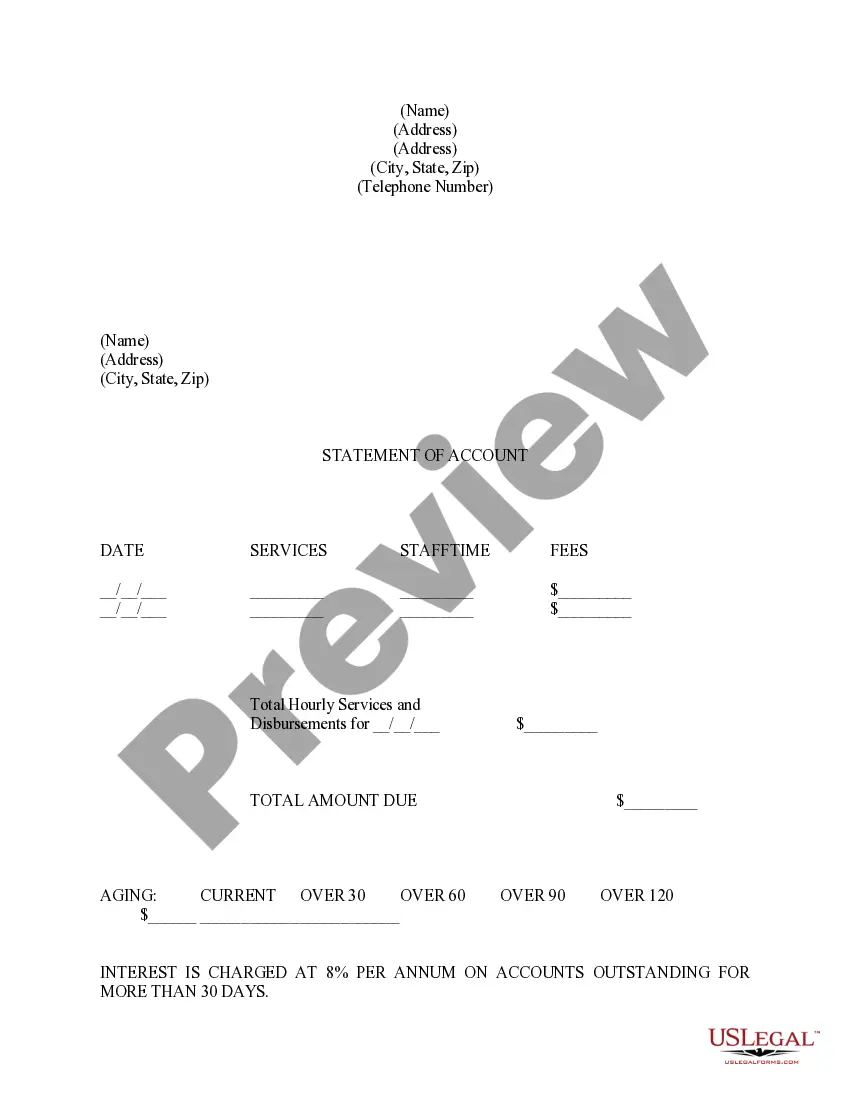

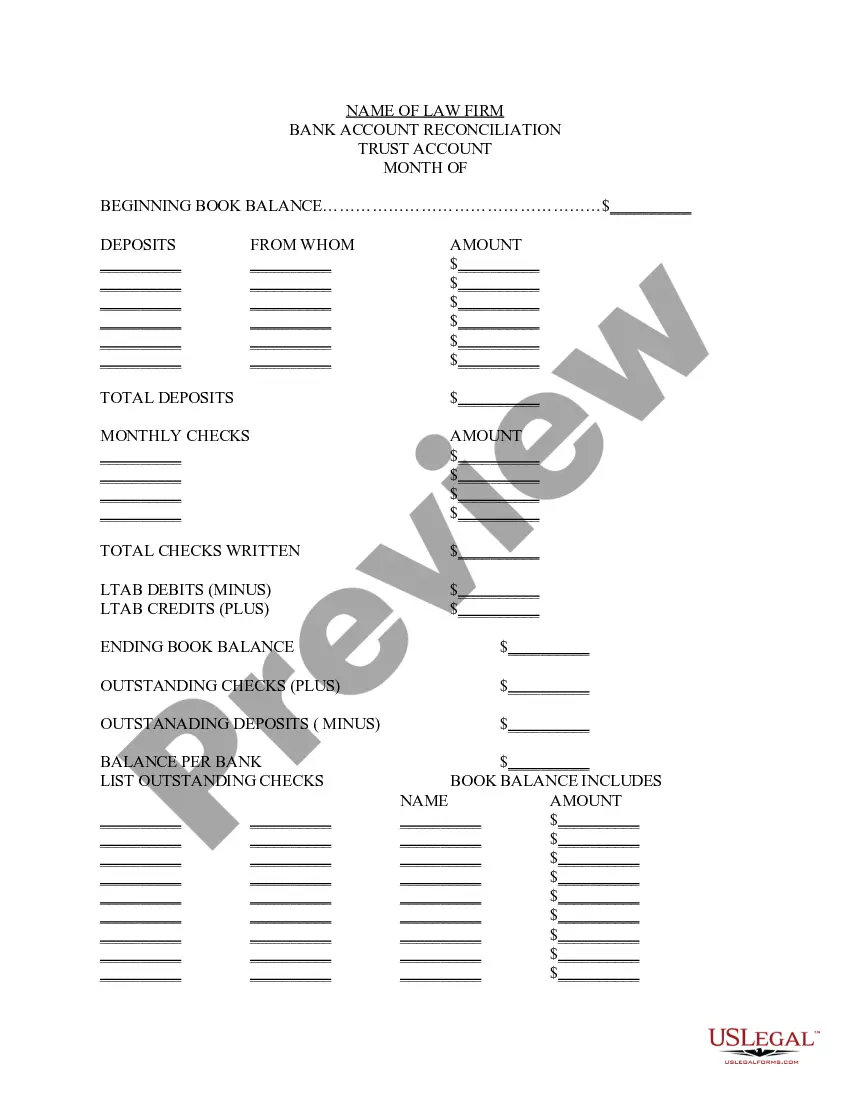

Minnesota Monthly reconciliation of trust account from bank statement - template

Description

How to fill out Minnesota Monthly Reconciliation Of Trust Account From Bank Statement - Template?

Obtain any template from 85,000 legal documents including Minnesota Monthly reconciliation of trust account from bank statement - template online with US Legal Forms. Each template is crafted and refreshed by state-authorized lawyers.

If you already possess a subscription, Log In. Once you’re on the form’s page, click the Download button and navigate to My documents to gain access to it.

If you haven’t subscribed yet, follow the instructions below: Check the state-specific prerequisites for the Minnesota Monthly reconciliation of trust account from bank statement - template you wish to utilize. Review the description and preview the sample. Once you are confident the sample meets your needs, simply click Buy Now. Select a subscription plan that fits your budget. Create a personal account. Pay using one of two suitable methods: by credit card or via PayPal. Choose a format to download the document in; two options are available (PDF or Word). Download the document to the My documents tab. When your reusable form is downloaded, print it or save it to your device.

- With US Legal Forms, you will consistently have immediate access to the appropriate downloadable template.

- The service grants you access to forms and categorizes them to enhance your search experience.

- Utilize US Legal Forms to obtain your Minnesota Monthly reconciliation of trust account from bank statement - template quickly and efficiently.

Form popularity

FAQ

To prepare a monthly bank reconciliation statement, begin by collecting your bank statement and your accounting records. Check off transactions that appear in both sets of records, and make a note of any discrepancies. Adjust your books for any errors or outstanding transactions, ensuring your records match the bank statement. A Minnesota Monthly reconciliation of trust account from bank statement - template is a valuable tool to assist in this preparation.

The steps to prepare a bank reconciliation statement include first gathering your bank statement and your internal financial records. Next, compare each transaction for consistency, noting any differences. Adjust your records for any errors discovered, and ensure all checks and deposits are accounted for. Using a Minnesota Monthly reconciliation of trust account from bank statement - template can provide a structured approach to this process.

A monthly reconciliation statement is a document that compares your trust account's records with your bank's records. It helps identify any differences in transaction amounts, outstanding checks, and deposits. By regularly preparing this statement, you maintain accurate financial records and ensure compliance with legal requirements. A Minnesota Monthly reconciliation of trust account from bank statement - template can help streamline this task.

