Wisconsin Chapter 11 is a type of reorganization bankruptcy for businesses in Wisconsin. It is a form of debt relief that helps companies who are unable to pay their creditors. The main purpose of Wisconsin Chapter 11 is to allow businesses to continue to operate while restructuring their debt. It allows businesses to keep ownership of their assets and renegotiate contracts with creditors. The reorganization plan is approved by the court and is binding on all creditors. There are two types of Wisconsin Chapter 11: Straight Bankruptcy and Reorganization Bankruptcy. Straight Bankruptcy is when a business liquidates its assets to pay its creditors. Reorganization Bankruptcy is when a business restructures its debt to make it more manageable.

Wisconsin Chapter 11

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Wisconsin Chapter 11?

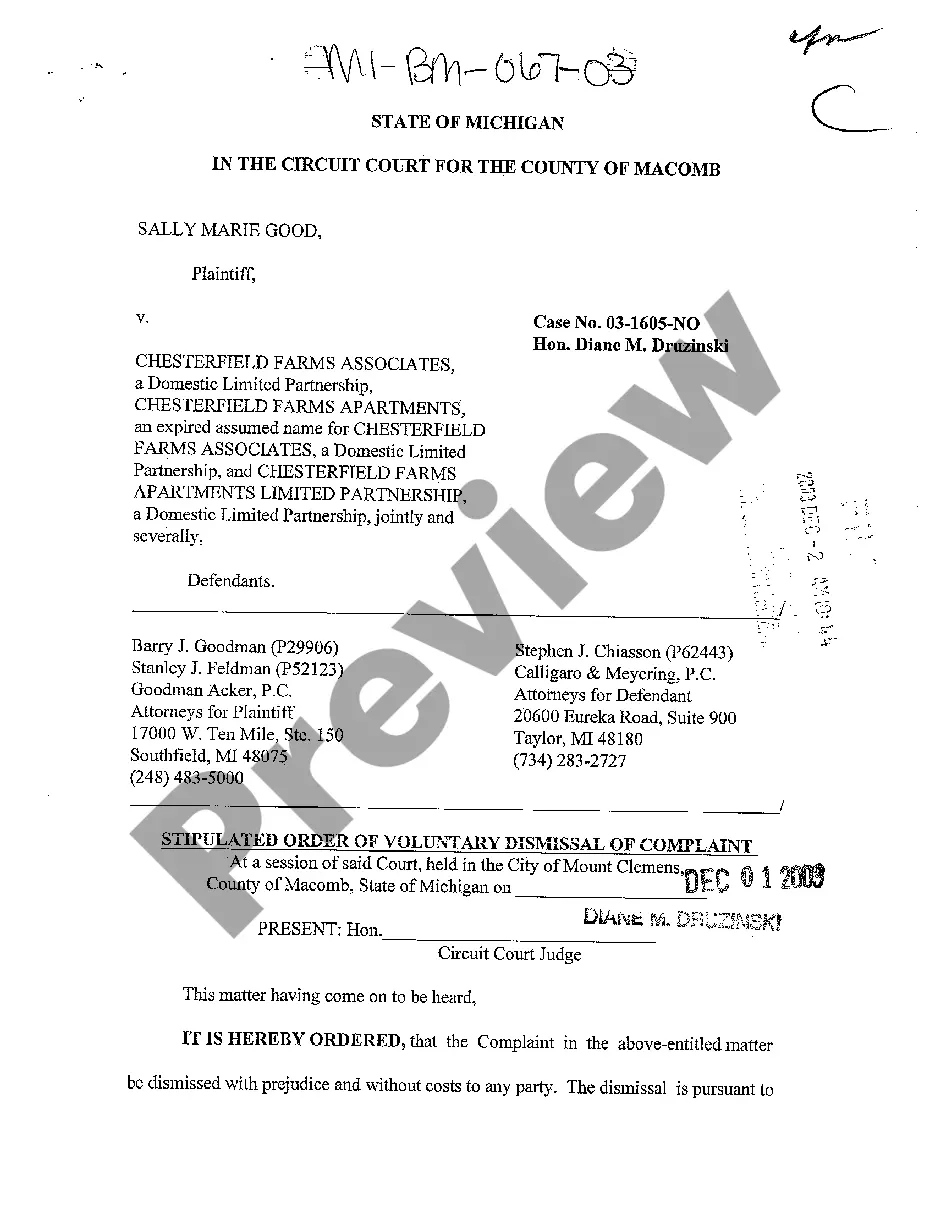

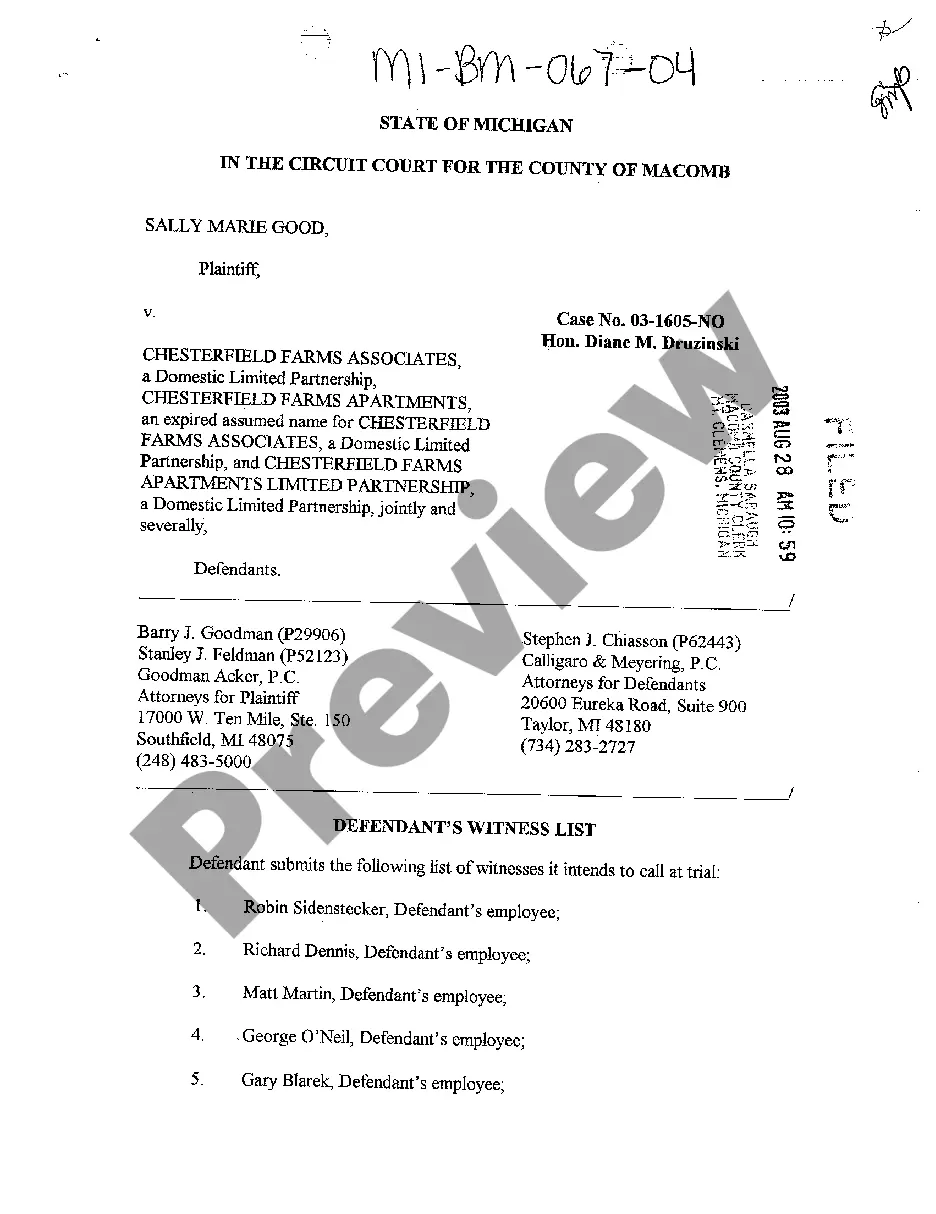

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state regulations and are examined by our specialists. So if you need to fill out Wisconsin Chapter 11, our service is the best place to download it.

Obtaining your Wisconsin Chapter 11 from our catalog is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they find the correct template. Afterwards, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a brief guide for you:

- Document compliance verification. You should carefully examine the content of the form you want and check whether it suits your needs and complies with your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate blank, and click Buy Now when you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Wisconsin Chapter 11 and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Proof of Claim Requirements for Chapter 11 Bankruptcy Chapter 11 is solely for companies that plan to reorganize and continue business at the conclusion of the bankruptcy. Chapter 11 creditors are not required to file a Proof of Claim because the debtor is required to file a Schedule of Assets and Liabilities.

