Massachusetts Hauling Services Contract - Self-Employed

Description

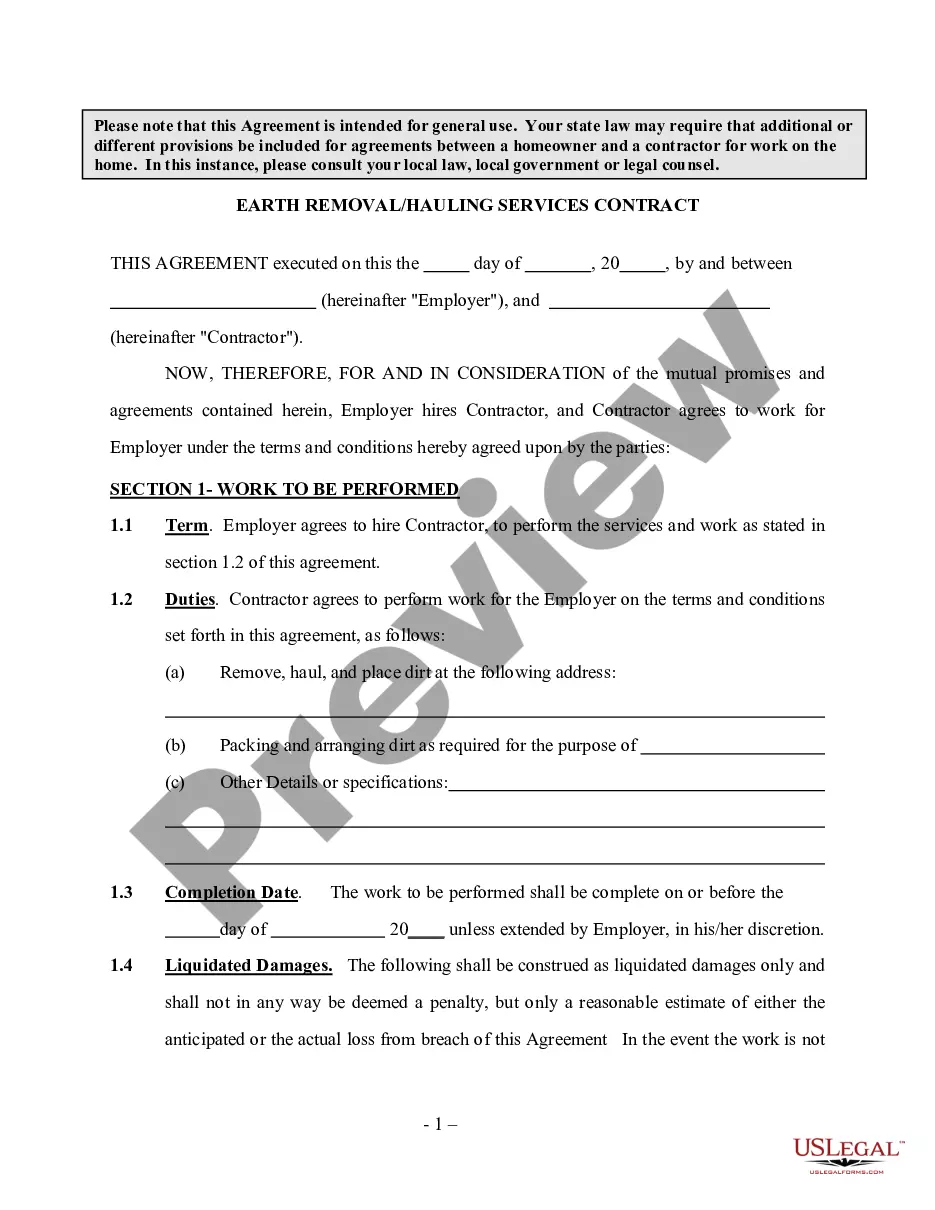

