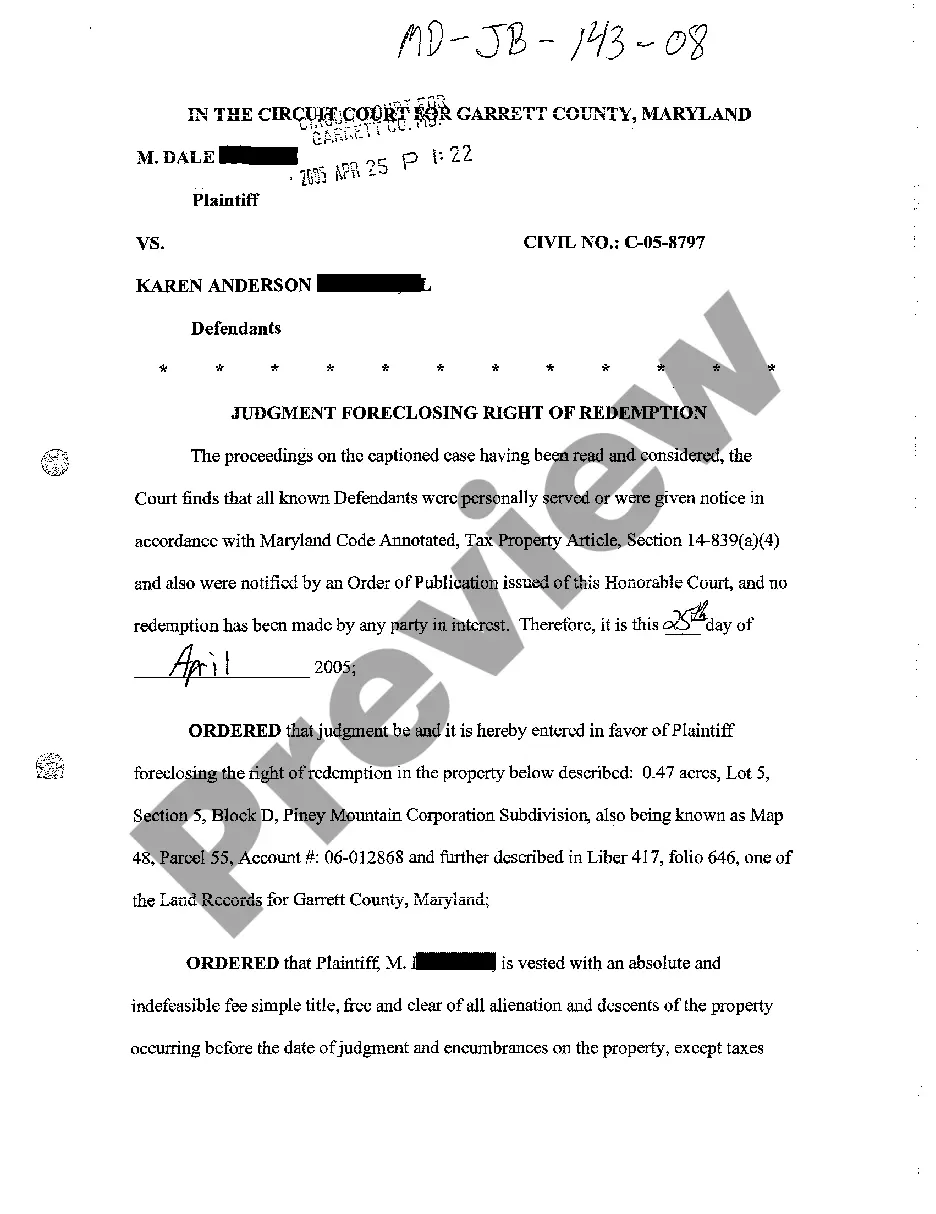

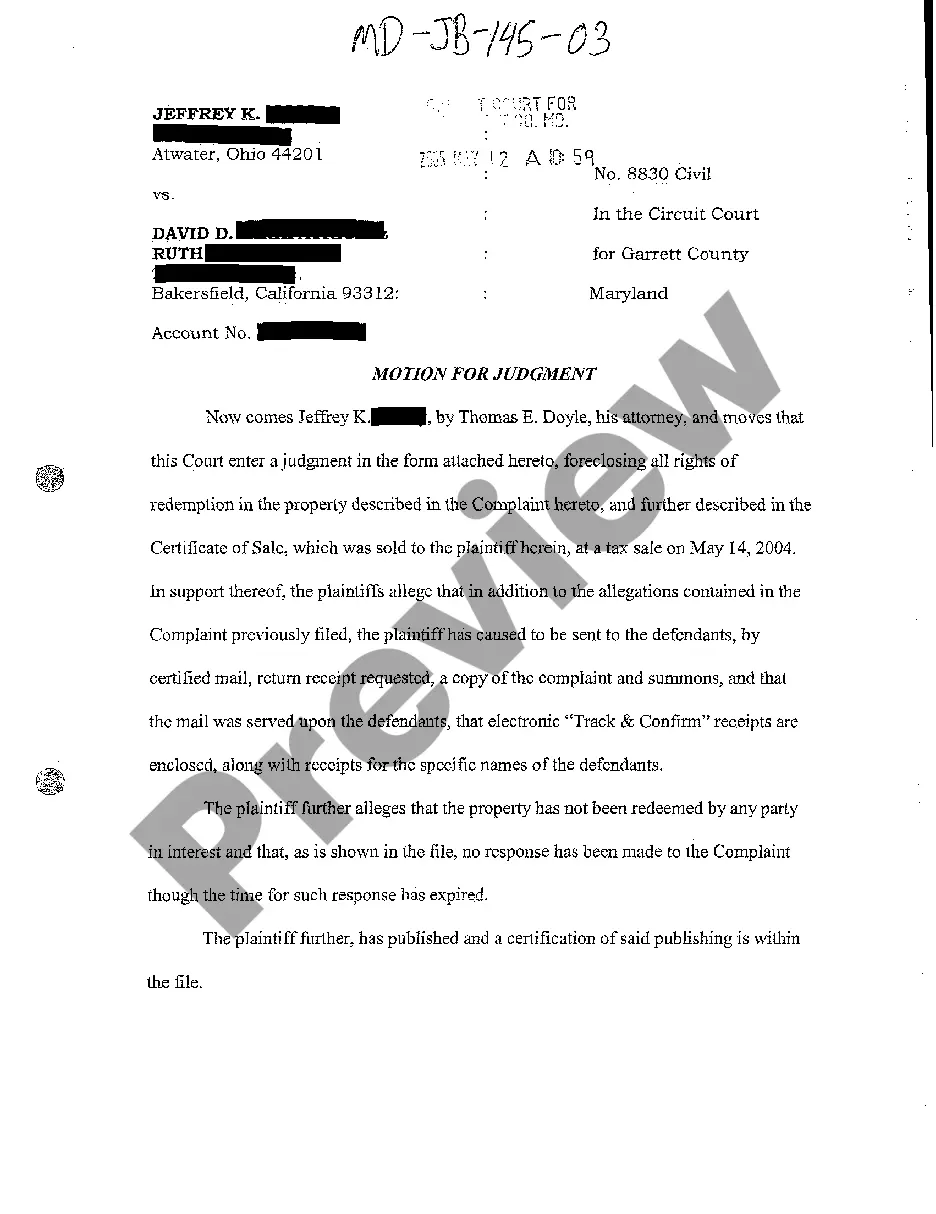

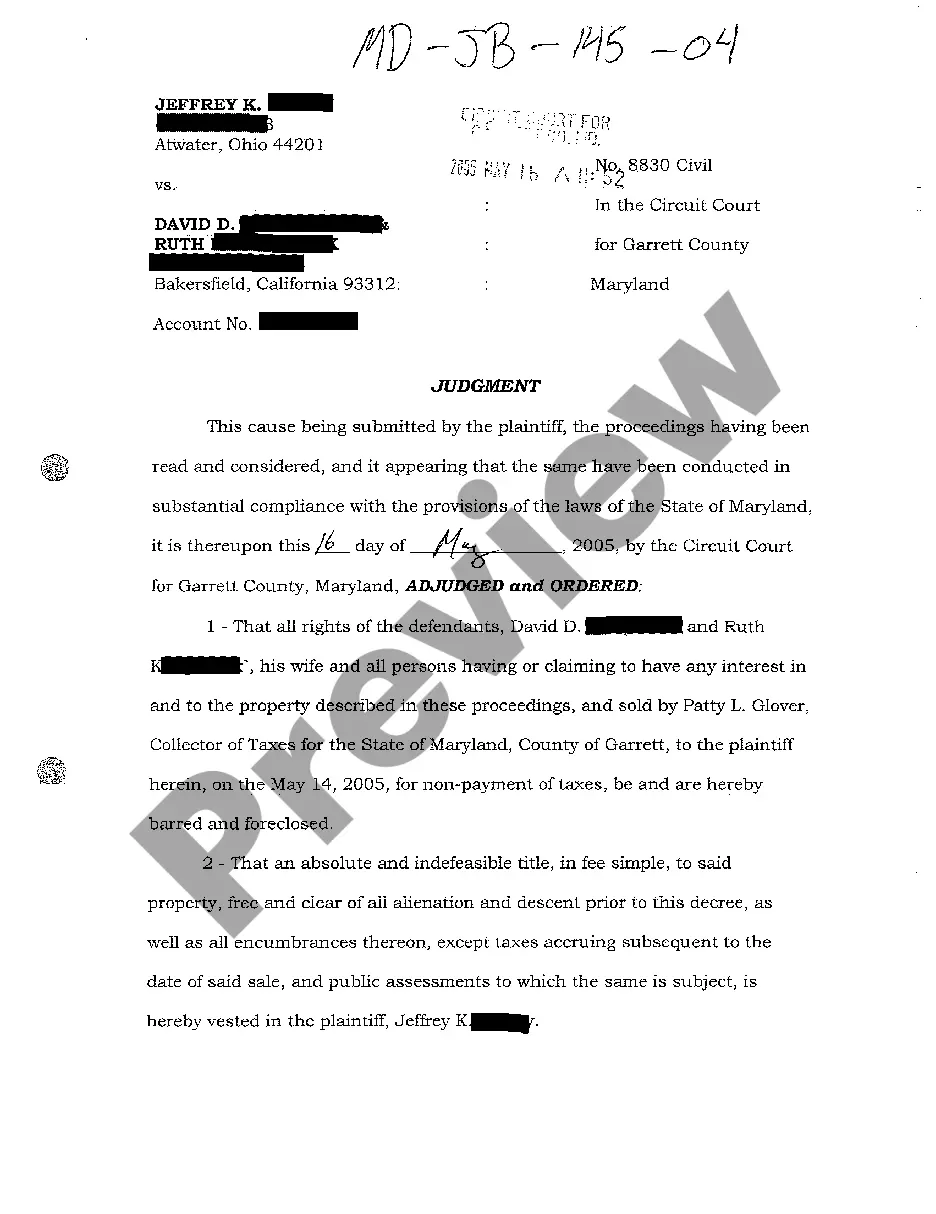

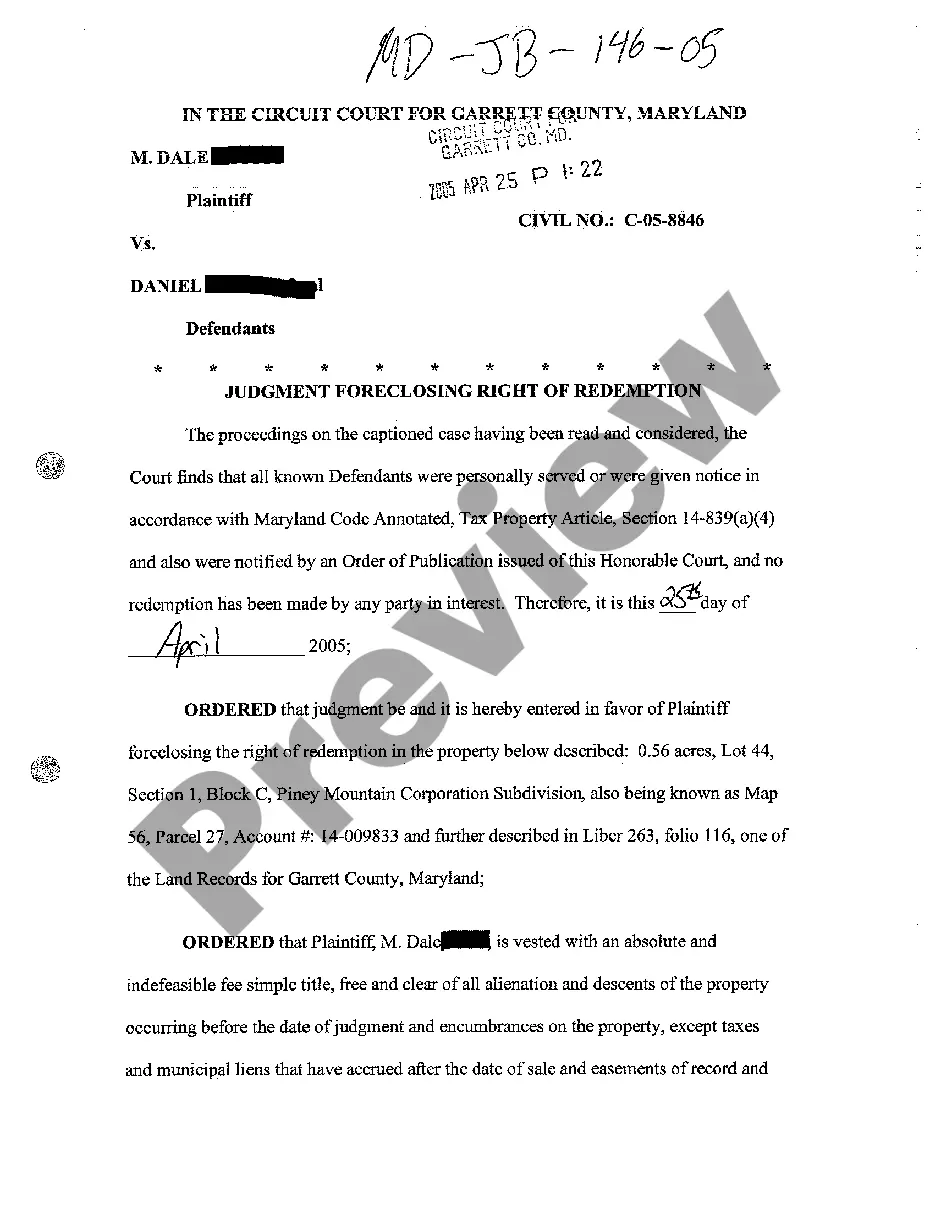

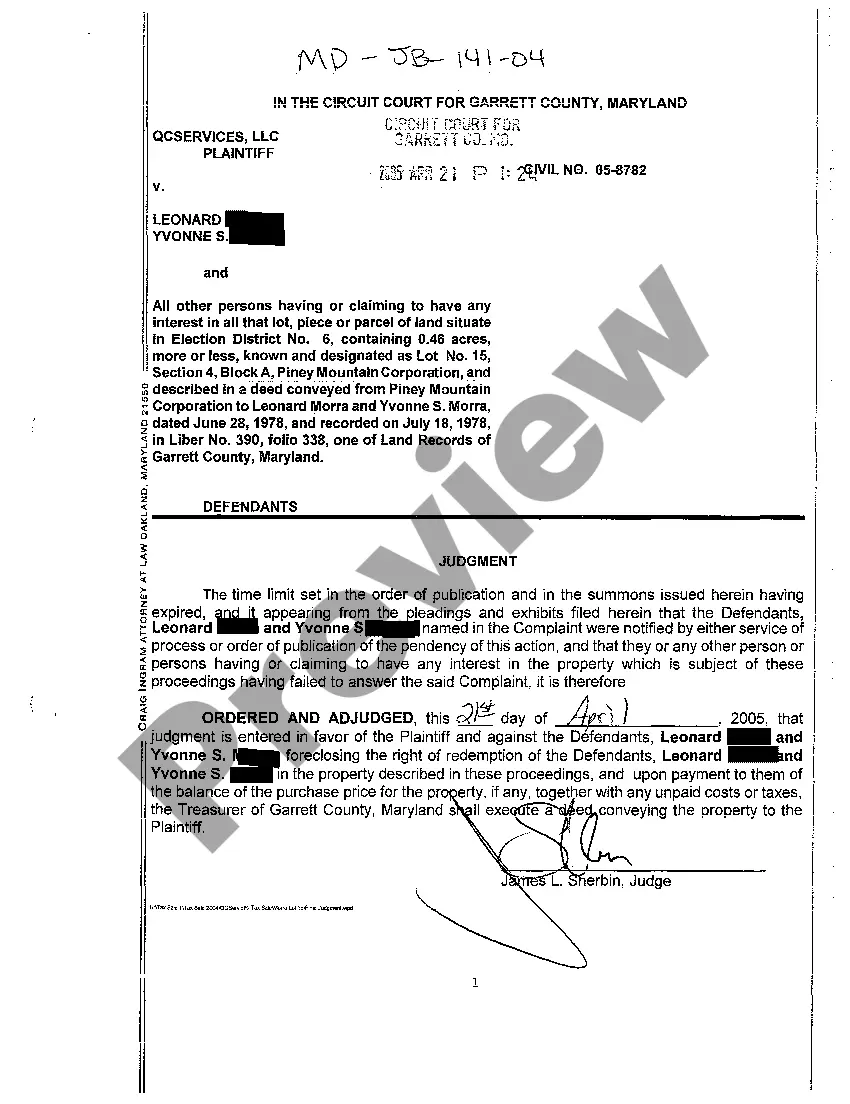

Maryland Judgment Foreclosing Right of Redemption

Description

How to fill out Maryland Judgment Foreclosing Right Of Redemption?

Greetings to the most excellent legal documents repository, US Legal Forms. Here, you can obtain any template such as Maryland Judgment Foreclosing Right of Redemption forms and preserve them (as many as you desire/require). Prepare official papers within a few hours, instead of days or even weeks, without spending a fortune on an attorney.

Acquire your state-specific template in just a few clicks and rest assured knowing that it was created by our licensed legal professionals.

If you’re already a registered user, simply Log In to your account and select Download next to the Maryland Judgment Foreclosing Right of Redemption you need. As US Legal Forms is online, you’ll consistently have access to your downloaded documents, no matter the device you’re employing. Find them in the My documents section.

Print the document and fill it with your or your business’s details. Once you’ve finalized the Maryland Judgment Foreclosing Right of Redemption, send it to your attorney for validation. It’s an extra measure but an essential one for ensuring you’re fully protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- If you do not possess an account yet, what are you waiting for.

- Follow our guidelines below to get started.

- If this is a state-specific template, verify its relevance in the state where you reside.

- Examine the description (if available) to determine if it’s the correct document.

