Minnesota Installments Fixed Rate Promissory Note Secured by Personal Property

What is this form?

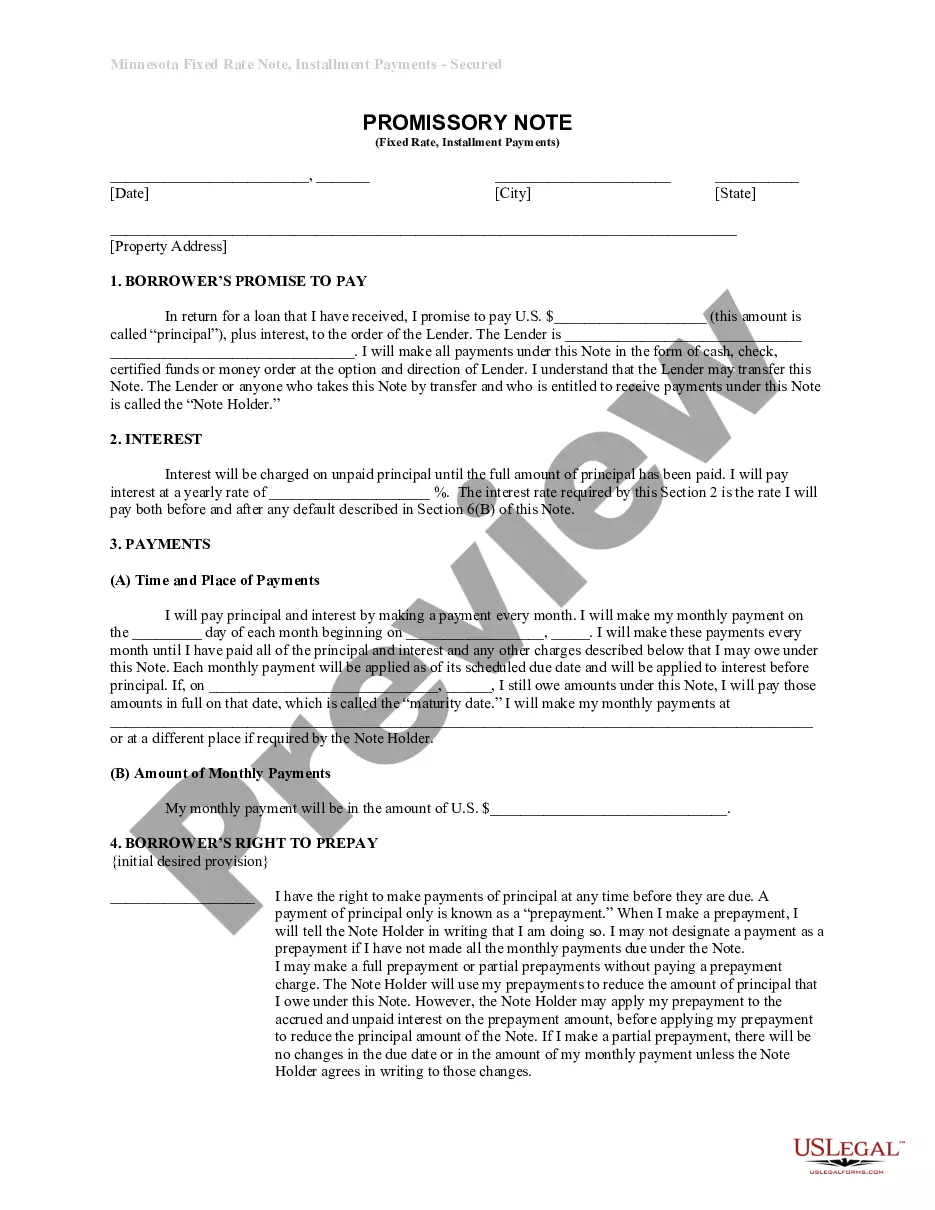

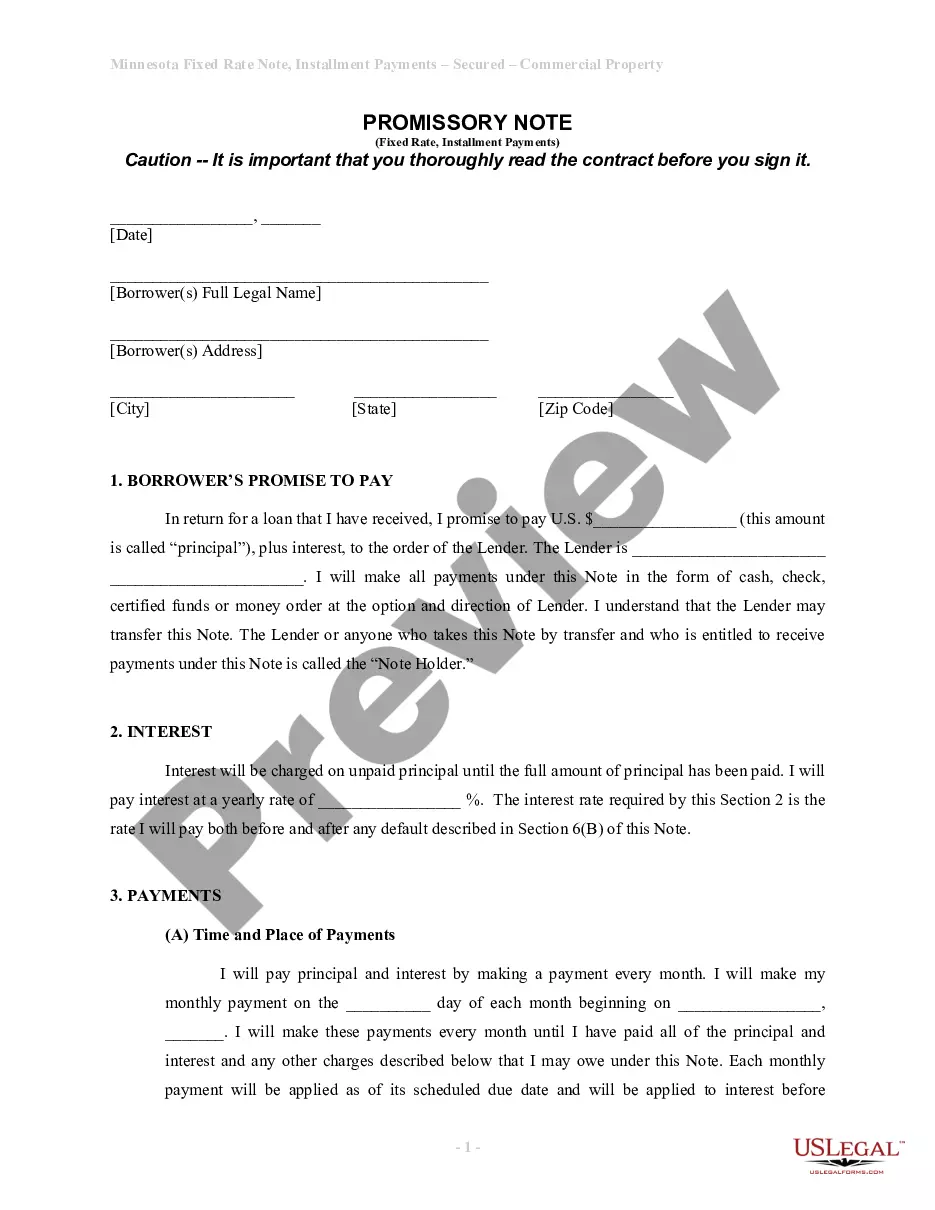

The Minnesota Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document wherein a borrower agrees to repay a specified amount of money, with interest, to a lender over time. This note is secured by personal property, which means that the property serves as collateral for the loan. This form differs from unsecured promissory notes because it includes a security agreement that outlines the collateral involved, providing the lender with additional protection in case of default.

Key parts of this document

- Borrower's Promise to Pay: Details the obligation of the borrower to repay the principal and interest to the lender.

- Interest Rate: Specifies the yearly interest rate applied to the unpaid principal amount.

- Payment Schedule: Outlines the frequency and due date of monthly payments.

- Borrowerâs Right to Prepay: Explains the conditions under which the borrower can make early payments on the loan.

- Loan Charges: Addresses potential maximum loan charges and refunds if applicable law limits are breached.

- Default Conditions: Outlines what constitutes default and the consequences thereof, including late charges and demand for immediate payment.

- Secured Note: Confirms that the loan is secured by personal property as described in a separate security agreement.

Common use cases

This form is used when a borrower seeks a loan that is secured by personal property, such as vehicles, equipment, or other valuable items. It is ideal for situations where the lender wants a guarantee that the loan will be recouped in case of non-payment. This form is appropriate for both personal and business loans where collateral is necessary to facilitate the lending process.

Who this form is for

- Individuals borrowing money for personal use who want to secure the loan with personal property.

- Small business owners seeking a loan to finance operations or purchases while offering personal property as collateral.

- Lenders who require a formal agreement outlining the borrowing terms and security arrangements.

- Anyone needing to establish clear payment obligations and conditions to protect their investment.

Instructions for completing this form

- Identify the borrower and lender, ensuring all names and addresses are recorded accurately.

- Specify the principal amount to be borrowed and the applied interest rate.

- Fill in the payment schedule, including the start date and monthly payment amounts.

- Indicate any rights to prepay the loan and conditions under which this applies.

- Review the terms regarding default and late payments, and ensure understanding before signing.