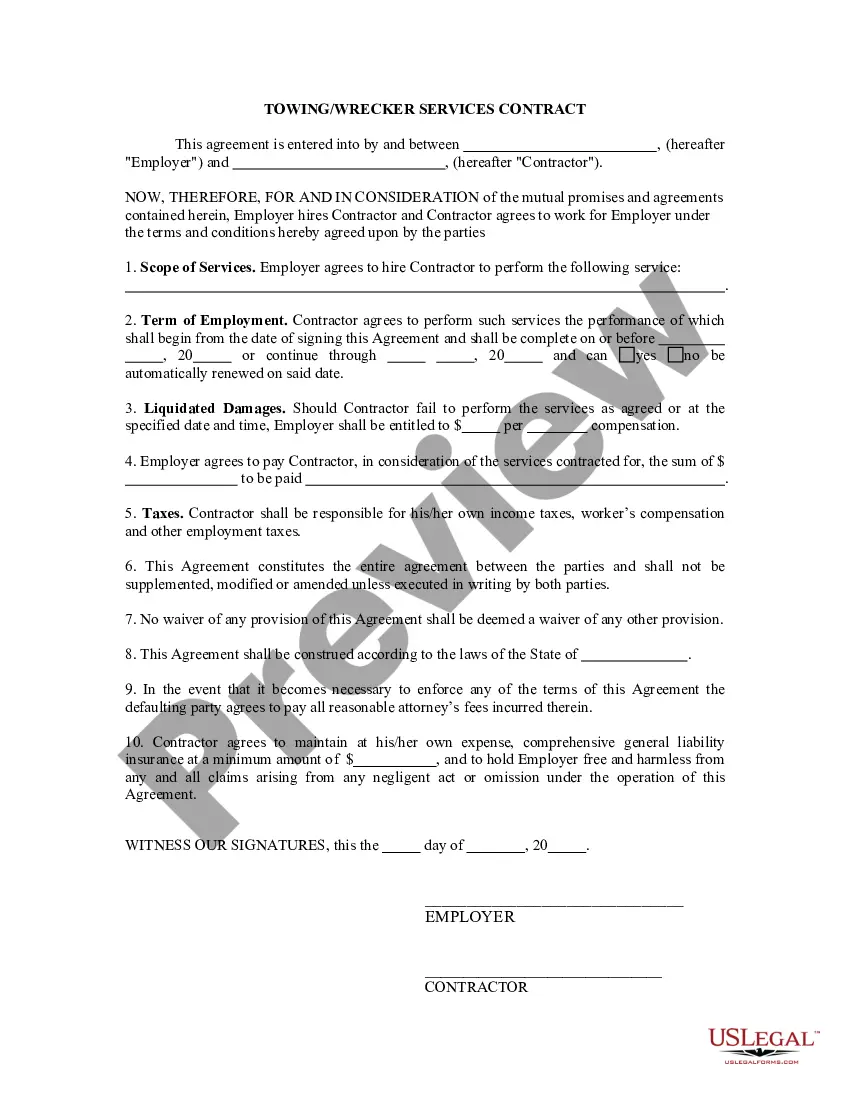

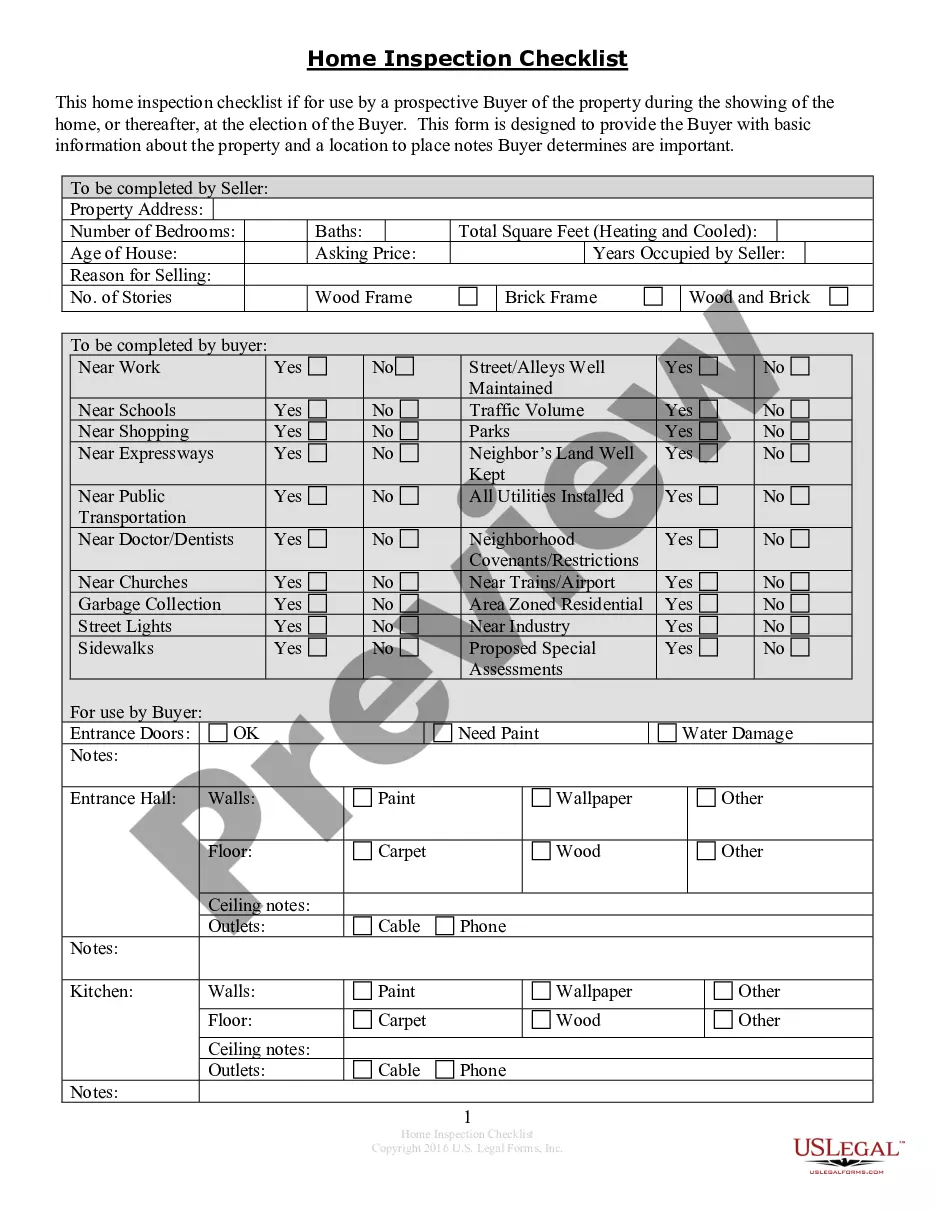

