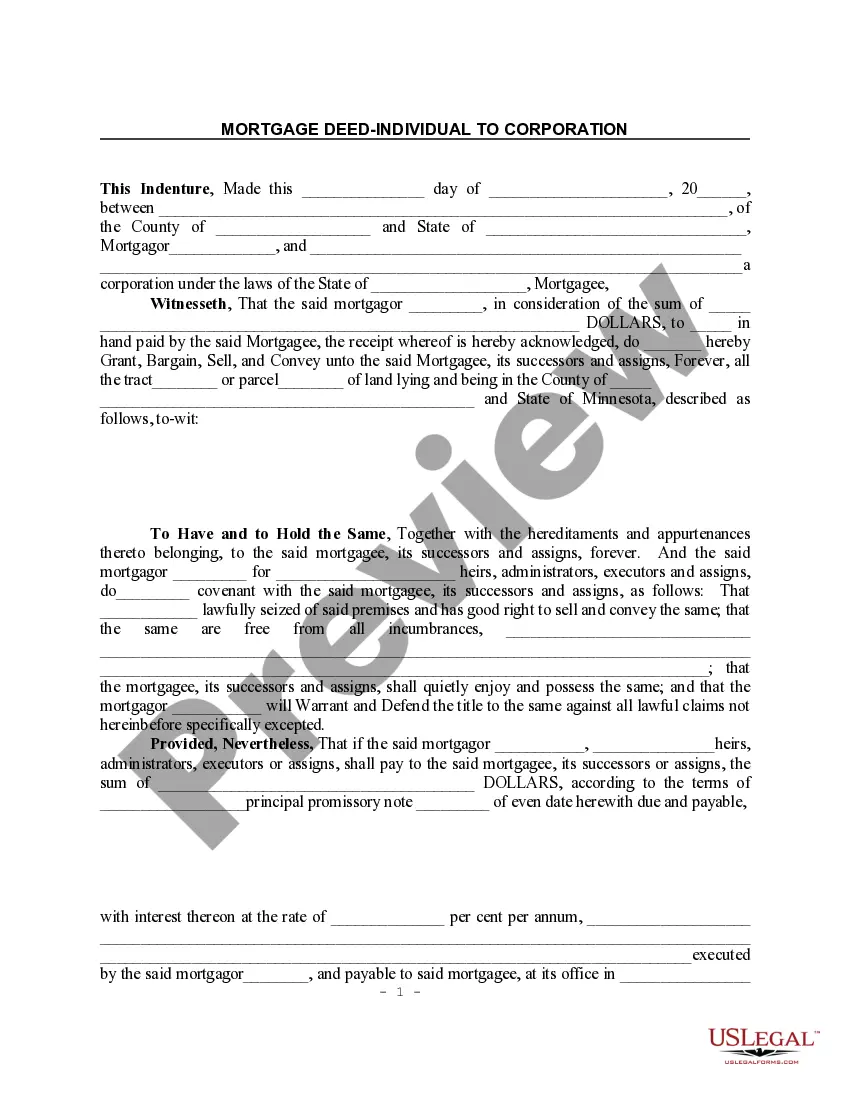

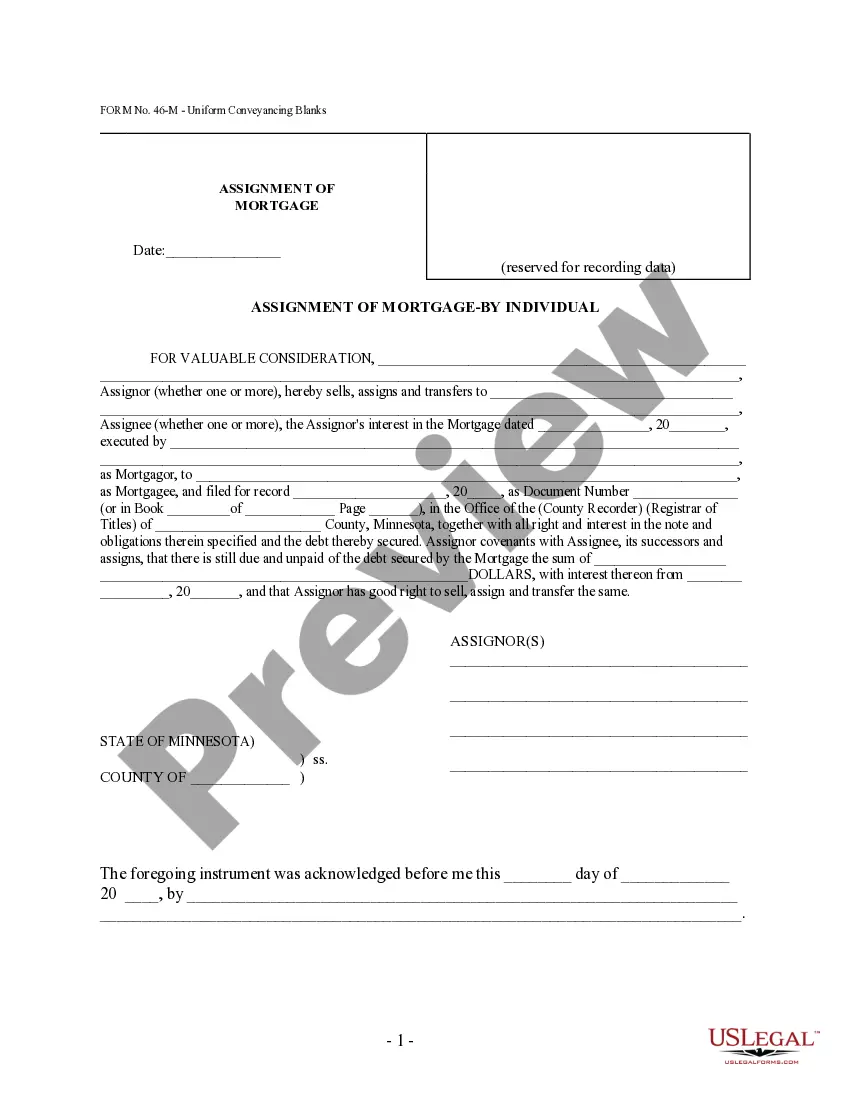

