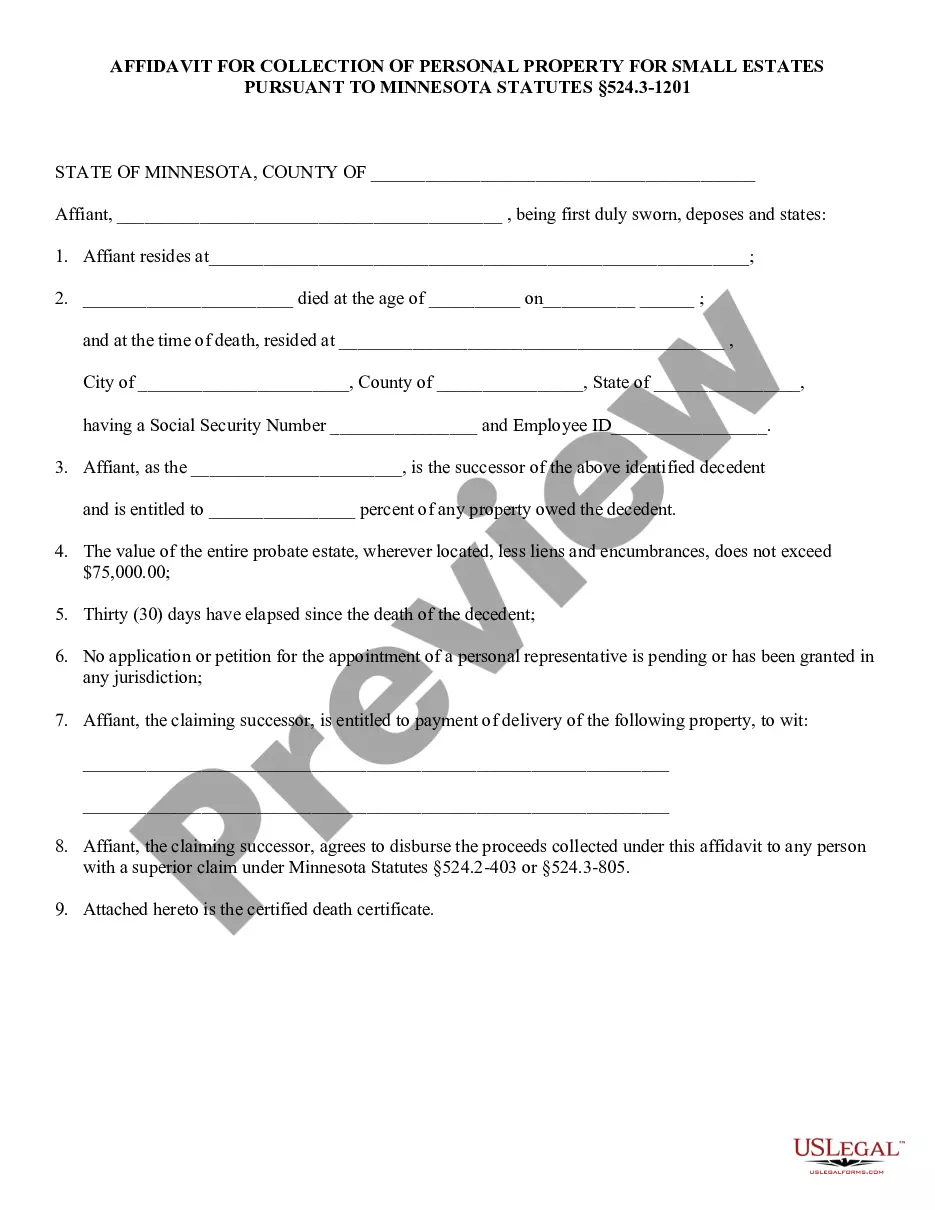

Minnesota Instructions — Affidavit for Collection of Personal Property (Small Estate — No Real Estate) is a legal document used in Minnesota to allow an individual (the "affine") to recover the property belonging to a deceased person (the "decedent") who has died without leaving a will. This document is used when the value of the estate is below a certain amount (generally $50,000) and does not include real estate. The affine must provide proof of the decedent's death, a list of all property to be collected, and a list of all creditors of the decedent. There are two types of Minnesota Instructions — Affidavit for Collection of Personal Property (Small Estate — No Real Estate): an Unsupervised Affidavit, and a Supervised Affidavit. An Unsupervised Affidavit is used when the affine believes that the estate has no creditors and no debts. A Supervised Affidavit is used when the affine believes that the estate has creditors and/or debts and the affine must submit the affidavit to a court for approval.

Minnesota Instructions - Affidavit for Collection of Personal Property (Small Estate - No Real Estate)

