Mortgage Deed

What this document covers

A mortgage deed is a legal document that grants a lender a secured interest in a property, typically used when a borrower pledges their home as collateral for a loan. Unlike a standard mortgage agreement, the mortgage deed specifically evidences the lender's rights over the property, enabling them to foreclose if the borrower fails to meet payment obligations. Understanding this form is crucial for anyone looking to secure a loan using real property as collateral.

What’s included in this form

- Borrower and lender identification, including full names and addresses.

- Details of the loan amount (principal sum) and interest terms.

- Property description, with the address and specific legal description.

- Covenants and agreements to protect the lender's interests, including payment obligations and obligations regarding property maintenance.

- Conditions under which the lender may foreclose on the property.

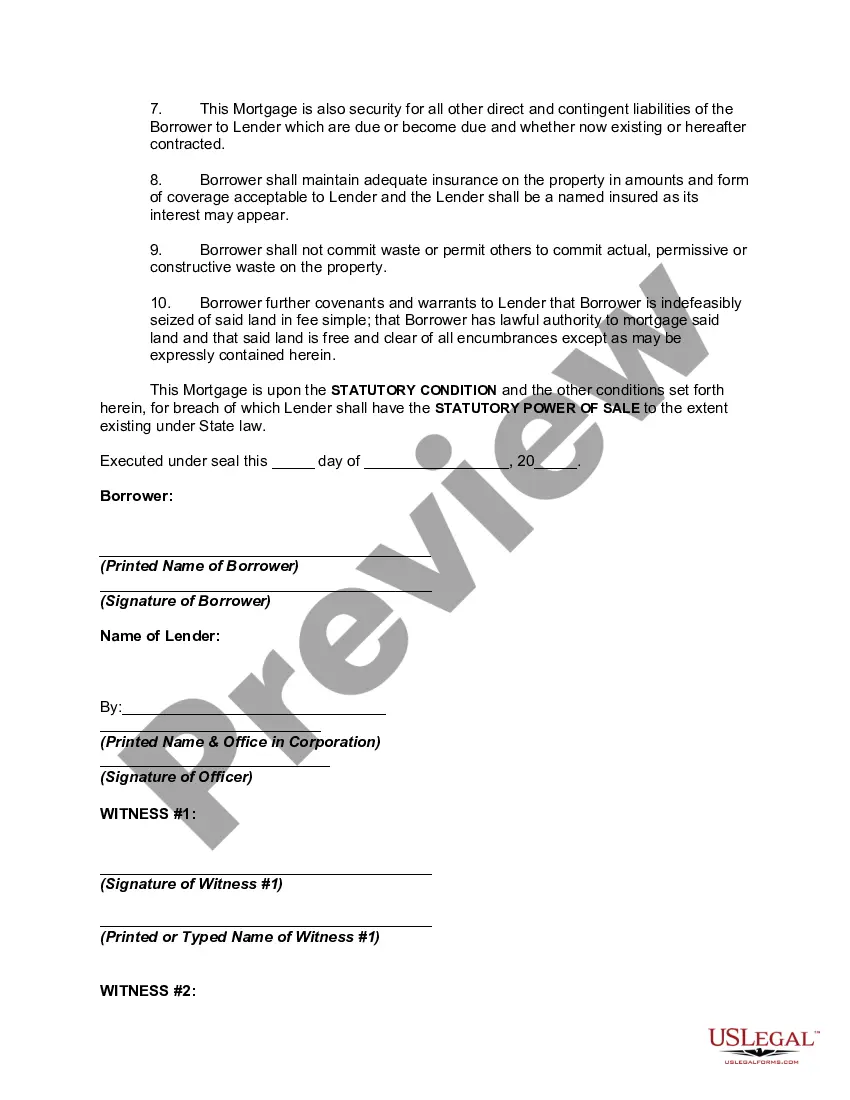

- Signatures of the parties involved and witness acknowledgment.

When to use this document

This mortgage deed should be used when a borrower seeks a loan and is willing to secure it with their property. It is particularly relevant in situations where a borrower requires financing to purchase a home, refinance an existing mortgage, or undertake home improvements that require additional funding. Use this form to formalize the agreement between the borrower and lender and to establish the legal rights to the property.

Who this form is for

- Homeowners seeking to secure a loan with their property.

- Lenders providing loans secured by real estate.

- Real estate professionals advising clients on mortgage transactions.

- Individuals refinancing their existing mortgage under new terms.

Completing this form step by step

- Identify the parties involved by entering the names and addresses of the borrower and lender.

- Specify the total principal sum of the loan and the interest rate.

- Provide a clear description of the property being mortgaged, including the address and legal description.

- Complete any required covenants and agreements, ensuring all obligations are clearly stated.

- Have all parties sign the document in the presence of witnesses, if required.

