Louisiana Sale and Mortgage

Description

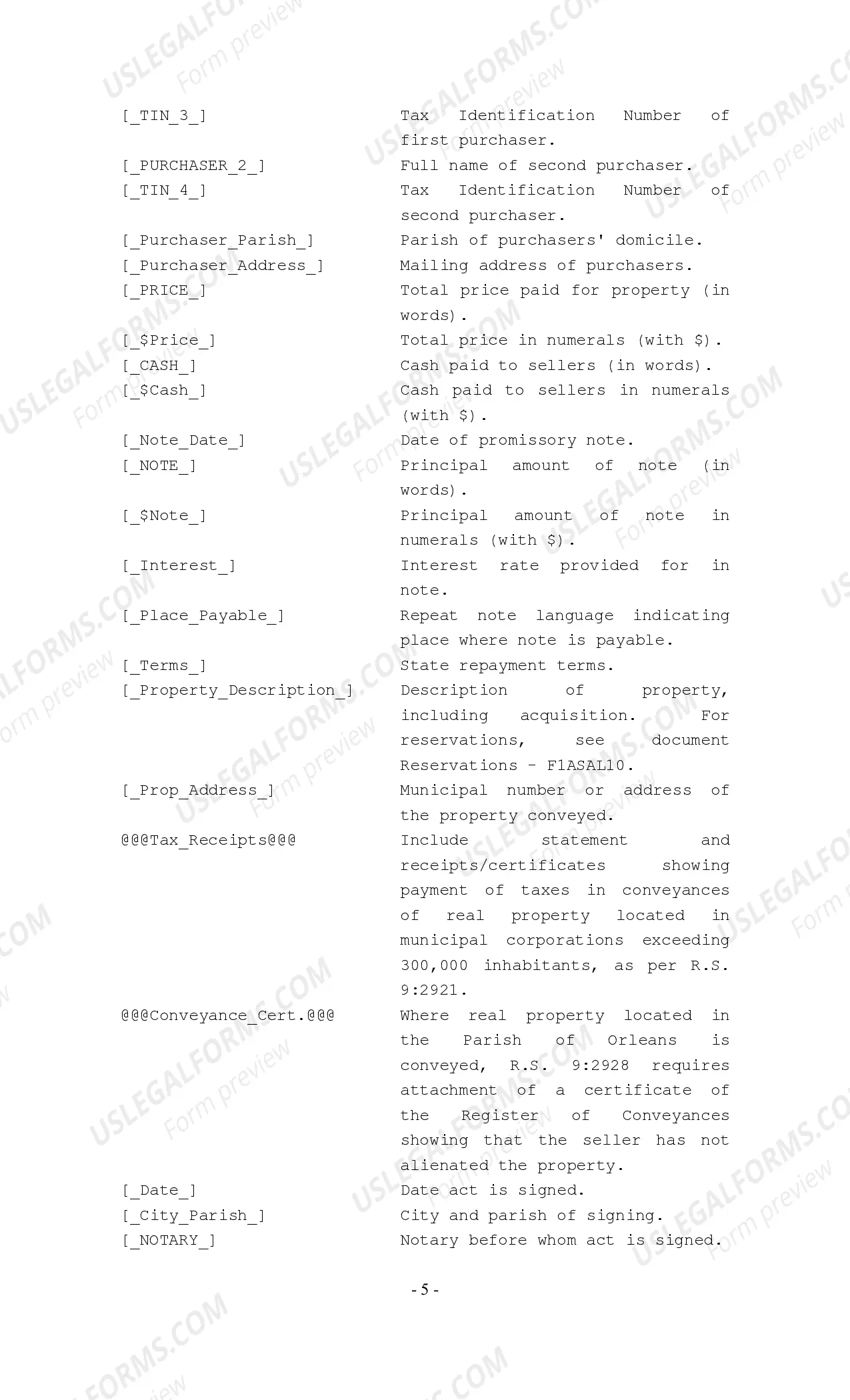

How to fill out Louisiana Sale And Mortgage?