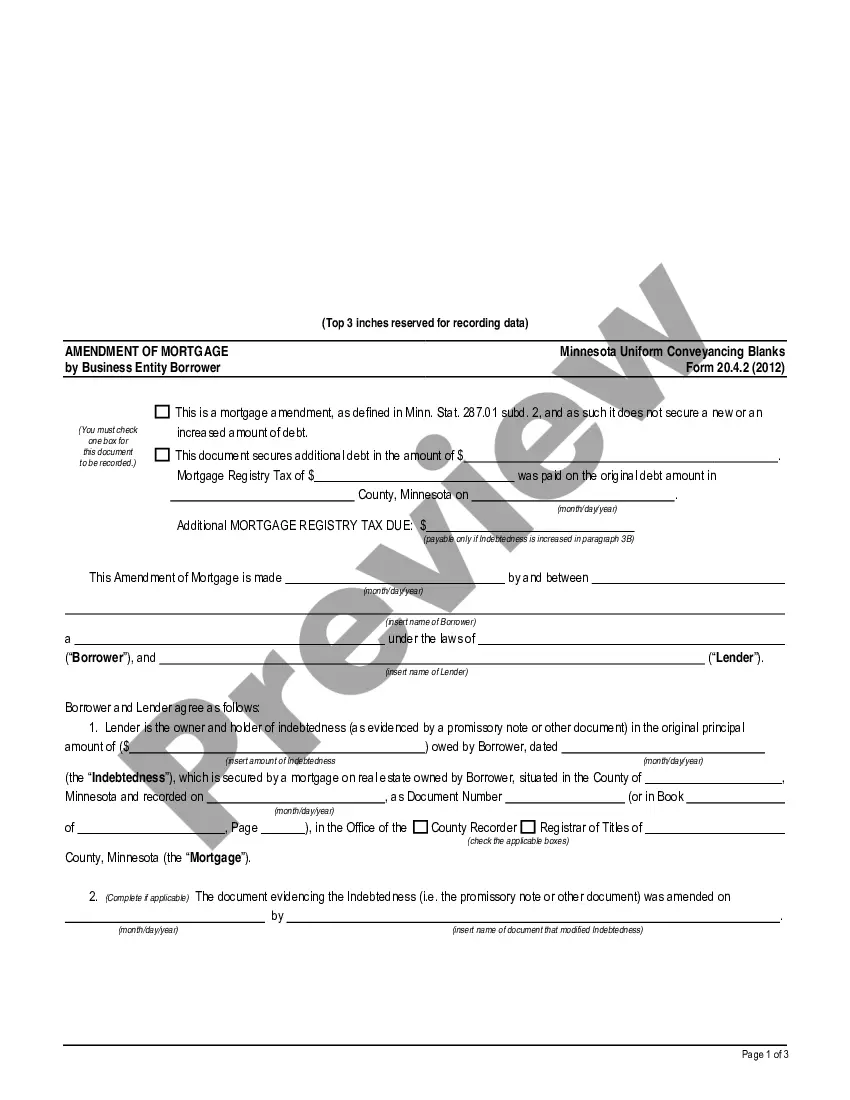

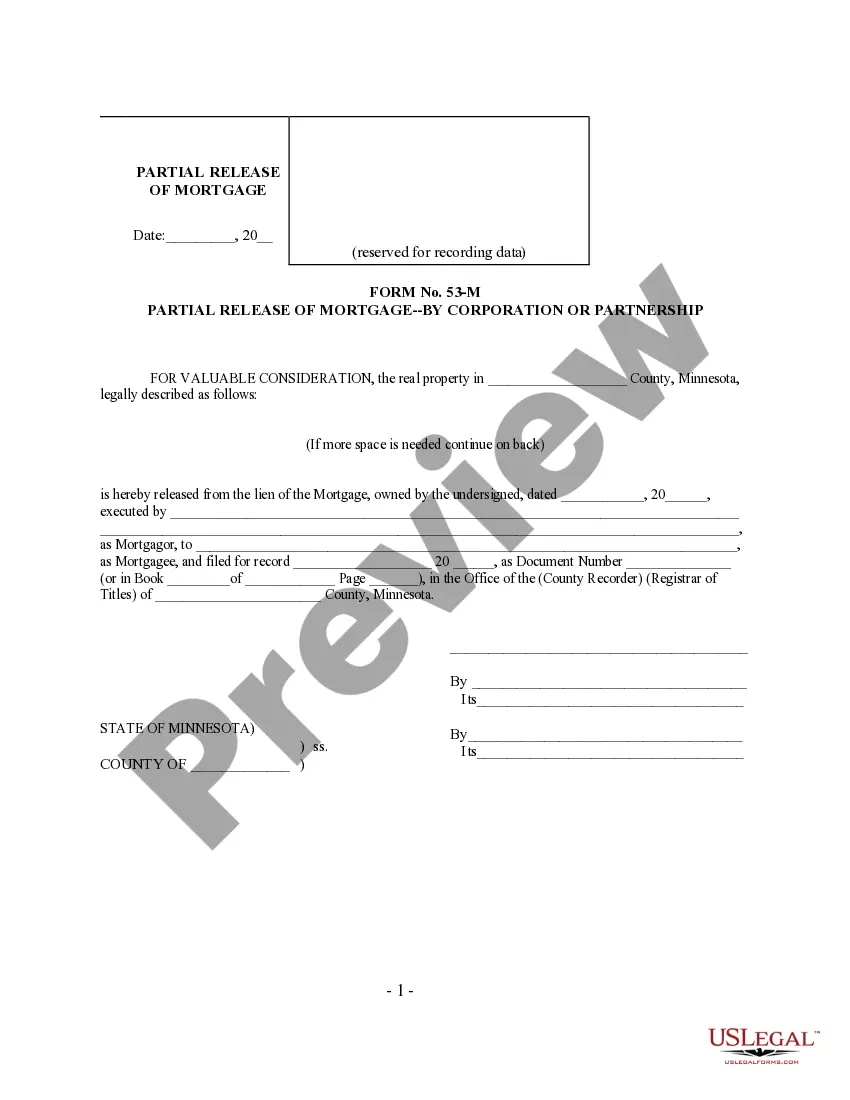

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Assignment of Mortgage by Business Entity - UCBC Form 20.3.2