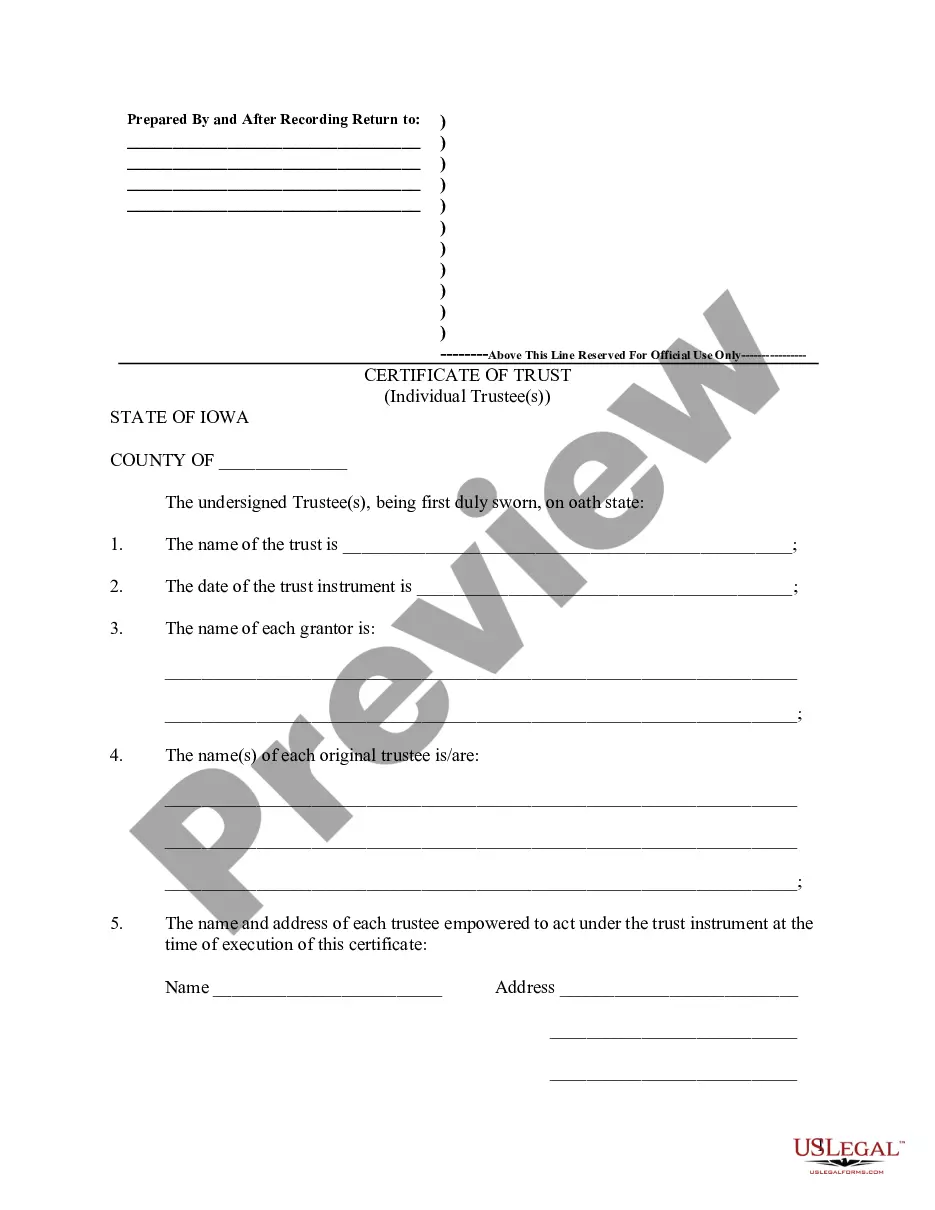

How to fill out Hauling Services Contract - Self-Employed?

