Credit Card Application for Unsecured Open End Credit

Description

How to fill out Credit Card Application For Unsecured Open End Credit?

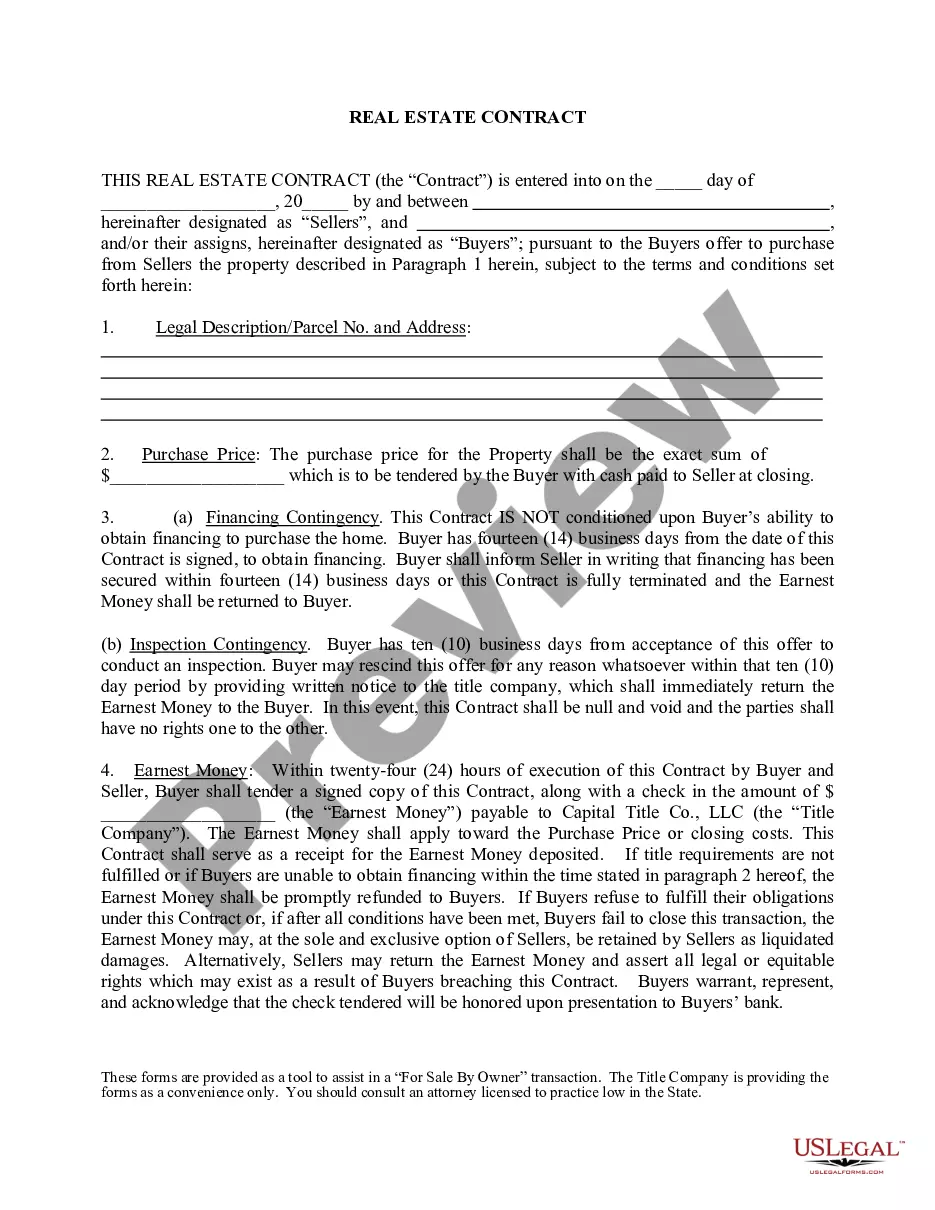

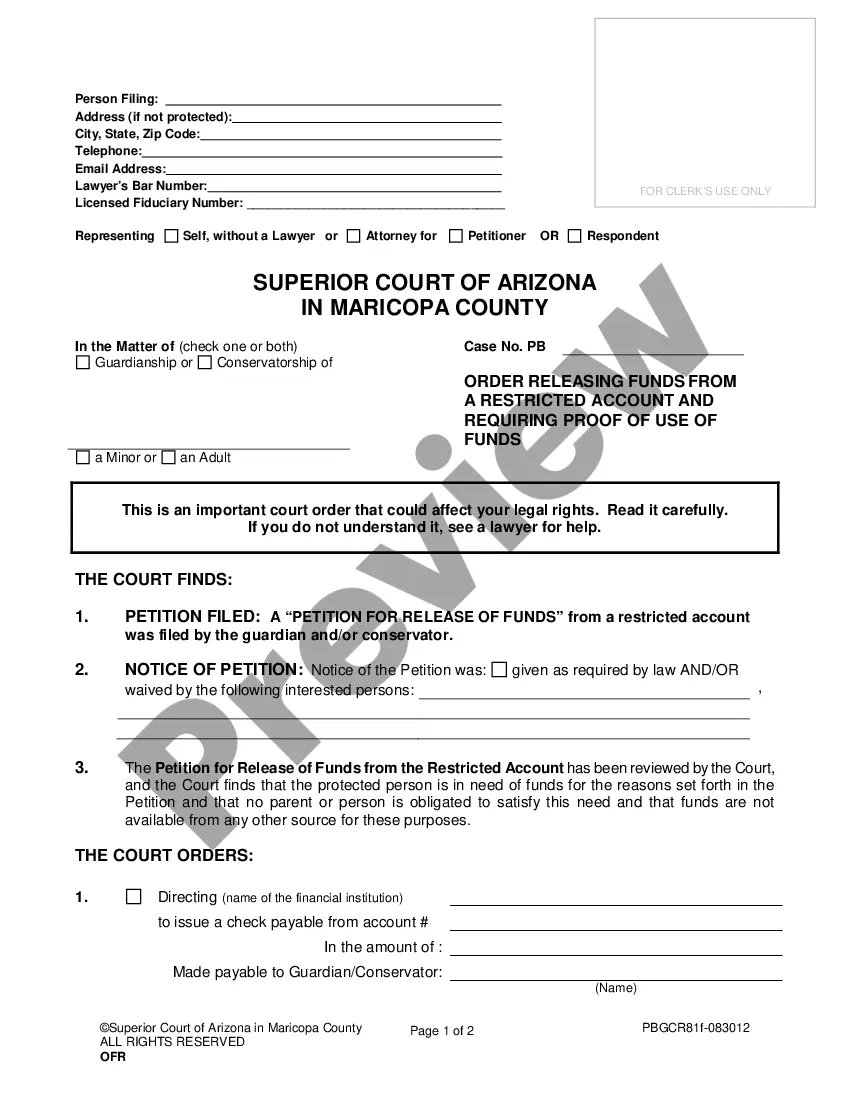

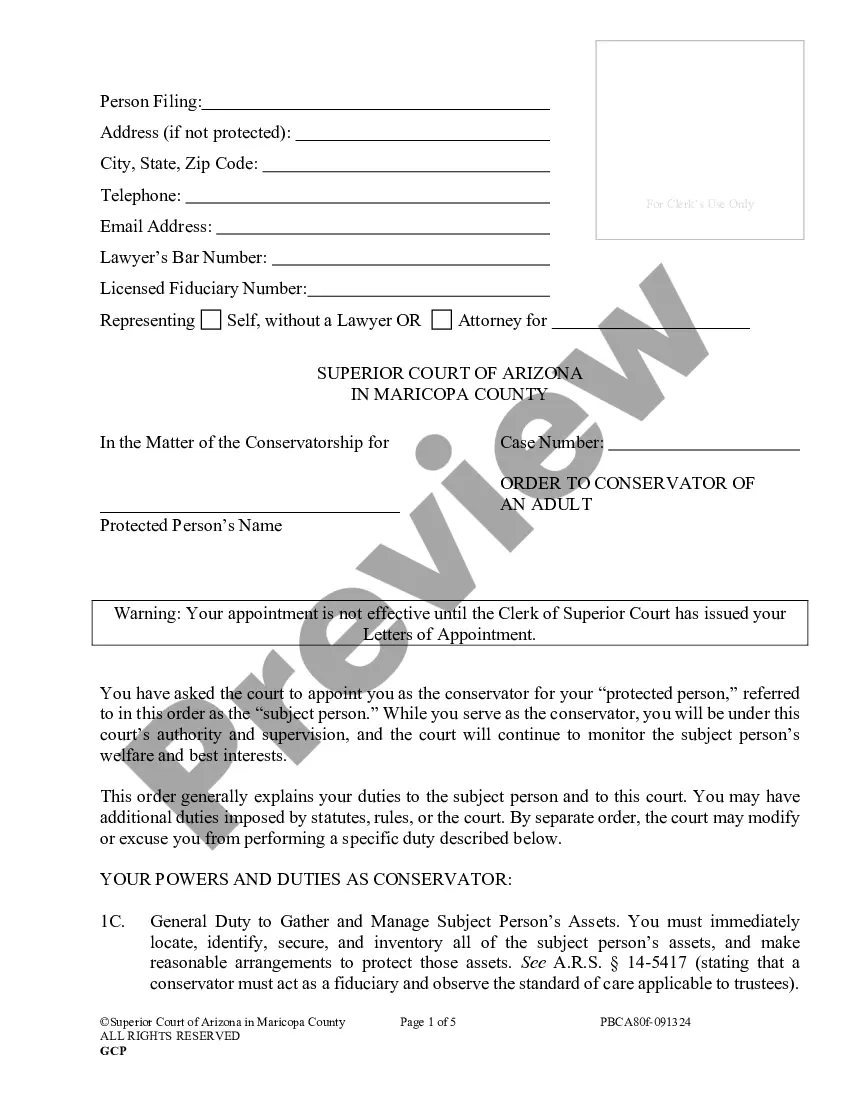

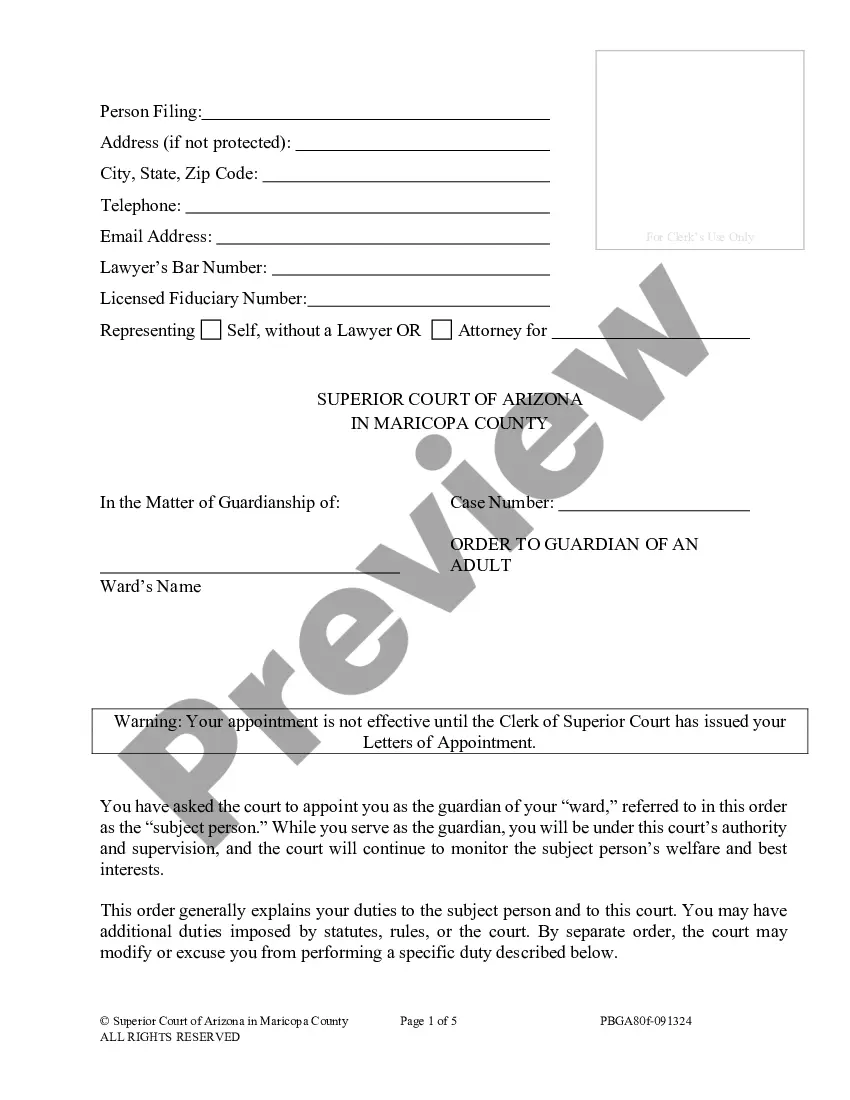

Aren't you sick and tired of choosing from numerous templates each time you require to create a Credit Card Application for Unsecured Open End Credit? US Legal Forms eliminates the lost time an incredible number of American people spend exploring the internet for perfect tax and legal forms. Our expert team of attorneys is constantly modernizing the state-specific Samples library, so it always has the proper files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have a subscription should complete a few simple actions before having the capability to download their Credit Card Application for Unsecured Open End Credit:

