Minnesota Notice of Satisfaction of Lien on Personal Property - For Filing with Sec. Of State and County Recorder

Description

How to fill out Minnesota Notice Of Satisfaction Of Lien On Personal Property - For Filing With Sec. Of State And County Recorder?

Obtain any type from 85,000 legal records including Minnesota Notice of Satisfaction of Lien on Personal Property - For Submission with Sec. Of State and County Recorder online with US Legal Forms. Every template is crafted and refreshed by state-certified attorneys.

If you possess a subscription, Log In. After reaching the form’s page, hit the Download button and navigate to My documents to access it.

If you haven't subscribed yet, follow the instructions outlined below: Check the state-specific criteria for the Minnesota Notice of Satisfaction of Lien on Personal Property - For Submission with Sec. Of State and County Recorder you wish to utilize. Browse through the description and preview the template. When you’re assured the template meets your needs, simply click Buy Now. Choose a subscription plan that fits your financial plan. Create a personal account. Make a payment in one of two suitable methods: by card or through PayPal. Select a format to download the document in; two options are available (PDF or Word). Download the file to the My documents tab. Once your reusable template is downloaded, print it out or save it to your device.

- With US Legal Forms, you’ll consistently have immediate access to the appropriate downloadable template.

- The service grants you access to documents and categorizes them to ease your search.

- Utilize US Legal Forms to acquire your Minnesota Notice of Satisfaction of Lien on Personal Property - For Submission with Sec. Of State and County Recorder swiftly and effortlessly.

Form popularity

FAQ

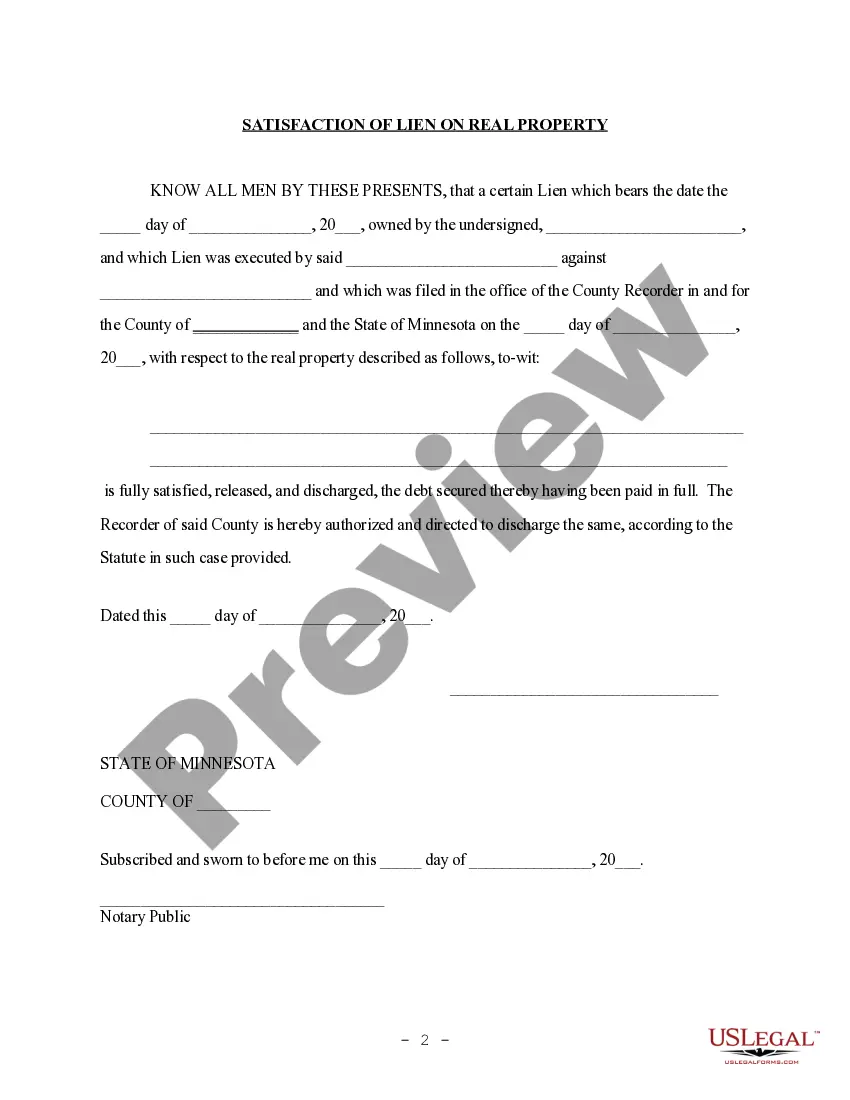

The notice of intent to lien form in Minnesota is a preliminary document that notifies a property owner of your intention to file a lien against their property. This form is an important step in the lien process, as it provides the property owner a chance to address the debt before the lien is formally filed. Utilizing the Minnesota Notice of Satisfaction of Lien on Personal Property - For Filing with Sec. Of State and County Recorder can help streamline this process. It lays the groundwork for your claim and encourages resolution.

