Massachusetts Warranty Deed for Separate or Joint Property to Joint Tenancy

Description

How to fill out Massachusetts Warranty Deed For Separate Or Joint Property To Joint Tenancy?

Among a multitude of complimentary and paid instances available online, you cannot guarantee their dependability.

For instance, who produced them or whether they possess the qualifications to handle what you require them for.

Always remain composed and utilize US Legal Forms! Discover Massachusetts Warranty Deed for Separate or Joint Property to Joint Tenancy templates crafted by skilled legal professionals and escape the costly and time-consuming endeavor of searching for a lawyer and subsequently compensating them to draft a document for you that you can effortlessly obtain independently.

Choose a pricing plan and set up an account. Process the payment for the subscription with your credit/debit card or Paypal. Download the form in your preferred file format. After registering and processing your subscription fee, you may utilize your Massachusetts Warranty Deed for Separate or Joint Property to Joint Tenancy as often as you wish or as long as it remains valid in your state. Modify it in your preferred editor, complete it, sign it, and produce a physical copy. Achieve more for less with US Legal Forms!

- If you already hold a subscription, Log In to your account and locate the Download button adjacent to the form you seek.

- You will also have access to all your previously stored files in the My documents section.

- If you are using our website for the first time, adhere to the instructions below to obtain your Massachusetts Warranty Deed for Separate or Joint Property to Joint Tenancy promptly.

- Ensure that the document you view is applicable in the state where you reside.

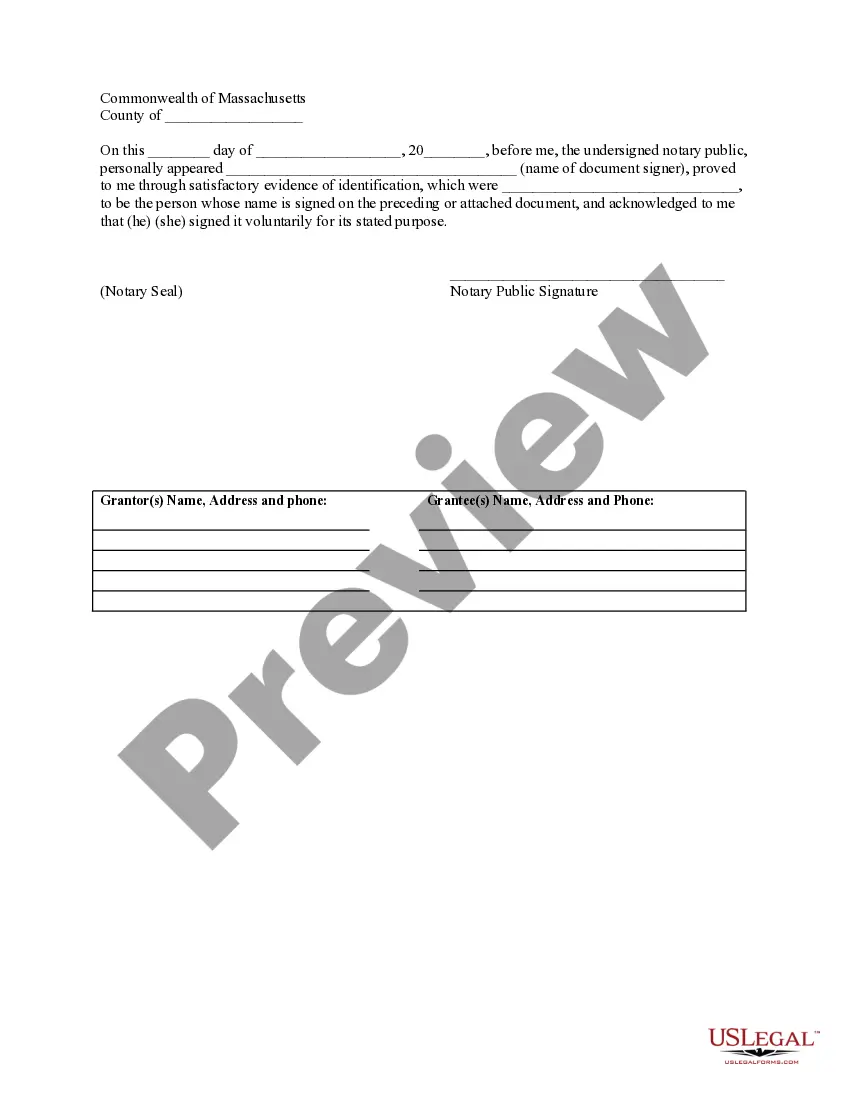

- Examine the template by reviewing the information using the Preview feature.