Description

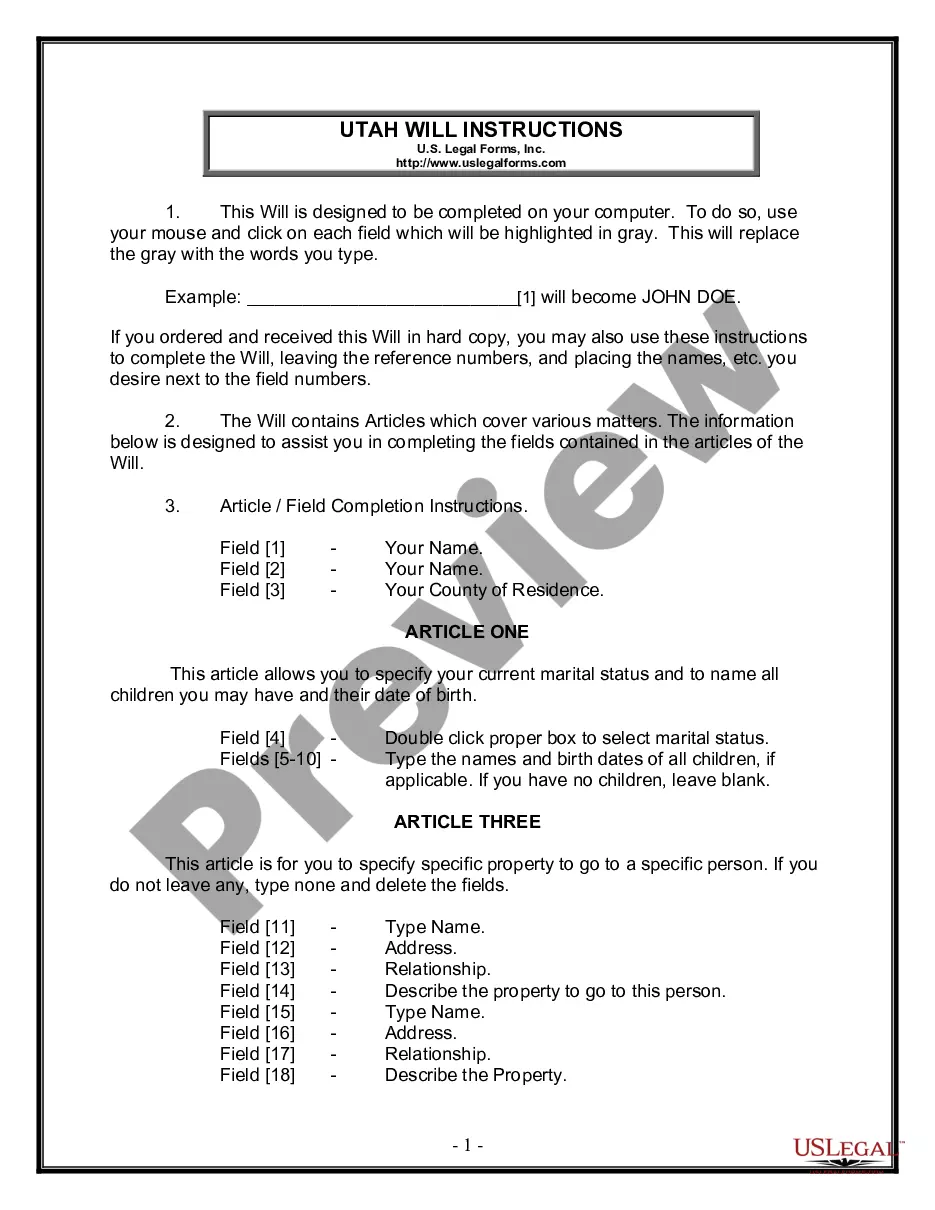

How to fill out Minnesota Instructions - Affidavit For Collection Of Personal Property (Small Estate - No Real Estate)?

Preparing official documentation can be a significant hassle unless you have accessible fillable templates. With the US Legal Forms online collection of formal documents, you can trust in the blanks you receive, as all of them align with federal and state laws and are verified by our specialists.

So if you need to prepare Minnesota Instructions - Affidavit for Collection of Personal Property (Small Estate - No Real Estate), our service is the optimal place to download it.

Here’s a brief guideline for you: Document compliance verification. You should carefully review the content of the form you desire and ensure it meets your requirements and adheres to your state law regulations. Previewing your document and examining its general description will assist you in doing just that.

- Acquiring your Minnesota Instructions - Affidavit for Collection of Personal Property (Small Estate - No Real Estate) from our service is as simple as ABC.

- Previously approved users with a valid subscription need only Log In and click the Download button once they locate the appropriate template.

- Then, if necessary, users can access the same document from the My documents section of their profile.

- However, even if you are unfamiliar with our service, registering with a valid subscription will only take a few moments.

