Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

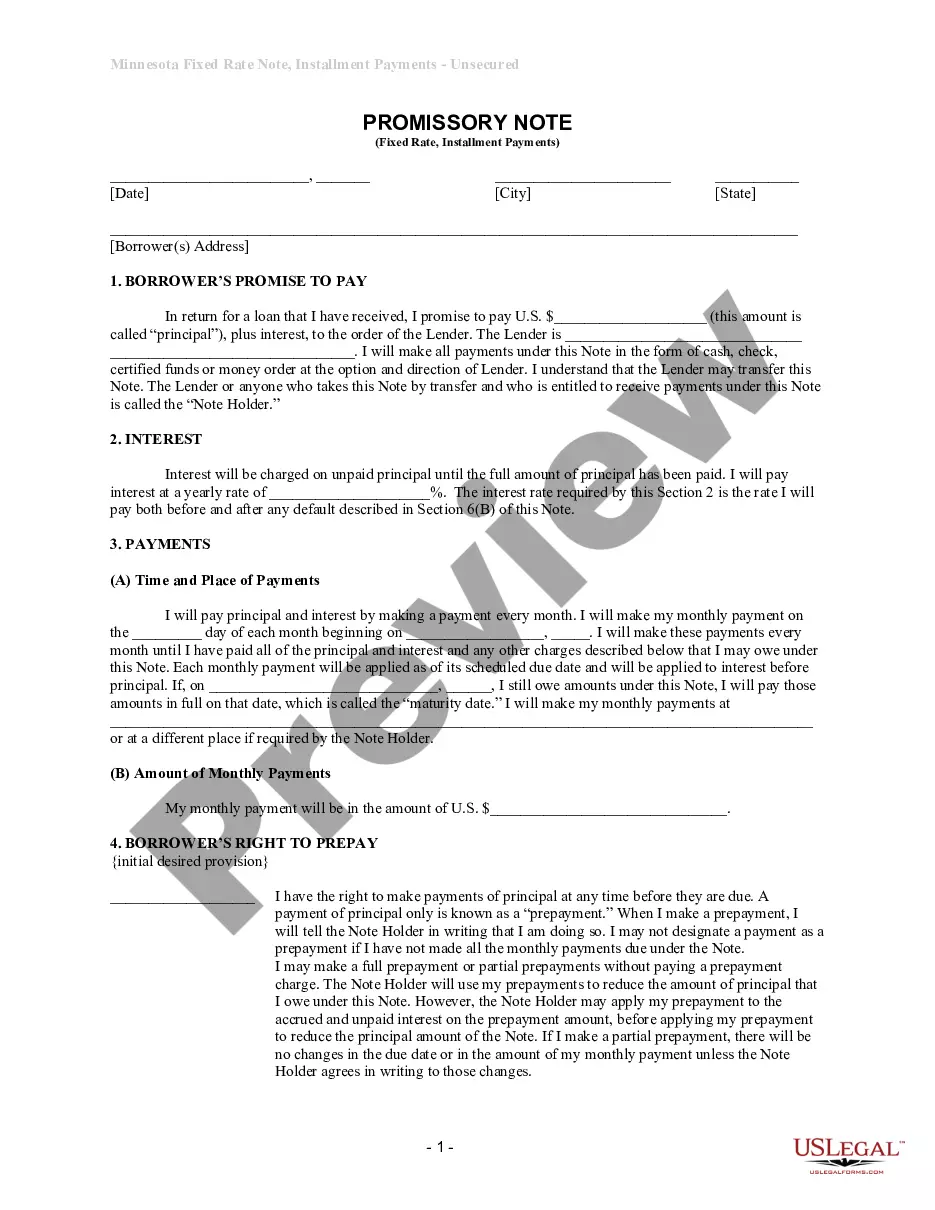

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

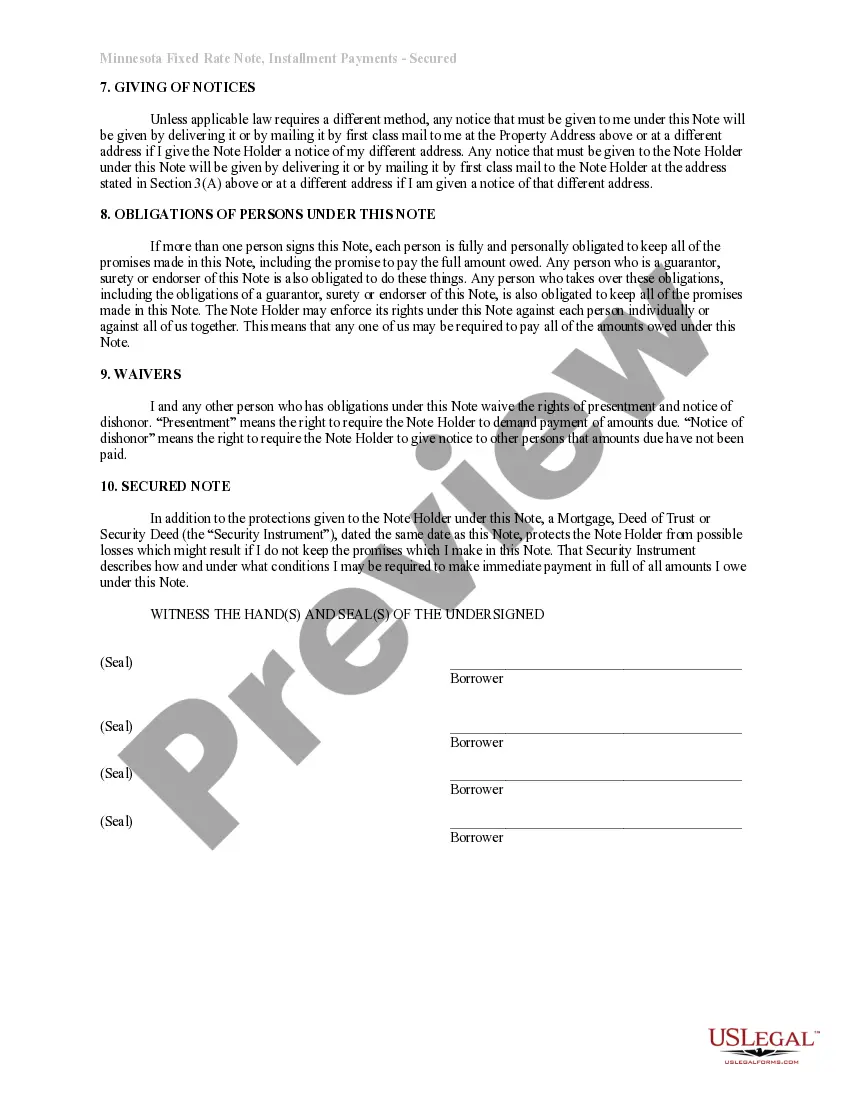

Obtain any version of 85,000 legal documents including the Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate online with US Legal Forms. Each template is created and revised by state-authorized lawyers.

If you already possess a subscription, Log In. When you’re on the document’s page, click on the Download button and navigate to My documents to gain access to it.

If you haven’t subscribed yet, follow these steps: Check the state-specific prerequisites for the Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate that you require.

With US Legal Forms, you’ll consistently have swift access to the appropriate downloadable template. The platform will provide you access to documents and categorizes them to make your search easier. Utilize US Legal Forms to obtain your Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate quickly and effortlessly.

- Review the description and preview the example.

- When you’re confident the template is what you need, just click Buy Now.

- Choose a subscription plan that suits your financial situation.

- Establish a personal account.

- Make a payment in one of two convenient methods: by card or through PayPal.

- Select a format to download the document in; two formats are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable template is downloaded, print it out or save it to your device.

