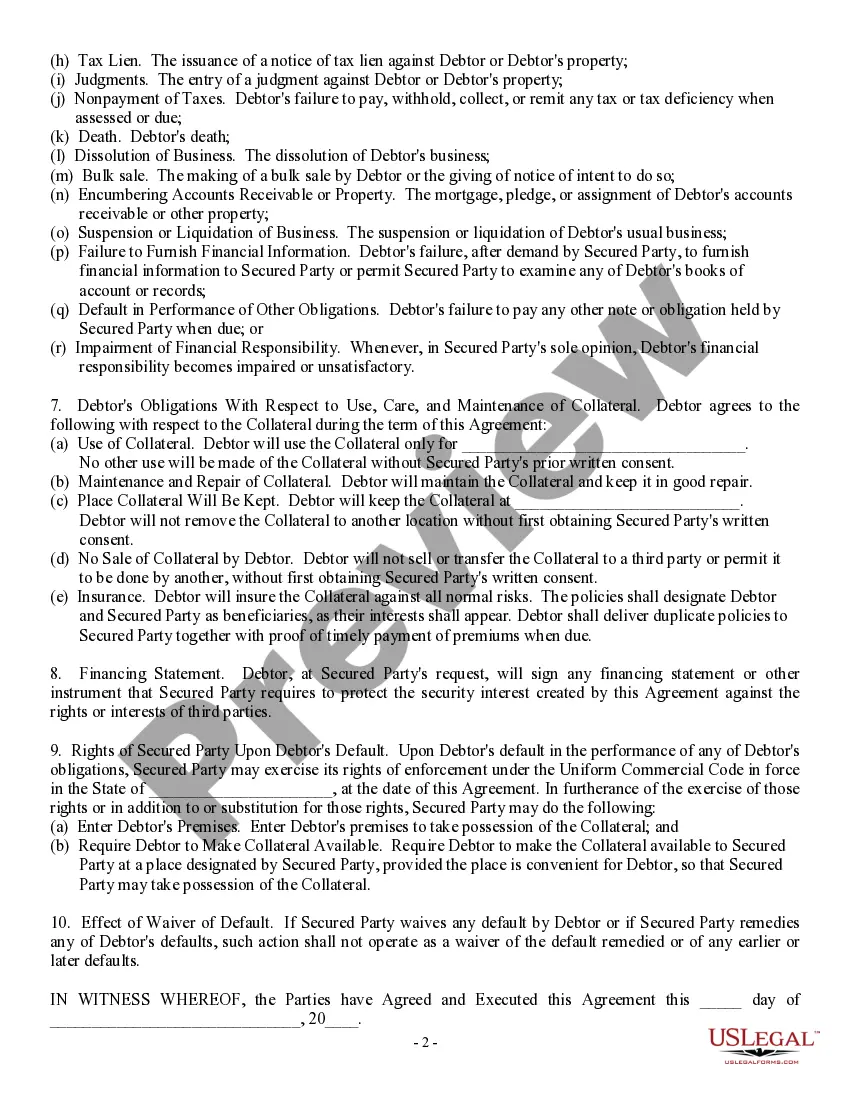

Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

Aren't you sick and tired of choosing from countless samples each time you want to create a Security Agreement involving Sale of Collateral by Debtor? US Legal Forms eliminates the lost time millions of Americans spend surfing around the internet for perfect tax and legal forms. Our expert group of lawyers is constantly changing the state-specific Forms collection, so it always offers the proper files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have a subscription need to complete quick and easy actions before having the ability to download their Security Agreement involving Sale of Collateral by Debtor:

- Utilize the Preview function and read the form description (if available) to ensure that it’s the right document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right sample for the state and situation.

- Use the Search field at the top of the page if you want to look for another document.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your document in a convenient format to finish, print, and sign the document.

When you have followed the step-by-step recommendations above, you'll always be able to log in and download whatever document you require for whatever state you require it in. With US Legal Forms, finishing Security Agreement involving Sale of Collateral by Debtor templates or other legal files is not difficult. Get going now, and don't forget to look at the samples with certified attorneys!