- Select Buy Now to initiate the ordering process or search for another template using the Search bar in the header.

Form popularity

FAQ

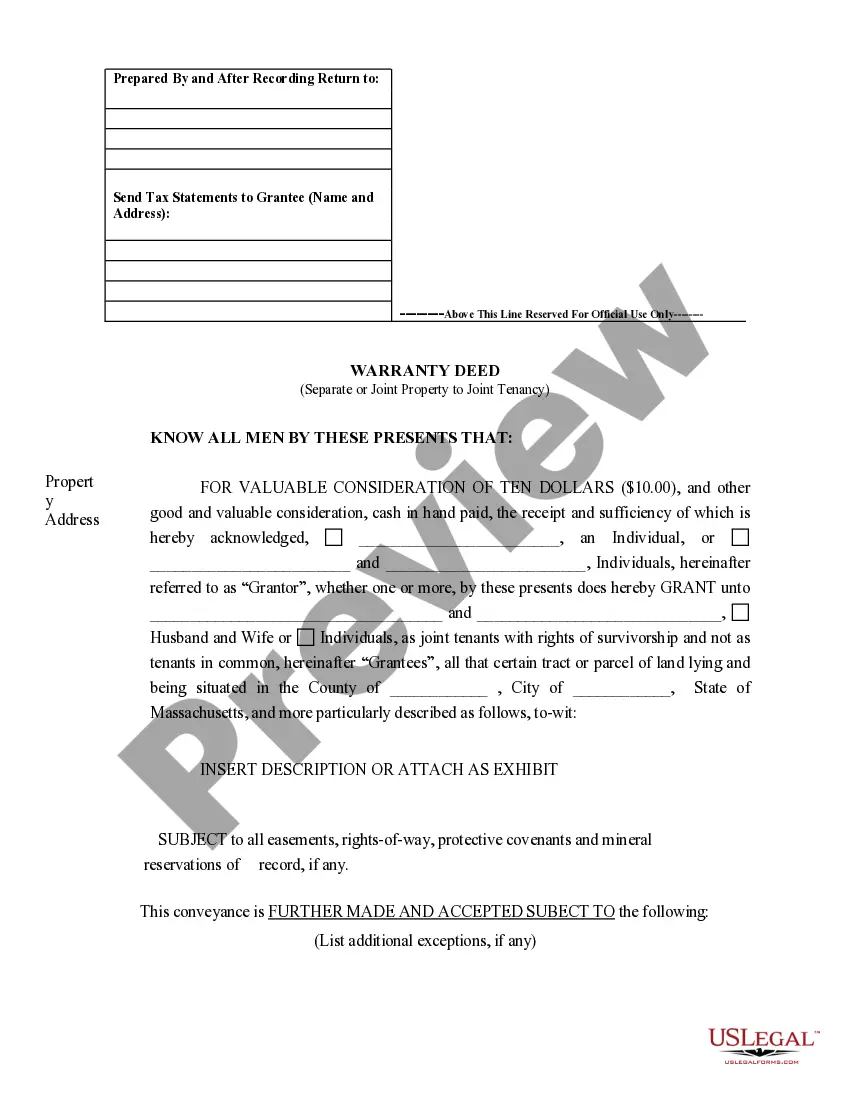

In Massachusetts, 'joint tenants' refers to co-ownership of property where each owner has an equal share and rights to the whole property. This arrangement includes the right of survivorship, which ensures that if one owner passes away, the other owner automatically inherits their share. This structure can be beneficial for couples or partners looking to secure their shared investment. Using a Massachusetts Warranty Deed for Separate or Joint Property to Joint Tenancy helps formalize this ownership arrangement effectively.

The best way to obtain a quitclaim deed is to use an online legal service that offers reliable templates. Services like US Legal Forms provide customized quitclaim deed forms tailored to Massachusetts laws. This approach ensures that your years of ownership are documented properly and legally. When creating a Massachusetts Warranty Deed for Separate or Joint Property to Joint Tenancy, using authentic resources eases the process.

If you look at the registered title to your own jointly owned property and the text isn't shown on it, you own it as joint tenants. If it is there, you own it as tenants-in-common.

