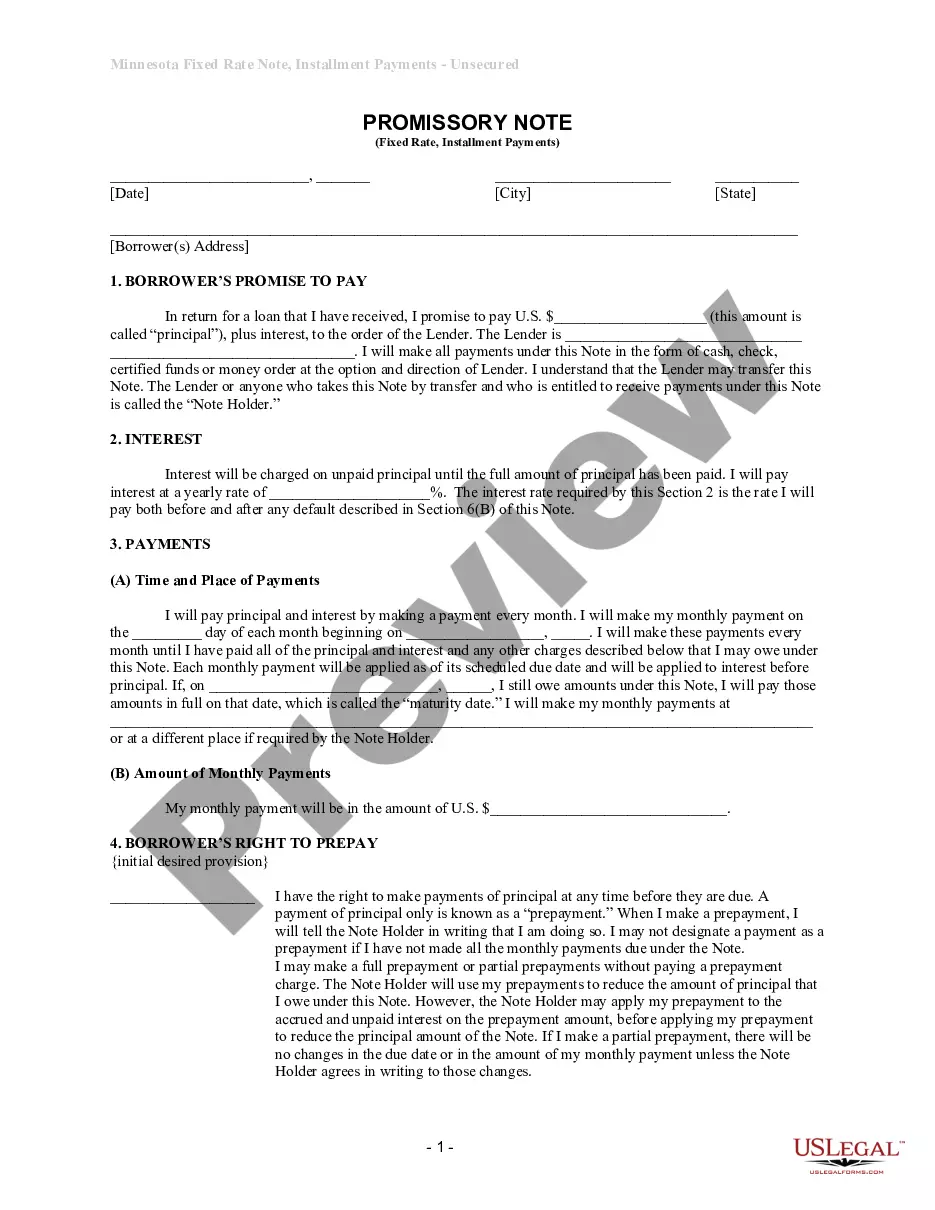

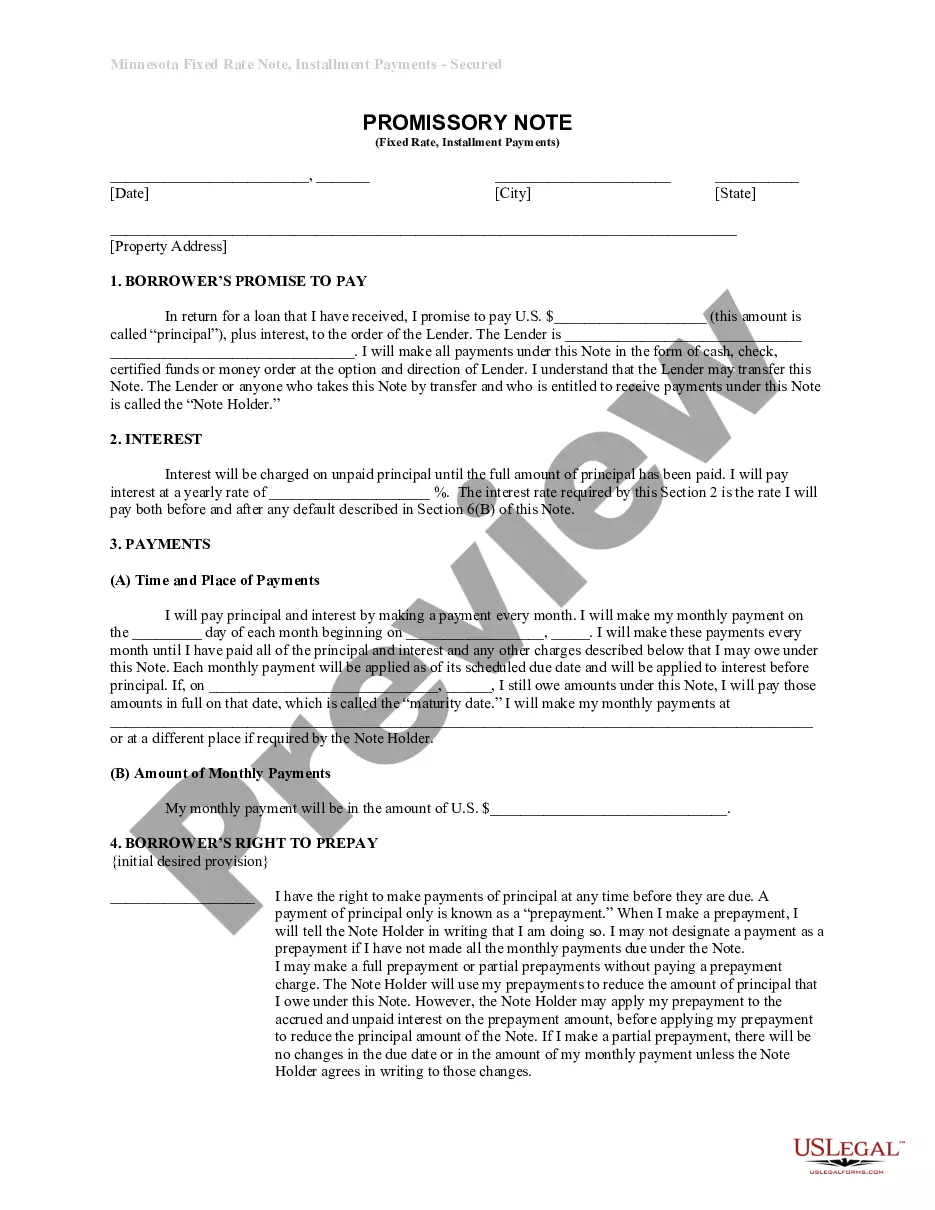

Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate

Understanding this form

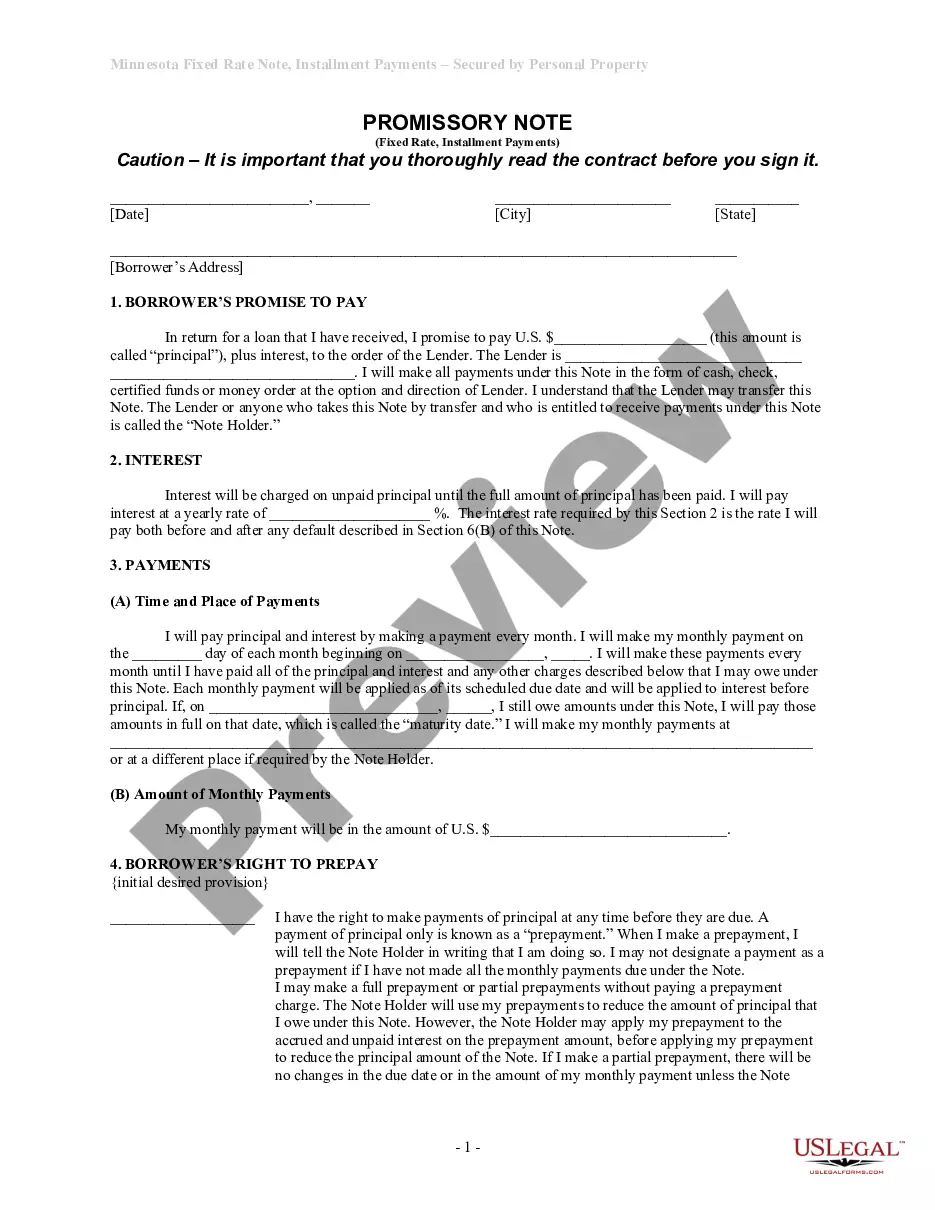

The Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines a borrower's agreement to repay a loan in fixed monthly installments. Unlike secured loans, this note does not require collateral, making it suitable for personal or informal loans. This promissory note specifies the amount borrowed, interest rate, payment schedule, and other essential terms, ensuring clarity and legality in the borrowing process.

