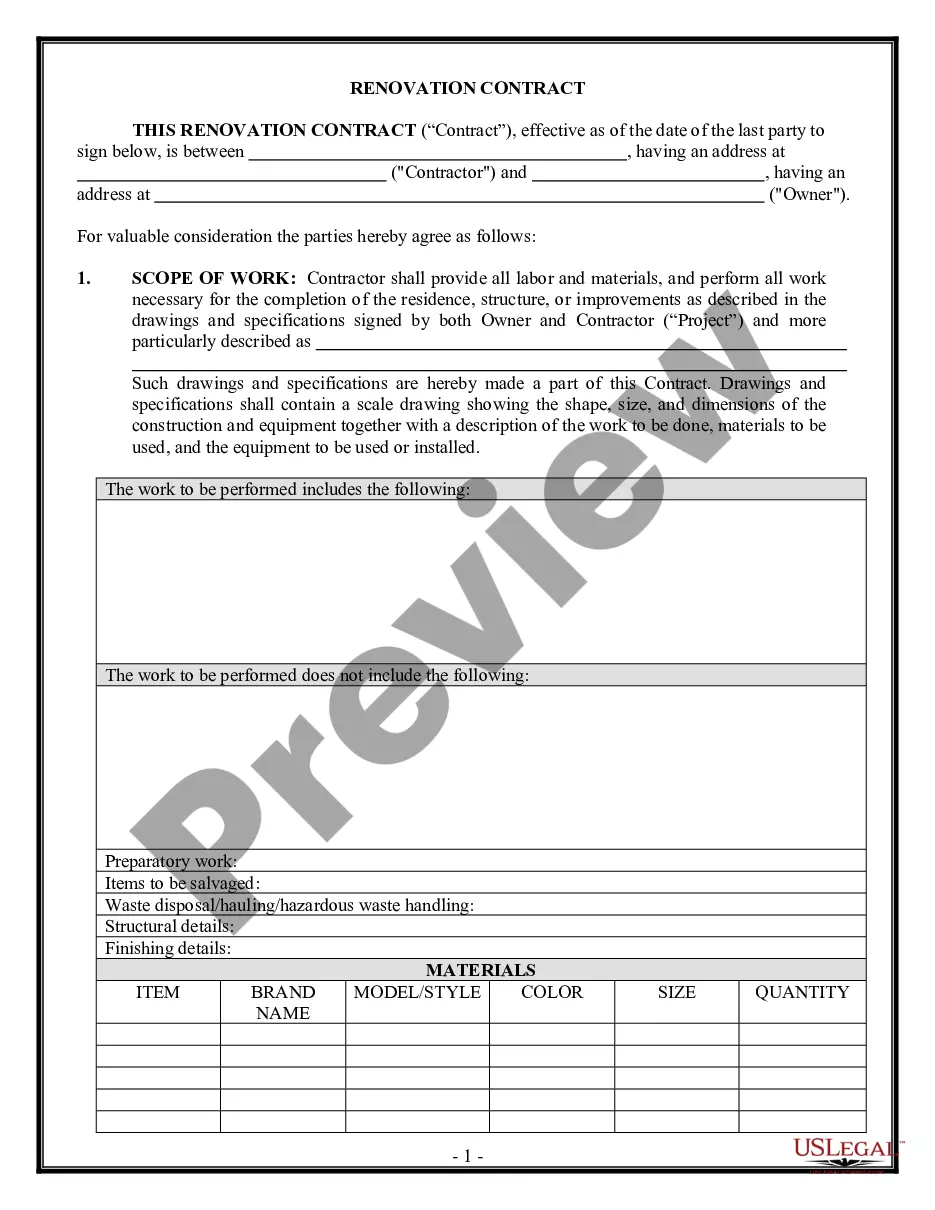

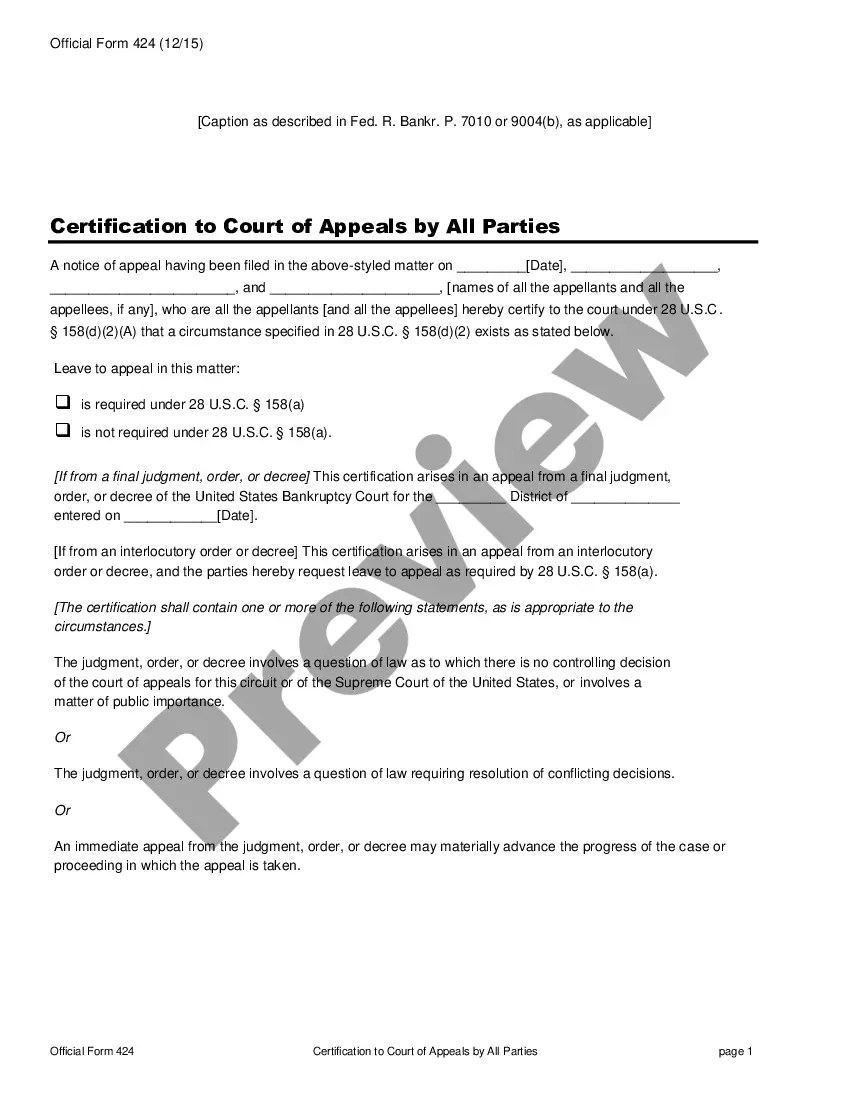

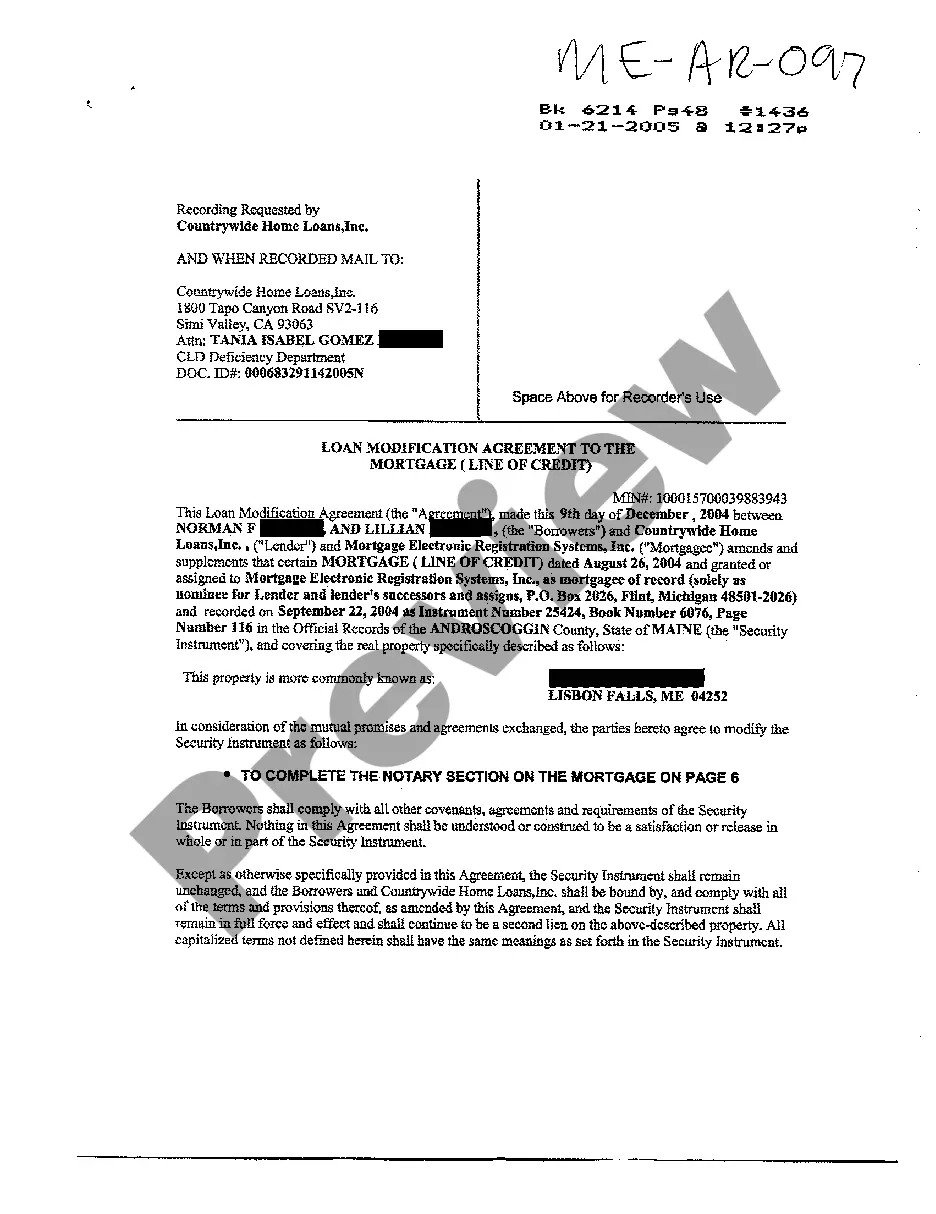

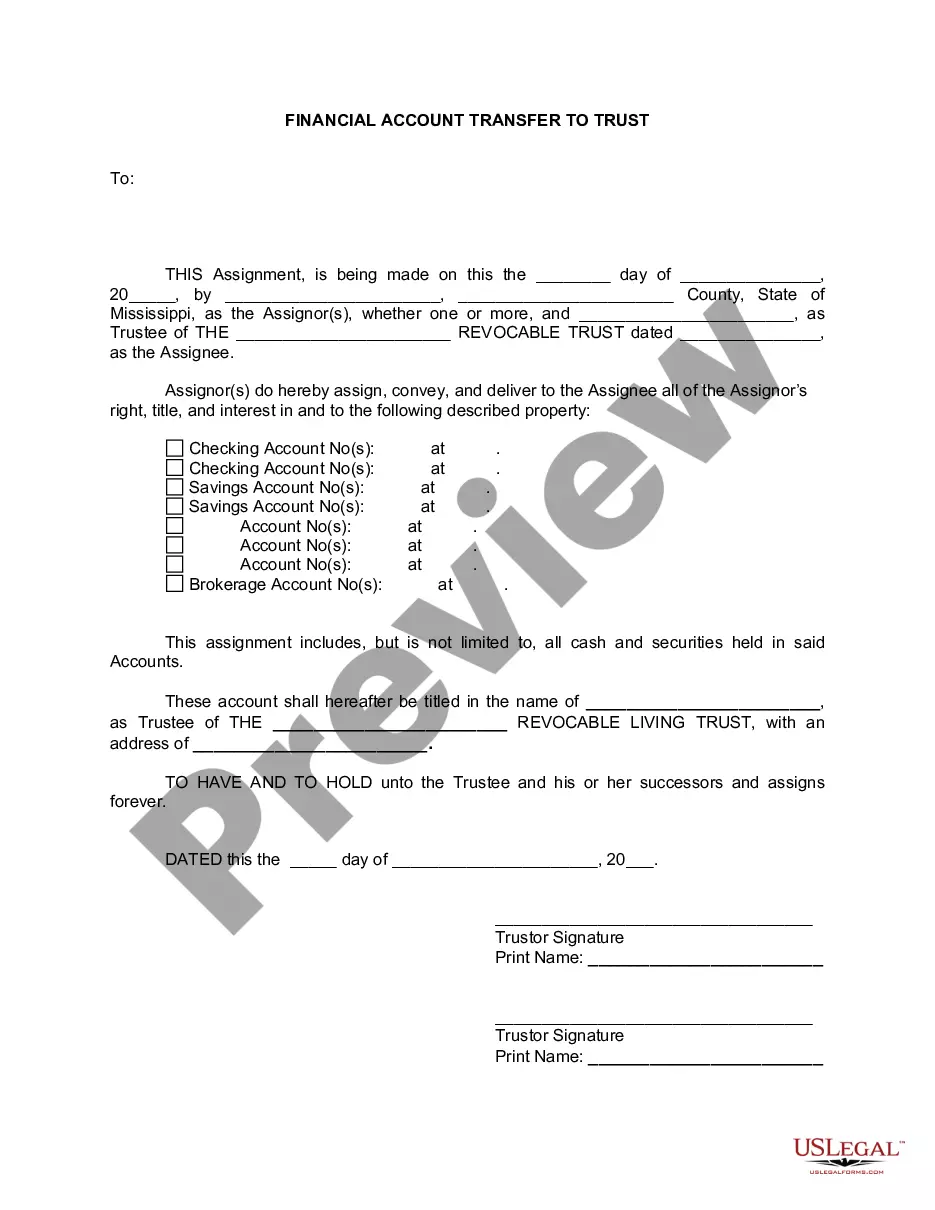

Bill of Sale by Corporation of all or Substantially all of its Assets

Description

How to fill out Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

Aren't you sick and tired of choosing from countless templates every time you require to create a Bill of Sale by Corporation of all or Substantially all of its Assets? US Legal Forms eliminates the wasted time an incredible number of American people spend exploring the internet for appropriate tax and legal forms. Our professional group of lawyers is constantly changing the state-specific Forms library, so it always provides the right files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription need to complete simple actions before having the capability to get access to their Bill of Sale by Corporation of all or Substantially all of its Assets:

