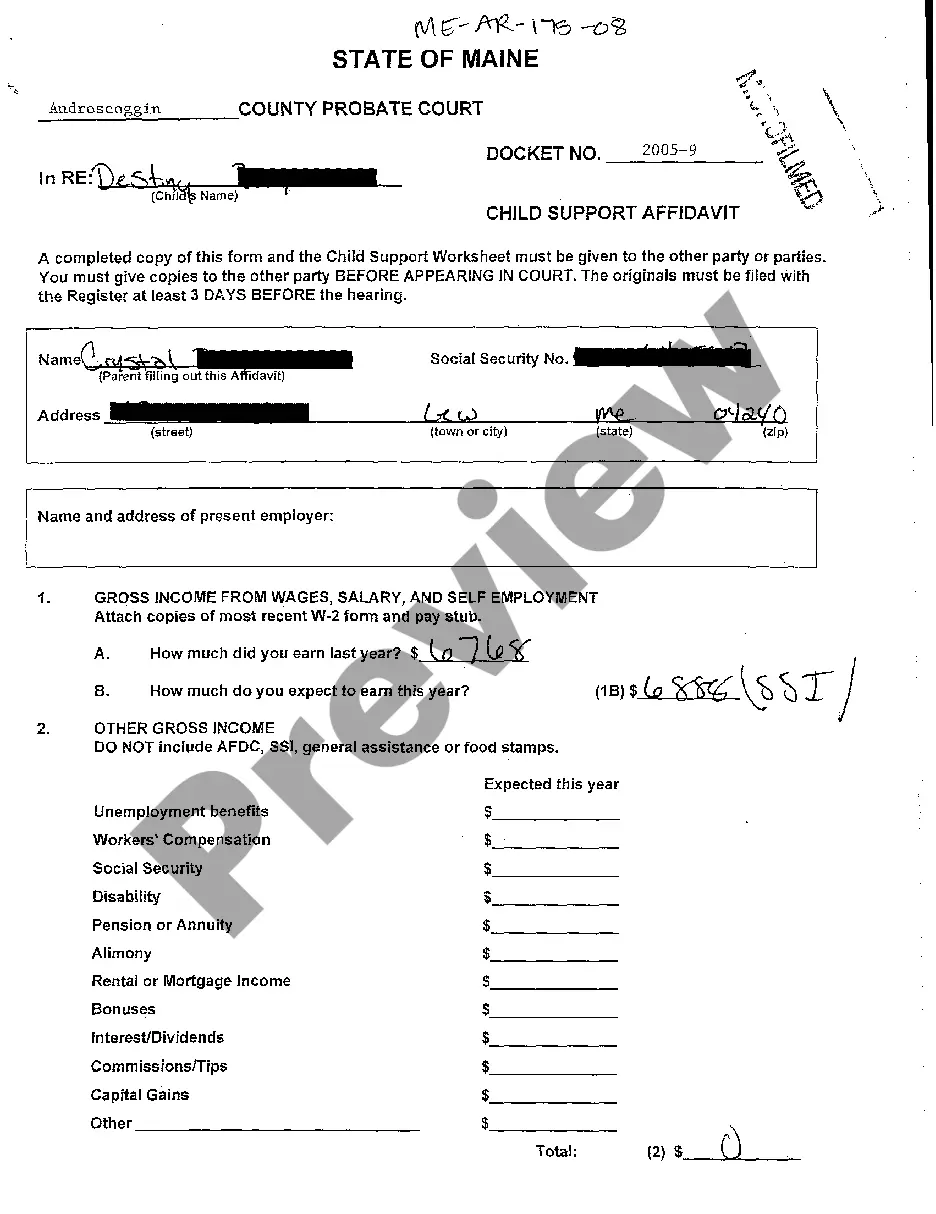

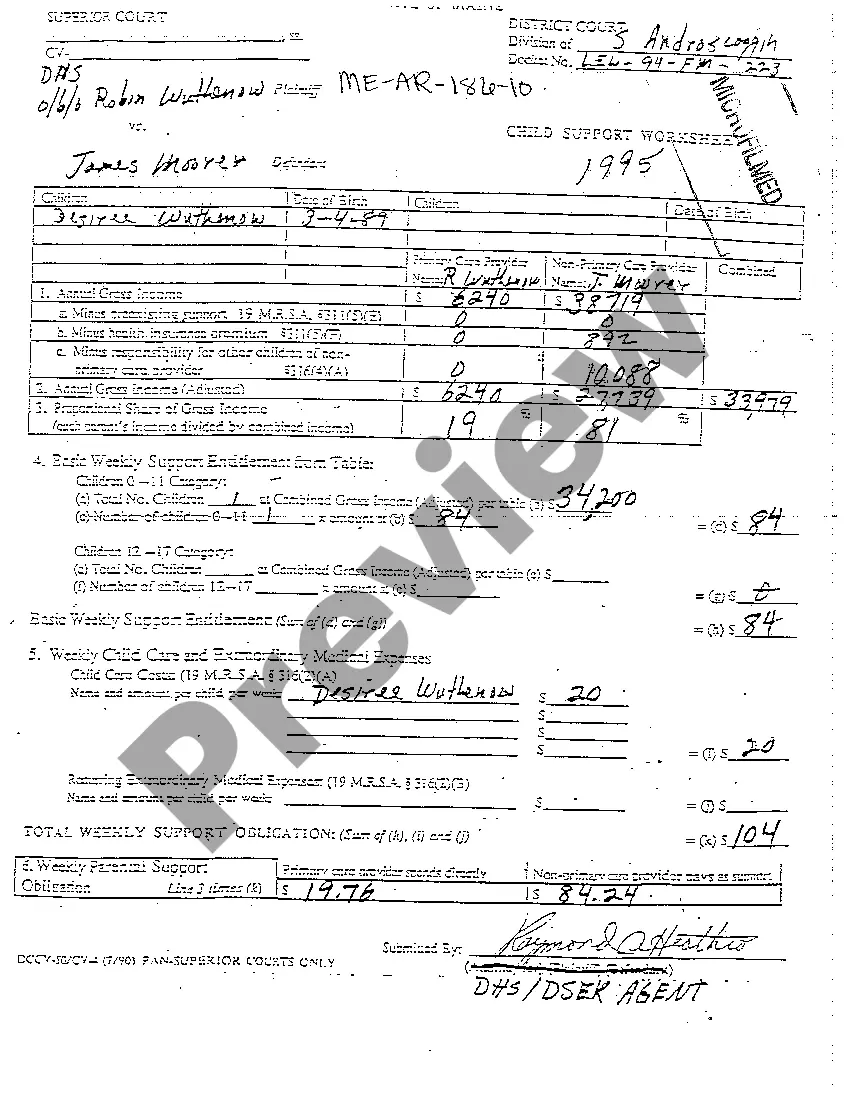

Maine Child Support Worksheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maine Child Support Worksheet?

Among numerous complimentary and paid samples that you can encounter online, you cannot be certain about their precision and dependability.

For instance, who created them or if they possess the expertise necessary to handle your requirements.

Always remain calm and utilize US Legal Forms!

