Exhibit B to Operating Agreement - Form of Lease

Description

Key Concepts & Definitions

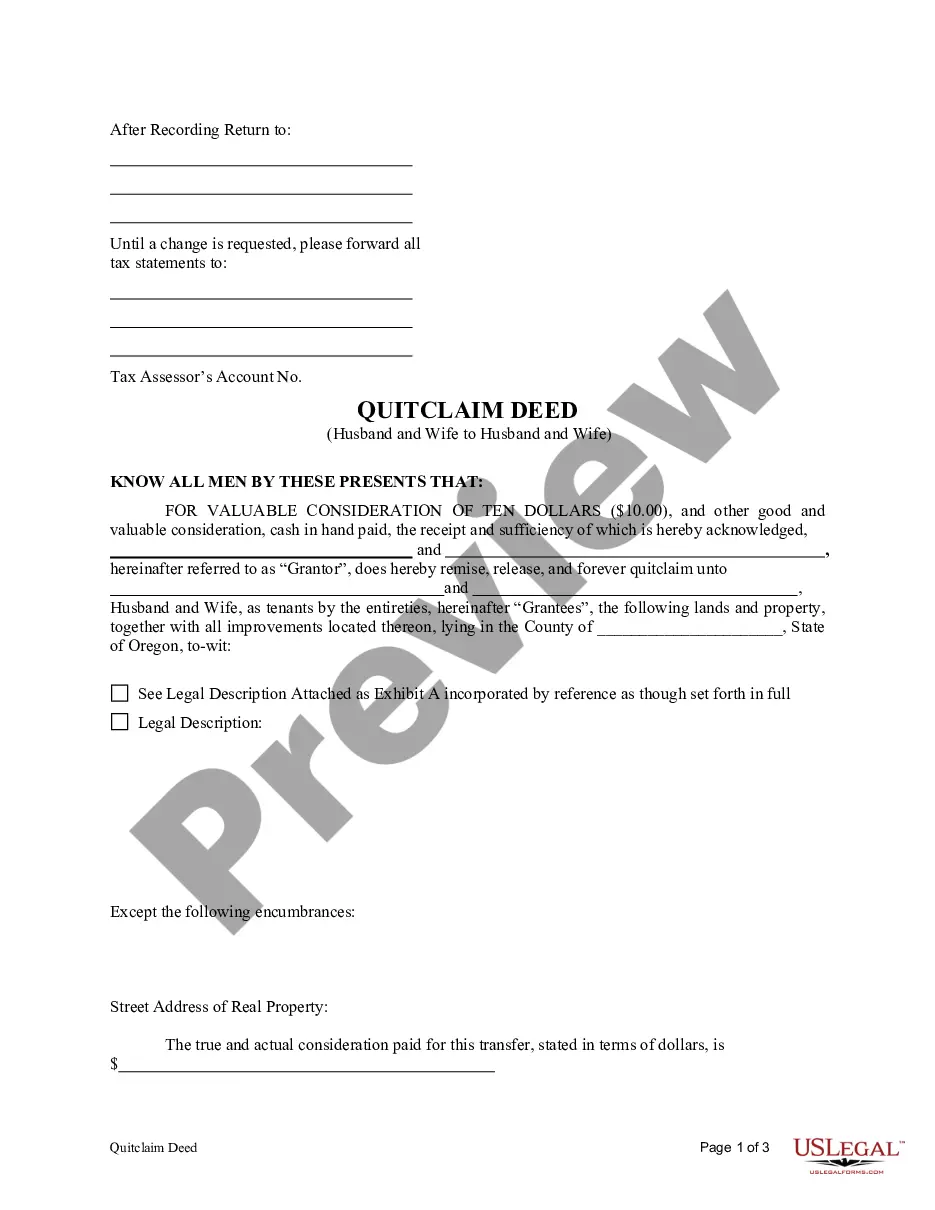

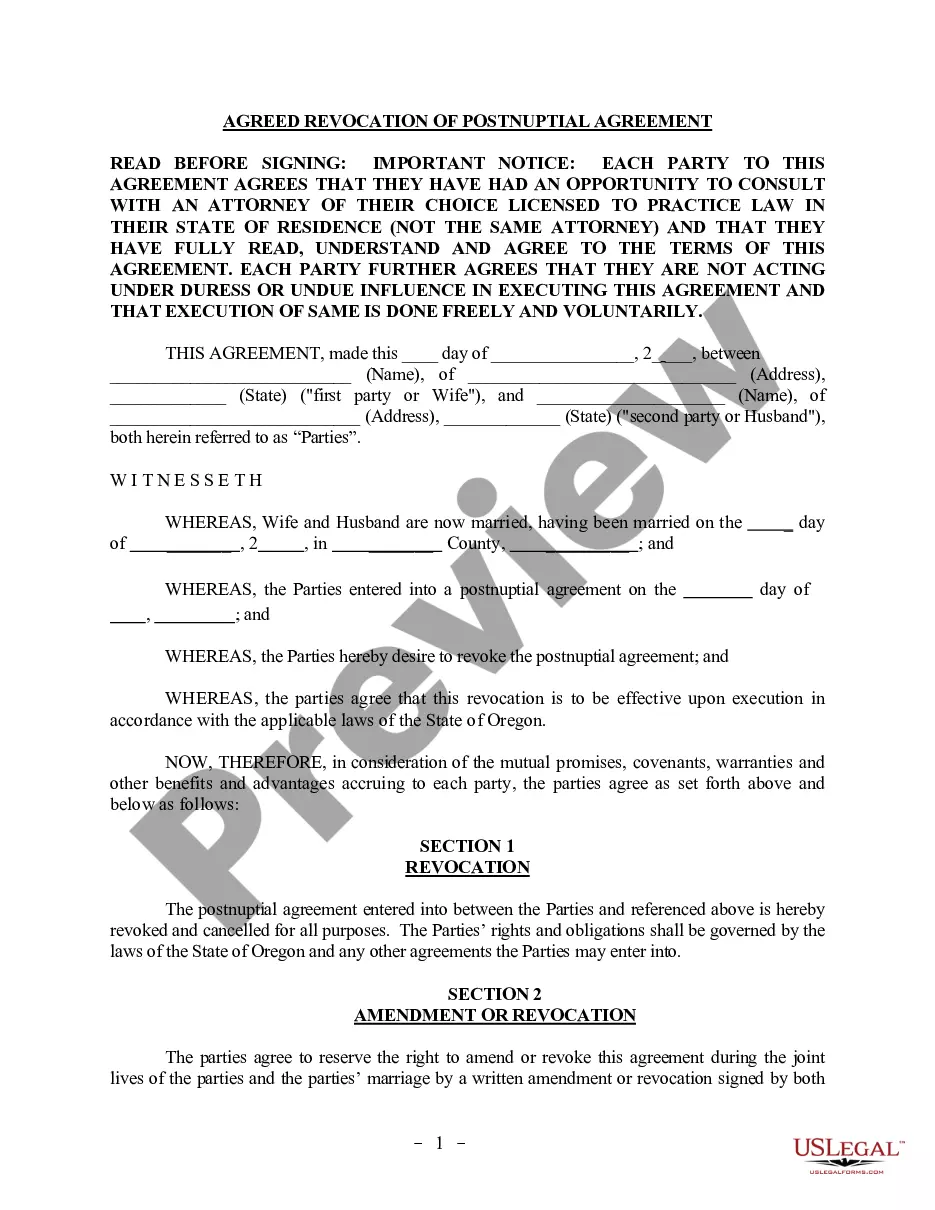

An Exhibit B to Operating Agreement Form of Lease is a crucial document within the context of a business operating agreement that outlines the specifics of a lease agreement controlled or governed by the operating agreement. This exhibit details the terms and conditions agreed upon by the involved parties regarding the leasing of property, typically for commercial purposes.

Step-by-Step Guide

- Review the Main Operating Agreement: Before drafting Exhibit B, thoroughly understand the main operating agreement to ensure consistency in terms and conditions.

- Determine Lease Details: Specify the property details, lease duration, rent amount, and other critical lease terms to include in the exhibit.

- Consult Legal Counsel: Engage with legal professionals to ensure that the exhibit complies with local and national laws.

- Finalize and Attach the Exhibit: Once the details are agreed upon by all parties, finalize Exhibit B and attach it to the main operating agreement.

- Execute the Agreement: Ensure all parties sign and execute the complete agreement, including the attached exhibit.

Risk Analysis

- Inconsistency Risks: Discrepancies between the lease terms in Exhibit B and the main operating agreement could lead to legal disputes.

- Compliance Risks: Failing to adhere to legal standards and regulations can result in fines or voiding of the lease.

- Financial Risks: Poorly defined financial terms might lead to unexpected costs or financial disputes.

Best Practices

- Detail Oriented: Ensure all lease terms are clearly and comprehensively documented.

- Legally Compliant: Regularly update the exhibits to reflect current laws and regulations.

- Clear Communication: Maintain open lines of communication between all parties involved to avoid misunderstandings.

Common Mistakes & How to Avoid Them

- Ignoring Legal Requirements: Always consult with legal experts during the drafting process to ensure compliance.

- Vague Terms: Specify all conditions clearly to prevent disputes and confusion.

- Skipping Regular Updates: Regularly review and update the lease terms to align with evolving business needs and laws.

How to fill out Exhibit B To Operating Agreement - Form Of Lease?

