from individual liability beyond their investment for the LLC's financial obligations. Unlike a corporation, the protection in a LLC also runs in reverse.

Also known as a medium-form merger or a Section 251(h) merger, an intermediate-form merger is a special type of merger permitted by Section 251(h) of the Delaware General Corporation Law (DGCL) for acquisitions of target companies that are Delaware public corporations that allows a buyer in a tender offer to complete a ...