Main sections of this form

- Borrower's promise to pay the specified principal plus interest.

- Interest rate details and how it applies to unpaid principal.

- Payment schedule indicating when and where to make payments.

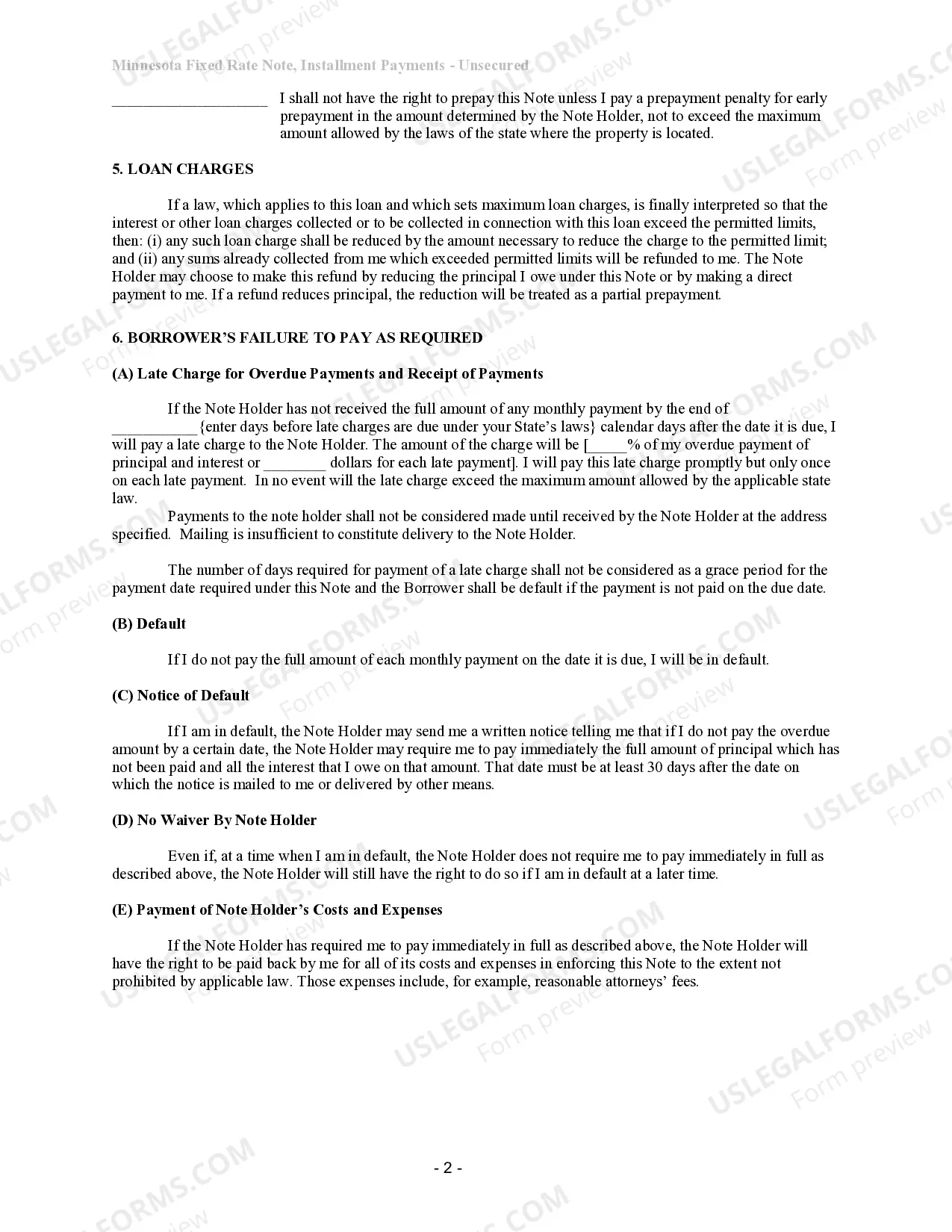

- Provisions for late payments and associated charges.

