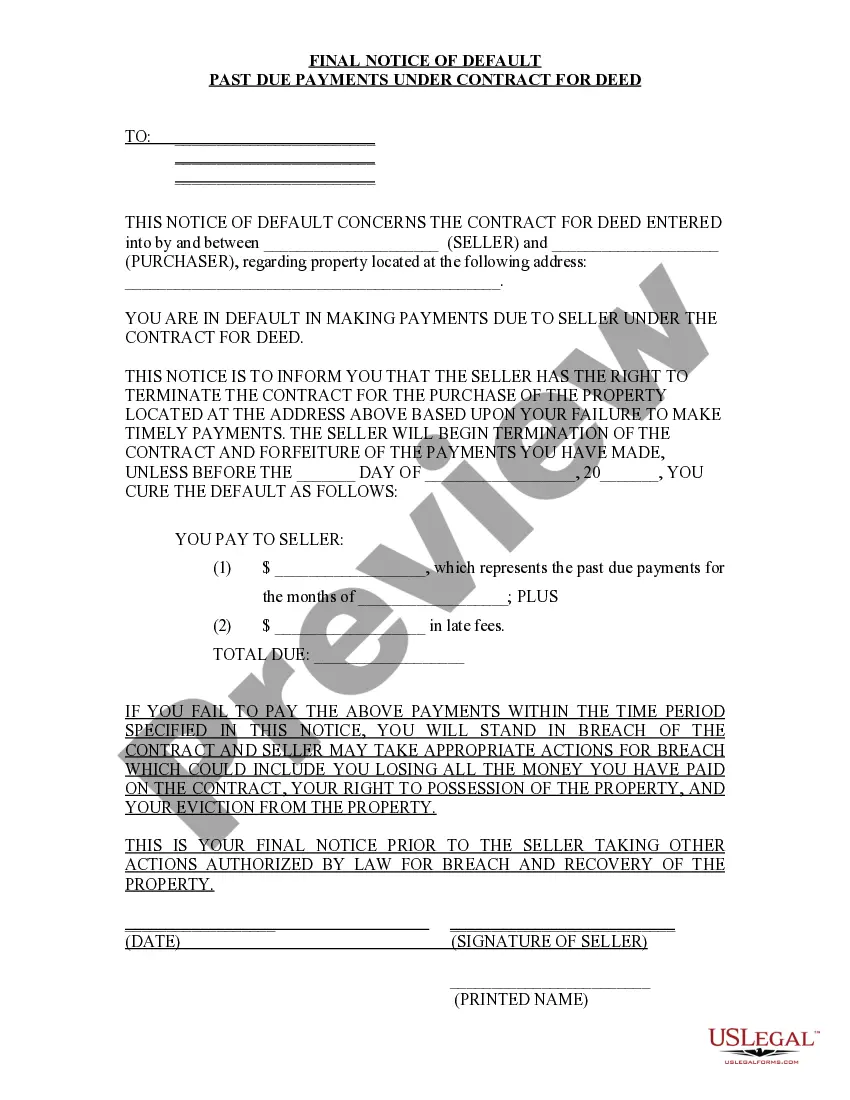

Minnesota Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Minnesota Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize US Legal Forms to acquire a printable Minnesota Final Notice of Default for Overdue Payments related to Contract for Deed. Our court-acceptable forms are crafted and frequently updated by expert attorneys.

Ours is the most extensive Forms catalog available online and provides economical and precise templates for individuals, legal professionals, and small to medium-sized businesses. The documents are organized into state-specific categories and some can be previewed before being downloaded.

To obtain templates, clients must possess a subscription and Log In to their account. Click Download next to any template you desire and locate it in My documents.

US Legal Forms offers a vast array of legal and tax templates and packages for both business and personal requirements, including Minnesota Final Notice of Default for Overdue Payments related to Contract for Deed. Over three million users have already successfully employed our platform. Choose your subscription plan and access high-quality forms in just a few clicks.

- Verify to ensure that you obtain the correct form pertaining to the required state.

- Examine the document by reading the description and utilizing the Preview feature.

- Select Buy Now if it is the document you desire.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Utilize the Search tool if you wish to find another document template.

Form popularity

FAQ

A request for notice of default is a formal notification that informs parties involved in a Contract for Deed that payments are overdue. In the context of Minnesota Final Notice of Default for Past Due Payments, this document serves as a critical step for both buyers and sellers. It ensures that all parties are aware of the financial status and outlines the necessary actions to address the default. Utilizing platforms like US Legal Forms can help you create an accurate request and navigate the complexities of this process.

Statute 548.101 in Minnesota outlines the legal framework for contracts for deed, including the rights of both buyers and sellers. This law emphasizes the importance of providing a Minnesota Final Notice of Default for Past Due Payments in connection with Contract for Deed before any legal actions can be taken. It ensures that all parties are informed and have the opportunity to resolve payment issues. Understanding this statute helps buyers and sellers navigate their legal responsibilities effectively.

If a buyer defaults on payments under a land contract, the seller typically sends a Minnesota Final Notice of Default for Past Due Payments in connection with Contract for Deed. This notice serves as an official warning, allowing the buyer a chance to rectify the situation. Failure to address the default can lead to the seller initiating foreclosure proceedings. It's crucial for buyers to understand their rights and obligations under the contract to avoid losing their investment.

A major danger associated with a contract for deed is the risk of losing the property through foreclosure if payments are not made on time. Buyers might not fully understand their obligations, leading to a Minnesota Final Notice of Default for Past Due Payments in connection with Contract for Deed. To navigate these risks, utilizing platforms like uslegalforms can provide necessary documentation and guidance for a smoother transaction.

If someone defaults on a contract for deed, the seller may begin foreclosure proceedings, which could lead to the loss of the property involved. The process typically starts with issuing a Minnesota Final Notice of Default for Past Due Payments in connection with Contract for Deed, giving the buyer a chance to remedy the situation. Legal advice and prompt action can help mitigate the consequences.

The new contract for deed law in Minnesota has introduced changes aimed at protecting buyers and ensuring transparency in the transaction process. These updates may include stricter guidelines on disclosures and the management of payments. Understanding these changes is essential to avoid receiving a Minnesota Final Notice of Default for Past Due Payments in connection with Contract for Deed.

When someone defaults on a contract, particularly a contract for deed, the seller may take legal action to recover the property. This process often begins with a Minnesota Final Notice of Default for Past Due Payments in connection with Contract for Deed. The involved parties should seek resolution quickly to avoid escalation into foreclosure, which can complicate the situation further.

Defaulting on a contract for deed in Minnesota can have serious implications for both the buyer and the seller. The seller has the right to initiate foreclosure proceedings, which can result in the loss of the property. It is important to understand that defaulting may lead to receiving a Minnesota Final Notice of Default for Past Due Payments in connection with Contract for Deed, prompting immediate action.

After receiving a notice of default in Minnesota, the borrower typically has a specific time frame to address the default. This may involve making overdue payments or negotiating with the seller to avoid further consequences. If the issue remains unresolved, the next steps could lead to foreclosure proceedings, making it crucial to act promptly upon receiving the Minnesota Final Notice of Default for Past Due Payments in connection with Contract for Deed.

In Minnesota, the penalty for late recordation of a contract for deed can lead to significant financial consequences. Late recordation can result in a loss of legal protections and may affect your standing in foreclosure proceedings. It is essential to adhere to the recordation timelines to avoid receiving a Minnesota Final Notice of Default for Past Due Payments in connection with Contract for Deed.