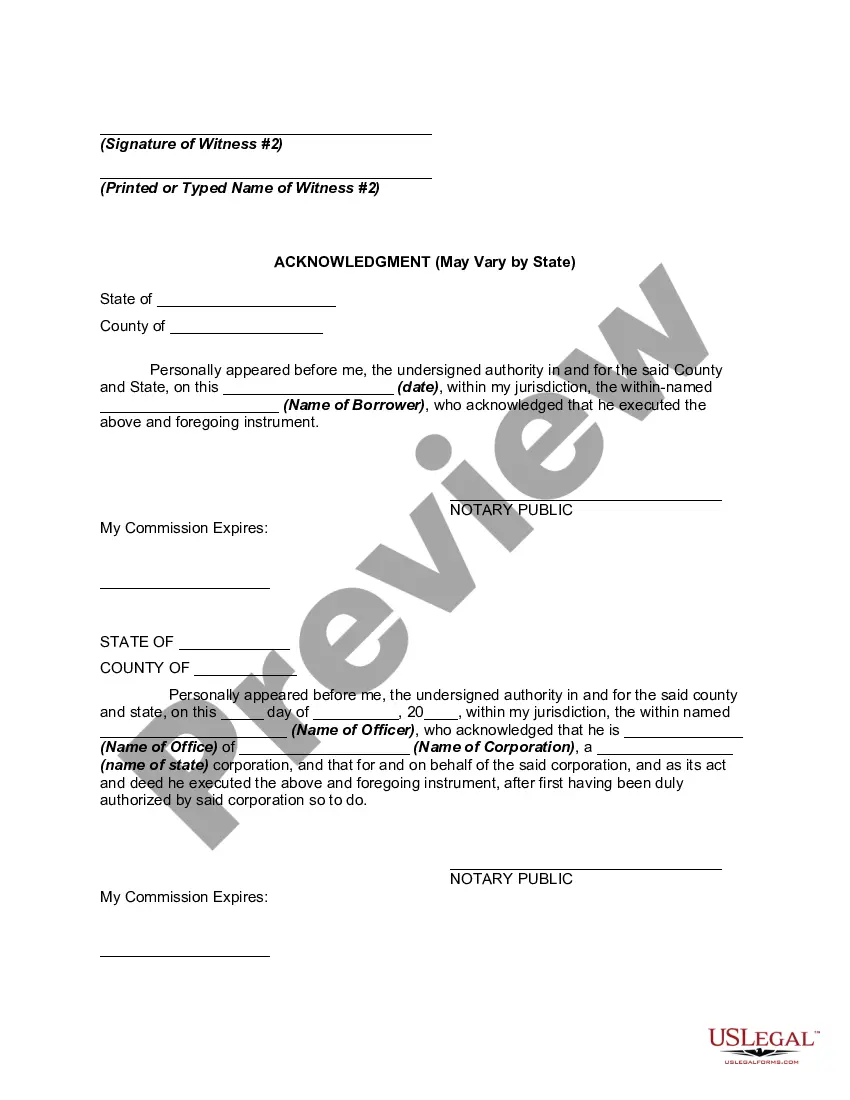

- Ensure the form is acknowledged by a notary public, if necessary according to your state laws.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to accurately describe the property, leading to possible legal challenges.

- Not completing all required signatures or witness sections.

- Overlooking local laws that may affect the execution and filing of the deed.

- Neglecting to maintain clear communication between the borrower and lender regarding obligations.

Benefits of using this form online

- Immediate access to a legally-sound document drafted by licensed attorneys.

- Ability to easily edit and customize the template to fit specific needs.

- Convenient downloading options at any time, eliminating the need for in-person visits.

- Secure storage and access to forms when needed for future reference.

Looking for another form?

Form popularity

FAQ

Who can be a witness to the signatory of a deed?A witness should not be the signatory's spouse or partner or a family member, and should not have a personal interest in the provisions of the document. Case law has confirmed that a party to the document cannot act as a witness to another party's signature.

If you own a computer and have a sheet of paper, you can create your own mortgage to finance the purchase of real estate. No one checks your credit, and you don't need a cash down payment.There is a huge market of investors who buy privately created mortgages and trust deeds (often referred to as paper).

The title deeds to a property with a mortgage are usually kept by the mortgage lender. They will only be given to you once the mortgage has been paid in full. But, you can request copies of the deeds at any time.

The title deeds to a property with a mortgage are usually kept by the mortgage lender. They will only be given to you once the mortgage has been paid in full. But, you can request copies of the deeds at any time.

What is the Mortgage Deed? This can sometimes be known as the legal charge form. Your mortgage deed is usually a 1 or 2 page document that, once signed, provides confirmation that you're happy to proceed based on the terms of your mortgage offer. Upon completion, the signed mortgage deed is a legally binding document.

Execute the mortgage documents. Affidavit to be sworn by two witnesses in the deed. Visit the notary public who will get the document notarized. Pay for the stamp duty. Pay for the registration in the Registrar of Deeds office. Obtain the title for the mortgage.

Definition. Simple mortgage is executed where without any property being delivered to the mortgagee; the mortgagor makes himself liable to repay the debt9.The fundamental characteristic of simple mortgage is that the mortgagee has no right to liquidate the property without the permission of the court.

While you have a mortgage, the lender has rights to the property title until the loan is paid. If you buy a home without a mortgage, the real estate attorney or title company records the deed and issues a copy to you.

Execute the mortgage documents. Affidavit to be sworn by two witnesses in the deed. Visit the notary public who will get the document notarized. Pay for the stamp duty. Pay for the registration in the Registrar of Deeds office. Obtain the title for the mortgage.