Joint Filing of Rule 13d-1(f)(1) Agreement

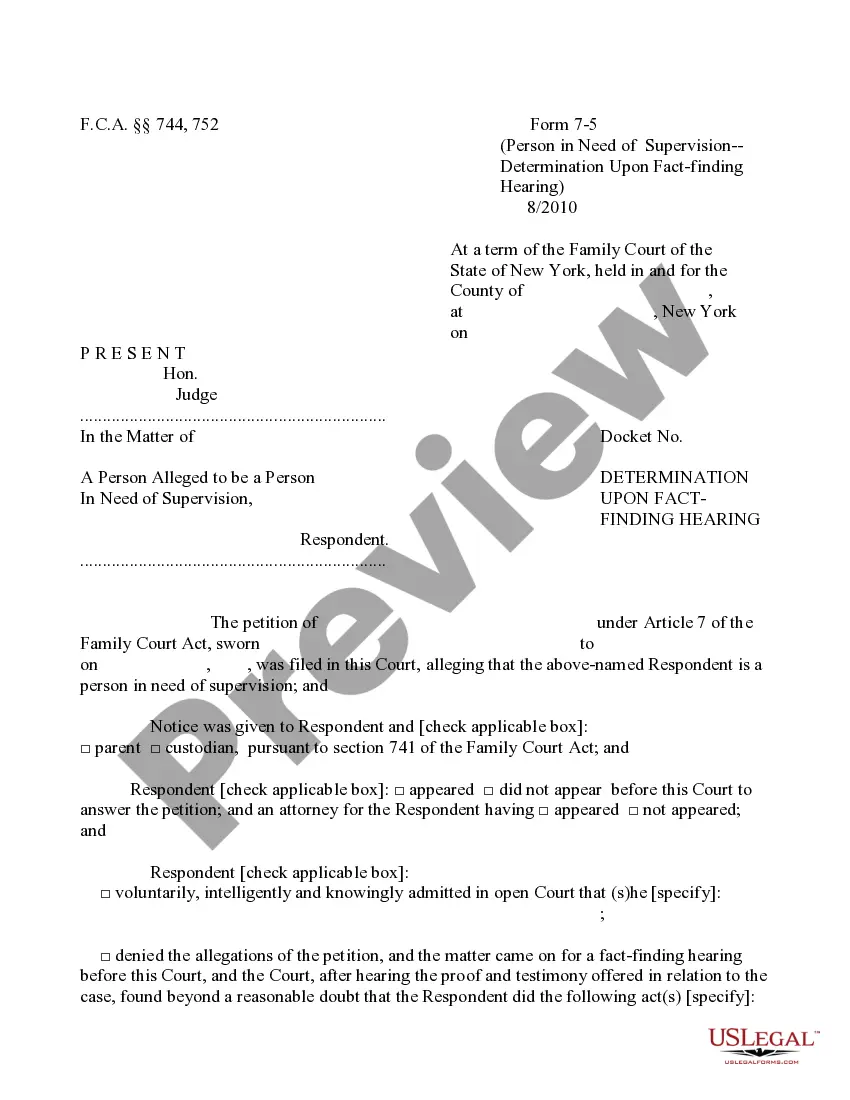

Description

How to fill out Joint Filing Of Rule 13d-1(f)(1) Agreement?

When it comes to drafting a legal form, it’s better to delegate it to the experts. However, that doesn't mean you yourself can not find a sample to utilize. That doesn't mean you yourself cannot find a template to use, nevertheless. Download Joint Filing of Rule 13d-1(f)(1) Agreement straight from the US Legal Forms web site. It offers a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. Once you are signed up with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things less difficult, we’ve provided an 8-step how-to guide for finding and downloading Joint Filing of Rule 13d-1(f)(1) Agreement quickly:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Hit Buy Now.

- Choose the suitable subscription for your needs.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Select a needed format if a number of options are available (e.g., PDF or Word).

- Download the file.

After the Joint Filing of Rule 13d-1(f)(1) Agreement is downloaded it is possible to fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Schedule 13G is a shorter version of Schedule 13D with fewer reporting requirements. Schedule 13G can be filed in lieu of the SEC Schedule 13D form as long as the filer meets one of several exemptions.

A Schedule 13D is a document that must be filed with the Securities and Exchange Commission (SEC) within 10 days of the purchase of more than 5% of the shares of a public company by anyone investor or entity. It is sometimes referred to as a beneficial ownership report.

A Schedule 13D is a document that must be filed with the Securities and Exchange Commission (SEC) within 10 days of the purchase of more than 5% of the shares of a public company by anyone investor or entity. It is sometimes referred to as a beneficial ownership report.

Schedule 13D is an SEC filing that must be submitted to the US Securities and Exchange Commission within 10 days by anyone who acquires beneficial ownership of more than 5% of any class of publicly traded securities in a public company.

Schedule 13D is a form that must be filed with the U.S. Securities and Exchange Commission (SEC) when a person or group acquires more than 5% of any class of a company's equity shares.Schedule 13D is also known as a "beneficial ownership report."

Institutional investors must file a Schedule 13G within 45 days after the calendar year in which the investor holds more than 5% as of the year end or within 10 days after the end of the first month in which the person's beneficial ownership exceeds 10% of the class of equity securities computed as of the end of the

The filing must be made within 10 days of breaking the five percent threshold. The 13D is useful because it can give the average investor the ability to follow the so-called smart money. Maybe a billionaire investor known for spotting good opportunities on the cheap is acquiring shares of Company XYZ.