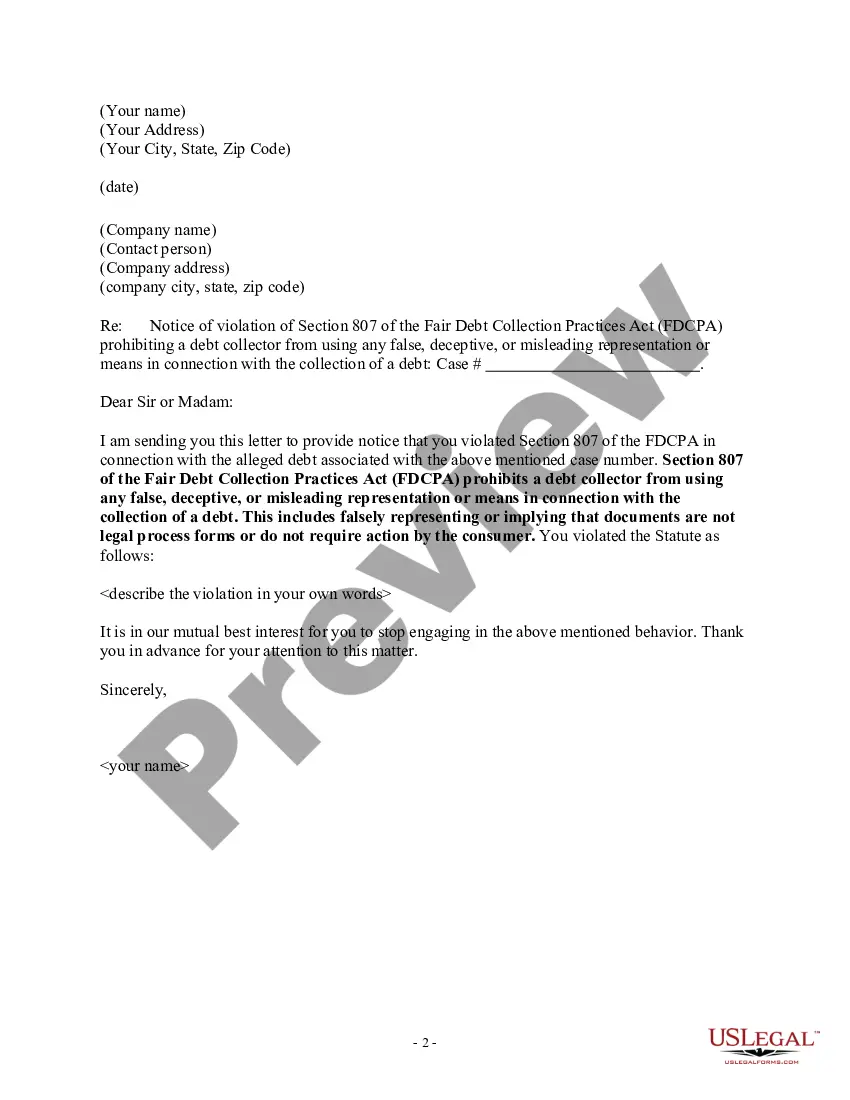

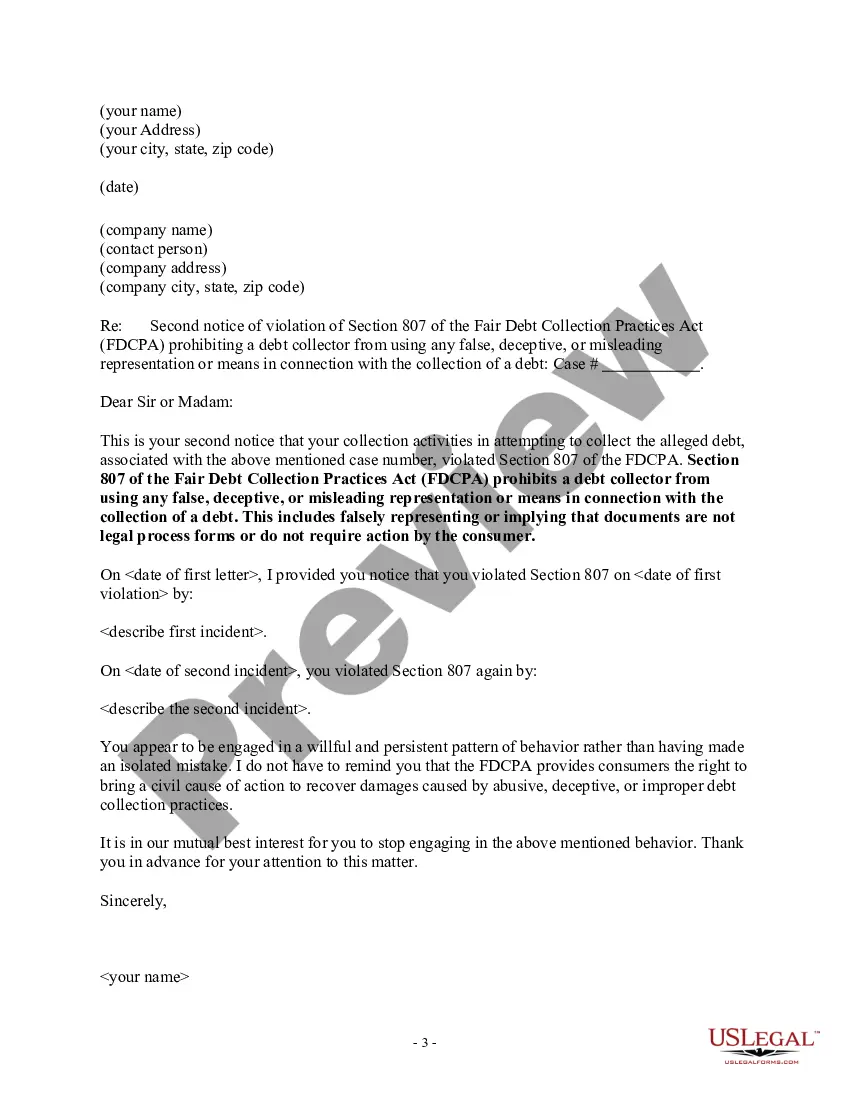

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Delaware Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

Are you currently in a situation where you require documents for potentially business or specific objectives almost every workday.

There are numerous legitimate document templates available online, but finding ones you can rely on is not straightforward.

US Legal Forms provides a vast array of template documents, such as the Delaware Notice to Debt Collector - Misrepresenting Documents are Not Legal Process or Do Not Require Action, which are designed to comply with state and federal regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Delaware Notice to Debt Collector - Misrepresenting Documents are Not Legal Process or Do Not Require Action whenever needed. Simply click the desired document to download or print the template.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and minimize errors. The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Delaware Notice to Debt Collector - Misrepresenting Documents are Not Legal Process or Do Not Require Action template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and verify it is for the correct state/region.

- Use the Review button to inspect the document.

- Read the description to confirm that you have selected the correct template.

- If the document is not what you’re looking for, utilize the Search field to locate the document that fits your needs and requirements.

- Once you find the correct document, click Buy now.

- Select the payment plan you want, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

Problems Faced by Debt Collection Agents and How to Solve Them!Oral Contracts:Faulty Written Agreements:Money Recovery Issues:Collection Methods Are Not Real-Time:Mobile Borrowers:Too Many Calls:Contacting Wrong People:Customer Bankruptcy:More items...?30-Nov-2019

Debt collection agencies may take you to court on behalf of a creditor if they have been unable to contact you in their attempts to recover a debt. Before being threatened by court action, the debt collection agency must have first sent you a warning letter.

The creditor has to prove who the borrower is These include: Where there is a dispute as to the identity of the borrower or hirer or as to the amount of the debt, it is for the firm (and not the customer) to establish, as the case may be, that the customer is the correct person in relation to the debt.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

Many people are surprised to learn that debt collectors can sue debtors for the balance of any outstanding debt. Many times, debt collection agencies will bring a lawsuit for breach of contract because when individuals don't pay the debt they agreed to pay.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Debt collectors have no special legal powers. You may feel under pressure to pay more than you can afford, but don't feel threatened. Find out more about the difference between debt collectors and bailiffs. Debt collectors may work for your creditor, or they may work for a separate debt collection agency.