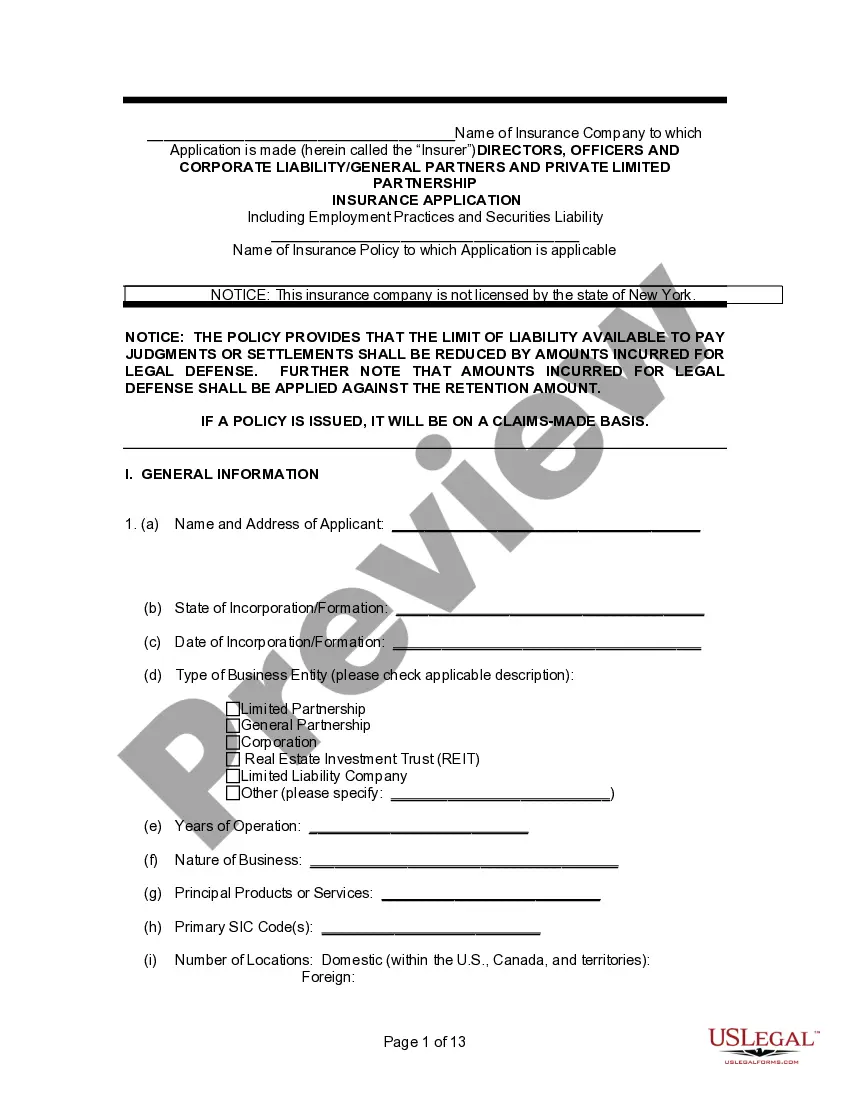

The Maryland Application for Sole Proprietorship and/or General Partnership is an official form that must be completed and submitted to the Maryland Department of Assessments and Taxation in order to register a business in the state of Maryland. This form allows sole proprietorship and/or general partnerships to register their business with the state and obtain an Entity ID number. The form must be completed accurately and signed by all the parties involved. There are two types of Maryland Applications for Sole Proprietorship and/or General Partnership: the Form 1: Application for Registration of a Business and Form 2: Application for Registration of a General Partnership. Both forms require the business owner to provide information about the business, including the business name, owner's name and address, business activities, and the type of business structure. The form also requests the name and address of the person to whom reports and payments should be sent. The Form 1 is used to register a single-owner business, while the Form 2 is used to register a general partnership with multiple owners. Both forms must be completed and submitted to the Maryland Department of Assessments and Taxation in order to obtain an Entity ID number and register the business.