Form popularity

FAQ

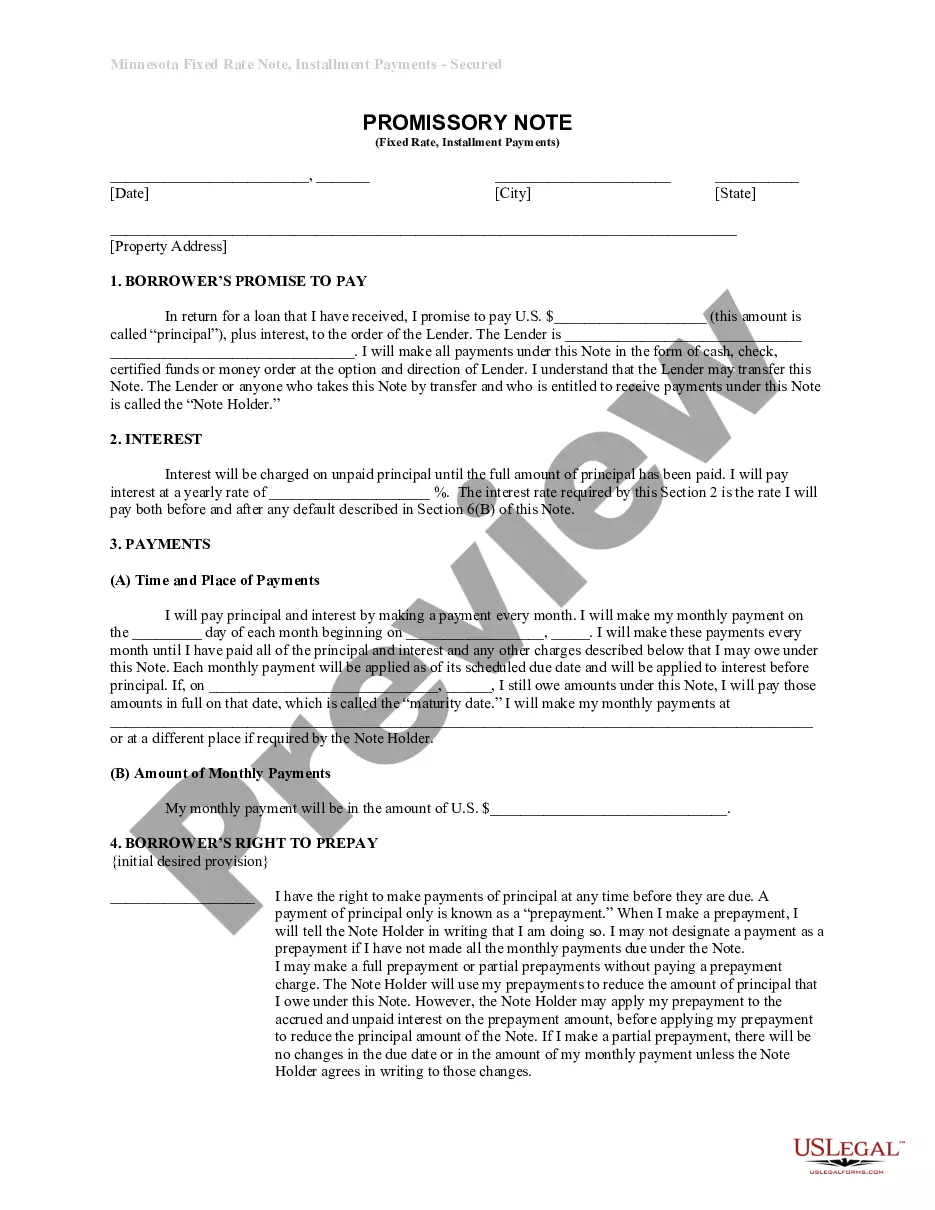

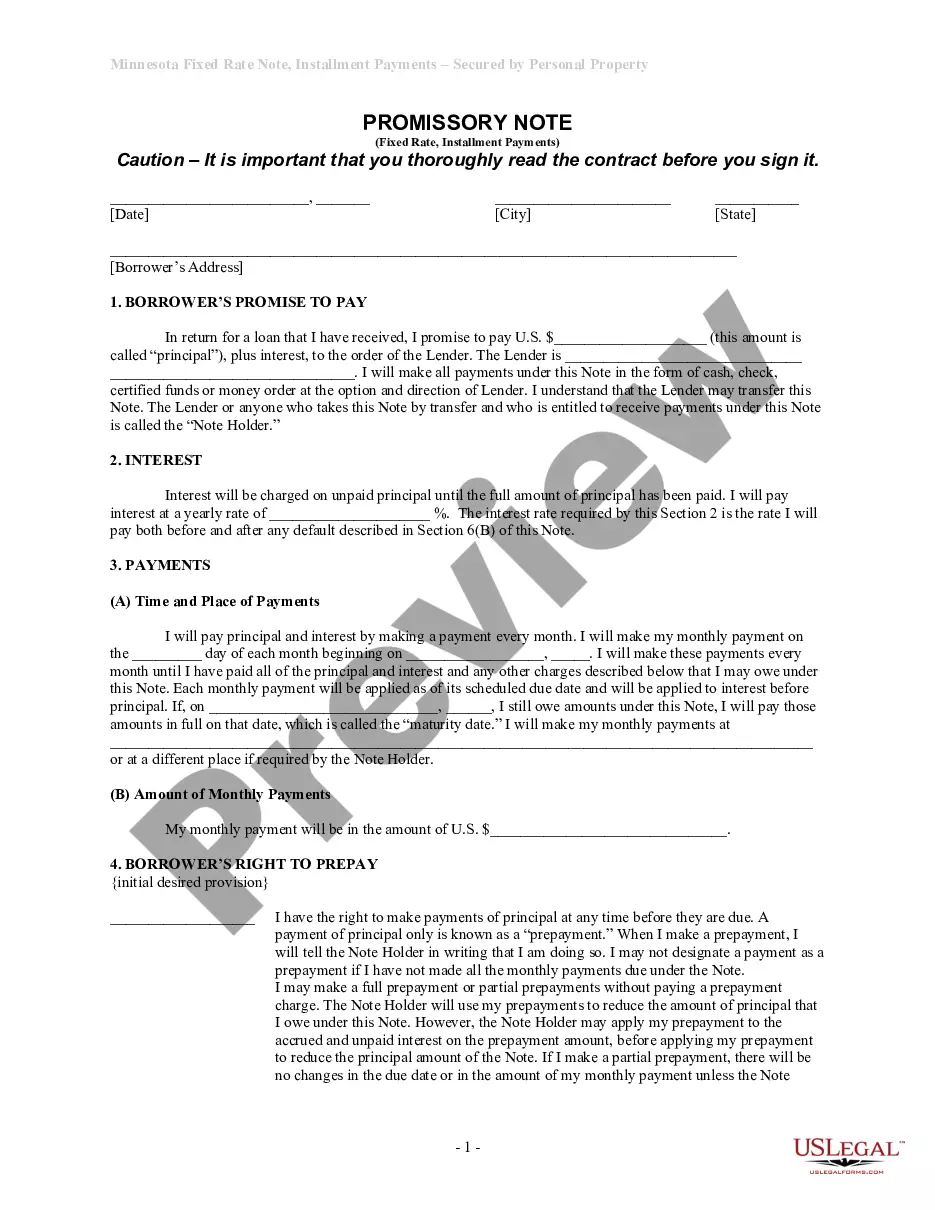

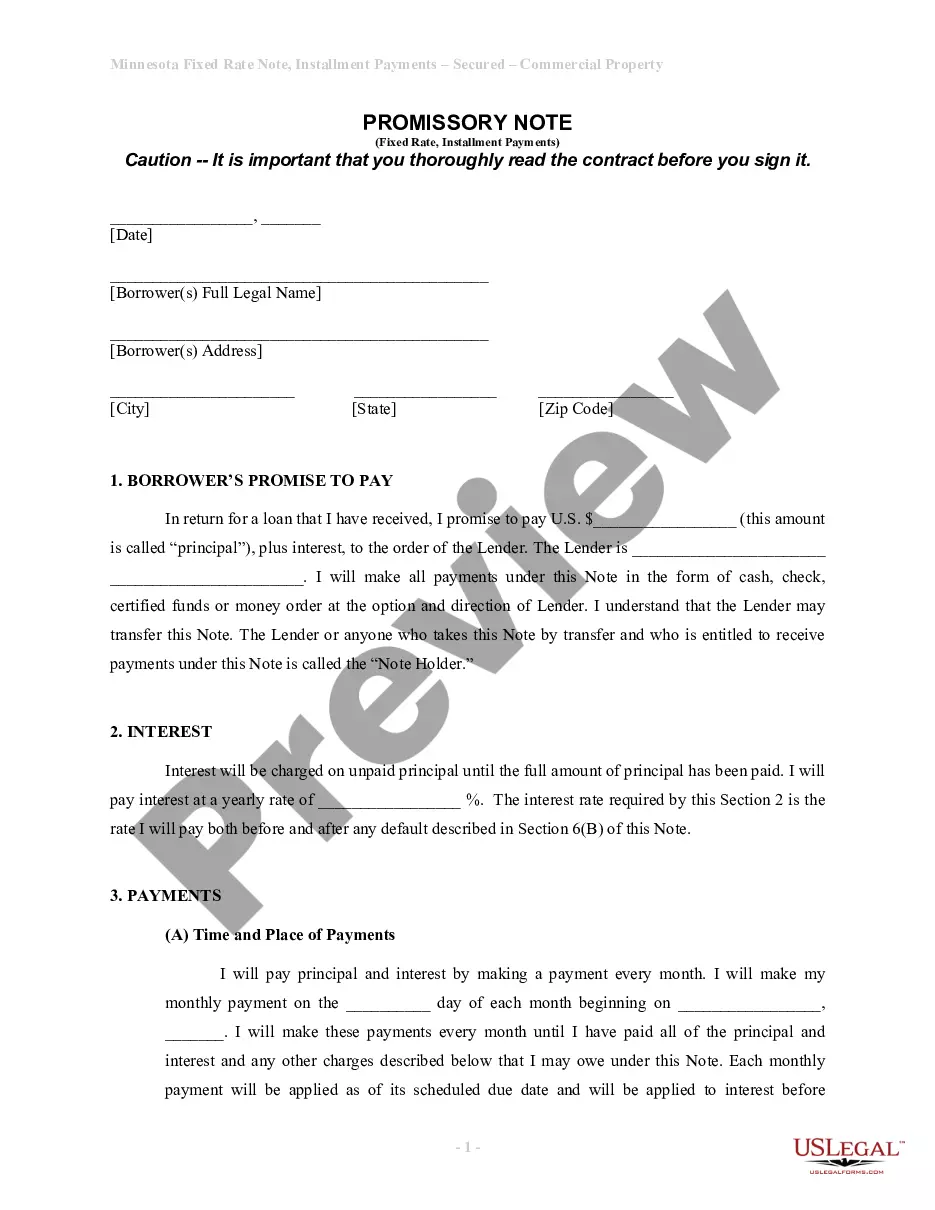

A promissory note is secured in real estate by attaching it to the property itself, which serves as collateral. This means if the borrower fails to make payments, the lender has the right to take possession of the property through foreclosure. In the case of a Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this process provides an added layer of security, ensuring that both parties have a clear understanding of their rights and responsibilities.

Yes, a promissory note can indeed be secured by real property. This type of arrangement provides additional security for the lender, as they can claim the property if the borrower does not fulfill their obligations. Specifically, a Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate allows you to leverage your property for financing. For guidance on creating this type of note, consider using uslegalforms to ensure all legal requirements are met.

