Massachusetts Heirship Affidavit - Descent

About this form

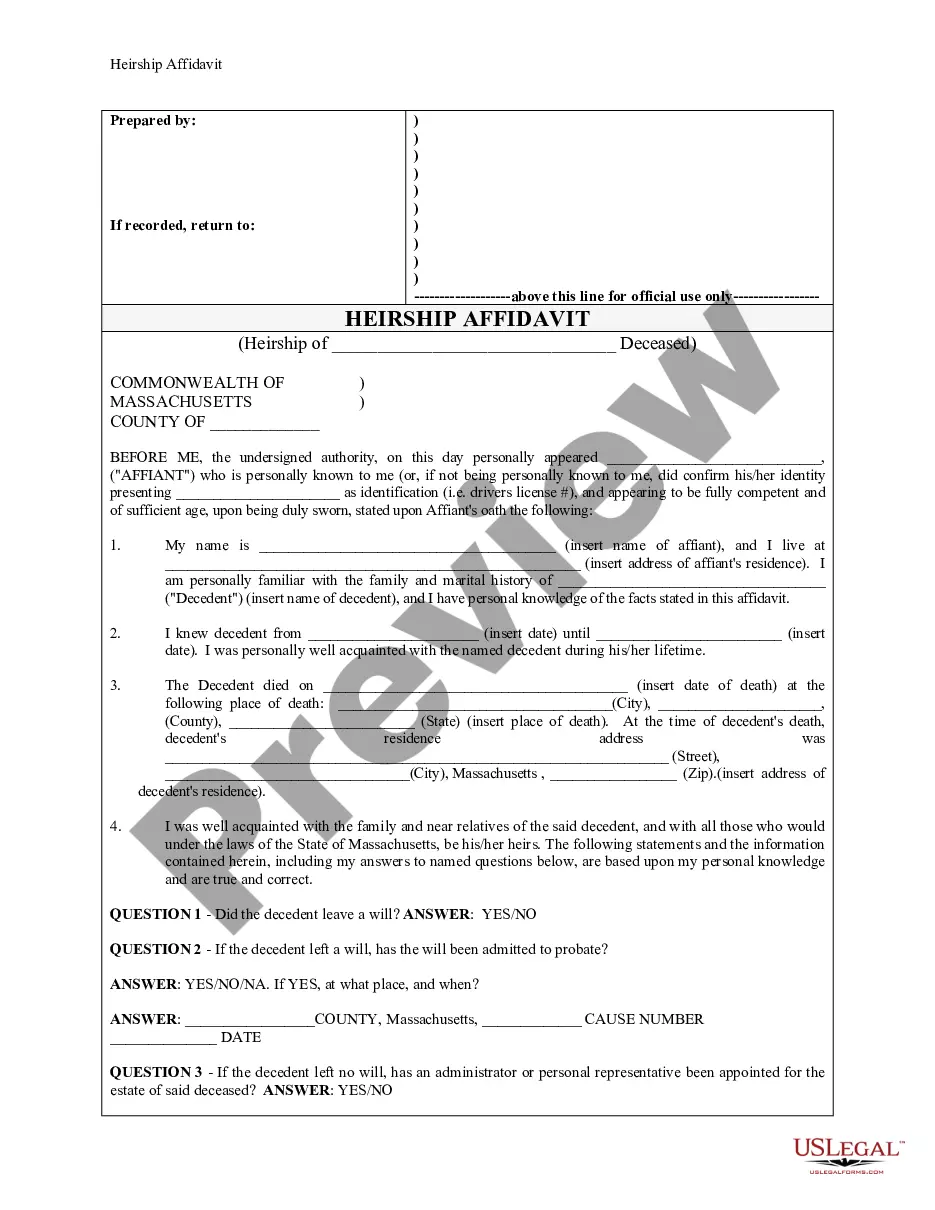

The Heirship Affidavit - Descent is a legal document used by an individual to declare the heirs of a deceased person when no will exists or when there is a need to clarify the succession of assets. This affidavit helps establish rightful ownership of both personal and real property and may be filed in official land records if required. Unlike probate documents, which involve the court, the Heirship Affidavit can be prepared without lengthy legal proceedings and is often signed by someone who is not an heir to ensure impartiality.

Form components explained

- Affiant's personal information and signature.

- Details about the deceased, including their name and date of death.

- Acknowledgment of the deceased's marital and family history.

- Responses to questions regarding the existence of a will and appointment of an administrator.

- Information on surviving heirs such as children, spouses, and other relatives.

- Declaration regarding real estate owned by the deceased.

When to use this document

This form is essential in situations where a person dies without a will (intestate) and there is a need to identify heirs for the distribution of assets. It can be utilized when an heir wishes to sell or transfer property but must first establish legal ownership as the rightful heir. Additionally, it is beneficial when there is a need to clarify family relationships for purposes of estate administration.

Who should use this form

- Individuals who are heirs or beneficiaries claiming rights to property of a deceased relative.

- Affiants who are not related to the deceased but have knowledge of the family structure.

- Personal representatives or administrators of the estate handling asset transfers.

How to prepare this document

- Identify the affiant and provide their contact information.

- Fill in the decedent's details, including name, date of death, and residence.

- Respond to the questions regarding the existence of a will and administration of the estate.

- List all surviving heirs, including children and spouses, along with their addresses and birth dates.

- Declare any known debts or real estate owned by the decedent.

- Sign the affidavit in front of a notary public for validation.

Does this form need to be notarized?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include complete information about all heirs.

- Not providing sufficient identification for the affiant during notarization.

- Omitting details about existing debts or property owned by the deceased.

- Incorrectly answering questions about the existence of a will or probate process.

Advantages of online completion

- Convenient access to legal forms at any time without the need for an attorney.

- Editable templates that can be tailored to specific situations and needs.

- Reliable legal information provided by licensed attorneys ensures accuracy.

- Easy download and storage for personal use or sharing with relevant parties.

Main things to remember

- The Heirship Affidavit - Descent is crucial for establishing heirs and transferring property when a will is not present.

- Clear and complete information is essential for the affidavit's effectiveness and legal acceptance.

- Notarization of the affidavit is required for it to hold legal weight in property transactions.

- This form simplifies the process of clarifying inheritance rights without the need for probate court, making it a valuable tool for heirs.

Looking for another form?

Form popularity

FAQ

An affidavit of heirship is needed to transfer a deceased person's interest in real or personal property to his or her heirs when the decedent dies without leaving a last will and testament or without disposing of all of his or her property in a will.

Degrees of kinship are used to identify heirs at law in the next of kin category ONLY if there are no members in the first four groups of heirs: (1) surviving spouse, (2) children and their descendants, (3) parents, and (4) brothers/sisters and their descendants.

If you die intestate, according to Massachusetts intestacy law, everything goes to your next of kin. Your next of kin are the people who have the closest relation to you. If you're married, then that's your spouse. If you're not married, your closest blood relations or equivalent, will inherit your property.

"If you die without a will in Massachusetts, your assets will go to your closest relatives under state 'intestate succession' laws.

When a person who owns real property dies intestate, and there is no survivor mentioned in the deed, the heirs of the decedent, must file an affidavit of descent to establish their chain of title to the property. This affidavit, is known as an affidavit of descent.

An heir-at-law is anyone who's entitled to inherit from someone who dies without leaving a last will and testament or other estate plans.

"If you die without a will in Massachusetts, your assets will go to your closest relatives under state 'intestate succession' laws.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.

Heirs at law are persons entitled to receive the Decedent's property under the intestacy succession laws if there is no will. For dates of death on or after March 31, 2012, the Massachusetts Uniform Probate Code, G. L.