Form popularity

FAQ

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

By Practical Law Finance. This is a standard form of pledge agreement to be used in connection with a syndicated loan agreement. It is intended to create a security interest over equity interests and promissory notes owned by the grantors. The grantors are usually the borrower, its parent and its subsidiaries.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan. A pledged asset is collateral held by a lender in return for lending funds.Pledged assets can include cash, stocks, bonds, and other equity or securities.

Under the UCC, a pledge agreement is a security agreement. The nature of the pledged assets means that a pledge agreement may contain different representations and warranties and covenants than a security agreement over business assets (for example, voting rights).

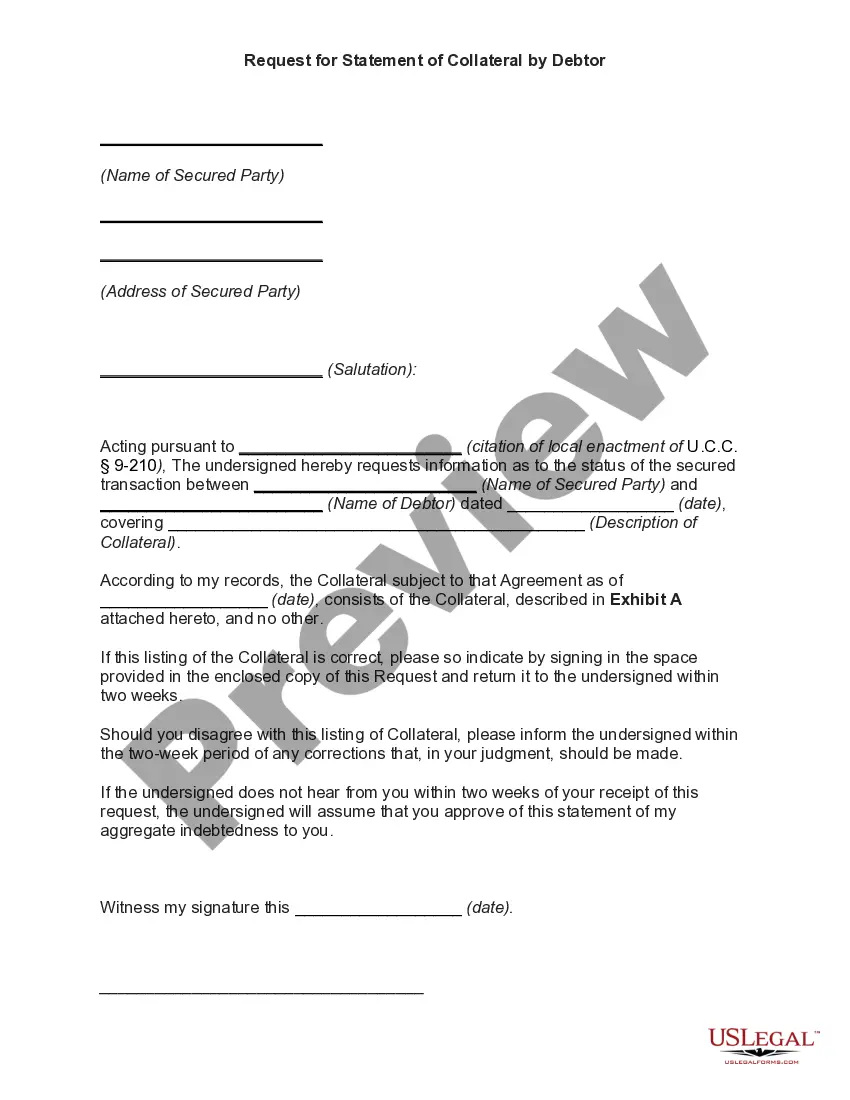

Security agreements and financing statements are often confused with one another. The primary difference is that the financing statement largely serves as notice that a creditor possesses security interest in the debtor's assets or property. The financing statement is not a contract.

A security agreement refers to a document that provides a lender a security interest in a specified asset or property that is pledged as collateral.In the event that the borrower defaults, the pledged collateral can be seized by the lender and sold.