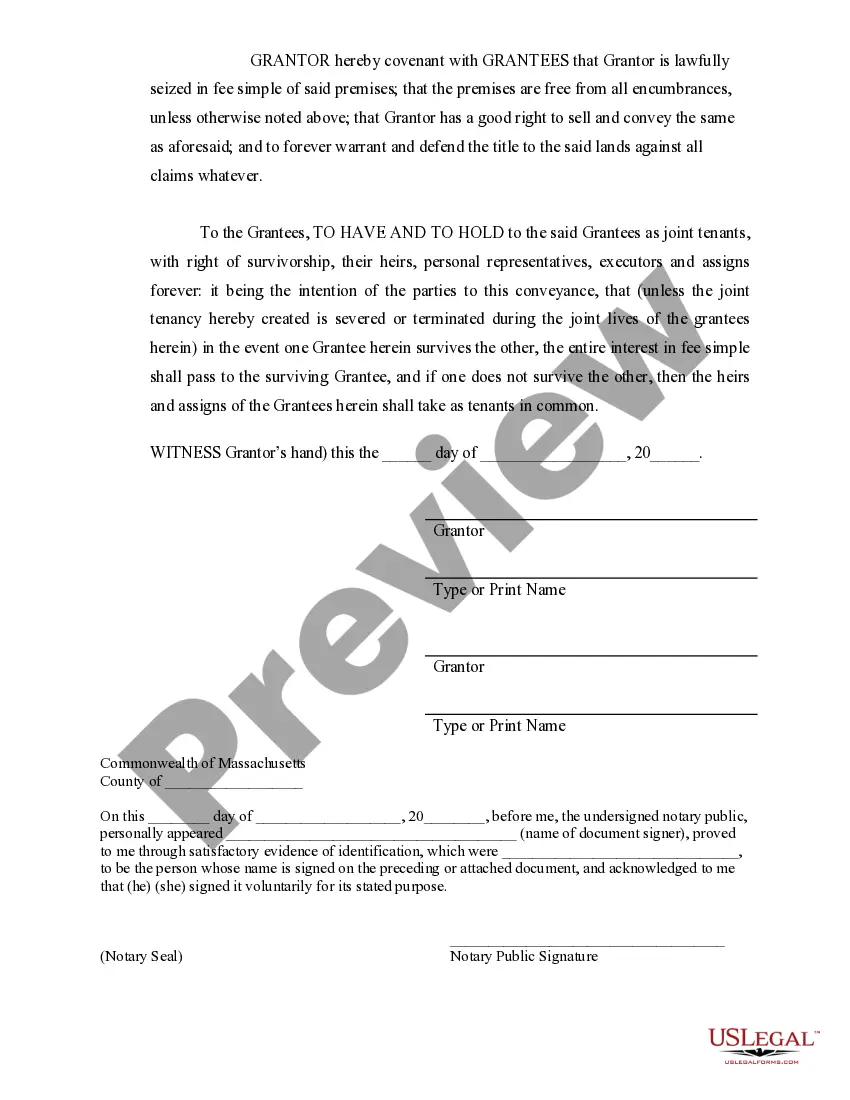

Survivorship rights take precedence over any contrary terms in a person's will because property subject to rights of survivorship is not legally part of their estate at death and so cannot be distributed through a will.

What Is the Difference Between a Warranty Deed & a Survivorship Deed?A warranty deed is the most comprehensive and provides the most guarantees. Survivorship isn't so much a deed as a title. It's a way to co-own property where, upon the death of one owner, ownership automatically passes to the survivor.

For example, joint tenants must all take title simultaneously from the same deed while tenants in common can come into ownership at different times. Another difference is that joint tenants all own equal shares of the property, proportionate to the number of joint tenants involved.

A joint tenant can indeed sever the right of survivorship WITHOUT the consent of the other joint tenants.In order to sever the right of survivorship, a tenant must only record a new deed showing that his or her interest in the title is now held in a Tenancy-in-Common or as Community Property.

In title law, when we talk about tenants, we're talking about people who own property.When joint tenants have right of survivorship, it means that the property shares of one co-tenant are transferred directly to the surviving co-tenant (or co-tenants) upon their death.

In that case, you simply divide your interest into equal parts. For example, if there are two of you, you would each agree to divide your shares 50/50. If you have a TIC, you have more options, because you don't have to divide your interests 50/50. Instead, you can divide the shares into fractional ownership.

With a Survivorship Deed in place, when one of the parties in a joint tenancy dies, the other party (or parties) takes over the deceased party's interest in the property instead of it passing to the deceased's heirs or beneficiaries.