Letter regarding trust money

About this form

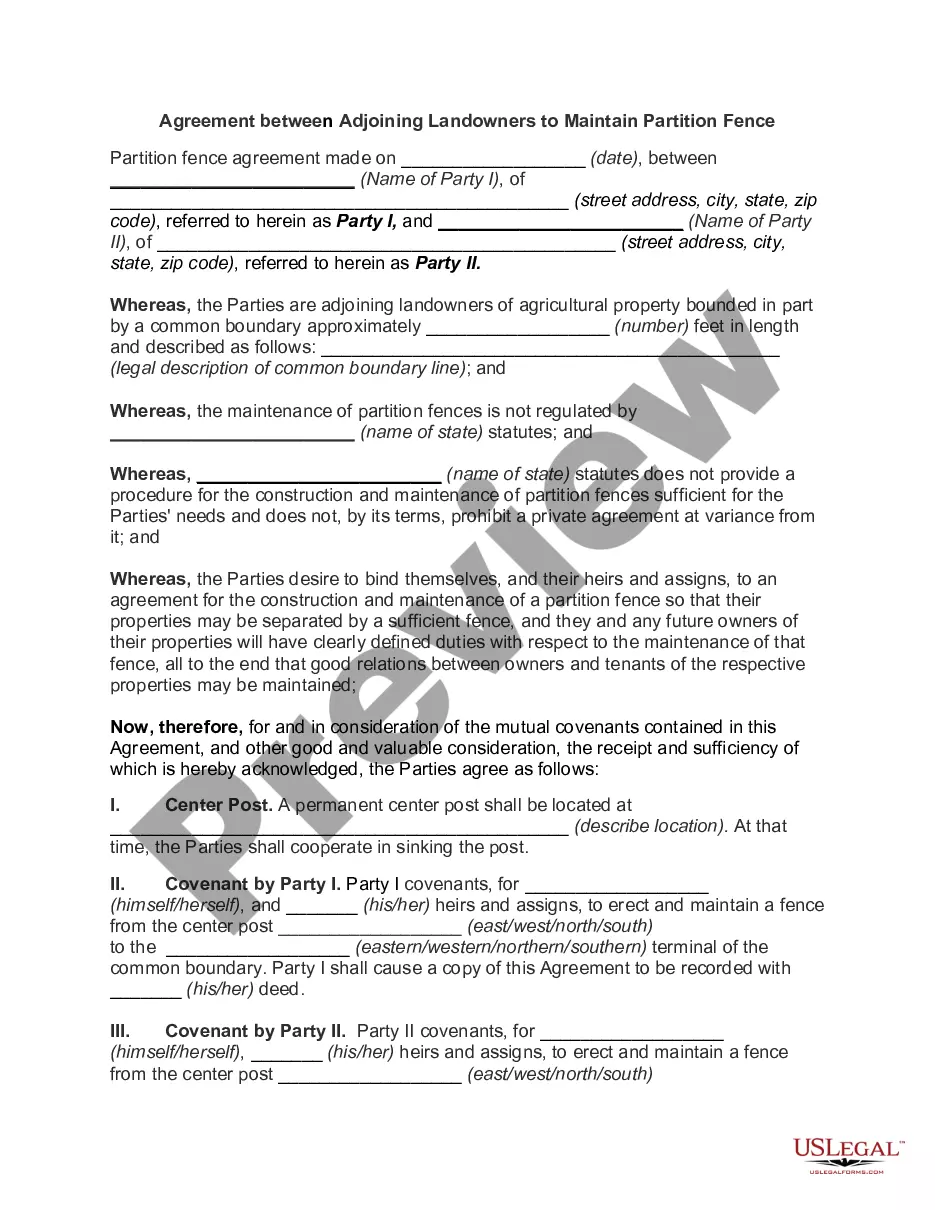

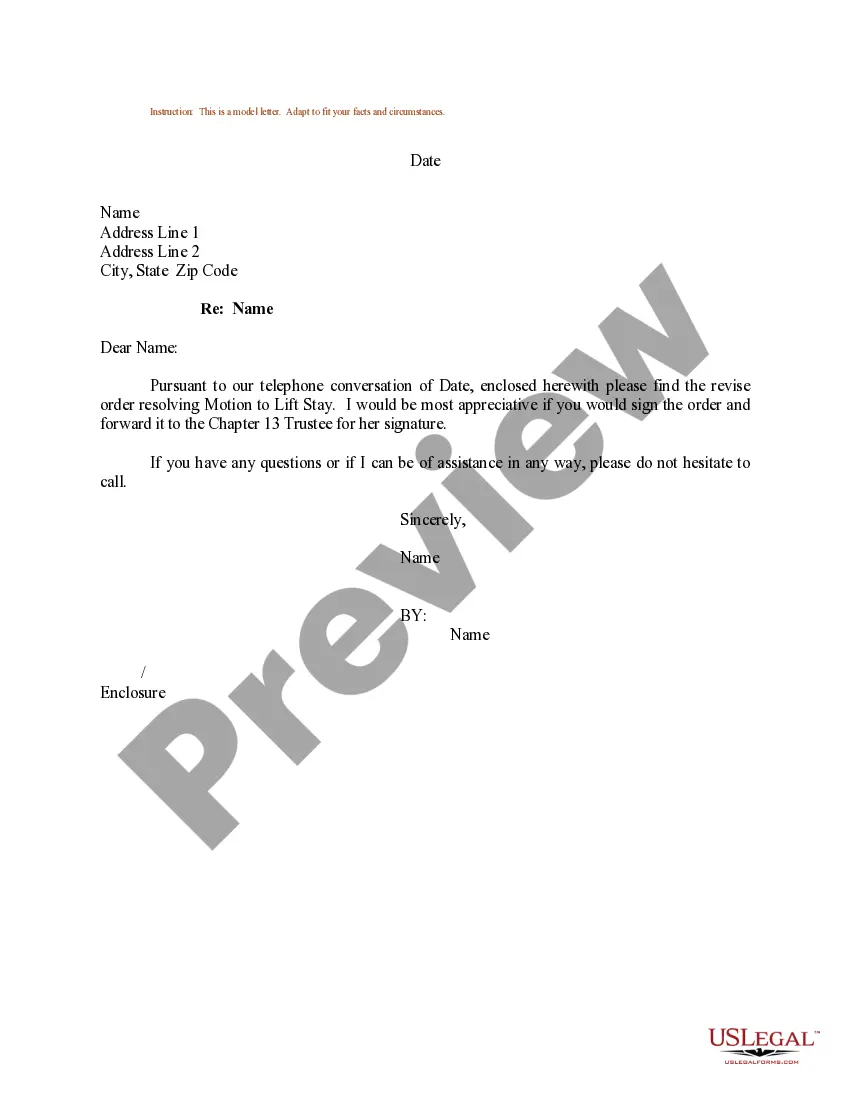

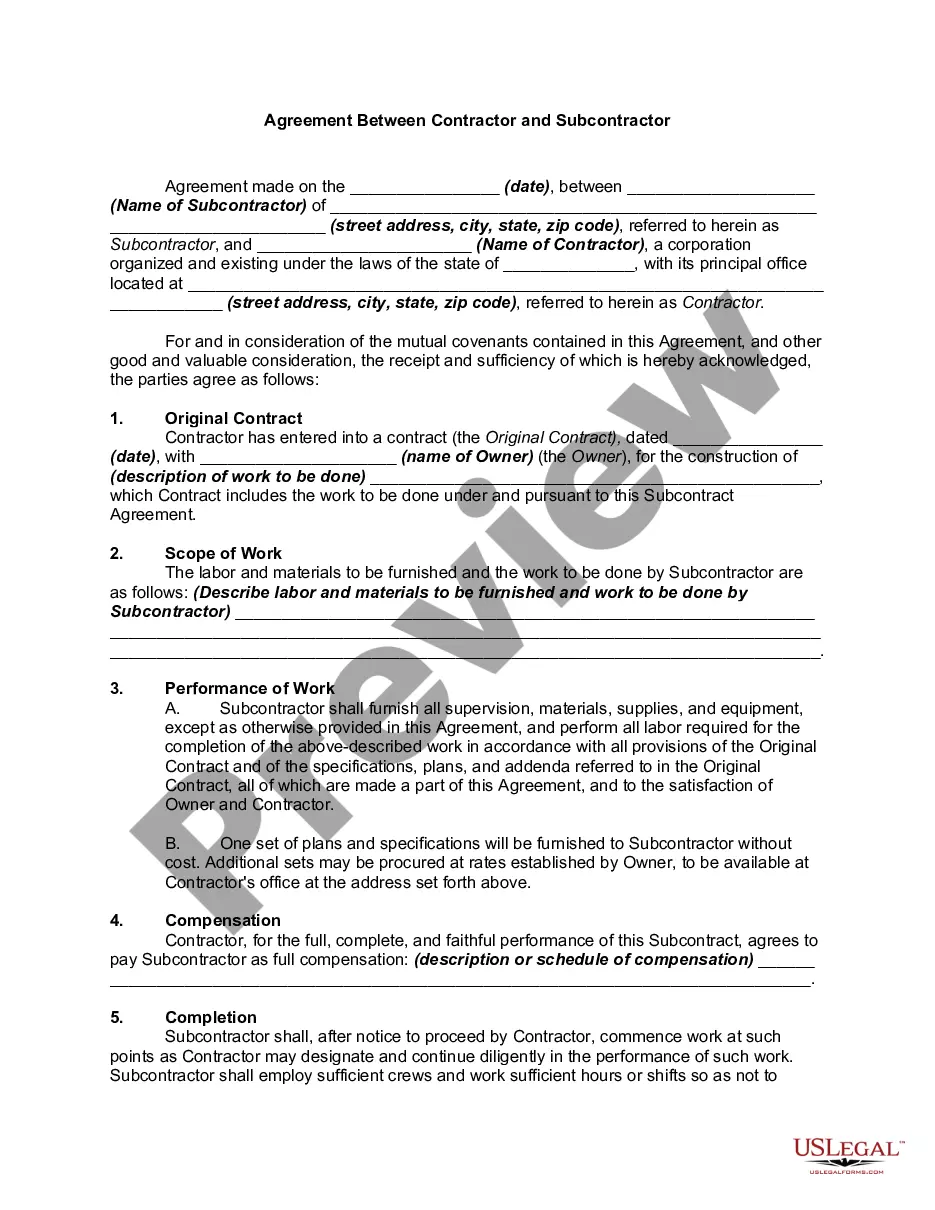

The Letter Regarding Trust Money is a formal notification from a trustee to a trustor, informing them of their rights to withdraw funds from the trust. This document outlines the amount that can be demanded during the year and the conditions under which the withdrawal can occur. Unlike other trust-related forms, this letter specifically addresses the immediate right to demand cash or property from the trust, making it crucial for beneficiaries to understand their options and obligations.

Key parts of this document

- Date of the letter

- Trustor's information and acknowledgment of funds transferred

- Amount beneficiaries may demand from the trust

- Details on how to exercise the right to demand withdrawals

- Trustee's contact information for inquiries

When this form is needed

This form is needed when a trustee wishes to formally inform a trustor of their right to access funds from a trust. It is applicable when a trustor may need cash or property for themselves or for other beneficiaries within a specified timeframe. This letter ensures that the trustor is aware of their rights and the procedures to follow for accessing these funds.

Who can use this document

- Trustees managing a trust who need to inform trustors of their rights.

- Trustors who hold rights to demand funds or property from the trust.

- Beneficiaries seeking clarity on their rights regarding trust fund withdrawals.