What Are the Main Differences Between a Chapter 11 and Chapter 13 Bankruptcy? Almost anyone can file for Chapter 11 bankruptcy. This includes individuals, companies, partnerships, joint ventures, and LLCs. The filer doesn't have to meet any debt limits under Chapter 11 rules and there are no limits to file.

The discharge received by an individual debtor in a Chapter 11 case discharges the debtor from all pre-confirmation debts except those that would not be dischargeable in a Chapter 7 case filed by the same debtor.

Secured creditors like banks are going to get paid first. This is because their credit is secured by assets?typically ones that your business controls. Your plan and the courts may consider how integral the assets are that secure your loans to determine which secured creditors get paid first though.

Conspicuous examples of chapter 11 bankruptcy include Lehman Brothers in 2008, General Motors in 2009, and Kmart in 2002. However, Section 109 of the Code permits and courts agree that individual debtors not engaged in business may file for relief under chapter 11.

Does a Chapter 11 bankruptcy erase a business's debts? Not exactly. Creditors often have to accept less under a court-approved reorganization plan. But the idea is for the business to keep earning money so it can pay back as much as possible.

Once the debtor has fulfilled the obligations in the plan, the remaining debts are discharged. That means that the debtor no longer owes the debt, and creditors cannot make an effort to collect them. With the debts wiped out, the debtor can begin to recover their financial and credit health.

Examples Of Chapter 11 Bankruptcy While Chapter 11 bankruptcies may appear to be a lot more successful than Chapter 7 situations, history shows that most companies entering Chapter 11 don't survive either. Less than 10% of Chapter 11 filings have actually been successful.