To secure a promissory note, you typically attach collateral to the note. This collateral is often a valuable asset, such as residential real estate. In the case of a Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the property serves as security, ensuring that the lender has a claim to the asset if the borrower defaults. Utilizing a platform like uslegalforms can help you draft the necessary documentation to secure your promissory note effectively.

Writing a secured promissory note starts with specifying that it is secured by collateral, such as residential real estate. Include essential details, such as the names of the parties involved, the principal amount, interest rate, and repayment schedule. Additionally, clearly describe the terms of the security interest to protect the lender. You can use the uslegalforms platform to find templates that guide you in creating a Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

To fill in a promissory note, start by entering the date at the top of the document. Next, include the names and addresses of both the borrower and lender. Specify the amount being borrowed, the interest rate, and the repayment schedule. Finally, ensure to sign and date the document, making it a legally binding Minnesota Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

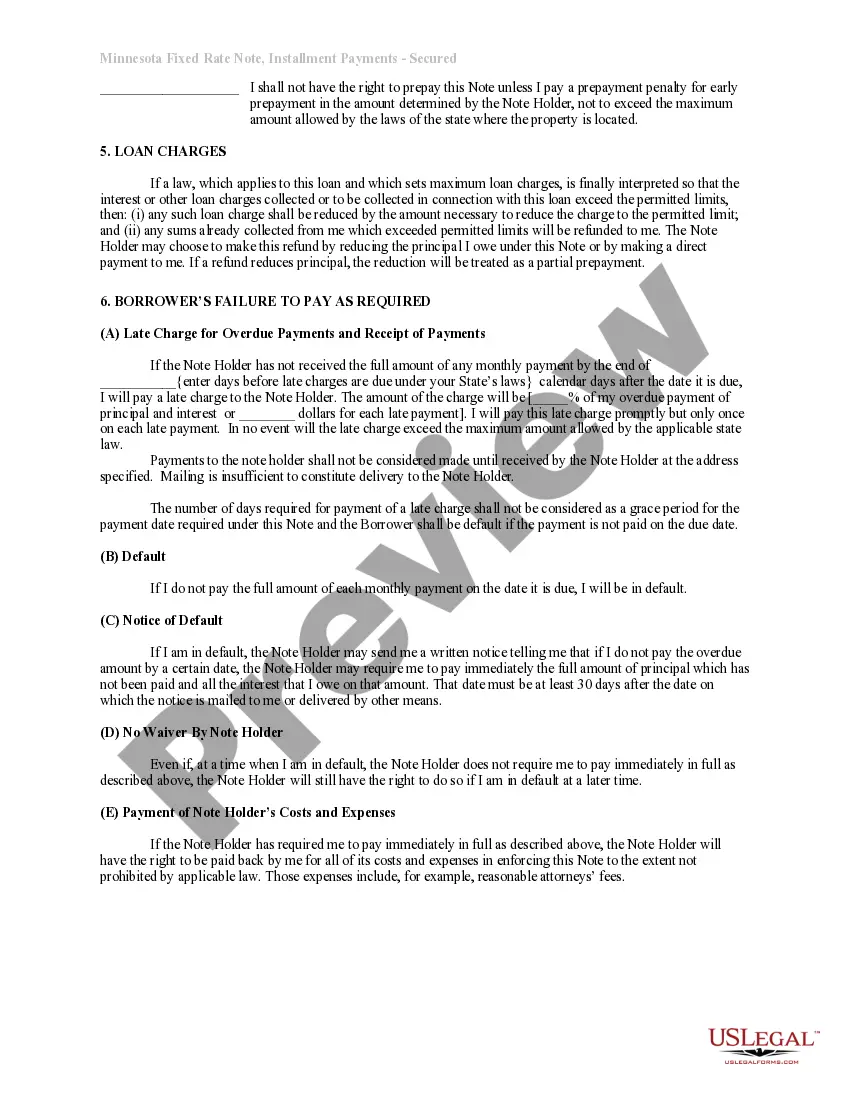

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.