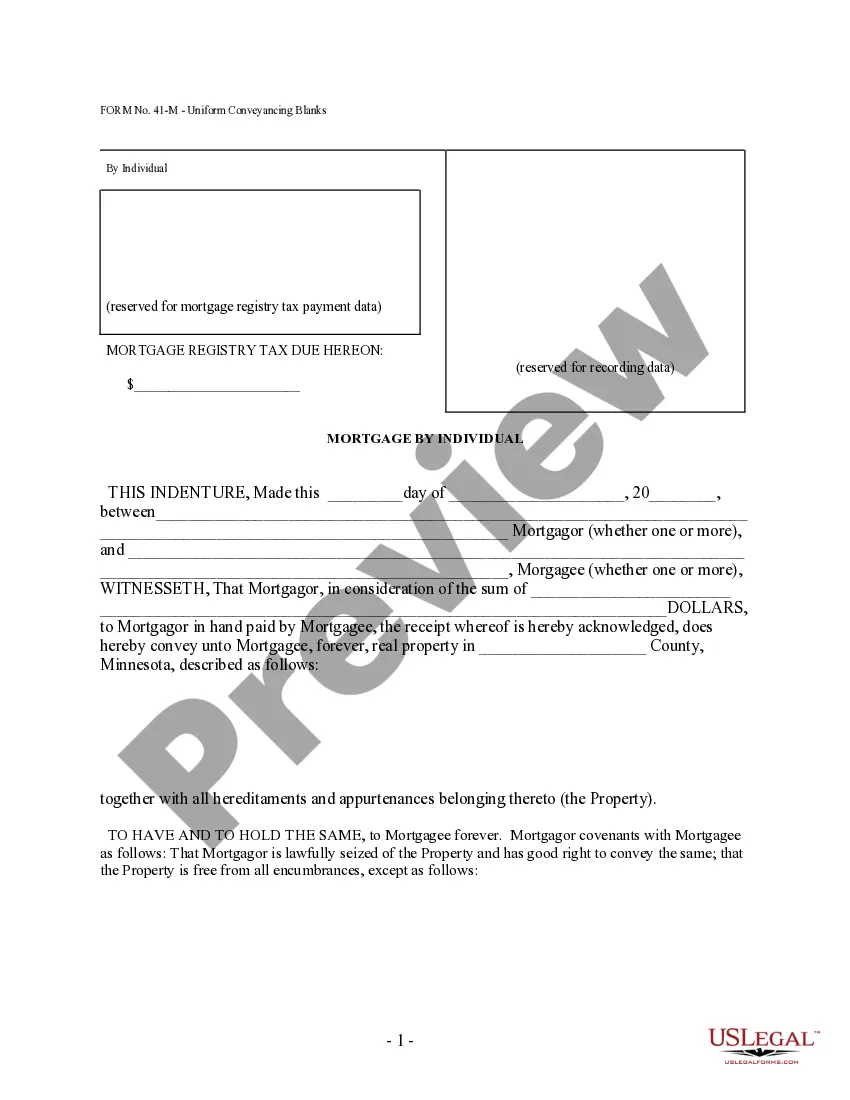

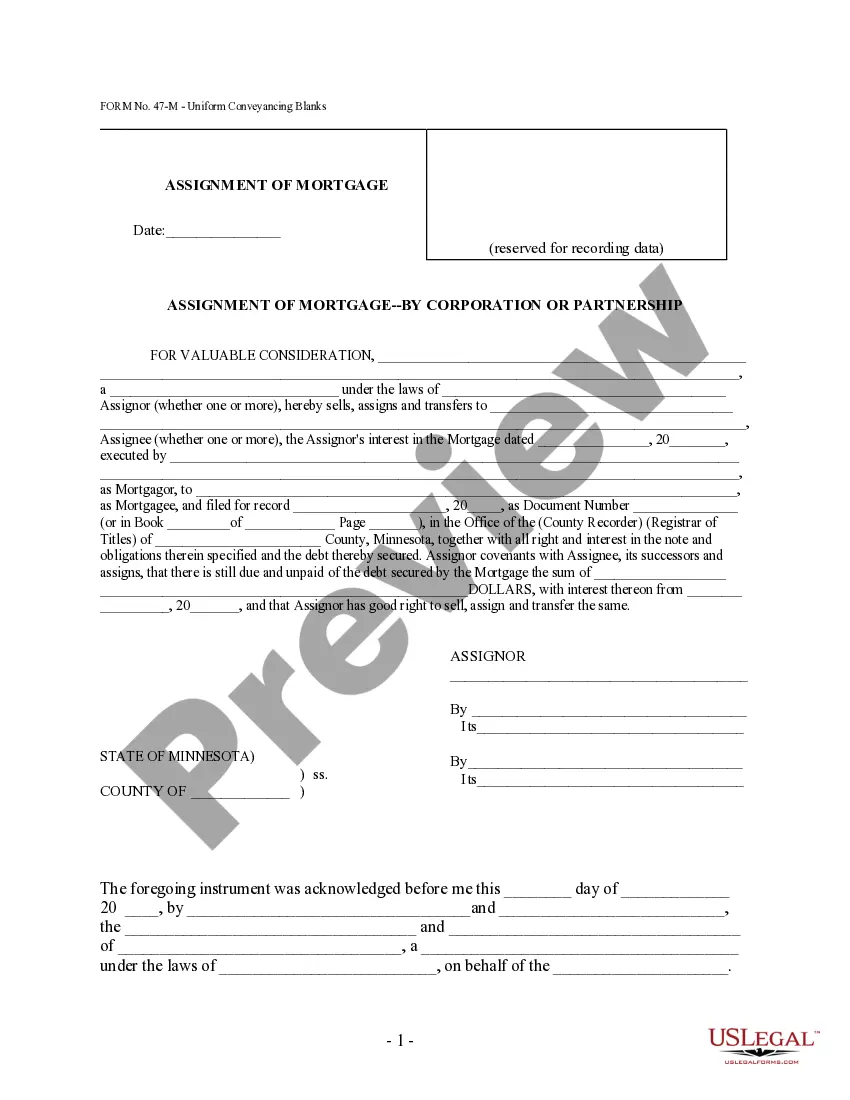

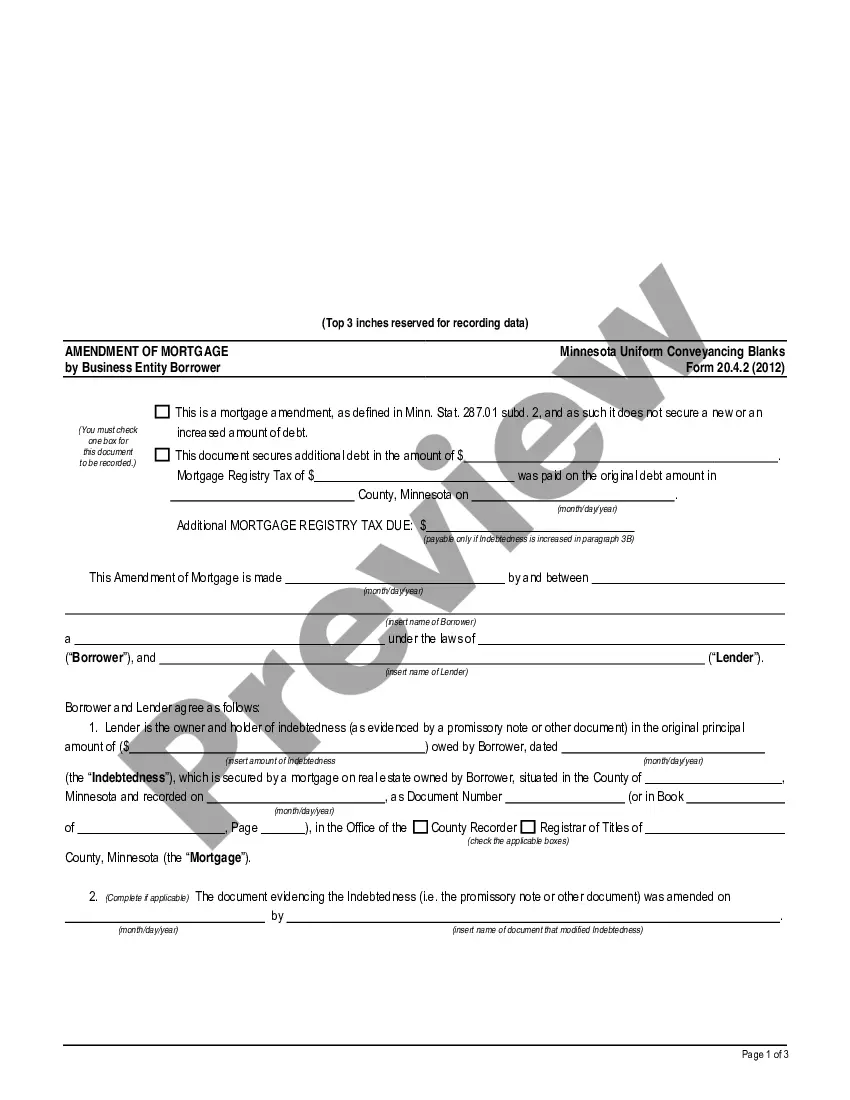