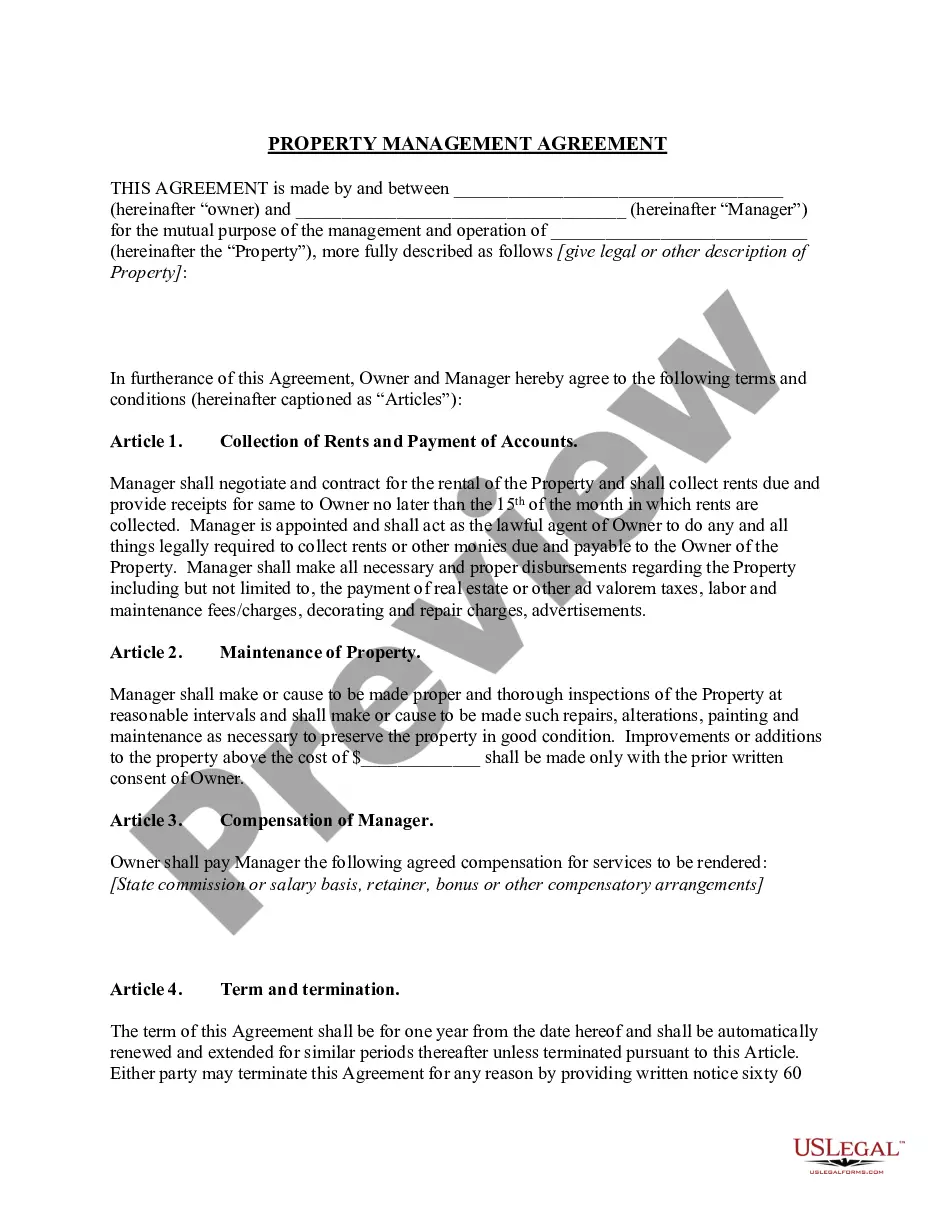

You are invited to the most important legal documents repository, US Legal Forms. Here, you will discover various templates such as Louisiana Sale and Mortgage documents and download them (as many as you want/need). Create formal documents within a few hours, rather than days or weeks, without incurring excessive costs with a lawyer. Acquire the state-specific template in just a couple of clicks and feel assured knowing it was prepared by our state-certified legal experts.

If you’re already a registered member, simply Log Into your account and click Download next to the Louisiana Sale and Mortgage form you wish to obtain. Because US Legal Forms is an online platform, you’ll always have access to your saved forms, no matter what device you are using. View them within the My documents section.

If you do not have an account yet, what are you waiting for? Follow our guidelines below to get started.

Once you’ve finished the Louisiana Sale and Mortgage, forward it to your legal advisor for confirmation. It’s an additional step but a vital one for ensuring you’re thoroughly protected. Join US Legal Forms today and gain access to a vast array of reusable templates.

- If this is a state-specific template, verify its relevance in the state you reside in.

- Review the description (if provided) to determine if it’s the right template.

- Explore additional content with the Preview feature.

- If the template meets all your criteria, simply click Buy Now.

- To establish your account, select a pricing option.

- Utilize a credit card or PayPal account to register.

- Download the document in the desired format (Word or PDF).

- Print the file and complete it with your/your business’s details.

