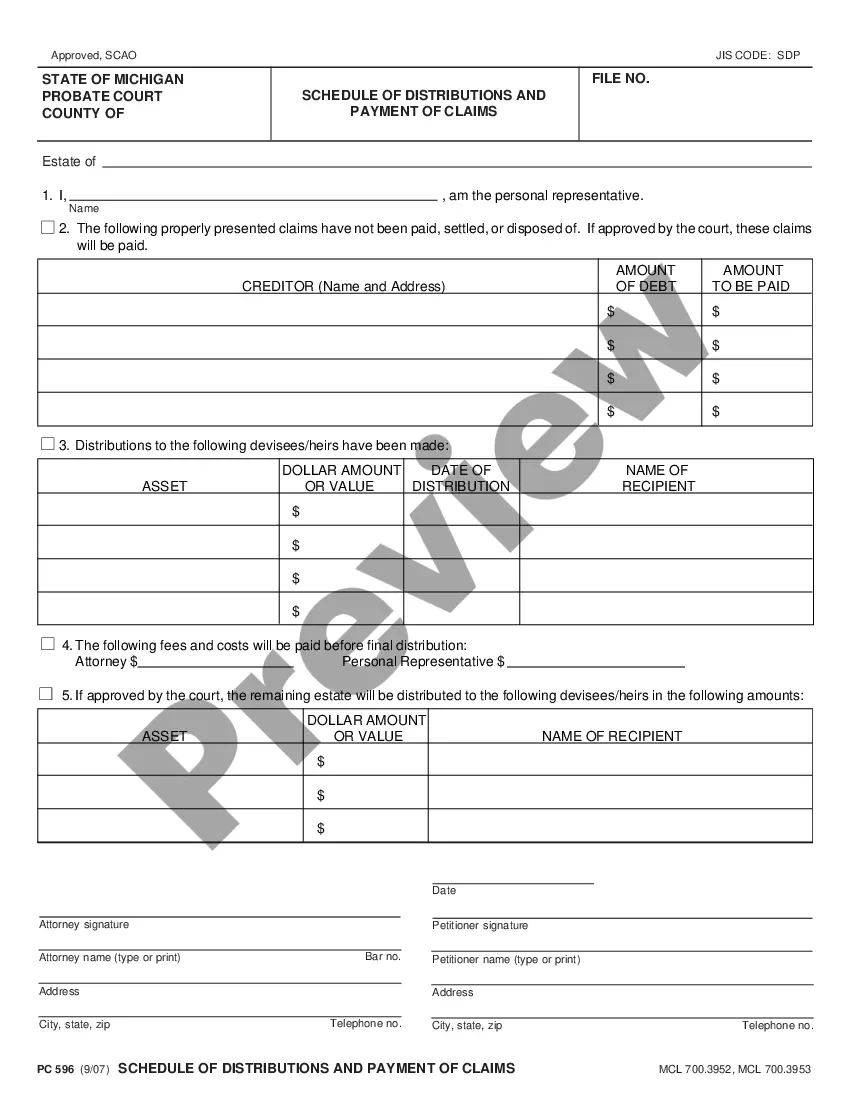

This Schedule of Distributions and Payment of Claims is an official document from the Michigan State Court Administration Office, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Michigan Schedule of Distributions and Payment of Claims

Description

How to fill out Michigan Schedule Of Distributions And Payment Of Claims?

Access any version from 85,000 legal documents including Michigan Schedule of Distributions and Payment of Claims online with US Legal Forms. Each template is created and refreshed by state-certified attorneys.

If you already possess a subscription, Log In. Once you are on the form’s page, click on the Download button and navigate to My documents to gain access to it.

If you haven't subscribed yet, follow the instructions below.

With US Legal Forms, you’ll consistently have quick access to the appropriate downloadable sample. The platform will provide you access to forms and categorize them to ease your search. Utilize US Legal Forms to acquire your Michigan Schedule of Distributions and Payment of Claims swiftly and effortlessly.

- Review the state-specific prerequisites for the Michigan Schedule of Distributions and Payment of Claims you intend to utilize.

- Browse through the description and preview the sample.

- When you are assured that the sample meets your needs, simply click Buy Now.

- Choose a subscription plan that fits your budget.

- Establish a personal account.

- Make payment in one of two suitable methods: by credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- After your reusable form is downloaded, print it out or save it to your device.

Form popularity

FAQ

Form PC 598 is used in Michigan to report the distribution of an estate's assets. This form is essential for complying with the Michigan Schedule of Distributions and Payment of Claims. It provides detailed information about what was distributed, to whom, and when. Utilizing resources like US Legal Forms can simplify your understanding and completion of this form.

An executor can distribute funds to beneficiaries after settling all debts, taxes, and expenses of the estate. This process typically follows the Michigan Schedule of Distributions and Payment of Claims guidelines. The executor must ensure that all claims are resolved and that the estate is legally clear before making distributions. It's advisable to consult legal resources, like US Legal Forms, for detailed steps.

To file a claim against an estate in Michigan, you need to submit a written claim to the personal representative of the estate. It is important to do this within the time frame specified by the Michigan Schedule of Distributions and Payment of Claims, typically within four months after the notice is sent. Ensure that your claim includes all relevant details and supporting documentation. For a streamlined process, consider using uslegalforms, which provides easy-to-follow templates and guidance on filing claims effectively.

In Michigan, an executor typically has one year to settle an estate, though this period can be extended in certain circumstances. Timely execution of the Michigan Schedule of Distributions and Payment of Claims helps the executor meet legal deadlines. Properly managing estate assets and settling debts can streamline this process. USLegalForms offers resources and forms that can assist executors in fulfilling their duties efficiently.

Distribution Order means an order entered by the Court authorizing and directing that the Net Settlement Fund be distributed, in whole or in part, to Authorized Claimants.

Distribution of trust funds after death The Trustee simply transfers all assets to the beneficiary. Distribution is also fairly easy if the trust document identifies all assets and specific amounts to be paid to each beneficiary.

The estate must be open for at least five months. Required notice to creditors must be published at least four months before closing. The inventory fee must be paid. Any estate/inheritance taxes must be paid (proof of payment required)

Formal Probate Most Michigan probate cases can be wrapped up within seven months to a year after the personal representative is appointed. After notice of the probate is given, creditors have four months to file a claim.

In order to qualify for a simplified process, an estate must be valued at or below $24,000 for a decedent who died in 2020. This number goes up every few years. To learn more about the simplified processes, read the article An Overview of Small Estate Processes.

Distribution Schedule The frequency with which a mutual fund pays dividends from its portfolio to shareholders. It also may refer to the frequency with which the fund collects fees from shareholders to defray its own costs.