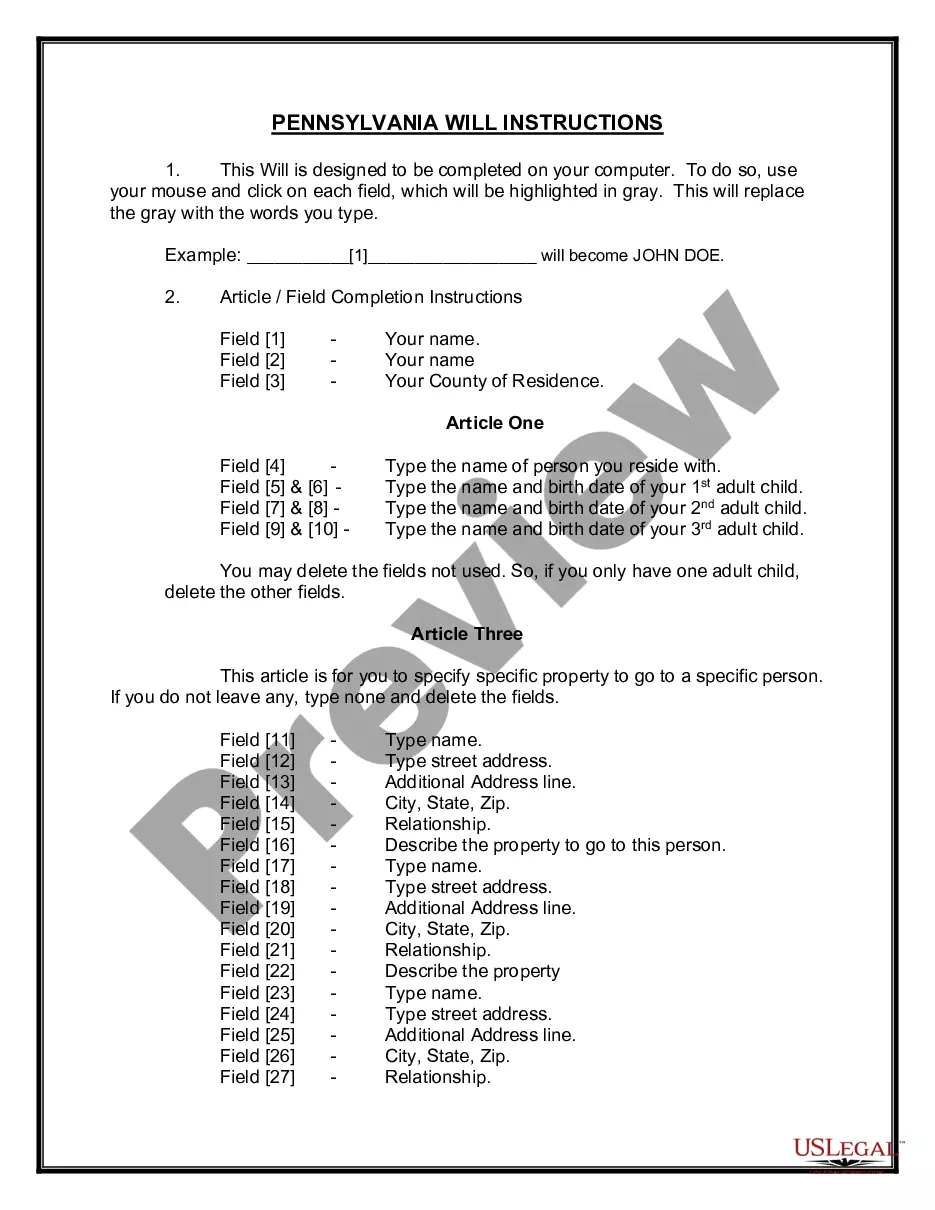

Ensure that the document you find is applicable in your state. Review the template by inspecting the description using the Preview feature. Click Buy Now to initiate the ordering process or search for another template using the Search bar in the header. Select a pricing option and set up an account. Complete the subscription payment using your credit/debit card or PayPal. Download the form in the required file format. Once you’ve registered and purchased your subscription, you can use your Maine Child Support Worksheet as frequently as necessary or for as long as it remains valid in your area. Modify it in your chosen editor, fill it out, sign it, and print it. Achieve more for less with US Legal Forms!

- Find Maine Child Support Worksheet templates prepared by experienced attorneys.

- Avoid the costly and lengthy process of searching for a lawyer.

- Then compensating them to draft a document for you that you can obtain on your own.

- If you already possess a subscription, Log In to your account to locate the Download button adjacent to the form you seek.

- You will also gain access to your previously saved templates in the My documents section.

- If this is your first time using our service, adhere to the instructions below to acquire your Maine Child Support Worksheet swiftly.

Form popularity

FAQ

In Alberta, the basic amount of child support that someone with an income of $150,000 would have to pay for one child is $1318.00 per month.

CHILD SUPPORT BASED ON GROSS INCOME CSA advises parties that this is what the children would be entitled to if the two parents were still together. But they would only be entitled to a net amount if the two parents were still together.

In Alberta, the basic amount of child support that someone with an income of $150,000 would have to pay for one child is $1318.00 per month.