A notice of property lien is a legal document that establishes a creditor's claim against a debtor's property. When filed, it informs the public that there is a financial obligation associated with that property. In Minnesota, the Minnesota Notice of Satisfaction of Lien on Personal Property - For Filing with Sec. Of State and County Recorder serves as an important tool for creditors. It helps secure your right to payment by formally recording your claim.

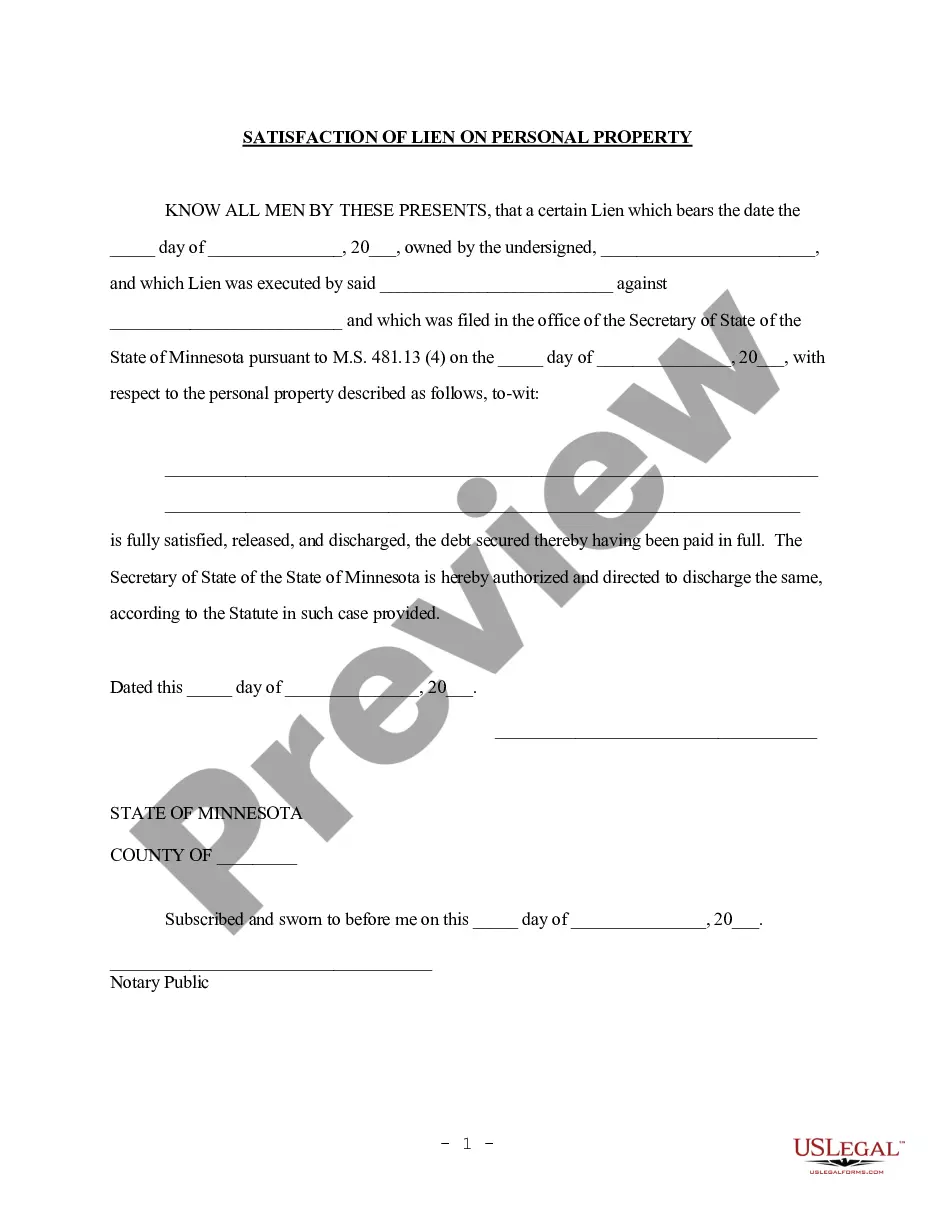

Filing a lien on property in Minnesota involves a few key steps. Begin by gathering the required information about the debtor and the amount owed. Next, prepare the lien statement and submit it to the Secretary of State and the County Recorder. By using the Minnesota Notice of Satisfaction of Lien on Personal Property - For Filing with Sec. Of State and County Recorder, you can ensure that you comply with all necessary legal requirements and protect your interests.

