Michigan Direct Credit Form is a document administered by the Michigan Department of Treasury that allows taxpayers to make direct electronic payments to the state. This form is used to submit payments for Michigan state taxes, such as the Individual Income Tax, Corporate Income Tax, and Sales and Use Tax. There are two types of Michigan Direct Credit Forms: the Direct Credit Authorization Form and the Direct Credit Online Payment Form. The Direct Credit Authorization Form provides authorization for the Michigan Department of Treasury to initiate electronic payments from the taxpayer's designated financial institution account. The Direct Credit Online Payment Form allows taxpayers to make one-time electronic payments directly to the Michigan Department of Treasury. Both forms must be completed and submitted in order to make electronic payments to the state.

Michigan Direct Credit Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

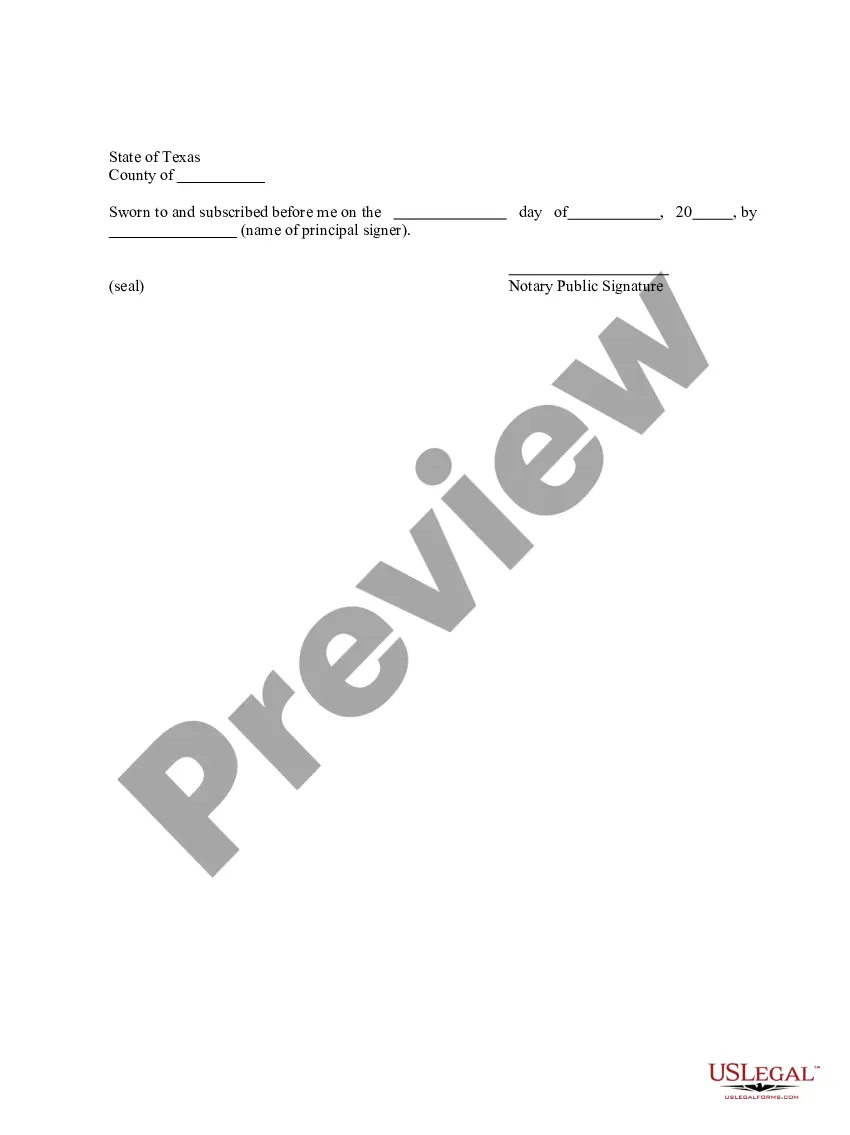

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Direct Credit Form?

US Legal Forms is the simplest and most cost-effective method to locate suitable legal templates.

It boasts the largest online repository of business and personal legal documents crafted and validated by legal professionals.

Here, you can access printable and editable forms that adhere to national and local laws - similar to your Michigan Direct Credit Form.

Review the form description or preview the document to confirm you've identified the one that matches your requirements, or discover another one via the search tab above.

Click Buy now when you’re confident about its suitability with all the criteria, and select the subscription plan that appeals to you the most.

- Obtaining your template entails just a few uncomplicated steps.

- Users who already possess an account with an active subscription need only to Log In to the online platform and download the document to their device.

- Subsequently, they can locate it in their profile under the My documents section.

- Additionally, here’s how you can acquire a professionally prepared Michigan Direct Credit Form if you’re using US Legal Forms for the first time.

Form popularity

FAQ

You can pick up Michigan tax forms at various locations, including local government offices and libraries. The Michigan Department of Treasury's website is also a resource for accessing forms online. For those who prefer printed copies, consider checking nearby tax preparation services, as they often have a selection available. Don’t forget to include the Michigan Direct Credit Form if applicable during your tax preparation.

Tax forms are typically not available at post offices, so it’s best to look elsewhere. Most people find their forms online at the Michigan Department of Treasury website. Additionally, some organizations and libraries provide access to these forms. Be sure to download or request the Michigan Direct Credit Form if you're eligible for credits.

You can obtain Michigan tax forms directly from the Michigan Department of Treasury's website, making it very straightforward. They offer a range of forms including the Michigan Direct Credit Form, which is crucial for tax credits. Local CPA offices and tax preparation services usually have these forms too, should you need printed copies. Remember to check these resources early to avoid last-minute stress.

In Michigan, the home heating credit is available for low-income residents who meet certain criteria. This may include individuals receiving state assistance, as well as those meeting specific income guidelines. To apply for the home heating credit, you may need to include the Michigan Direct Credit Form with your application. Understanding these requirements ensures that you receive the benefits you deserve.

You can find tax return forms at several locations. The Michigan Department of Treasury provides these forms online, which is convenient. Additionally, many local libraries and government offices have physical copies available for pickup. Don't forget that the Michigan Direct Credit Form is also accessible through these channels.

To claim the home heating credit on your taxes, you should complete the Michigan Direct Credit Form and include it with your tax return. This form outlines your eligibility and provides the necessary details for claiming the credit. Ensure you keep copies of all documents for your records and reference.

Yes, you can file the MI 1040CR online through the Michigan Department of Treasury's e-filing system. This process allows you to efficiently complete your Michigan Direct Credit Form alongside your tax return. Be sure to verify all entries for accuracy before final submission to avoid any delays.

To apply for the home heating credit in Michigan online, visit the Michigan Department of Treasury's website and access the Michigan Direct Credit Form. Follow the prompts to complete the form with your information, then submit your application electronically. This method can save time and provides immediate confirmation of your application.

The income limit for the Michigan home heating credit varies based on your household size and circumstances. You can find the current limits outlined in the Michigan Direct Credit Form instructions. Understanding these limits is essential before applying, as they determine your eligibility for financial assistance.

To apply for the Michigan property tax credit, begin by completing the Michigan Direct Credit Form. This form requires details about your property and income to determine your eligibility. Make sure to follow all instructions carefully and submit your application by the specified deadlines to receive your credit.