Form popularity

FAQ

Title fees (or attorney fees) Pre-paids and escrow (property taxes and homeowner's insurance) Mortgage insurance. Loan-related fees (lender fees) Property-related fees (may also be found in lender fees)

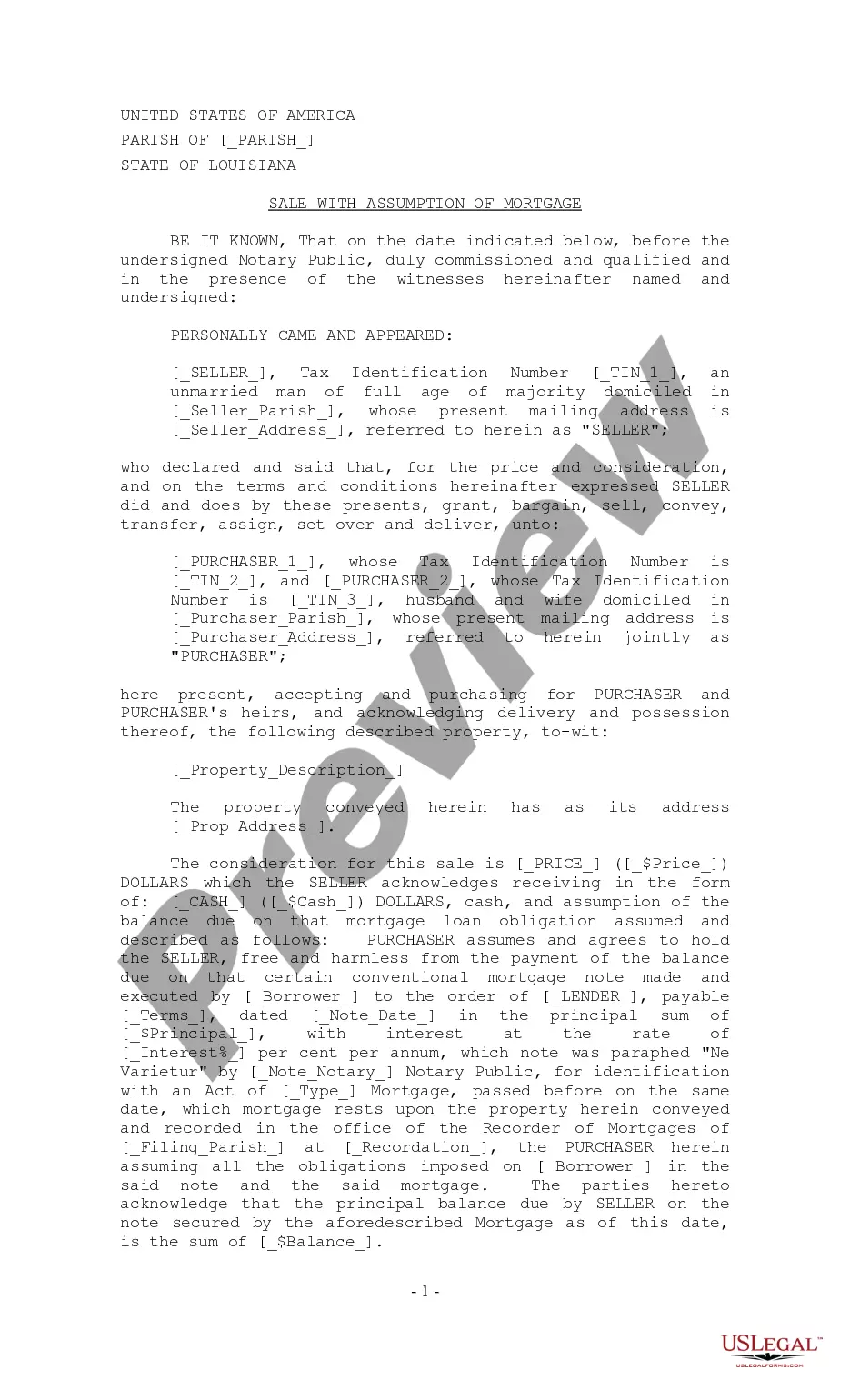

At the top of the page, you should center the title between the left- and right-hand margins. Title your document something like Purchase and Sale Agreement or Agreement to Purchase Real Estate. Identify the parties to the sale. You need to identify the purchaser and the seller at the start of your agreement.

The real estate commission is usually the biggest fee a seller pays 5 percent to 6 percent of the sale price. If you sell your house for $250,000, say, you could end up paying $15,000 in commissions. The commission is split between the seller's real estate agent and the buyer's agent.

Scope Out the Competition (Be A Nosey Neighbor) Give Louisiana Buyers What They Want. Analyze Louisiana's Real Estate Market Data for a Correct Listing Price. Make Sure Your Real Estate Photographs Don't Suck.

Closing costs: ~1-3% While the buyers will typically be responsible for the lion's share, sellers should expect to pay between 1-3% of the home's final sale price at closing. Based on the average home value in Louisiana of $178,000, that roughly translates to $2,000 to $5,000.