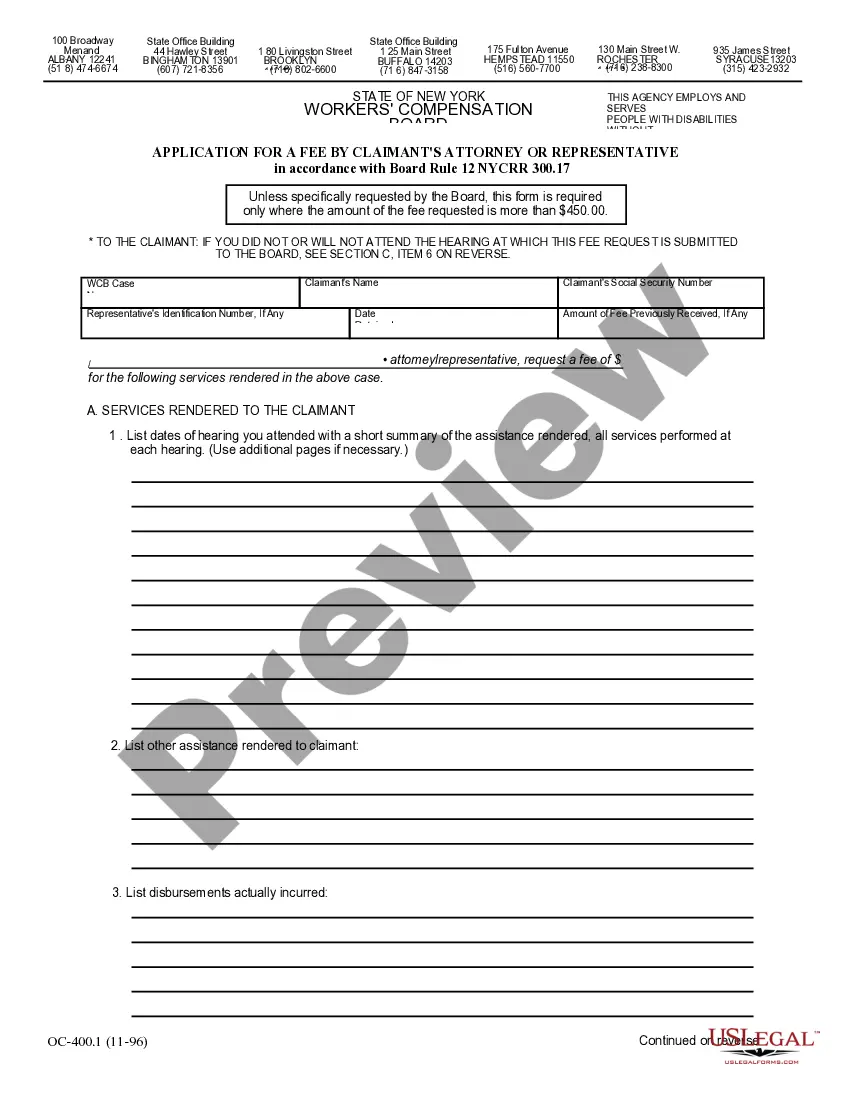

- Explore further content using the Preview option.

- If the template satisfies your needs, just click Buy Now.

- To create an account, select a subscription plan.

- Utilize a credit card or PayPal account to register.

- Download the document in your preferred format (Word or PDF).

Form popularity

FAQ

A Judgment foreclosing the right of redemption is a legal ruling that effectively removes a homeowner's ability to reclaim their property after a foreclosure sale. This situation arises once a court determines the property can no longer be redeemed, finalizing the new ownership. It's vital for homeowners to be informed about the implications of the Maryland Judgment Foreclosing Right of Redemption. Consulting with legal experts can provide clarity and guidance in these complex situations.

State Statutory Redemption Laws The redemption period in states that allow it ranges from just 30 days to as high as two years. Many states reduce the redemption period if the property has been abandoned, while borrowers may waive their redemption rights in many states.

Statutory redemption laws work if the winning bidder at the foreclosure sale bids a fair price for the home; otherwise, the former owner may not be able to redeem the property.The former homeowner also can opt to waive the right of redemption after the foreclosure sale.

Yes you can waive your right to redemption. Mortgage companies often will pay you for a waiver of your redemption rights in certain circumstances.

Yes, within one year after foreclosure sale only if foreclosing lender is purchaser at such sale. Borrower must give written notice of intent to redeem at the sale or within ten days before the sale. Borrower must post a redemption bond within 20 days of the sale.

(Md. Code Ann., Tax-Prop. § 14-833). These six months are called a "redemption period." (In Baltimore City, the redemption period is nine months from the date of sale for owner-occupied residential properties.