The Michigan Acceptance of Receivership Appointment (Receivership Estate) is a legal document that is required for the appointment of a receiver in the state of Michigan. This document is used when a person or entity (the “appointee”) is appointed by a court to take possession of the assets of a business, individual, or estate in order to manage and protect them. The appointee is then responsible for the management of the assets until the debt or other obligations of the estate are resolved. The Michigan Acceptance of Receivership Appointment (Receivership Estate) outlines the powers and duties of the receiver, as well as the terms of the receivership. It also outlines the process for filing a petition for the appointment of a receiver in Michigan. There are two types of receivership estates in Michigan: General Receivership Estates and Special Receivership Estates. The General Receivership Estates are those where the court appoints a receiver to manage all the assets of the estate. The special receivership estates are those where the court appoints a receiver to manage only some assets or to fulfill certain specific tasks. In either case, the Michigan Acceptance of Receivership Appointment (Receivership Estate) outlines the duties and responsibilities of the receiver in both cases.

Michigan Acceptance of Receivership Appointment (Receivership Estate)

Description

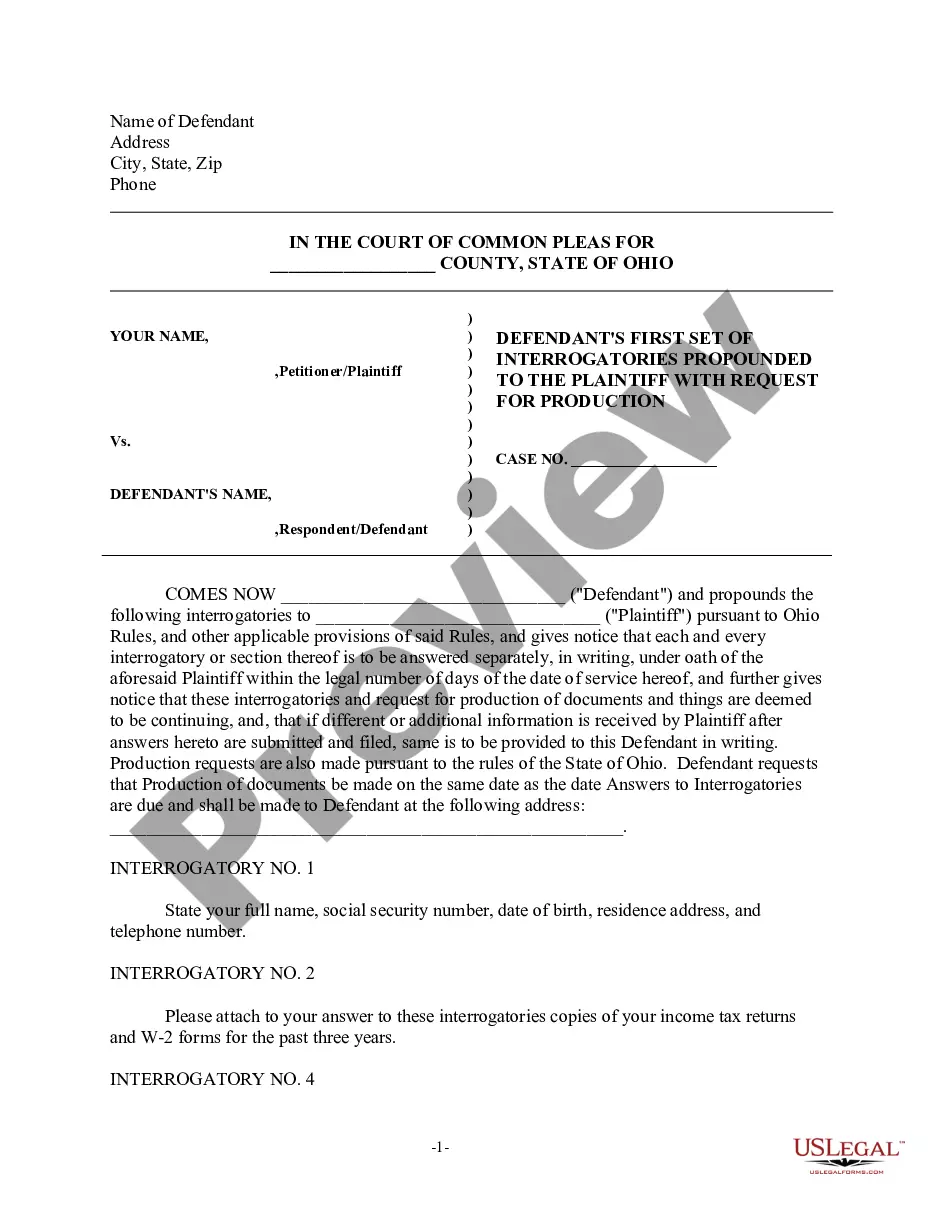

How to fill out Michigan Acceptance Of Receivership Appointment (Receivership Estate)?

