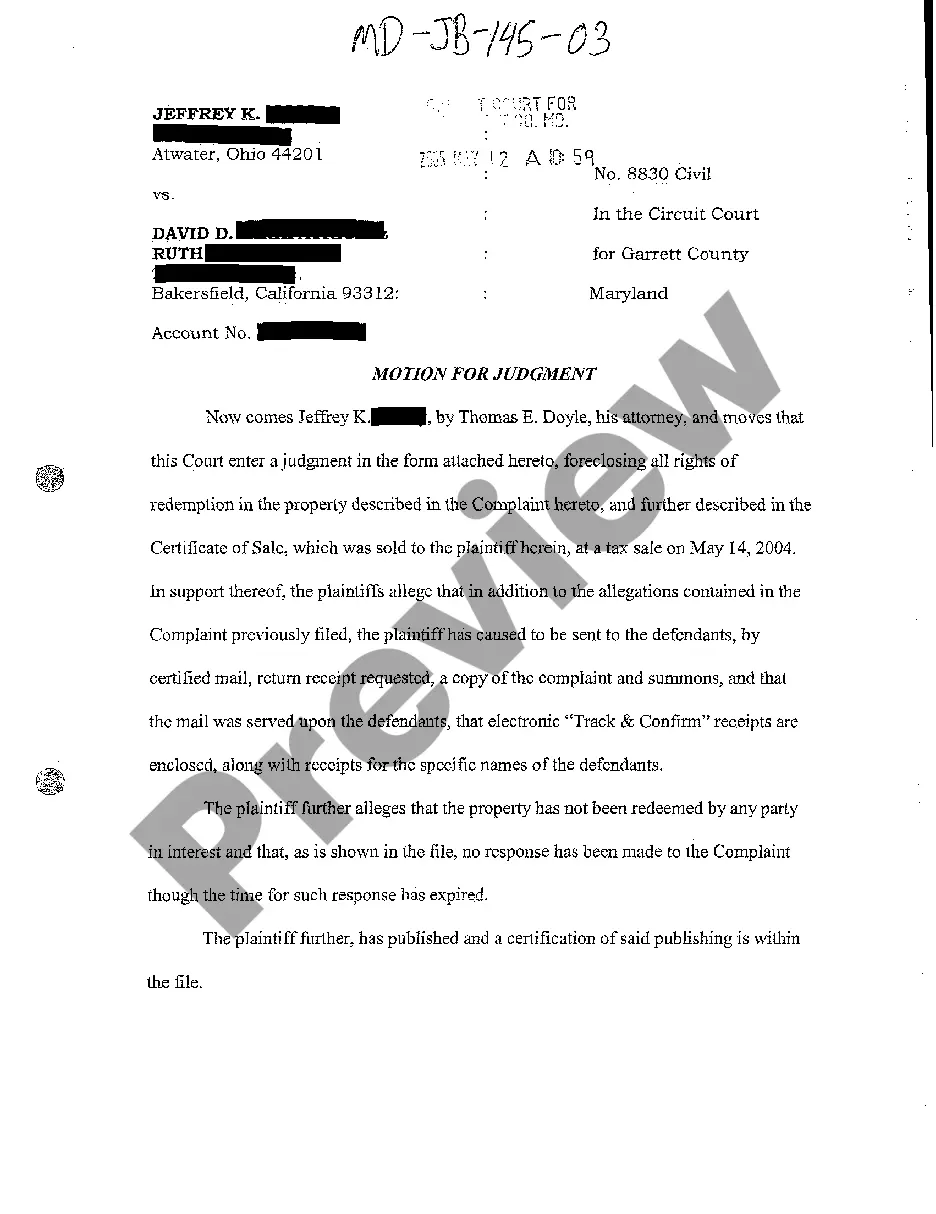

Maryland Motion for Judgment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Motion For Judgment?

You are invited to the most important legal documents library, US Legal Forms.

Here you can obtain any template such as Maryland Motion for Judgment templates and store them (as many as you desire or need).

Prepare official papers within a few hours, rather than days or even weeks, without spending a fortune on a lawyer.

If the example fulfills all your criteria, just click Buy Now. To set up an account, select a pricing option. Use a credit card or PayPal account to subscribe. Download the document in the format you need (Word or PDF). Print out the document and fill it in with your or your business’s details. Once you’ve completed the Maryland Motion for Judgment, forward it to your attorney for verification. It’s an additional step, but a necessary one to ensure you’re completely protected. Join US Legal Forms now and gain access to thousands of reusable templates.

- Acquire your state-specific sample in just a few clicks and feel assured knowing it was created by our licensed attorneys.

- If you’re already a subscribed member, simply Log In to your account and click Download next to the Maryland Motion for Judgment you want.

- Since US Legal Forms is internet-based, you’ll typically have access to your saved documents, regardless of the device you’re using.

- Find them under the My documents section.

- If you have not registered yet, what exactly are you anticipating.

- Review our instructions below to get started.

- If this is a state-specific document, verify its relevance in your residing state.

- Examine the description (if present) to determine if it’s the correct example.

Form popularity

FAQ

The 2-341 rule in Maryland pertains to the procedure for filings related to motions. This rule is vital for ensuring that motions, including those for judgments, are presented properly to the court. Understanding this rule can facilitate a smoother process and enhance your chances of success in obtaining a Maryland Motion for Judgment.

Collecting on a judgment in Maryland can involve various strategies, including garnishment, property liens, and executing judgments through the court. It is essential to follow the legal processes to ensure compliance. Utilizing the Maryland Motion for Judgment equips you with the tools necessary to effectively pursue collections.

To file a judgment lien in Maryland, you must obtain a certified copy of the judgment from the court. Next, you can file this copy with the land records office in the county where the property is located. A judgment lien created through the Maryland Motion for Judgment can attach to real estate, ensuring your claim for payment.

In general, the statute of limitations in Maryland for debt collection is three or four years after you stopped making payments, although it can be as long as 12 years in limited cases.

Generally, if a defendant fails to respond to a complaint you can get a default judgment after 45 days. However, the court system is very slow these days and it can take several months to get the court to issue the default judgment.

First, you can ask the court to set aside the default judgment and give you an opportunity to contest it. Next, you can settle the debt with the debt buyer for an amount less than what the default judgment is for. And finally you can eliminate the default judgment completely by filing for bankruptcy.

It does not restrict the creditor from reporting the debt to the credit reporting agencies or contacting you to collect the debt. Once a judgment is entered against you, the creditor has 12 years to collect it.

In Maryland, a judgment is only valid for 12 years. If you have not been able to collect your judgment within that time, you will have to renew the judgment to continue your collection efforts.

Generally, if a defendant fails to respond to a complaint you can get a default judgment after 45 days. However, the court system is very slow these days and it can take several months to get the court to issue the default judgment.

Is there a statute of limitations on my judgment? While there are time limits for collecting debts, once a court judgment is obtained, that limit does not apply. In California a judgment is valid for 10 years; however, if renewed prior to 10 years, it is extended for another decade.