- Use the Preview function and look at the form description (if available) to make sure that it is the right document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the right template for the state and situation.

- Use the Search field on top of the page if you want to look for another file.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your template in a needed format to complete, print, and sign the document.

When you’ve followed the step-by-step guidelines above, you'll always have the capacity to log in and download whatever document you will need for whatever state you need it in. With US Legal Forms, completing Bill of Sale by Corporation of all or Substantially all of its Assets samples or other legal paperwork is simple. Begin now, and don't forget to double-check your examples with certified lawyers!

Form popularity

FAQ

An asset sale occurs when a company sells some or all of its actual assets, either tangible or intangible. In an asset sale, the seller retains legal ownership of the company but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.Normalized net working capital is also typically included in a sale.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities.In a stock purchase, the buyer purchases the entire company, including all assets and liabilities.

An asset sale is the purchase of individual assets and liabilities, whereas a stock sale is the purchase of the owner's shares of an entity. The deal structure of any transaction can have a major impact on the future for both the buyer and seller.

The simple answer is yes, as a director, you can sell your company assets before going through liquidation. However, it's important to understand that there are strict regulations you'd need to follow if any assets are sold. And remember, the creditors interest will always take priority.

When a company sells its assets, the seller typically enters into an asset purchase and sales agreement with a buyer.The asset purchase agreement should also address how the seller and the buyer intend to pay the liabilities, debts, and obligations associated with the assets being transferred.

Your company will also still exist after an asset sale, and administratively you will still need to take steps to dissolve the company and deal with any remaining liabilities and assets. Unlike a stock sale, 100% of the interests of a company can usually be transferred without the consent of all of the stockholders.

Types of Assets Purchased An asset deal purchase can include either tangible or intangible assets. Tangibles include equipment, inventory, and fixtures. Intangibles, on the other hand, may include customer lists or patents.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.