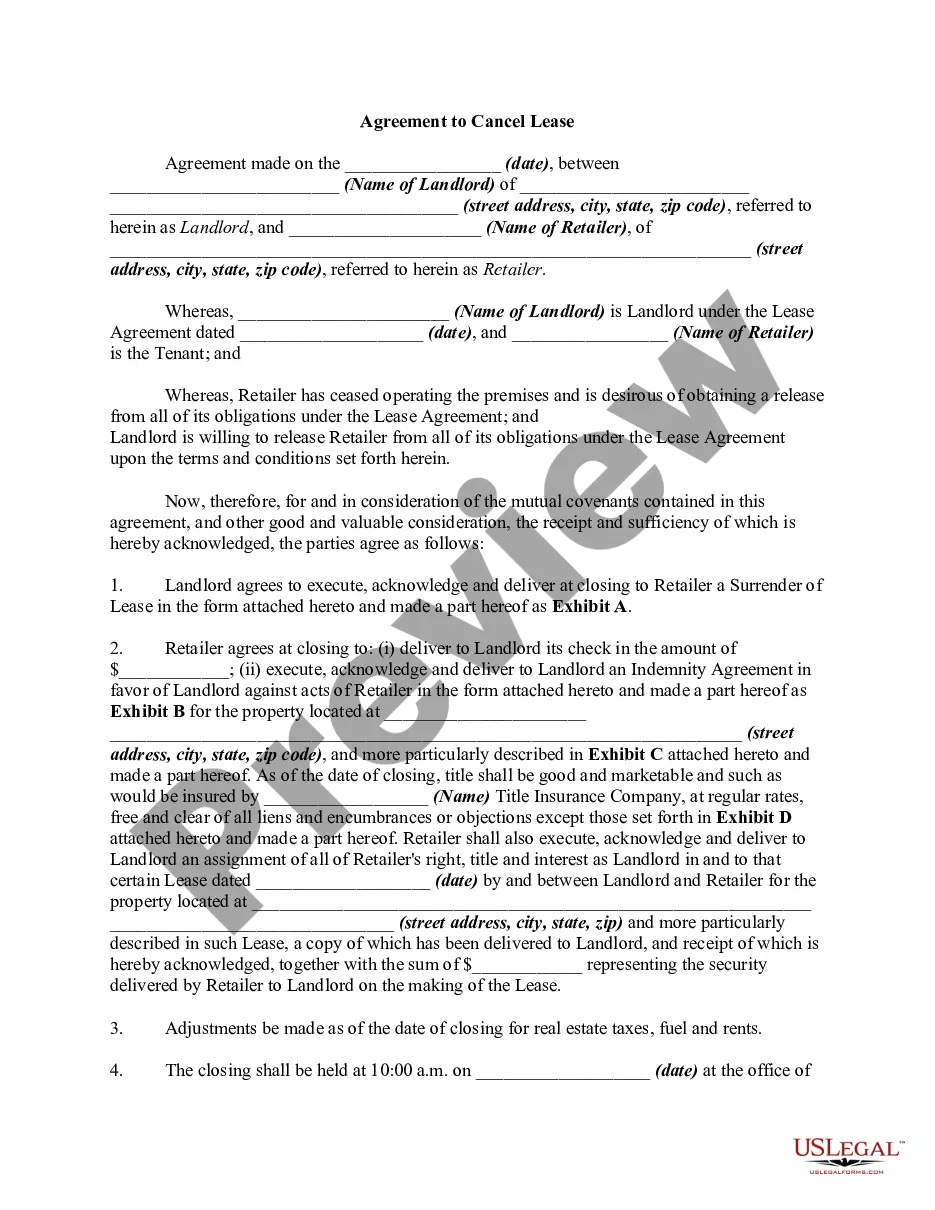

A real estate deal can take a turn for the worst if the contract is not carefully written to include all the legal stipulations for both the buyer and seller.You can write your own real estate purchase agreement without paying any money as long as you include certain specifics about your home.

A seller can often expect to pay some significant closing costs, including real estate agent commissions, transfer taxes and recording fees.But then come all of the closing costs you're responsible for. Unlike buyers, sellers are usually on the hook for real estate agent commissions and title insurance.

According to lines 235 to 237 of the Louisiana Residential Agreement to Buy or Sell, SELLER's title shall be merchantable and free of all liens and encumbrances except those that can be satisfied at Act of Sale. All costs and fees required to make title merchantable shall be paid by SELLER.

Your Buyer pays for your house. The Buyer wires funds for down payment and closing costs to the Escrow Company. Then, if the Buyer is taking out a mortgage, the Buyer's Lender wires loan funds to the Title Company. If you sell your home to a cash buyer, the Buyer wires all the funds to the Escrow Company.