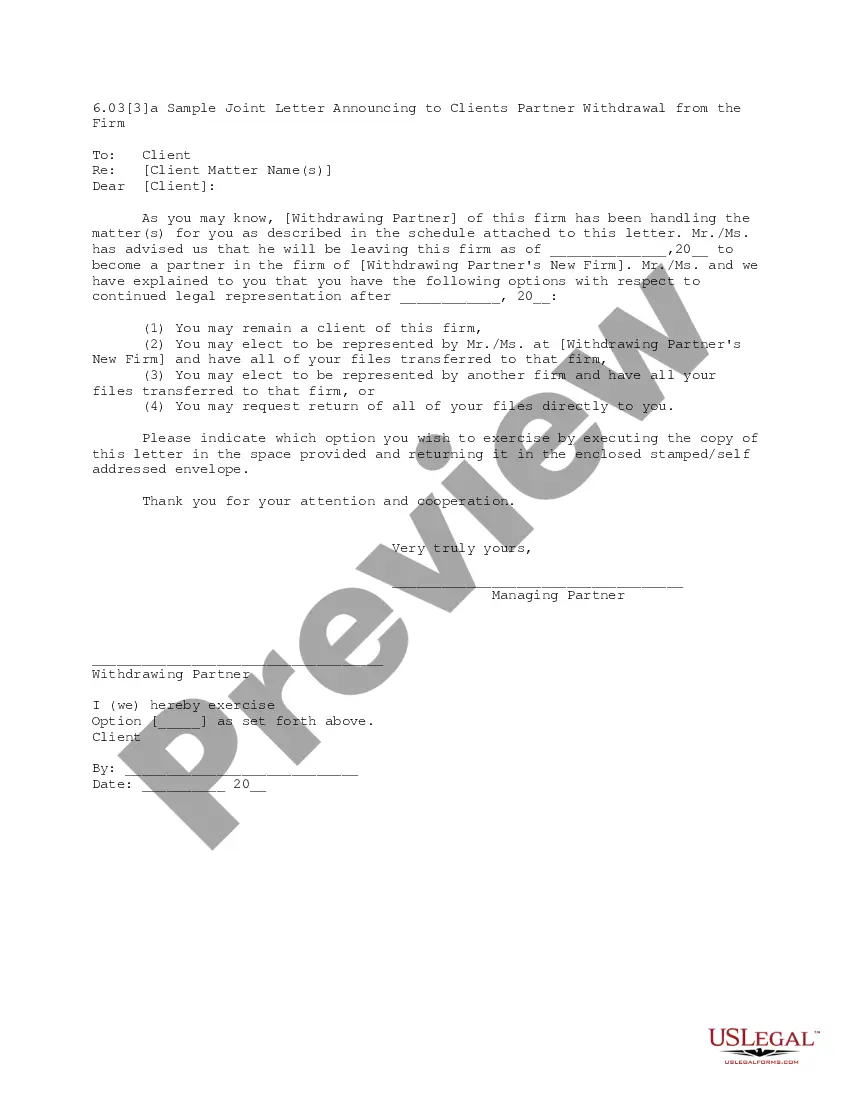

This is a letter from a withdrawing partner to the clients he has represented at his former firm. The letter is also mailed with an enclosure that gives the clients the options of transferring their files with the withdrawing attorney, remaining with the same firm, or choosing another firm to represent them. This letter includes an example of the enclosure with the file transfer options.

Alabama Letter from Individual Partner to Clients

Description

How to fill out Letter From Individual Partner To Clients?

If you want to full, down load, or print out lawful papers layouts, use US Legal Forms, the biggest assortment of lawful varieties, that can be found on the web. Use the site`s basic and handy lookup to obtain the papers you need. Different layouts for business and specific functions are categorized by groups and suggests, or key phrases. Use US Legal Forms to obtain the Alabama Letter from Individual Partner to Clients in just a couple of mouse clicks.

In case you are presently a US Legal Forms buyer, log in to your bank account and then click the Download button to obtain the Alabama Letter from Individual Partner to Clients. You may also entry varieties you earlier acquired from the My Forms tab of your bank account.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have selected the form for the proper area/region.

- Step 2. Use the Review option to look over the form`s articles. Do not neglect to read the outline.

- Step 3. In case you are unhappy together with the type, take advantage of the Look for industry towards the top of the screen to locate other variations in the lawful type design.

- Step 4. After you have identified the form you need, click on the Acquire now button. Opt for the rates strategy you like and put your accreditations to sign up on an bank account.

- Step 5. Method the purchase. You may use your credit card or PayPal bank account to finish the purchase.

- Step 6. Pick the structure in the lawful type and down load it on your product.

- Step 7. Full, change and print out or signal the Alabama Letter from Individual Partner to Clients.

Each lawful papers design you get is your own eternally. You may have acces to each type you acquired within your acccount. Click the My Forms portion and decide on a type to print out or down load again.

Be competitive and down load, and print out the Alabama Letter from Individual Partner to Clients with US Legal Forms. There are thousands of expert and express-distinct varieties you may use for your personal business or specific requirements.

Form popularity

FAQ

Now that partnerships and S corporations have the opportunity to deduct state taxes as C corporations do, they must also pay state taxes as C corporations do, which includes quarterly estimated tax payments and payments with extensions of time to file returns. Partnerships and S Corporations May Owe Tax with State Extensions cbh.com ? guide ? articles ? partnerships-an... cbh.com ? guide ? articles ? partnerships-an...

PPT ? S Corps, Limited Liability Companies, and PLLCs file a PPT form for their business privilege tax. The PPT form also includes the AL-, which is used for the annual report. Both are filed with Alabama's Department of Revenue. Alabama Business Privilege Tax: Everything You Need to Know upcounsel.com ? alabama-business-privilege... upcounsel.com ? alabama-business-privilege...

Individual and Corporate Tax This tax is owed by all corporations, limited liability entities, and disregarded entities which either are doing business in the State of Alabama, or are registered with the Alabama Secretary of State's Office to do business in Alabama.

Those whose filing status is ?Married Filing Joint Return? and whose gross income for the year is at least $10,500 must file an Alabama Individual Income Tax Return while an Alabama resident. Nonresidents must file a return if their Alabama income exceeds the allowable prorated personal exemption.

The Alabama Form 65 is similar to the federal Form 1065 in many ways. And, the Form 65 requires that an Alabama Schedule K-1 be completed for any entity that was a partner or owner during the taxable year. Partnership/Limited Liability Company Return of Income alabama.gov ? uploads ? 2021/10 alabama.gov ? uploads ? 2021/10

All partnerships Section 810-3-28-. 01 - Partnership Returns (1) (a) All partnerships having "substantial nexus" from property owned or business conducted in this state shall file the Alabama Form 65 on or before the due date, including extension. Partnership Returns, Ala. Admin. Code r. 810-3-28-.01 - Casetext casetext.com ? alabama-administrative-code ? sect... casetext.com ? alabama-administrative-code ? sect...

Only one Form 1065 is required per partnership or LLC, but each member of the entity must complete their own Schedule K-1 to file with the 1065 tax form, as well as their personal tax returns.

A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565.