Have you ever found yourself in a situation where you require documents for various organizational or particular reasons almost daily.

There are numerous legal document templates accessible online, but finding reliable ones isn’t straightforward.

US Legal Forms offers thousands of template options, including the Massachusetts Hauling Services Contract - Self-Employed, designed to comply with state and federal regulations.

Select the pricing plan you prefer, complete the required information to create your account, and process the payment using your PayPal or credit card.

Choose a convenient file format and download your document. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Massachusetts Hauling Services Contract - Self-Employed at any time if needed. Just click on the necessary form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and prevent errors. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Massachusetts Hauling Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/state.

- Use the Review button to examine the document.

- Check the summary to confirm you have chosen the correct form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that meets your needs and requirements.

- When you find the appropriate form, click on Get now.

Form popularity

FAQ

An independent contractor in trucking operates their business and typically hires their own truck and staff. Under a Massachusetts Hauling Services Contract - Self-Employed, these contractors are responsible for their expenses, including insurance and maintenance while retaining control over their operations. This model offers flexibility and potential tax advantages for drivers who wish to set their schedules and choose their loads. Utilizing platforms like uslegalforms can simplify the process of drafting a suitable contract, ensuring all legal requirements are met.

To create an effective independent contractor contract, begin by defining the scope of work clearly. Include essential details such as payment terms, project deadlines, and responsibilities. It’s wise to reference a legally sound template like the Massachusetts Hauling Services Contract - Self-Employed, as it can provide a solid foundation. Utilize resources such as uslegalforms to access templates and ensure your contract covers all necessary legal aspects.

An independent contractor in Massachusetts operates under their terms, distinct from traditional employees. They control their schedules, provide their equipment, and engage in business transactions based on agreements, such as a Massachusetts Hauling Services Contract - Self-Employed. By embracing this classification, you can enjoy the freedom to grow your hauling services business while managing your own operational decisions.

To be recognized as an independent contractor, you must control how and when you work, have the opportunity for profit or loss, and provide services outside the usual course of the business. Additionally, you typically work under a contract, like a Massachusetts Hauling Services Contract - Self-Employed, which outlines the terms of your engagement. This classification allows for greater flexibility in your work arrangements.

The new federal rule clarifies the classification of independent contractors, impacting various industries, including hauling services. Under this rule, the intention behind the work relationship takes precedence, focusing on the degree of control between the contractor and the employer. For those considering a Massachusetts Hauling Services Contract - Self-Employed, understanding this rule is crucial for compliance and benefits.

Yes, you can write your own legally binding contract, as long as it meets certain legal requirements such as clarity and mutual agreement between parties. Ensure that all necessary elements are included, including signatures and dates. For peace of mind, consider using resources from USLegalForms to create a robust Massachusetts Hauling Services Contract - Self-Employed that covers all bases.

To write a self-employed contract, begin by defining the services you will provide, compensation, and the duration of the agreement. Include provisions for revisions, payment schedules, and termination rights to ensure clarity. Accessing templates from USLegalForms can help you craft a solid Massachusetts Hauling Services Contract - Self-Employed tailored to your needs.

Yes, you can be an independent contractor in Massachusetts, provided you meet specific criteria set by state laws. Your work must be independent of the employer's control and centered on the completion of specific tasks. When engaging in such work, using a Massachusetts Hauling Services Contract - Self-Employed can help clarify your rights and responsibilities.

To write a contract for a 1099 employee, define the specific services expected, payment details, and the relationship between the parties. It is crucial to clarify that the individual is not an employee, but rather an independent contractor. Consider using USLegalForms to find reliable templates for your Massachusetts Hauling Services Contract - Self-Employed to ensure all legal criteria are met.

employment contract should detail the nature of the services provided, the duration of the contract, and compensation arrangements. Be sure to include payment schedules and termination conditions. With the right templates, such as those available at USLegalForms, you can create a comprehensive Massachusetts Hauling Services Contract SelfEmployed that addresses all essential points.