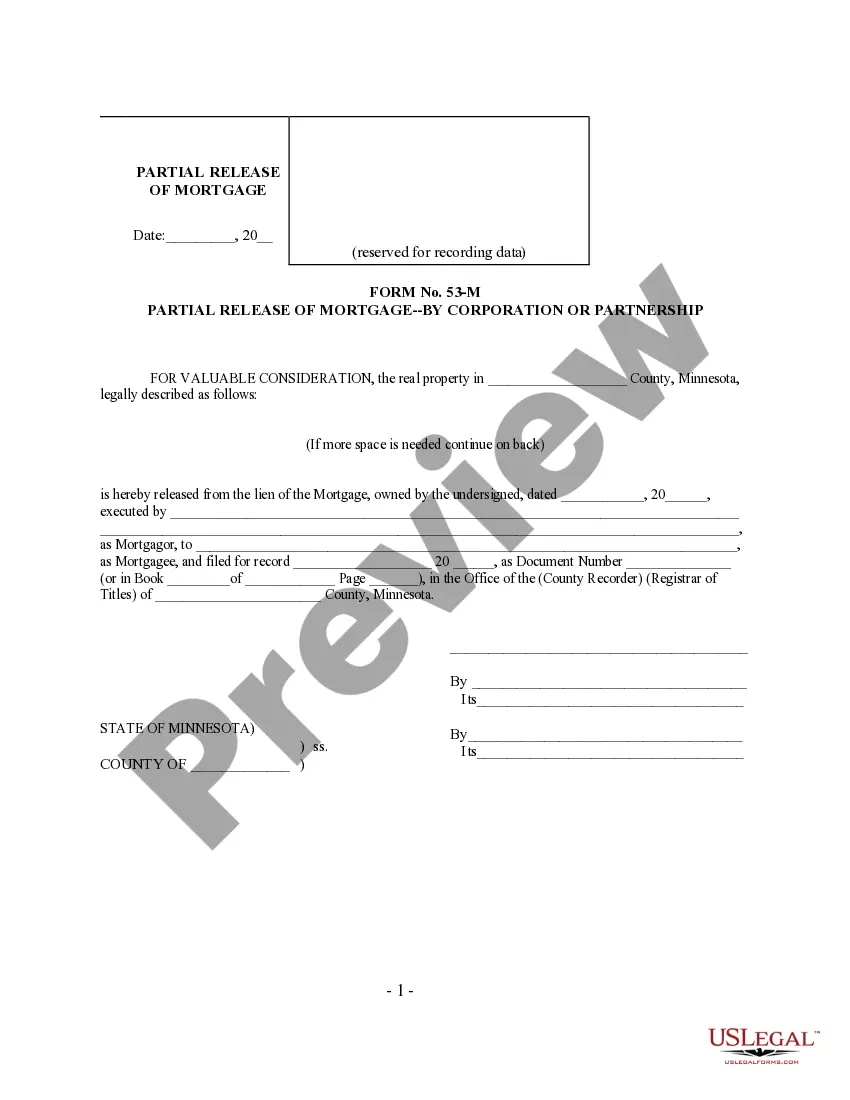

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Mortgage by Business Entity - UCBC Form 20.1.2

Description

How to fill out Minnesota Mortgage By Business Entity - UCBC Form 20.1.2?

