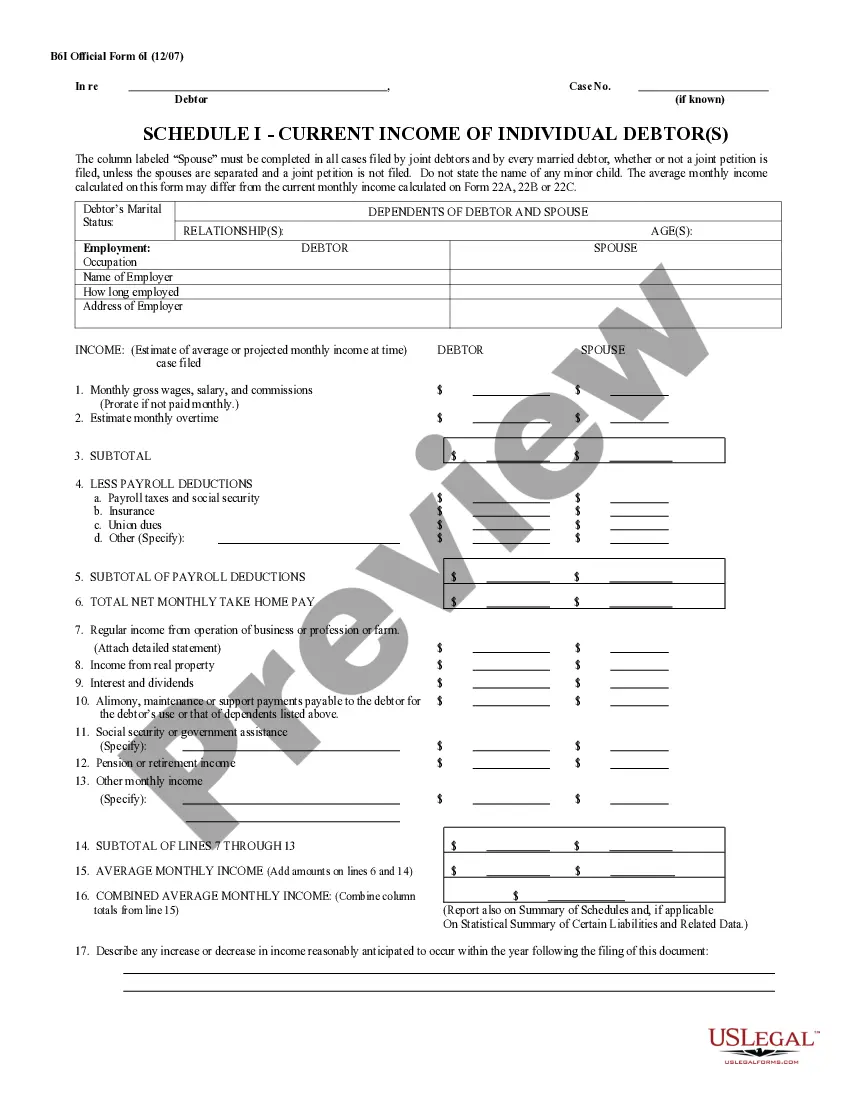

Nebraska Worksheet 1 — Basic Net Income and Support Calculation (DC 6:1(1)) is a form used by the Nebraska child support enforcement agency to calculate the basic net income and the corresponding support amount for a custodial parent. This form is used to help establish and/or modify a child support order based on the parent’s combined/total net income. The form consists of three major sections: Basic Support Calculation, Support Adjustment Worksheet, and Support Adjustment Factors. The Basic Support Calculation section is used to calculate the basic support obligation based on the combined/total net income of both parents. The Support Adjustment Worksheet section is used to determine if the basic support obligation should be adjusted according to Nebraska State Statute 43-512.04. The Support Adjustment Factors section is used to calculate the adjustment factors that may apply to the support obligation. The adjustment factors include the number of minor children involved, the amount of time the custodial parent has physical custody of the children, and other factors. The form also includes calculations for health insurance premiums, daycare costs, and other support obligations.

Nebraska Worksheet 1 - Basic Net Income and Support Calculation (DC 6:1(1))

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Nebraska Worksheet 1 - Basic Net Income And Support Calculation (DC 6:1(1))?

How much time and resources do you usually spend on composing formal paperwork? There’s a better option to get such forms than hiring legal experts or spending hours searching the web for an appropriate template. US Legal Forms is the top online library that provides professionally drafted and verified state-specific legal documents for any purpose, such as the Nebraska Worksheet 1 - Basic Net Income and Support Calculation (DC 6:1(1)).

To get and complete a suitable Nebraska Worksheet 1 - Basic Net Income and Support Calculation (DC 6:1(1)) template, adhere to these simple steps:

- Examine the form content to ensure it complies with your state requirements. To do so, read the form description or use the Preview option.

- In case your legal template doesn’t meet your needs, locate another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Nebraska Worksheet 1 - Basic Net Income and Support Calculation (DC 6:1(1)). If not, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally secure for that.

- Download your Nebraska Worksheet 1 - Basic Net Income and Support Calculation (DC 6:1(1)) on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most reliable web solutions. Sign up for us now!

Form popularity

FAQ

The court orders a flat percentage of 25% of the non-custodial parent's income to be paid in child support to the custodial parent.

If the person receiving the child support (Obligee) agrees that the child support should be terminated, that person can sign the form entitled Waiver of Notice on Termination of Child Support....For use when: child is 19 years. child has married. child has died. child has been emancipated by court order.

Typically, parents must pay child support until the child turns 19. The amount of these payments depends on Nebraska's child support guidelines. These guidelines are the rules for calculating child support.

In Nebraska, criminal non-support is a crime that occurs when any parent fails, refuses, or neglects his/her obligation to support the child. For example, refusal to pay hospital costs. Do not forget that criminal non-support is a class iv felony charge in the state.

Nebraska child support is meant to cover basic needs such as food, clothing, shelter, and medical services. The court may rule additional coverage for other needs as well. Joint, or shared, custody is the most common ruling for child care between parents who are no longer together.

If the person receiving the child support (Obligee) agrees that the child support should be terminated, that person can sign the form entitled Waiver of Notice on Termination of Child Support.

If both parents share custody in Nebraska, who pays child support? Yes, in Nebraska there will always be a payment unless the parents have the same income and spend the exact same amount of time with the child.

The age of emancipation is 19 in Nebraska. Child support is paid through to the birth month of the child when they reach age 19, unless otherwise determined in the court order.