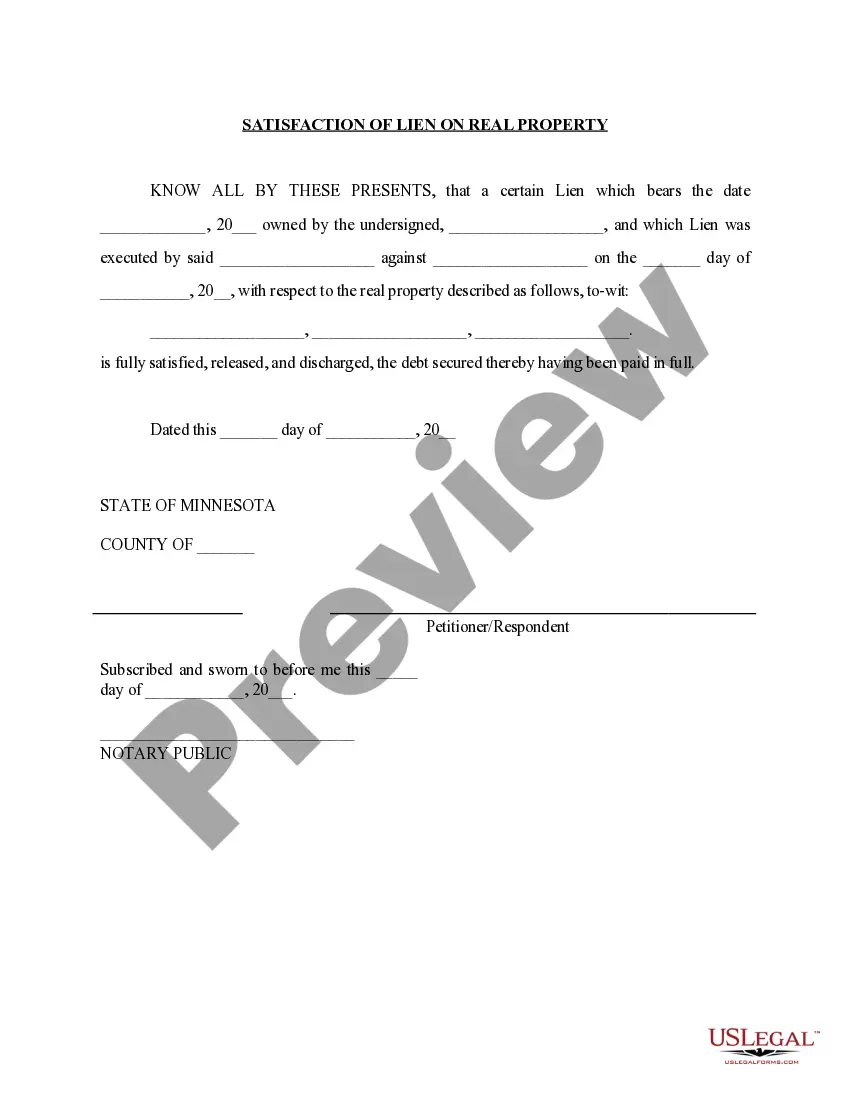

To record a release of lien, you must first obtain a release document from the lien holder stating that the debt has been satisfied. After preparing this document, you should file it with the Secretary of State and the County Recorder where the original lien was filed. This step is crucial to clear the public record and protect your property. Using the Minnesota Notice of Satisfaction of Lien on Personal Property - For Filing with Sec. Of State and County Recorder can simplify this process.

To put a lien on someone's property in Minnesota, you must have a valid debt and follow the legal process to file a lien. Typically, you need to prepare a lien statement that includes necessary details such as the debtor's information and the amount owed. Once completed, you can file the lien with the Secretary of State and the County Recorder. Utilizing the Minnesota Notice of Satisfaction of Lien on Personal Property - For Filing with Sec. Of State and County Recorder ensures that you follow the correct procedures.

You can obtain a lien release form through various sources, including legal offices and online platforms. Specifically, for the Minnesota Notice of Satisfaction of Lien on Personal Property - For Filing with Sec. Of State and County Recorder, you can visit USLegalForms. Our platform provides easy access to the necessary forms, ensuring you meet all state requirements for filing. This helps streamline the process and promotes a smooth resolution of your lien.

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

If a lien is filed against your property (in the form of a lien statement), it must be filed with the county recorder and a copy delivered to you, the property owner, either personally or by certified mail, within 120 days after the last material or labor is furnished for the job.

In Minnesota, all mechanics liens must be filed within 120 days from the claimant's last day providing materials or labor. In Minnesota, mechanics liens expire 1 year from the date of the lien claimant's last furnishing of labor or materials to the project.

If a lien is filed against your property (in the form of a lien statement), it must be filed with the county recorder and a copy delivered to you, the property owner, either personally or by certified mail, within 120 days after the last material or labor is furnished for the job.