How much time and resources do you typically allocate for creating official documents.

There’s a better chance to acquire such forms than engaging legal professionals or spending hours searching the internet for an appropriate template.

Register for an account and pay for your subscription. You can complete a transaction with your credit card or through PayPal - our service is entirely secure for that.

Download your Michigan Acceptance of Receivership Appointment (Receivership Estate) onto your device and fill it out on a printed hard copy or electronically.

- US Legal Forms is the premier online repository that offers expertly crafted and validated state-specific legal forms for any purpose, including the Michigan Acceptance of Receivership Appointment (Receivership Estate).

- To obtain and finalize a suitable Michigan Acceptance of Receivership Appointment (Receivership Estate) template, follow these straightforward steps.

- Review the form details to ensure it aligns with your state regulations. To do this, read the form overview or utilize the Preview option.

- If your legal template does not meet your requirements, find an alternative using the search bar at the top of the page.

- If you already possess an account with us, Log In and download the Michigan Acceptance of Receivership Appointment (Receivership Estate). If not, continue to the next steps.

- Click Buy now after you locate the correct blank. Choose the subscription plan that best fits your needs to access our library’s complete service.

Form popularity

FAQ

In Michigan, the priority for appointment as a personal representative is based on a statutory order of preference, which starts with the surviving spouse and children. If there are no immediate family members, the court will consider other relatives and close associates. Knowing this hierarchy is important when navigating Michigan Acceptance of Receivership Appointment (Receivership Estate). Consider using the US Legal Forms platform to ensure compliance and to streamline the necessary documentation.

In Michigan, the 7 day rule refers to the requirement for parties to respond to a court's notice regarding the acceptance of a receivership appointment. This means that individuals or entities involved must respond within seven days if they wish to contest the appointment. Understanding this timeline is crucial for ensuring a smooth process related to Michigan Acceptance of Receivership Appointment (Receivership Estate). Stay informed to protect your interests.

To obtain a letter of authority in Michigan, you typically need to request this from the court at the time of the receiver’s appointment. This letter grants the receiver the legal power to act on behalf of the receivership estate. Utilizing a platform like USLegalForms can streamline this process by providing necessary forms and guidance aligned with the Michigan Acceptance of Receivership Appointment.

When receivers are appointed, they immediately begin to assess the entity's financial situation and develop a management plan. Their primary goal is to stabilize operations and fulfill obligations to creditors. This process, as outlined in the Michigan Acceptance of Receivership Appointment, can ultimately lead to a restructuring or liquidation of assets to ensure fairness and transparency.

If a receiver has been appointed, it indicates that a court has recognized the need for intervention due to financial distress or mismanagement. This appointment allows the receiver to take control over the business and make necessary decisions to protect the assets and the interests of creditors. The Michigan Acceptance of Receivership Appointment underscores the seriousness of this situation.

When a receiver is appointed to a company, they assume responsibility for its financial management and operational decisions. The receiver's role is to stabilize the business, address outstanding debts, and work toward a resolution that benefits all parties involved. This process is part of the Michigan Acceptance of Receivership Appointment, which aims to facilitate a structured recovery.

Being appointed a receiver means you are tasked with overseeing and managing a receivership estate on behalf of the court. This role includes safeguarding assets, addressing financial issues, and ensuring compliance with legal obligations. A clear understanding of the duties laid out during the Michigan Acceptance of Receivership Appointment is essential for success.

The power of appointment in Michigan allows the court to delegate control of a business or estate to a receiver under specific circumstances. This authority includes making decisions regarding the operation and management of assets. It is a crucial part of the Acceptance of Receivership Appointment, ensuring that proper oversight is maintained.

In Michigan, a receiver can be appointed through court proceedings initiated by a creditor or interested party. Typically, the court evaluates the need for a receiver based on evidence of mismanagement or financial distress. This process ensures that the appointment follows the guidelines outlined in the Acceptance of Receivership Appointment.

When a receiver is appointed in Michigan under the Acceptance of Receivership Appointment, they take control of the assets and operations of the entity in question. This process often aims to stabilize the company, manage debts, and protect creditors’ interests. The receiver’s actions can significantly influence the future of the receivership estate.