Obtain any template from 85,000 legal documents including Minnesota Mortgage by Business Entity - UCBC Form 20.1.2 online with US Legal Forms. Each template is crafted and refreshed by state-licensed attorneys.

If you currently possess a subscription, Log In. Once you reach the form's page, click the Download button and head to My documents to retrieve it.

If you have not subscribed yet, follow the instructions below: Check the state-specific criteria for the Minnesota Mortgage by Business Entity - UCBC Form 20.1.2 you wish to use. Review the description and preview the sample. Once you’re sure the template meets your needs, click on Buy Now. Choose a subscription plan that fits your budget. Create a personal account. Make a payment in one of two convenient ways: by credit card or via PayPal. Select a format to download the document in; two options are available (PDF or Word). Download the document to the My documents tab. Once your reusable template is prepared, print it out or save it to your device.

- With US Legal Forms, you will always have instant access to the appropriate downloadable template.

- The platform will provide you access to forms and categorizes them to ease your search.

- Utilize US Legal Forms to acquire your Minnesota Mortgage by Business Entity - UCBC Form 20.1.2 swiftly and effortlessly.

Form popularity

FAQ

Calculating the mortgage registration tax (MRT) in Minnesota involves determining the total amount of your mortgage and applying the appropriate rate. For the Minnesota Mortgage by Business Entity - UCBC Form 20.1.2, the MRT is calculated at 0.23% of the total mortgage amount. To ensure accuracy and compliance, consider using resources like US Legal Forms, which can guide you through the calculation and filing process effortlessly.

Many states in the U.S. use a deed of trust instead of a traditional mortgage. States like California, Texas, and Virginia primarily utilize deeds of trust, while states like Minnesota, New York, and Florida typically use mortgages, including the Minnesota Mortgage by Business Entity - UCBC Form 20.1.2. Knowing whether your state uses a mortgage or deed of trust can help you make informed decisions about your financing options.

The mortgage registry tax is a state tax applied to mortgages recorded against real estate. It serves as a revenue source for local governments and is calculated based on the mortgage amount. If you're dealing with a Minnesota Mortgage by Business Entity - UCBC Form 20.1.2, it's important to understand how this tax impacts your financial obligations. Using a platform like uslegalforms can simplify the process of ensuring compliance with all applicable tax requirements.

The mortgage registry tax in Minnesota is a tax collected on loans secured by real estate. It is an essential consideration for anyone dealing with a Minnesota Mortgage by Business Entity - UCBC Form 20.1.2. The tax rate is typically a percentage of the total mortgage amount and is due when the mortgage is recorded. Failing to account for this tax can lead to unexpected costs during the mortgage process.

Completing a quit claim deed in Minnesota requires you to gather essential information, such as the names of the parties and the legal description of the property. Fill in each section carefully, ensuring all details are accurate. Finally, sign the document before a notary public to make it legally binding. Using the Minnesota Mortgage by Business Entity - UCBC Form 20.1.2 can enhance your efficiency, as it lays out the necessary steps clearly.

Filling out a Minnesota quit claim deed involves several key steps. Start by entering the names of the current property owner and the person receiving the property. Make sure to include the property's legal description to avoid any confusion. For a seamless experience, consider utilizing the Minnesota Mortgage by Business Entity - UCBC Form 20.1.2, which offers structured instructions and essential fields for accurate completion.

To properly fill out a quitclaim deed, begin by identifying the parties involved, including the grantor and grantee. Clearly describe the property being transferred, including its legal description. Next, sign the deed in front of a notary public to ensure its validity. Using the Minnesota Mortgage by Business Entity - UCBC Form 20.1.2 can simplify this process, as it provides clear guidelines and templates for completion.