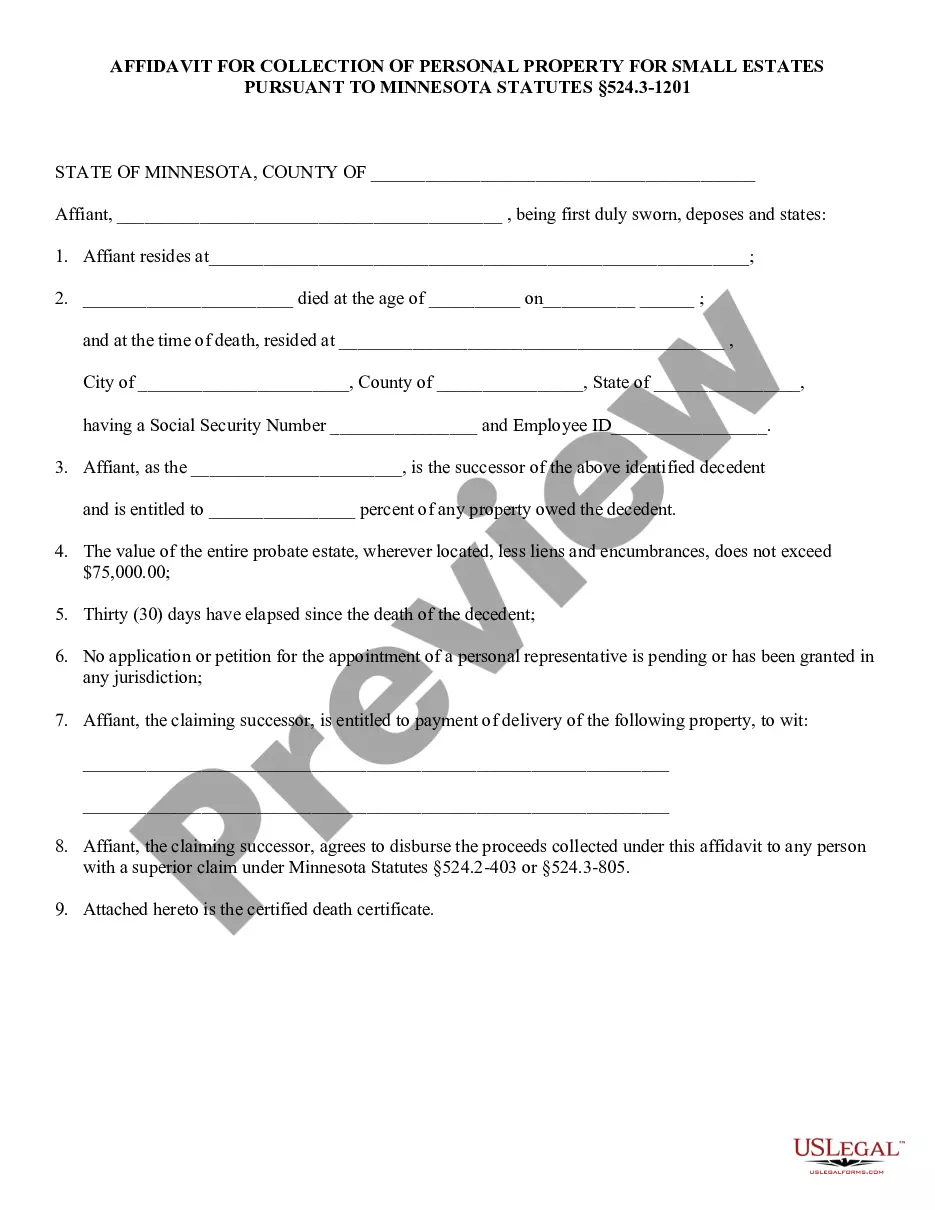

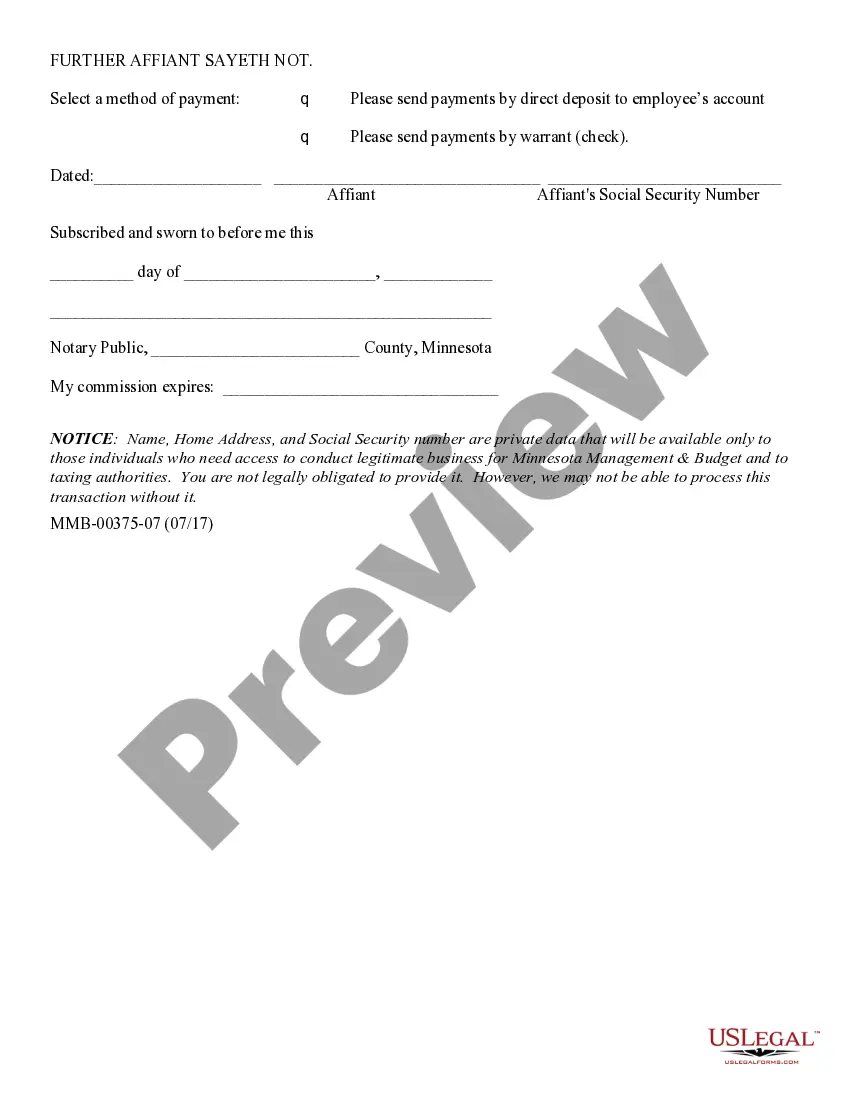

The Minnesota Affidavit for Collection of Personal Property for Small Estates is a legal document that is used when a decedent has passed away with an estate valued at $50,000 or less. It allows a person, known as the affine, to collect the decedent’s personal property without having to go through the traditional probate process. The affine must be a qualified person, such as a close relative, or a financial institution that holds an account in the name of the decedent. The document must be signed in front of a notary and must include a list of the decedent’s personal property that is being collected. There are two types of Minnesota Affidavit for Collection of Personal Property for Small Estates. The first type is an Unsupervised Affidavit, which does not require court approval and allows the affine to collect the estate without having to go through the probate process. The second type is a Supervised Affidavit, which requires court approval and must be submitted to the court for review.

Minnesota Affidavit for Collection of Personal Property for Small Estates

Description

How to fill out Minnesota Affidavit For Collection Of Personal Property For Small Estates?

Managing legal paperwork demands focus, accuracy, and utilizing correctly prepared templates. US Legal Forms has been assisting individuals across the country for 25 years, so when you select your Minnesota Affidavit for Collection of Personal Property for Small Estates form from our database, you can trust it adheres to federal and state regulations.

Utilizing our service is straightforward and fast. To acquire the required document, all you need is an account with an active subscription. Here’s a concise guideline for you to secure your Minnesota Affidavit for Collection of Personal Property for Small Estates in just a few minutes.

All documents are designed for multiple uses, such as the Minnesota Affidavit for Collection of Personal Property for Small Estates displayed on this page. If you require them in the future, you can complete them without additional payment - simply access the My documents section in your profile and finalize your document whenever needed. Experience US Legal Forms and prepare your business and personal documents quickly and in complete legal compliance!

- Ensure to carefully review the form's contents and its alignment with general and legal standards by previewing it or reading its description.