Maryland Application for Sole Proprietorship and/or General Partnership

Description

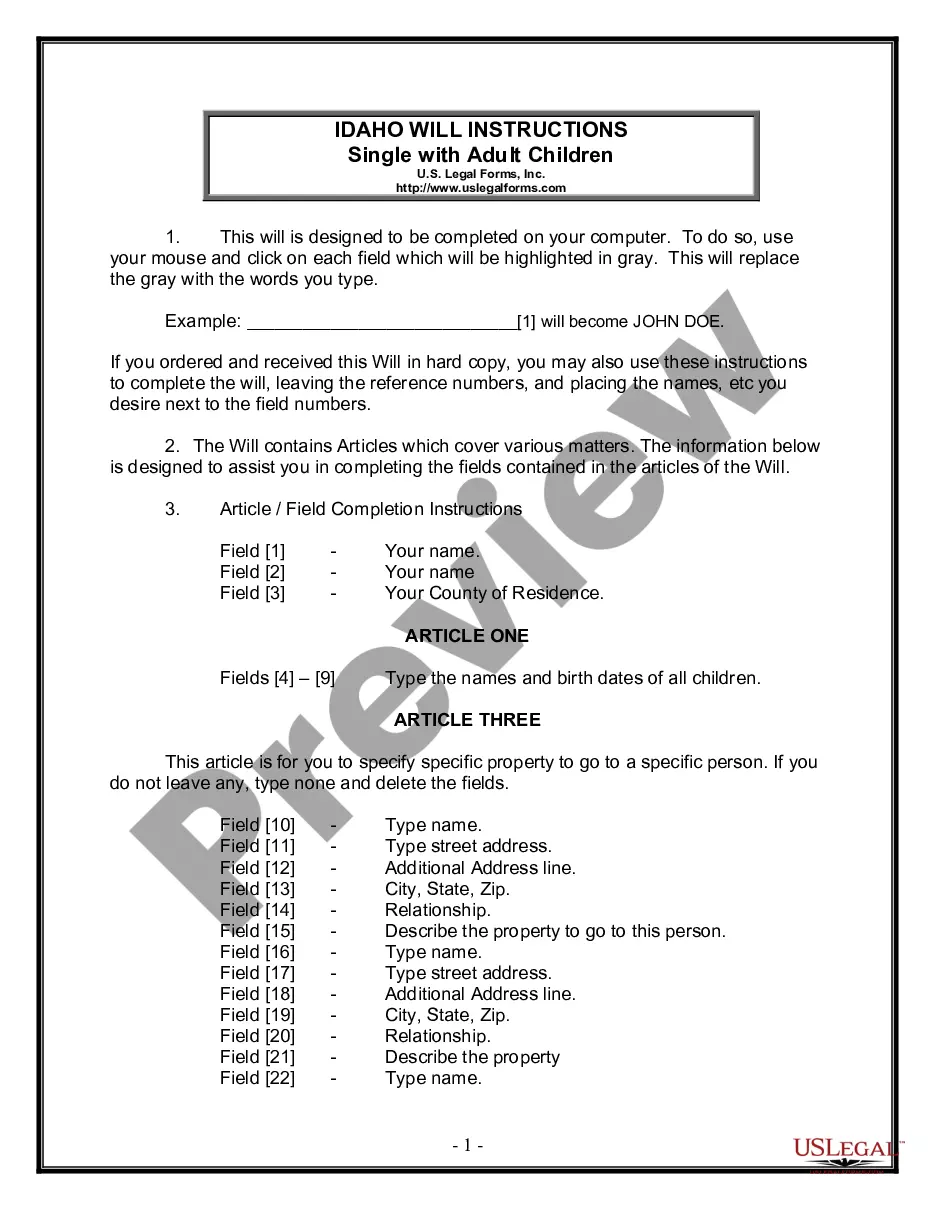

How to fill out Maryland Application For Sole Proprietorship And/or General Partnership?

How much time and resources do you regularly allocate to creating formal documents.

There is a greater potential to obtain such forms than to hire legal professionals or to spend countless hours searching for a suitable template online.

Another benefit of our service is that you can retrieve previously obtained documents that you securely store in your profile under the My documents section. Access them anytime and re-fill your paperwork as often as you wish.

Conserve time and effort on formal documentation with US Legal Forms, one of the most reliable online services. Join us today!

- Review the form details to ensure it adheres to your state regulations. To do this, examine the form summary or use the Preview option.

- If your legal template does not satisfy your requirements, locate an alternative using the search bar located at the top of the page.

- If you are already a registered user of our service, Log In and retrieve the Maryland Application for Sole Proprietorship and/or General Partnership. If not, continue to the following steps.

- Click Buy now after identifying the correct document. Select the subscription plan that is most suitable for you to gain full access to our library’s offerings.

- Create an account and pay for your subscription. You can complete your payment using a credit card or via PayPal - our service is entirely secure for this purpose.

- Download your Maryland Application for Sole Proprietorship and/or General Partnership onto your device and fill it out either on a printed copy or electronically.

Form popularity

FAQ

Choosing between a sole proprietorship and a partnership depends on your business goals and personal circumstances. A sole proprietorship offers complete control and simplicity, while a partnership allows for shared resources and expertise. By carefully evaluating your situation and potentially using the Maryland Application for Sole Proprietorship and/or General Partnership, you can make an informed decision that aligns with your business vision.

Structure: A partnership involves two or more individuals, whereas a sole proprietor is a single person operating a business alone. A partnership may form an agreement that outlines operational terms and other business matters to regulate any future disagreements.

You can also download the application and mail the completed form to the address provided in the application instructions. As of 2023, the filing fee is $25. You can expedite the filing with an additional $50 fee. Maryland considers all online filings expedited.

A sole proprietor who has net earnings from Schedule C of $400 or more must file Schedule SE (Form 1040), Self-Employment Tax. A taxpayer uses Schedule SE to figure self-employment tax, which is the sum of the social security and Medicare taxes on self-employment income.

By law, single-owner businesses are sole proprietorships, whereas companies with two or more owners are required to file as general or limited partnerships. If you're the only business owner, you must create a sole proprietorship, unless you set up a limited liability company (LLC).

Sole proprietorships and general partnerships registered to do business in Maryland MUST file an Annual Report (Form 2, no fee).

A Maryland personal property return (Form2) must be filed by all sole proprietorships and general partnerships if they possess (own, lease, rent, use or borrow) business personal property or need a business license. A business which fails to file this return will likely receive an estimated assessment.

Individuals or businesses without any employees who want to operate as a "sole proprietorship" still must register with the Maryland Department of Assessments and Taxation if they wish to open a bank account.

Can a sole proprietorship become a partnership? Yes, and it's simple. The moment you agree to do business with someone else and share profits and losses, you have turned your sole proprietorship into a partnership, even without a written partnership agreement.