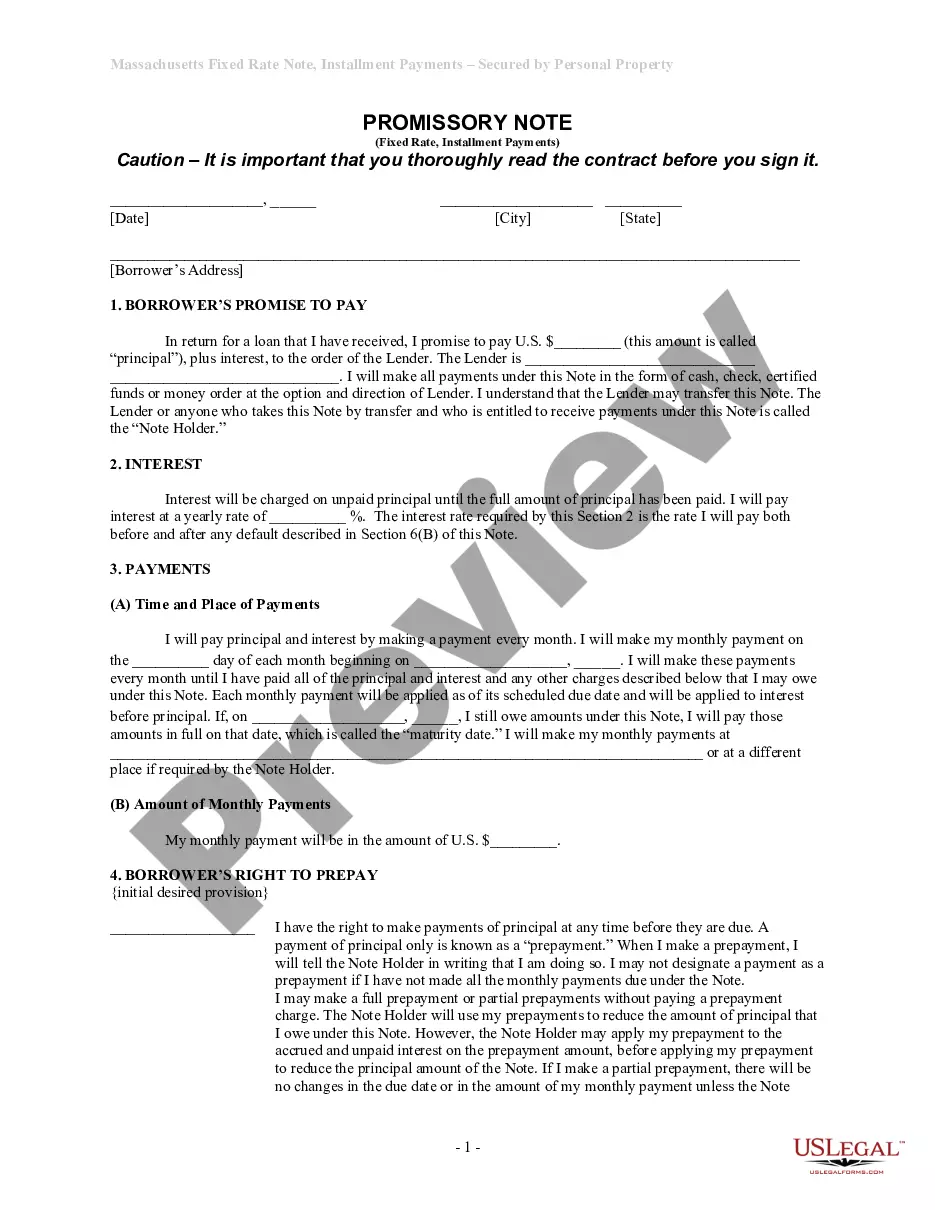

Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate

Overview of this form

The Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines a borrower's promise to repay a loan at a specified interest rate in fixed monthly installments. This form is unsecured, meaning it is not backed by collateral, and is designed to protect both the lender and the borrower by clearly defining the terms of repayment, including interest rates and payment schedules. Unlike secured notes, this document does not require property or assets to guarantee the loan, making it suitable for personal or informal loans.

Form components explained

- Details of the borrower and lender, including names and addresses.

- Loan amount, referred to as principal, and fixed interest rate.

- Scheduled payment details, including frequency and due dates.

- Provisions for prepayment, including any applicable penalties.

- Consequences of default, including late fees and potential legal actions.

- Notices that must be exchanged between the borrower and lender.

Common use cases

This form is useful when an individual or entity needs to borrow money without securing the loan with collateral. It is commonly used in personal loans among friends, family, or informal lending situations, as well as for smaller business loans where the lender and borrower wish to establish clear repayment terms. It is particularly suitable when both parties agree on the repayment terms and want to ensure legal enforceability of the loan agreement.

Intended users of this form

- Individuals seeking a personal loan without collateral.

- Friends or family members lending money informally.

- Small business owners needing a straightforward loan agreement.

- Lenders looking for a legally binding repayment structure.

- Borrowers who want a clear understanding of repayment obligations and interest terms.

Completing this form step by step

- Identify the parties by entering the names and addresses of the borrower(s) and lender.

- Specify the loan amount, which is the principal, and the fixed interest rate.

- Enter the payment schedule, including the start date and monthly due dates.

- Include any provisions for prepayments and penalties if applicable.

- Ensure all parties review the terms and sign where indicated to make the document legally binding.

Does this document require notarization?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Not entering the correct loan amount or interest rate.

- Failing to specify a clear payment schedule or start date.

- Overlooking the need for both parties to sign the document.

- Not discussing or understanding the implications of the prepayment provisions.

- Ignoring local laws that might affect the enforceability of the note.

Benefits of using this form online

- Quick and easy access to legally vetted forms tailored for your state.

- Editable templates allow you to customize terms to fit your situation.

- Convenient downloading and printing options for immediate use.

- Peace of mind knowing the form complies with local legal requirements.

- Faster completion and less hassle compared to traditional legal consultations.

Looking for another form?

Form popularity

FAQ

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.