- Search for another official template if the one you opened does not fit your circumstances or state laws (the option for that is located at the top corner of the page).

- Sign in to your account and download the Minnesota Affidavit for Collection of Personal Property for Small Estates in your preferred format. If this is your first time using our service, click Buy now to continue.

- Create an account, select your subscription plan, and pay using your credit card or PayPal account.

- Select the format in which you wish to receive your form and click Download. Print the template or upload it to a professional PDF editor to submit it online.

Form popularity

FAQ

Minnesota Small Estate Affidavit - EXPLAINED - YouTube YouTube Start of suggested clip End of suggested clip Before we go where can you find legal documents. Online click the button to the right for aMoreBefore we go where can you find legal documents. Online click the button to the right for a minnesota small state affidavit.

A. See Minnesota Statutes, section 524.3-1201. The affidavit can collect the decedent's personal property in safe deposit boxes, interests in multiple-party accounts, and debts owed to the decedent. See Minnesota Statutes, sections 524.3-1201, 55.10, and 524.6-207.

Minnesota small estate affidavit is a legal form used in estates valued and under $75,000. Minnesota statute 524.3-1201 tells us that this dollar amount is the threshold level by which an estate in Minnesota does or does not need to be probated.

Under Minnesota statute, where as estate is valued at not more than $75,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to collect any debts owed to the decedent.

How to Write (1) Name Of Minnesota Deceased.(2) County Of Minnesota Deceased.(3) Name of Minnesota Petitioner.(4) Address Of Minnesota Petition. (5) Date Of Minnesota Decedent Death.(6) Basis For Minnesota Petitioner Claim.(7) Minnesota Decedent Estate Assets.(8) Signature Date Of Minnesota Petitioner.

An heir can use a small-estate affidavit if the estate's worth is below the $75,000 limit set by Minnesota law.

Affidavit of No-Probate (PS2071) is used by one or more heirs at law (adult children, parents, siblings), who affirm they have the authority to represent all heirs and that the estate is not subject to probate. The applicant's signature must be notarized or witnessed.

An affidavit for collection is a procedure that transfers assets of estates that would otherwise be probated and that have a net value of under $75,000. With the affidavit, there is no court appearance, no personal representative appointed, and no mailed notification to interested parties.