When it comes to drafting a legal document, it is better to leave it to the professionals. Nevertheless, that doesn't mean you yourself can’t find a sample to utilize. That doesn't mean you yourself cannot find a template to utilize, however. Download Exhibit B to Operating Agreement - Form of Lease right from the US Legal Forms website. It offers numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. When you are registered with an account, log in, find a certain document template, and save it to My Forms or download it to your device.

To make things easier, we have included an 8-step how-to guide for finding and downloading Exhibit B to Operating Agreement - Form of Lease fast:

- Make confident the form meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Click Buy Now.

- Select the suitable subscription to meet your needs.

- Create your account.

- Pay via PayPal or by credit/credit card.

- Choose a needed format if a few options are available (e.g., PDF or Word).

- Download the document.

When the Exhibit B to Operating Agreement - Form of Lease is downloaded it is possible to fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant documents in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

When you hire a lawyer in the Priori network, drafting an operating agreement typically costs anywhere from $350-$1000 for a single-member operating agreement and from $750-$5000 for a multi-member operating agreement.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

There is no requirement that the operating agreement is notarized. Even without being notarized, the document is still considered legally enforceable among the parties.

An operating agreement is mandatory as per laws in only 5 states: California, Delaware, Maine, Missouri, and New York. LLCs operating without an operating agreement are governed by the state's default rules contained in the relevant statute and developed through state court decisions.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.However, a written operating agreement defines in writing how the LLC is run.

The requirement of an operating agreement depends on the state it was formed in. While many states do not require operating agreements, some, such as Missouri and New York. This information can generally be found on your secretary of state website.

You can use online services to create an operating agreement, but you are better served by getting the help of an attorney. Your attorney can make sure all the relevant clauses are included, and he or she can tailor the document to the requirements of your state.