- Sign and date the form in the presence of a witness if necessary.

Does this document require notarization?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to accurately specify collateral leading to miscommunication about what is secured.

- Overlooking the importance of the interest rate, which can lead to future disputes.

- Not understanding the repayment schedule may result in accidental default.

- Ignoring state-specific requirements regarding loan charges that could impact the legality of the agreement.

Why use this form online

- Convenience of accessing and downloading the form at any time.

- Editability allows customization to fit specific loan details.

- Reliability, knowing the templates are drafted by licensed attorneys to ensure legal validity.

- Time savings compared to drafting a promissory note from scratch.

Looking for another form?

Form popularity

FAQ

To fill in a promissory note, start by clearly stating the names of the lender and borrower at the top. Next, include the amount being borrowed, the interest rate, and the repayment schedule. For a Minnesota Installments Fixed Rate Promissory Note Secured by Personal Property, ensure you specify the collateral and any terms related to default. Finally, both parties should sign and date the document to make it legally binding.

Yes, a promissory note can be secured by real property. This type of arrangement often involves a mortgage or deed of trust, which provides the lender with a claim on the property if the borrower defaults. While a Minnesota Installments Fixed Rate Promissory Note Secured by Personal Property typically involves personal property, securing it with real estate also offers solid protection for the lender.

Not all promissory notes need to be secured. A promissory note can be unsecured, meaning it does not require collateral. However, using a Minnesota Installments Fixed Rate Promissory Note Secured by Personal Property can provide more security for the lender, as it involves personal property as collateral. This can lead to better terms for both parties.

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Use our promissory note if you prefer a standard basic contract. Do I have to charge the Borrower interest? No, the Lender can choose whether or not to charge interest.However, there may be tax consequences to the Lender or Borrower if interest is charged but it is not a reasonable rate.

A promissory note or promissory letter is a legal instrument that details a contractual agreement between two parties. When the parties are in agreement and sign the promissory note, it becomes a legally binding instrument that obligates both parties to perform according to their agreement.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.