Form popularity

FAQ

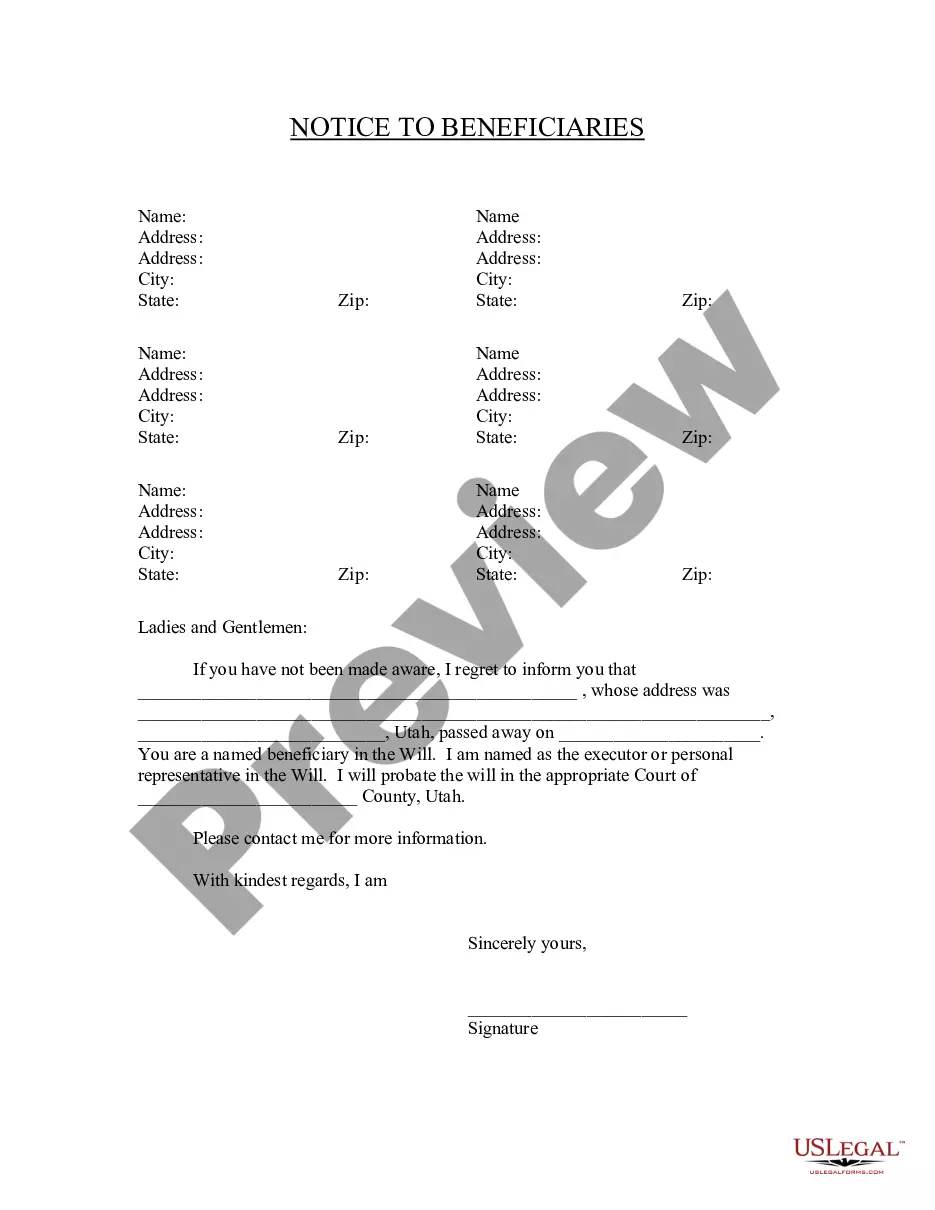

Yes, an affidavit for collection of personal property in Minnesota must be notarized to be considered valid. Notarization adds a layer of authenticity and ensures that the document meets legal requirements. When you follow the Minnesota Instructions - Affidavit for Collection of Personal Property (Small Estate - No Real Estate), you can easily prepare this document for notarization. UsLegalForms offers templates and guidance to help you with the notarization process, ensuring you meet all necessary standards.

An affidavit for collection of personal property in Minnesota allows heirs to collect the personal belongings of a deceased person without going through a formal probate process. This document simplifies the transfer of small estate assets, ensuring that loved ones can access what they need quickly and efficiently. By following the Minnesota Instructions - Affidavit for Collection of Personal Property (Small Estate - No Real Estate), you can navigate this process smoothly. UsLegalForms provides comprehensive resources to help you complete this affidavit accurately.

Yes, if you wish to collect personal property from a small estate in Minnesota, you must file a small estate affidavit. This legal document provides proof of your right to access the deceased's assets. By following the Minnesota Instructions - Affidavit for Collection of Personal Property (Small Estate - No Real Estate), you can navigate this process efficiently and ensure all necessary steps are completed.