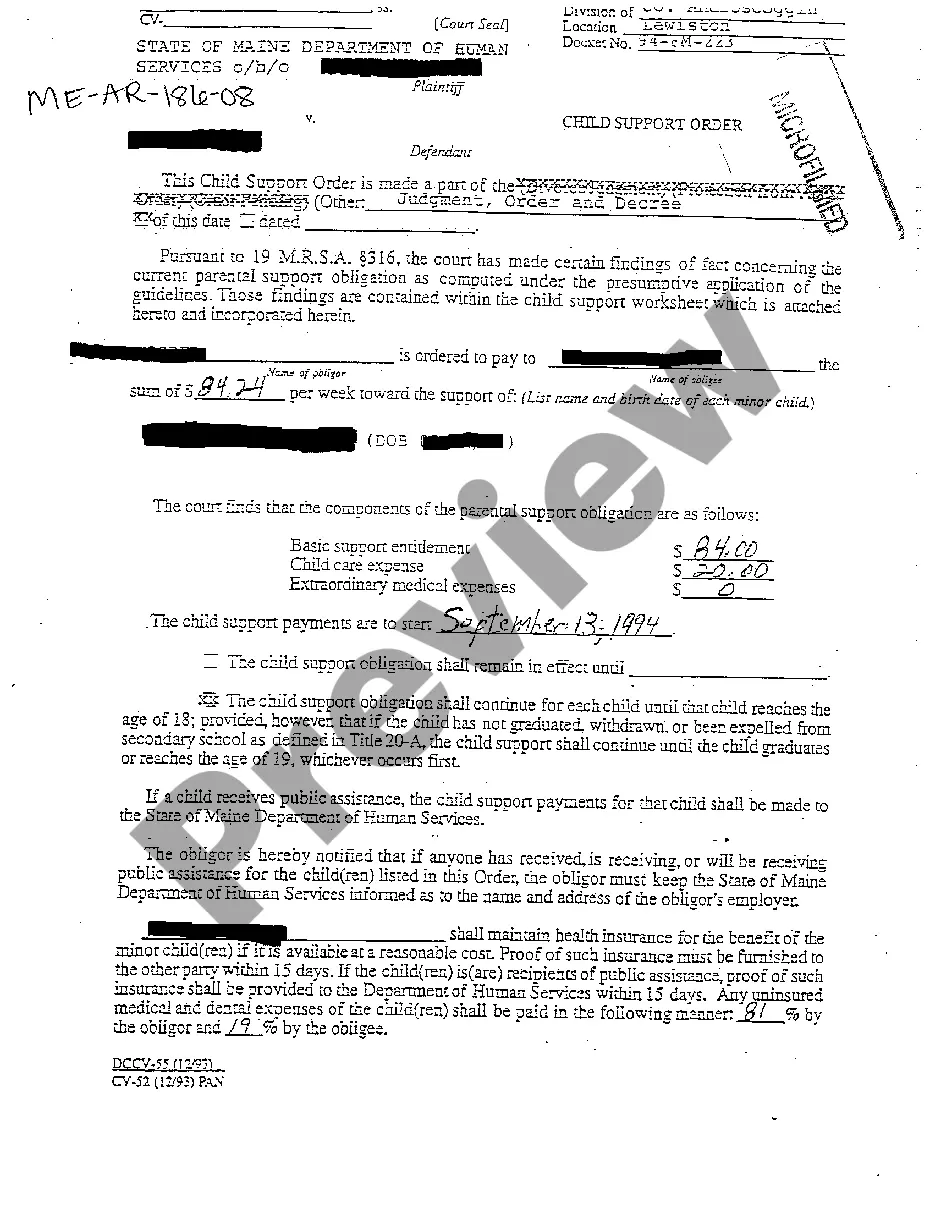

Establishing Child Support in MaineMaine follows the Income Shares Model, which means that a judge will determine support by calculating how much each parent spent on the child while living together as a family. This number is then divided according to each parent's income to come up with a final support amount.

I Have 50/50 Custody, Why Am I still Required to Pay Child Support? 50/50 custody arrangements do not necessarily absolve parents of child support obligations.A court will consider the income and earning potential of both parents and order the spouse with the higher income to pay child support.

In determining a parent's income for child support purposes, courts typically look at the parent's gross income from all sources. They then subtract certain obligatory deductions, like income taxes, Social Security, health care, and mandatory union dues.

Deductions of child support are made after tax withheld deductions and formal salary sacrificing. This is before other deductions such as voluntary superannuation, health fund and loan repayments. Once you make a deduction from your employee's or contractor's pay, you're legally required to pay it to us.