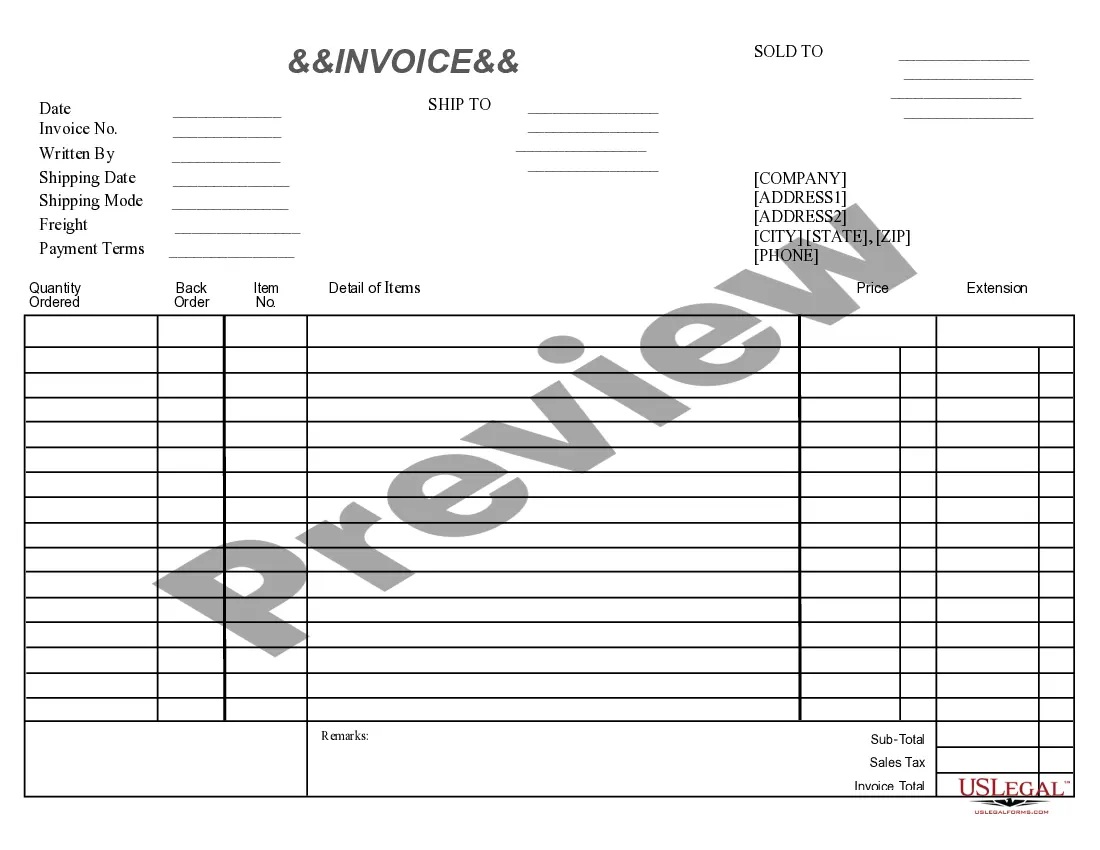

Instructions for completing this form

- Enter the date at the top of the letter.

- Fill in the names of the trustor and trustee, along with the trust's details.

- Specify the amount that beneficiaries are allowed to demand within the year.

- Provide instructions on how to deliver the written notice of demand.

- Ensure both the trustee and trustor sign and date the document for acknowledgment.

Does this document require notarization?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to specify the correct amount beneficiaries can demand.

- Not including the deadline for making demands.

- Omitting signatures from both parties, which can lead to disputes.

Benefits of completing this form online

- Convenient downloadable format allows immediate access to the document.

- Editability makes it simple to customize the letter for your specific needs.

- Reliable templates drafted by licensed attorneys ensure legal compliance and accuracy.

Looking for another form?

Form popularity

FAQ

Letters of trust means the written instrument which describes the trust property, the trustee and the beneficiary.

A letter of wishes is a document drawn up to accompany your will. Unlike a will, it is not legally binding, but it provides guidance for the people dealing with your estate and/or any trusts that are to be set up after you die.

Only the trustee not the beneficiaries can access the trust checking account. They can write checks or make electronic transfers to a beneficiary, and even withdraw cash, though that could make it more difficult to keep track of the trust's finances. (The trustee must keep a record of all the trust's finances.)

Identify yourself as a beneficiary of the irrevocable trust in the body of the letter. State that you are requesting money from the trust, and the reason for the request. Include supporting documentation. For example, if you are requesting money to pay medical bills, enclose copies of the bills.

Reference the name of the irrevocable trust, and the trust account number if applicable. Write a salutation followed by a colon. Identify yourself as a beneficiary of the irrevocable trust in the body of the letter. State that you are requesting money from the trust, and the reason for the request.

A trustee is required by law to notify beneficiaries of a trust upon the settlor's death. The settlor is the person who created the trust. The trustee has 60 days from the settlor's death to provide the notification to the beneficiaries.The name, address, and telephone number of the trustee.

The short answer to the question, Can you withdraw cash from a trust account? is Yes, but there are some caveats.If you have created a revocable trust and have appointed someone else as trustee, you will have to request the cash withdrawal from the person you appointed as the trustee.

What is a Notice of Trust? A notice of trust is a document that must be filed after someone's passing. This document must be filed in the probate court in the county where the deceased person lived at the time of their death.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.