- Make use of the Preview function and read the form description (if available) to make sure that it’s the appropriate document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the proper sample for your state and situation.

- Make use of the Search field at the top of the web page if you want to look for another document.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your template in a needed format to finish, print, and sign the document.

As soon as you’ve followed the step-by-step recommendations above, you'll always be capable of sign in and download whatever document you need for whatever state you need it in. With US Legal Forms, completing Credit Card Application for Unsecured Open End Credit templates or other official files is easy. Get going now, and don't forget to recheck your examples with certified attorneys!

Form popularity

FAQ

If your credit score is below the 550 to 650 threshold needed to get a good unsecured card, you'd be much better off applying for a secured card such as the Discover it® Secured Credit Card or the Secured MastercardA® from Capital One.

Got a credit score (aka FICO score) of 600, 610, 620, 630 or 640? There's good news and bad news. Unfortunately, these credit scores are considered fair to poor, which means you may not be approved for many prime credit cards.

It can strengthen your credit score by helping you use credit wisely, and it's a great card to start off with when you're first learning to use credit. When you have bad credit, unsecured cards may carry high fees or come with high interest rates, and neither option is good for someone trying to rebuild credit.

Discover it® Secured Credit Card The best rewards credit card with high odds of instant approval is the Discover it Secured Credit Card. Secured cards are the easiest type of credit card to get, in general.

The easiest unsecured credit cards for bad credit are the Credit One Bank® VisaA® Credit Card, the Applied BankA® Unsecured Classic VisaA® Card, the First Access VISAA® Credit Card, the Surge MastercardA® Credit Card and the Fit MastercardA® Credit Card.

Pay your bill on time every month. Keep your balance relatively low. Avoid multiple credit applications in a short period.

The one thing anyone with a 500 credit score should do is open a secured credit card.For that, you'll need an unsecured credit card for bad credit. Such cards aren't ideal, as they charge high rates and fees while allowing you to borrow very little.