- Rights regarding prepayment options, including any penalties if applicable.

- Notices and obligations of all parties involved in the agreement.

Common use cases

You should use the Minnesota Unsecured Installment Payment Promissory Note when you intend to borrow or lend money without securing the loan with collateral. This is ideal for personal loans between individuals, small business financing, or informal arrangements where both parties agree on repayment terms. It ensures that both the borrower and lender have a clear understanding of their rights and obligations.

Who can use this document

- Lenders who wish to document the terms of a personal loan.

- Borrowers looking for clarity on repayment terms.

- Individuals engaging in informal borrowing or lending without collateral.

How to prepare this document

- Enter the date and location where the agreement is made.

- Fill in the names and addresses of the borrower(s) and lender.

- Specify the total amount borrowed (principal) and the interest rate.

- Outline the payment schedule, including the date of the first payment and subsequent monthly due dates.

- Sign and date the document to finalize the agreement between the parties.

Does this form need to be notarized?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Not specifying the interest rate clearly, leading to confusion on payments.

- Failing to include the exact payment schedule and maturity date.

- Not informing the lender in writing when making prepayments.

- Leaving out signatures or failing to date the document.

Benefits of using this form online

- Convenience of accessing the form anytime from any location.

- Editability to customize the document to fit specific agreements.

- Instant download for immediate use.

- Reliability in having attorney-drafted content ensuring legality.

Looking for another form?

Form popularity

FAQ

In Minnesota, a promissory note does not necessarily need to be notarized to be legally enforceable. However, notarization can provide an extra layer of validation and security for both parties involved. To ensure clarity and legality, it's wise to follow best practices when drafting a Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate. Utilizing resources from US Legal Forms can help simplify the process and ensure all legal requirements are met.

Obtaining a Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate is straightforward. You can create one by utilizing templates available on platforms such as US Legal Forms, which provide reliable and legally compliant forms. Make sure to customize the note to fit your specific terms and conditions. This ensures that the agreement meets your needs while adhering to Minnesota laws.

To collect on a Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate, you need to first review the terms outlined in the note. If the borrower fails to make payments, you can send a formal notice requesting payment. If they still do not respond, you may consider legal action to enforce the terms of the note. Utilizing a platform like US Legal Forms can help you draft the necessary documents to initiate this process.

Yes, a promissory note can be unsecured, meaning it is not backed by collateral. This type of note relies on the borrower's promise to repay, making it crucial to define the terms clearly. When drafting a Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate, it is important to outline the consequences of default to protect the lender's interests. Uslegalforms offers user-friendly templates that can help you create an effective unsecured promissory note tailored to your situation.

A promissory note does not necessarily need to include an interest rate. In the context of a Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate, you can choose to create a note with or without interest. However, including an interest rate can incentivize timely payments and can provide a clearer agreement between parties. Utilizing a reliable platform like uslegalforms can help you draft a comprehensive promissory note that meets your specific needs.

Enforcing an unsecured promissory note involves several steps, including sending reminders for payment and potentially taking legal action if necessary. If the borrower fails to meet their obligations, the lender may file a lawsuit to recover the owed amount. Using a Minnesota Unsecured Installment Payment Promissory Note for Fixed Rate can provide clarity on the terms, making enforcement easier. Platforms like USLegalForms guide you in creating an enforceable document that protects your interests.

Although this case relates to state securities law claims, in applying the Reves test and holding that the Notes are not securities, the court has ruled squarely in favor of the long-held view in the loan industry that loans are not securities.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Lenders, whether banks or individual sellers, typically require the persons who are borrowing money in order to finance the purchase of real estate to sign a "note" and a "security instrument." A note is a written, unconditional promise to pay a certain sum of money at a certain time or within a certain period of time.