Description

How to fill out Minnesota Assignment Of Mortgage By Business Entity - UCBC Form 20.3.2?

Access any version from 85,000 lawful documents including Minnesota Assignment of Mortgage by Business Entity - UCBC Form 20.3.2 online via US Legal Forms. Each template is crafted and refreshed by state-licensed attorneys.

If you already possess a subscription, Log In. When you arrive on the form’s page, click the Download button and navigate to My documents to retrieve it.

If you haven’t registered yet, adhere to the guidelines below.

With US Legal Forms, you will consistently have immediate access to the appropriate downloadable template. The platform provides you with forms and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Minnesota Assignment of Mortgage by Business Entity - UCBC Form 20.3.2 swiftly and effortlessly.

- Verify the state-specific prerequisites for the Minnesota Assignment of Mortgage by Business Entity - UCBC Form 20.3.2 you wish to utilize.

- Examine the description and review the example.

- Once you are sure the example meets your needs, simply click Buy Now.

- Select a subscription plan that genuinely fits your budget.

- Establish a personal account.

- Make payment using one of two convenient methods: by credit card or through PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the document to the My documents section.

- After your reusable template is downloaded, print it out or save it to your device.

Form popularity

FAQ

Typically, the assignment of a mortgage is prepared by the mortgage holder or their attorney. They must ensure that the document complies with the requirements outlined in the Minnesota Assignment of Mortgage by Business Entity - UCBC Form 20.3.2. To simplify this process, you can leverage the US Legal Forms platform, which offers ready-to-use forms and professional assistance.

An assignment of a mortgage generally involves several parties, including the original lender, the business entity receiving the assignment, and sometimes a legal representative. Each party plays a crucial role in ensuring that the transaction adheres to the Minnesota Assignment of Mortgage by Business Entity - UCBC Form 20.3.2. Understanding the roles of each participant helps facilitate a smooth assignment process.

A deed of assignment is typically prepared by a legal professional or an authorized representative of the business entity involved. They ensure that all legal requirements are met and that the document conforms to the Minnesota Assignment of Mortgage by Business Entity - UCBC Form 20.3.2. If you're uncertain about the preparation process, consider using the US Legal Forms platform, which provides templates and guidance for creating such documents.

If you use part of your home for business, you may be able to deduct expenses for the business use of your home. These expenses may include mortgage interest, insurance, utilities, repairs, and depreciation.

If your home office is 300 square feet or less and you opt to take the simplified deduction, the IRS gives you a deduction of $5 per square foot of your home that is used for business, up to a maximum of $1,500 for a 300-square-foot space.

If you own a business that is an LLC, you can get an FHA loan. However, the FHA loan cannot be in the name of the LLC.

You can however, take out money from your business account for personal expenses.Sole Proprietor/LLC You can make multiple draws from your account as needed for cash flow, but do not pay your mortgage, or anything else, directly from the business checking account.

An LLC is a business entity with its own assets and income. As such, it can purchase real estate, including a house or business premises, for any reason outlined in its articles of organization.Separation of personal and business finances. Liability protection.

Late to the party, but you can definitely get a 30 yr fixed mortgage with a private lender with the borrowing entity as an LLC . Most rates are mid 5's so you're paying a premium. Most banks are still at a 5 or 10 fix over 20/25 years.

Yes, you can get a conventional mortgage loan under an LLC name, and often for affordable interest rates.As mentioned above, conventional mortgage lenders usually require income documentation. They'll also pull your credit report, so if your credit isn't tip-top, start working on building your credit fast.