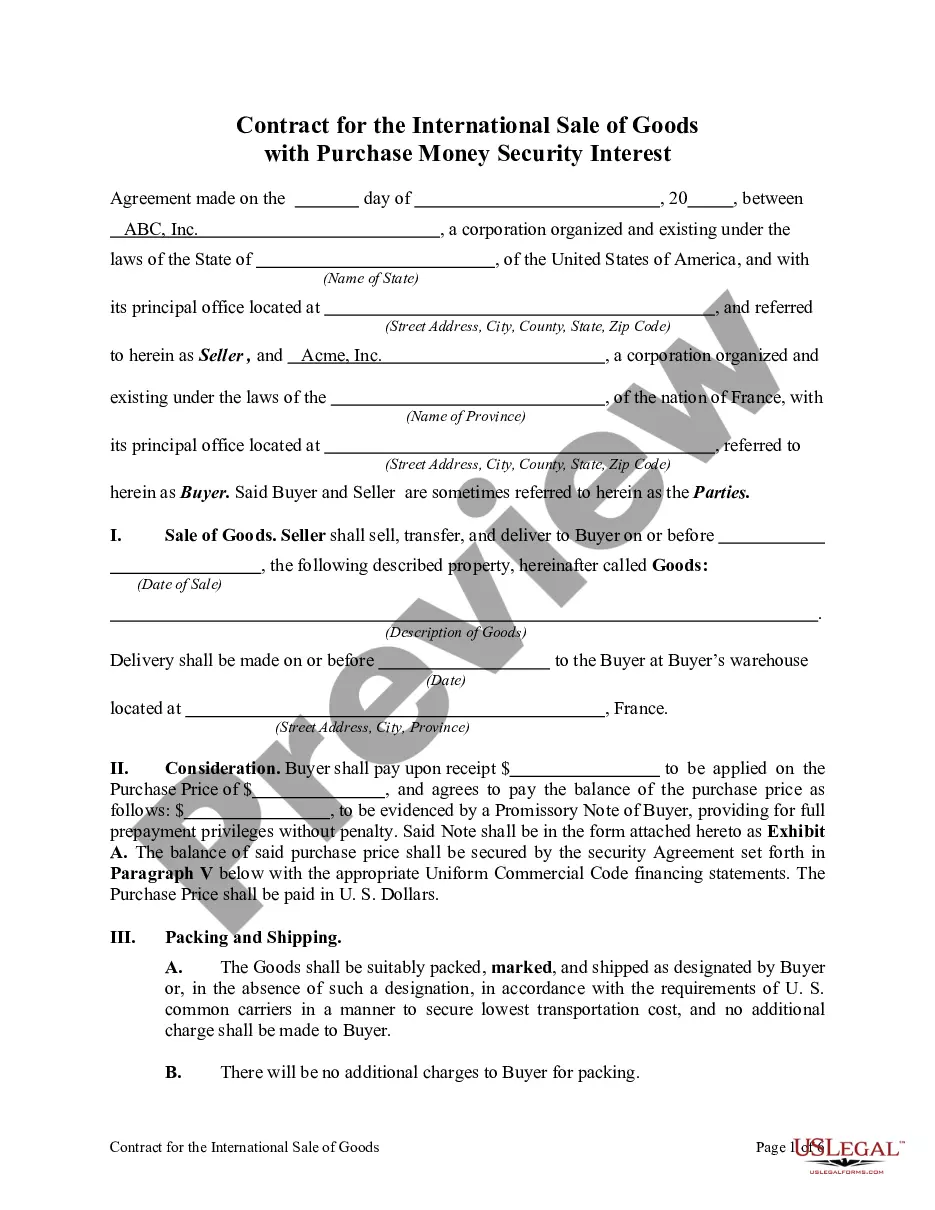

The term purchase money security interest (PMSI) refers to a legal claim that allows a lender to either repossess property financed with its loan or to demand repayment in cash if the borrower defaults. It gives the lender priority over claims made by other creditors.