To prepare a monthly bank reconciliation, start by gathering your bank statements and your accounting records. Compare each transaction recorded in your trust account against the bank statement. Identify any discrepancies, such as outstanding checks or deposits in transit. Utilizing a Minnesota Monthly reconciliation of trust account from bank statement - template can simplify this process and ensure accuracy.

A trust reconciliation statement is a document that outlines the process and results of reconciling a trust account. It highlights the account balance, lists any discrepancies, and confirms that all transactions align with the bank statement. By using a Minnesota monthly reconciliation of trust account from bank statement - template, you can create this statement efficiently and maintain compliance with regulatory requirements.

The purpose of a reconciliation statement is to provide a clear picture of the trust account's financial status. It helps identify any discrepancies between the bank records and your internal records. A Minnesota monthly reconciliation of trust account from bank statement - template can assist in creating this statement, ensuring clarity and accuracy in your financial reporting.

When reconciling a trust account, it is crucial to maintain accurate records of all transactions, including deposits, withdrawals, and fees. You should also keep copies of the bank statements used for reconciliation. Using a Minnesota monthly reconciliation of trust account from bank statement - template helps you organize and retain these records efficiently.

A monthly reconciliation report summarizes the findings of the trust account reconciliation process. It details any discrepancies, the balance of the account, and confirms that all transactions have been accounted for. This report is essential for maintaining compliance and can be easily generated using a Minnesota monthly reconciliation of trust account from bank statement - template.

Trust accounts should ideally be reconciled on a monthly basis. This regularity helps to catch any errors or discrepancies early, ensuring accurate financial management. Utilizing a Minnesota monthly reconciliation of trust account from bank statement - template can simplify this process and help keep your records in order.

A trust reconciliation is the process of comparing a trust account's bank statement with the account's internal records. This ensures that all transactions are accurately recorded and accounted for. By conducting a Minnesota monthly reconciliation of trust account from bank statement - template, you can identify discrepancies and maintain accurate financial records.