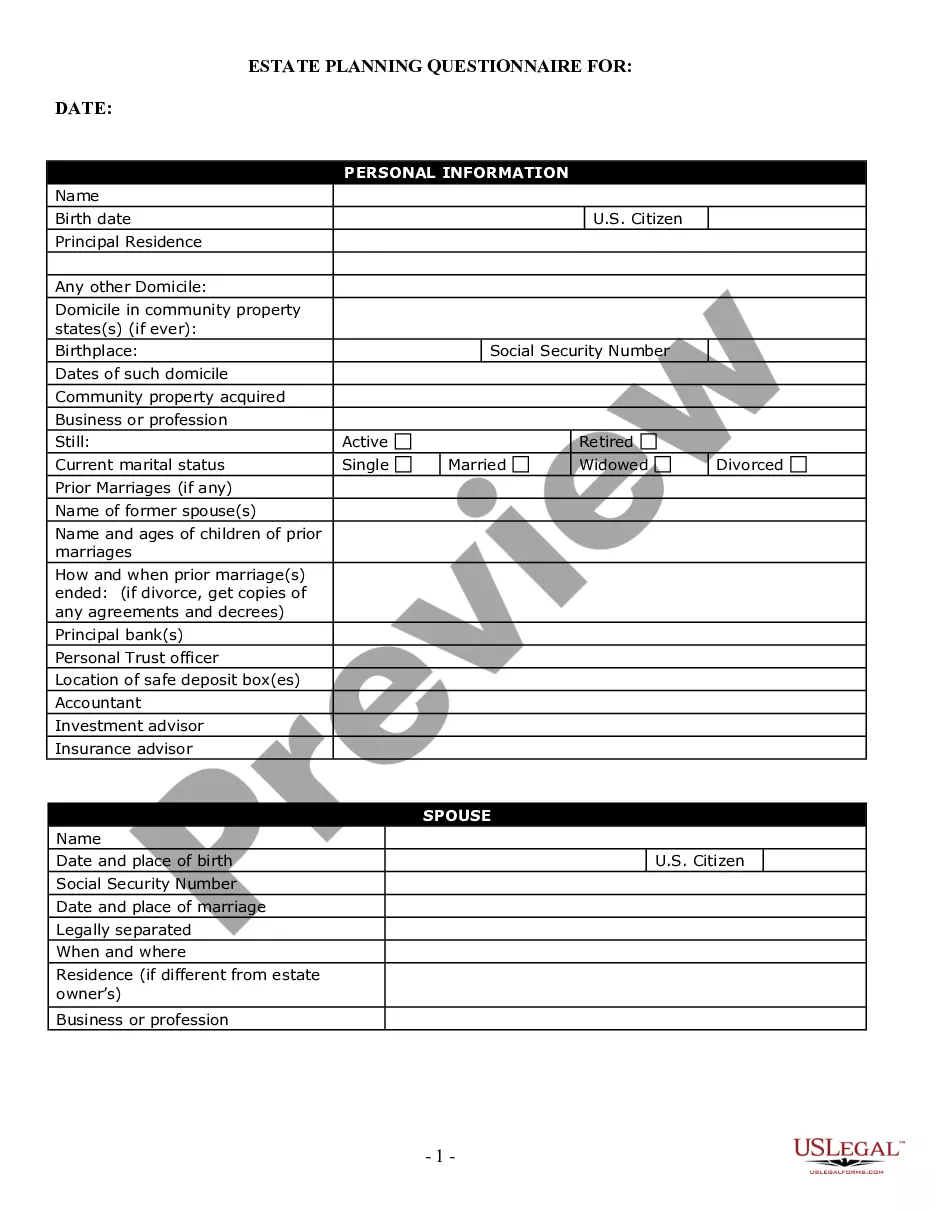

While anyone can technically fill out a small estate affidavit in Minnesota, it is typically completed by an individual who has a legal right to the deceased's personal property. This usually includes immediate family members or heirs. Using the Minnesota Instructions - Affidavit for Collection of Personal Property (Small Estate - No Real Estate) can ensure that you include all required information for a successful filing.

To file a small estate affidavit in Minnesota, you need to complete the Minnesota Instructions - Affidavit for Collection of Personal Property (Small Estate - No Real Estate). First, gather necessary information about the deceased and their assets. Next, sign the affidavit in front of a notary public. Finally, file the completed affidavit with the appropriate county court.

This process is used in Minnesota to avoid probate court if the value of the estate is no greater than $75,000.

Affidavit of No-Probate (PS2071) is used by one or more heirs at law (adult children, parents, siblings), who affirm they have the authority to represent all heirs and that the estate is not subject to probate. The applicant's signature must be notarized or witnessed.

An heir can use a small-estate affidavit if the estate's worth is below the $75,000 limit set by Minnesota law.

How to Write (1) Name Of Minnesota Deceased.(2) County Of Minnesota Deceased.(3) Name of Minnesota Petitioner.(4) Address Of Minnesota Petition. (5) Date Of Minnesota Decedent Death.(6) Basis For Minnesota Petitioner Claim.(7) Minnesota Decedent Estate Assets.(8) Signature Date Of Minnesota Petitioner.

Under Minnesota statute, where as estate is valued at not more than $75,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to collect any debts owed to the decedent.